Scrap Metal Prices: Weekly Market Report- January 9-15, 2026

Weekly Metal Price Report | 2026-01-16 17:25:15

Brass and bronze scrap prices moved higher across all categories last week, with Brass Radiator/Fe leading the advance by posting a 1.35% week-on-week increase.

MONTREAL (Scrap Monster): The report below outlines the weekly price movements for key scrap metal categories across North America, as tracked by the Scrap Monster Price Index for the period January 9–15, 2026.

Copper scrap markets experienced an overall positive week-on-week trend, with prices increasing in most segments. However, Cu/Al Radiators, Alternators, Copper Transformer Scrap, Cu/Al Radiator Ends, and Cu/Al Radiators/Fe showed no change on the index. Among all categories, Xmas Lights delivered the strongest gains, rising 3.23% compared with the prior week.

Aluminum scrap prices were generally flat on the Scrap Monster Price Index. All scrap varieties, except E.C. Aluminum Wire, held steady upon comparision with the prior week. In the meantime, E.C. Aluminum Wire prices edged higher marginally by 0.7% over the previous week's prices.

Brass and bronze scrap prices moved higher across all categories last week, with Brass Radiator/Fe leading the advance by posting a 1.35% week-on-week increase. However, Brass Radiator Ends prices were flat on the Index.

By comparison, lead scrap markets remained stable, showing no price changes across key trading regions.

Zinc scrap prices edged up marginally in several categories. Also, global steel scrap benchmarks edged higher marginally driven by modest recovery in market conditions.

Stainless steel scrap prices exhibited negative momentum on the Index.

In short, Copper scrap prices showed a generally positive week-on-week trend, while aluminum values remained mostly flat. Brass and bronze prices recorded overall gains, whereas lead markets were stable with no notable changes. Zinc and steel scrap prices edged up slightly, supported by modestly improving market conditions, while stainless steel scrap prices moved lower.

For full market breakdowns, visit the Daily Scrap Metal Price Report Hub or track real-time prices via the US Scrap Price Index.

NON-FERROUS SCRAP

Market Drivers

- Industrial and Manufacturing Demand – Activity levels in construction, automotive, electrical, and general manufacturing directly influence consumption of non-ferrous scrap.

Primary Metal Prices – Movements in LME and COMEX prices impact scrap valuations, as scrap prices closely track trends in primary metals.

Energy and Power Costs – Electricity and fuel prices affect smelting, refining, and recycling costs, influencing scrap demand and margins.

- Currency Fluctuations – Exchange rate movements affect international competitiveness and the attractiveness of exports and imports.

- Sustainability and Recycling Mandates– Decarbonization targets and circular economy policies continue to support long-term demand for recycled non-ferrous metals.

- Geopolitical and Macroeconomic Conditions – Economic growth, interest rates, and geopolitical disruptions influence both demand outlook and supply chain stability.

COPPER SCRAP PRICES

Market Highlights

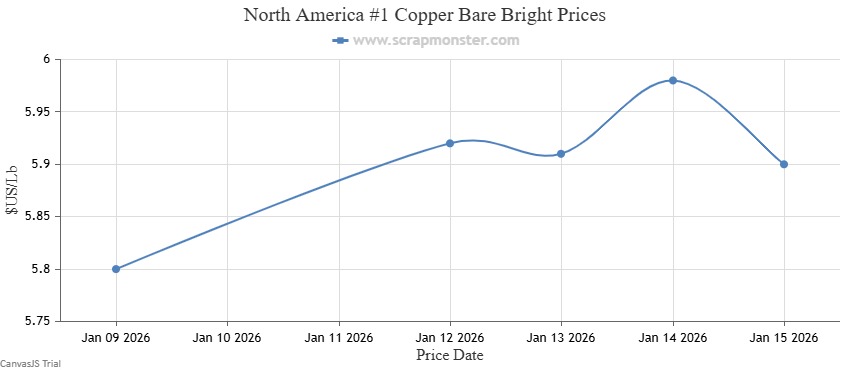

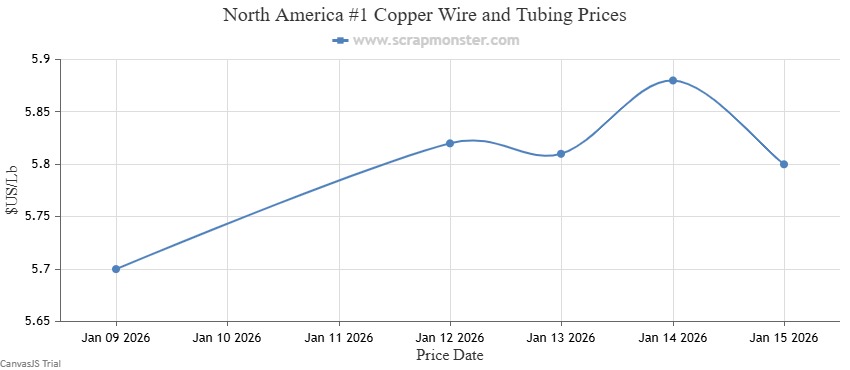

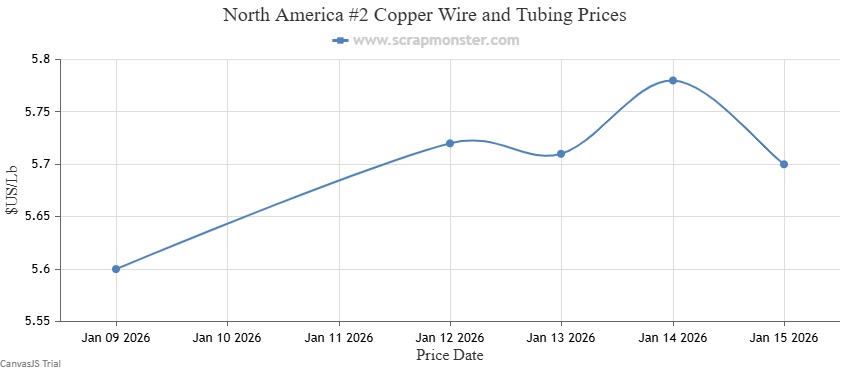

North America Copper Scrap Prices: Copper scrap prices strengthened during the past week amid improved market sentiment. #1 Copper Bare Bright rose by 1.72%, while #1 Copper Wire and Tubing increased 1.75% to $5.80 per pound. Meanwhile, #2 Copper Wire and Tubing edged higher by 1.79%, reaching $5.70 per pound.

Charts

The table below outlines the week-on-week price movements for #1 Copper Bare Bright, #1 Copper Wire and Tubing, and #2 Copper Wire and Tubing.

| Category | Price Change ($) | % Change |

| #1 Copper Bare Bright | 0.10 | +1.72% |

| #1 Copper Wire and Tubing | 0.10 | +1.75% |

| #2 Copper Wire and Tubing | 0.10 | +1.79% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Copper Scrap Prices

On the Scrap Monster Price Index, #1 Copper Bare Bright rose by $0.10 per pound as of Thursday, January 15, 2026, marking a week-on-week increase of ↑1.72%. #1 Copper Wire and Tubing also advanced by $0.10 per pound, up 1.75% from the previous week. Meanwhile, #2 Copper Wire and Tubing climbed ↑1.79% over the week, increasing from $5.60 per pound to $5.70 per pound.

USA Midwest Copper Scrap Prices

The price of #1 Copper Bare Bright on the Scrap Monster Price Index inched up by $0.10 per pound as of Thursday, January 15, 2026, a weekly jump of ↑1.79%. #1 Copper Wire & Tubing edged higher by $0.10 per pound, registering an increase by ↑1.82% from the prior week. By the end of the week, the price of #2 Copper Wire and Tubing had edged higher by ↑1.85% to close the week at $5.50 per pound.

USA West Coast Copper Scrap Prices

#1 Copper Bare Bright’s prices on the Scrap Monster Price Index increased by $0.10 per pound as of Thursday, January 15, 2026, a weekly increase of ↑1.71%. #1 Copper Wire & Tubing inched higher by $0.10 per pound, registering a jump by ↑1.74% from the prior week. #2 Copper Wire and Tubing prices had recorded an increase by ↑1.77% as at the end of the week.

International Comparison

China Copper Scrap Prices

- All of the copper scrap categories recorded upmove on the Scrap Monster Price Index.

- Top Gainer: #1 Insulated Copper Wire 85% Recovery ↑1.12%

India Copper Scrap Prices

- All copper scrap categories recorded week-over-week jump on the Scrap Monster Price Index.

ALUMINUM SCRAP PRICES

Market Highlights

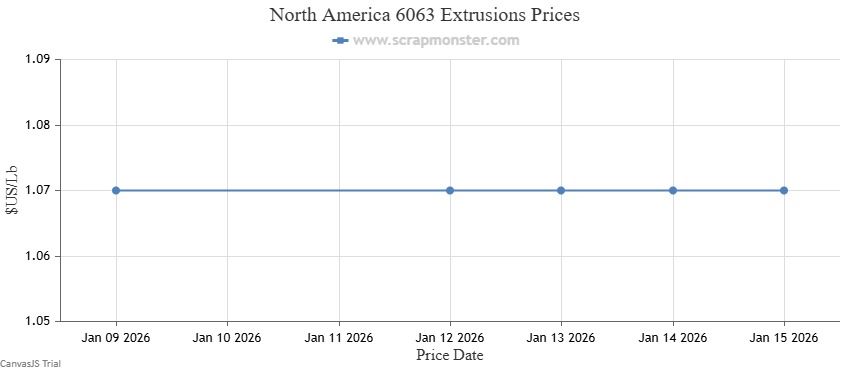

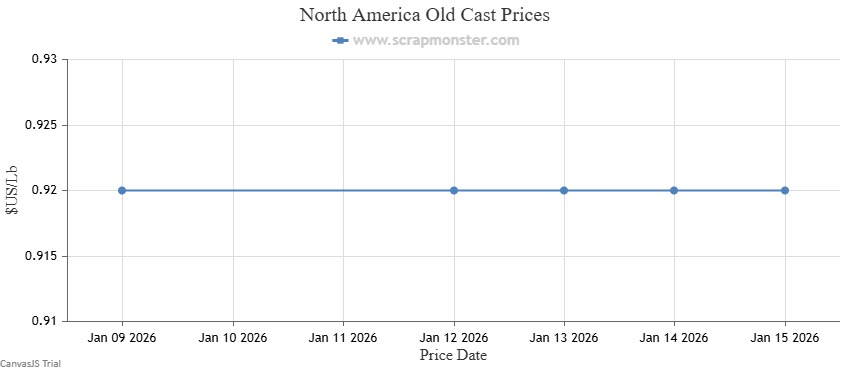

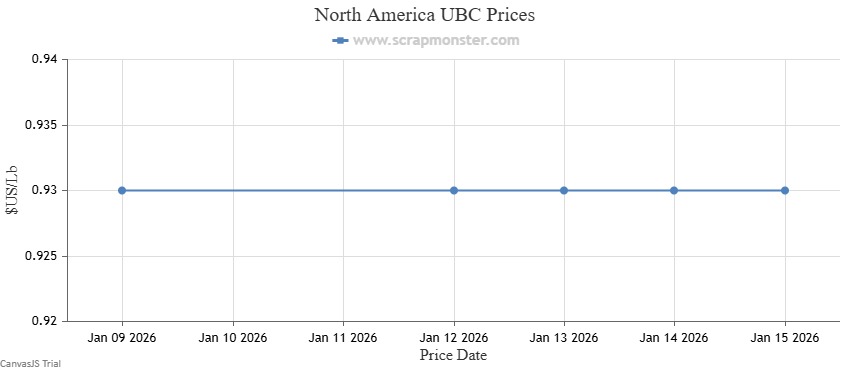

North America Aluminum Scrap Prices: Over the previous week, only E.C. Aluminum Wire recorded positive variation in prices. The prices of the commodity edged higher modestly by 0.70% to close the week at $1.43 per Lb on the Scrap Monster Price Index. 6063 Extrusions ended the week at $1.04 per pound, recording no variation from the prior week. Old Cast prices held steady during the week at $0.92 per pound. Also, UBC prices reported no fluctuation over the previous week's prices.

Charts

The table below provides weekly price fluctuations in E.C. Aluminum Wire, 6063 Extrusions, Old Cast and UBC.

Category | Price Change ($) | % Change |

0.01 | +0.70% | |

0 | Nil | |

0 | Nil | |

0 | Nil |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Aluminum Scrap Prices

The price of E.C. Aluminum Wire on the Scrap Monster Price Index recorded a jump of 0.70% as of Thursday, January 15, 2026. 6063 Extrusions remained flat at $1.07 per pound, compared with the previous week. Old Cast prices were flat during the week. Additionally, UBC prices held stedy on a week-on-week basis.

USA Midwest Aluminum Scrap Prices

Aluminum scrap prices recorded increase over the past week. E.C. Aluminum Wire ended the week at $1.43 per Lb, up by $0.01 per Lb during the course of the week, while 6063 Extrusions held steady on Index. Old Cast prices reported no variation week-on-week. Also, UBC prices were flat at $0.91 per pound at the close of the week.

USA West Coast Aluminum Scrap Prices

The price of E.C. Aluminum Wire on the Scrap Monster Price Index recorded an increase of 0.70% as of Thursday, January 15, 2026. 6063 Extrusions were unchanged upon comparison with the prior week. By the end of the week, the price of Old Cast witnessed no variation. Also, UBC prices recorded no fluctuation week-on-week.

International Comparison

China Aluminum Scrap Prices

- All aluminum scrap categories recorded decline from the previous week's prices on the Scrap Monster Price Index. Old Cast and Old Sheet prices recorded the biggest slumps, falling by ↓1.36% each on the Index.

India Aluminum Scrap Prices

- All aluminum scrap categories edged higher on the Scrap Monster Price Index.

- Aluminum ingots prices witnessed a jump of INR 6,000 per MT to close at INR 318,000 per Ton.

- The price of Aluminum utensil scrap was up by ↑1.98% during the week ended January 15, 2026.

BRASS/BRONZE SCRAP PRICES

Market Highlights

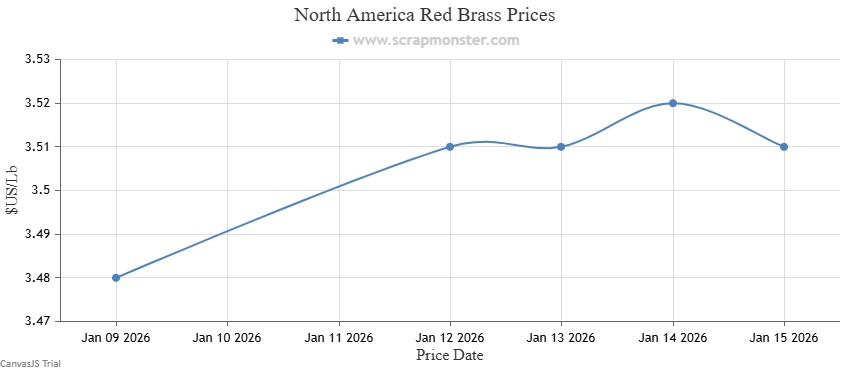

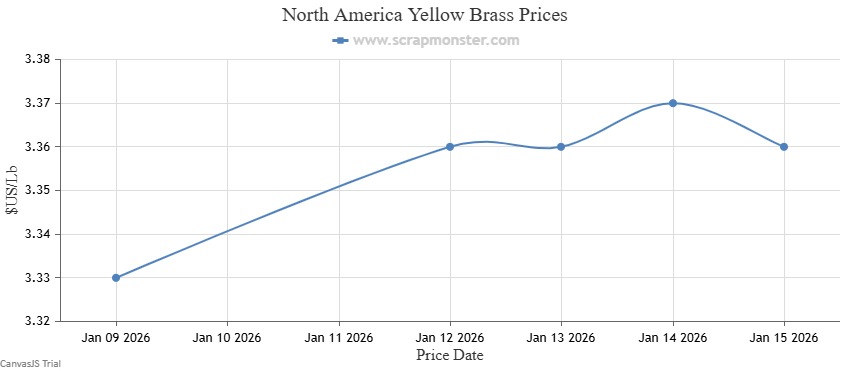

North America Brass/Bronze Scrap Prices: Over the previous week, there was a jump in brass/bronze scrap prices. Yellow Brass’s prices increased by 0.90% to close at $3.36 per Lb . Red Brass closed at $3.51 per pound, rising by 0.86% during the week.

Charts

The table below provides weekly price fluctuations in Yellow Brass and Red Brass.

Category | Price Change ($) | % Change |

0.03 | +0.86% | |

0.03 | +0.90% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Brass/Bronze Scrap Prices

The price of Red Brass on the Scrap Monster Price Index recorded an increase of 0.86% as of Thursday, January 15, 2025. Yellow Brass prices also jumped higher on the Index, to close at $3.36 per Lb.

USA Midwest Brass/Bronze Scrap Prices

By the conclusion of the week ended January 15, 2026, the price of Red Brass had recorded a jump of 0.88% from $3.42 per Lb. Additionally, Yellow Brass prices edged higher by 0.93% week-on-week.

USA West Coast Brass/Bronze Scrap Prices

Red Brass went higher by $0.03 per pound, witnessing a jump of ↑0.83% from the prior week. By the end of the week, the price of Yellow Brass had increased by 1.18% to close the week at $3.44 per Lb.

International Comparison

China Brass/Bronze Scrap Prices

- All brass/bronze scrap categories recorded increase on the Scrap Monster Price Index.

- Top Gainer: Brass Radiator ↑0.30%

India Brass/Bronze Scrap Prices

- All brass/bronze scrap categories recorded week-over-week jump on the Scrap Monster Price Index.

LEAD SCRAP PRICES

Market Highlights

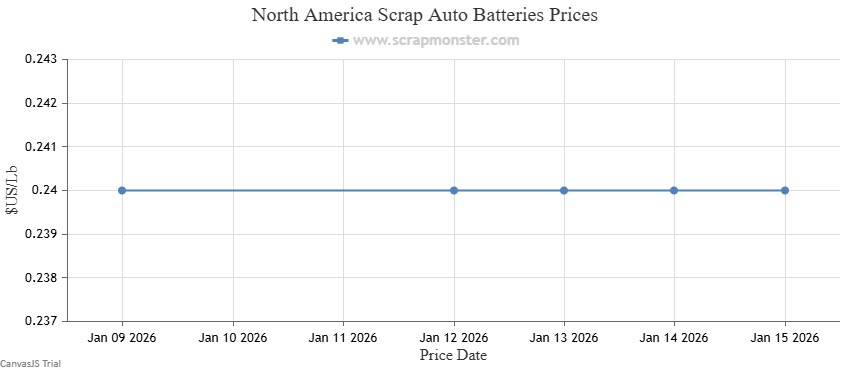

North America Lead Scrap Prices: Lead scrap prices stayed flat throughout the week, reflecting stable market conditions. Scrap Auto Battery prices also remained unchanged, closing the week at $0.24 per pound with no movement.

Chart

The table below provides weekly price fluctuations in Scrap Auto Batteries.

Category | Price Change ($) | % Change |

0 | Nil |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Lead Scrap Prices

The price of Scrap Auto Batteries on the Scrap Monster Price Index held steady as of Thursday, January 15, 2026.

USA Midwest Lead Scrap Prices

By the conclusion of the week ended January 15, 2026, the price of Scrap Auto Batteries maintained previous week’s price level.

USA West Coast Lead Scrap Prices

The prices of Scrap Auto Batteries recorded no change on the Scrap Monster Price Index as of Thursday, January 15, 2026.

International Comparison

China Lead Scrap Prices

- Soft Lead and #2 Lead scrap prices posted marginal week-over-week increase on the Scrap Monster Price Index. The prices of these categories were up by 0.35% and 0.36% respectively over the prior week.

- Auto Battery prices were unchanged to end the week at CNY 6,800 per MT.

India Lead Scrap Prices

- All lead scrap categories recorded week-over-week jump on the Scrap Monster Price Index.

- Top Gainer: Lead ingot ↑0.52%

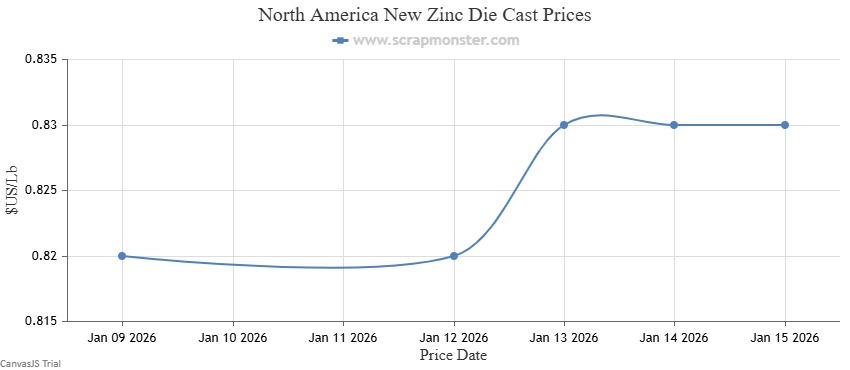

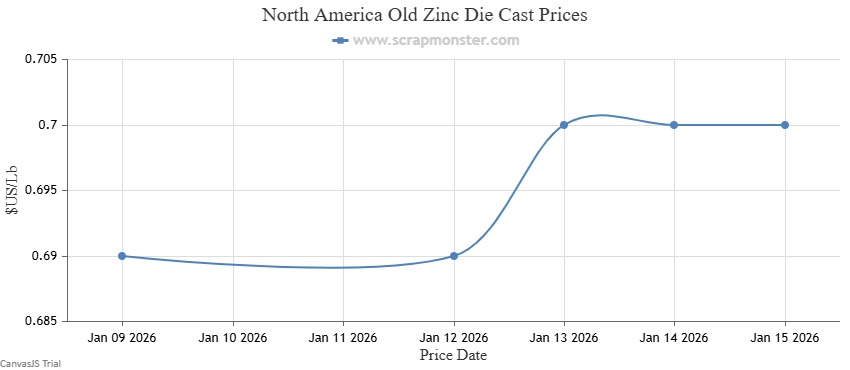

ZINC SCRAP PRICES

Market Highlights

North America Zinc Scrap Prices: Zinc scrap prices edged higher upon comparison with the previous week's prices. New Zinc Die Cast prices were up by 1.22%. Also, Old Zinc Die Cast prices posted a jump of 1.45% during the week.

Charts

The table below provides weekly price fluctuations in New Zinc Die Cast and Old Zinc Die Cast.

Category | Price Change ($) | % Change |

0.01 | +1.22% | |

0.01 | +1.45% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Zinc Scrap Prices

The price of New Zinc Die Cast on the Scrap Monster Price Index recorded a jump by 1.22% as of Thursday, January 15, 2025. Also, Old Zinc Die Cast prices were up by 1.45% over the previous week.

USA Midwest Zinc Scrap Prices

By the conclusion of the week ended January 15, 2026, the prices of New Zinc Die Cast and Old Zinc Die Cast recorded increase from the previous week’s price levels.

USA West Coast Zinc Scrap Prices

The prices of New Zinc Die Cast witnessed week-over-week jump of 1.22% on the Scrap Monster Price Index as of Thursday, January 15, 2026. Similarly, the Old Zinc Die Cast prices closed at $0.70 per Lb, higher by 1.45% week-over-week.

International Comparison

- Shred zinc scrap prices recorded a jump of ↑2.10% on the Scrap Monster Price Index. The commodity's price closed at CNY 17,000 per MT during the week ended January 15, 2026, recording a jump of CNY 350 per MT.

- Tin Slab prices held steady week-over-week on the Scrap Monster Price Index.

- Zinc slab prices recorded a modest jump of ↑2.58% over the previous week

FERROUS SCRAP

Market Drivers

Finished Steel Price Movements – Scrap buying appetite is closely tied to finished steel prices. When rebar, HRC, and other steel products face pricing pressure, mills tend to resist scrap price increases to protect margins.

Obsolete and Demolition Scrap Generation – Levels of construction, demolition, and infrastructure tear-down activity directly affect the supply of obsolete scrap, influencing availability and regional price stability.

Mill Inventory Management Strategies – Mills’ scrap stock levels and purchasing discipline play a critical role. Adequate inventories often result in cautious buying, while low stocks can trigger short-term price support.

Macroeconomic and Construction Activity Trends – Broader economic conditions, including interest rates and construction spending, influence steel consumption and indirectly shape scrap demand.

- Energy, Fuel, and Logistics Costs – Rising electricity, diesel, and transportation expenses increase processing and delivery costs, which can feed into higher scrap price expectations.

- Environmental Regulations and Decarbonization Goals - Emissions targets and sustainability policies continue to favor scrap-based steelmaking, reinforcing long-term demand even during short-term market weakness.

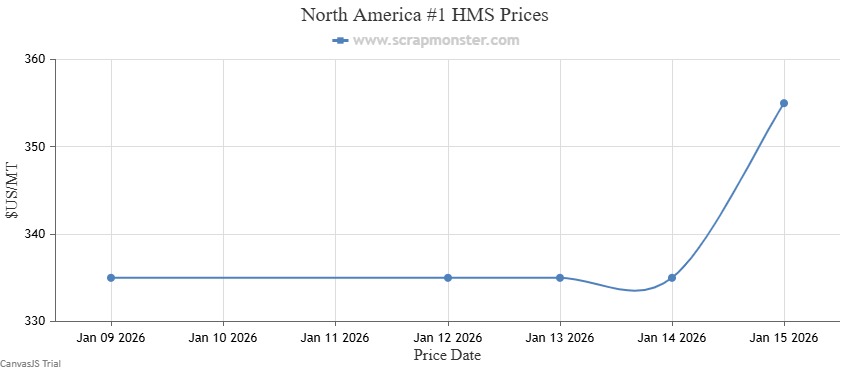

STEEL SCRAP PRICES

Market Highlights

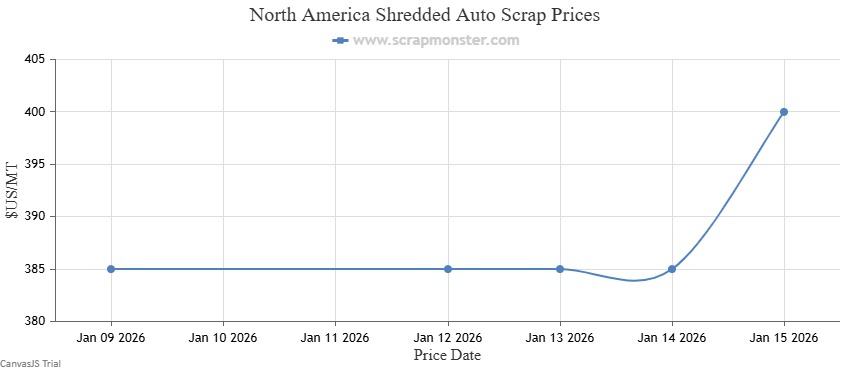

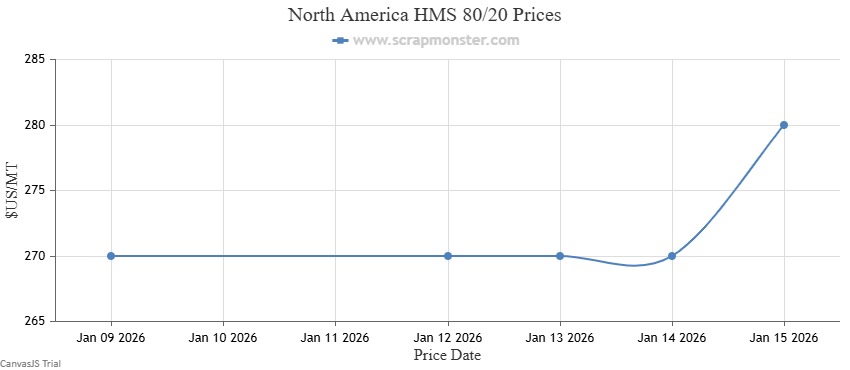

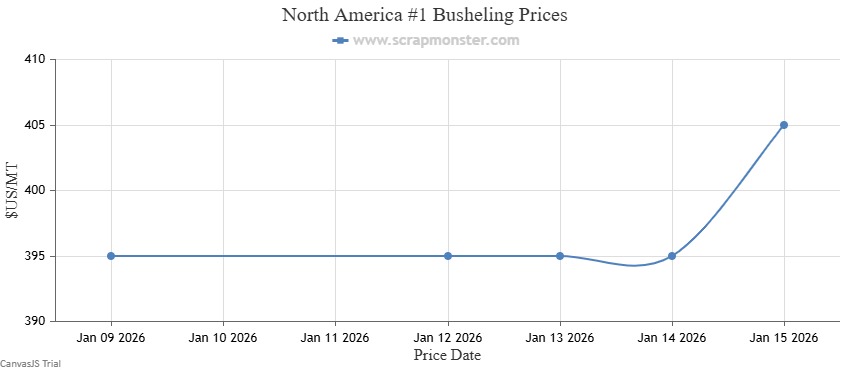

North America Steel Scrap Prices: Steel scrap prices showed upward movement over the past week, indicating a recovery in market environment. #1 HMS jumped by 5.97% over the previous week's prices, while Shredded Auto Scrap prices edged higher by 3.90%. HMS 80/20 prices inched up by 3.70% to close the week at $280 per metric ton, and #1 Busheling prices increased by $10 per metric ton.

Charts

The table below provides weekly price fluctuations in #1 HMS, Shredded Auto Scrap, HMS 80/20, and #1 Busheling.

Category | Price Change ($) | % Change |

20 | +5.97% | |

15 | +3.90% | |

10 | +3.70% | |

10 | +2.53% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Steel Scrap Prices

The price of #1 HMS on the Scrap Monster Price Index reported an increase of $20 per metric ton as of Thursday, January 15, 2026. Shredded Auto Scrap prices were up by $15 per metric ton on the Index upon comparison with the prior week. By the end of the week, the price of HMS 80/20 had recorded 3.70% jump. #1 Busheling prices also were up by 2.53% over the previous week.

USA Midwest Steel Scrap Prices

#1 HMS prices witnessed a jump of 5.97% on the Scrap Monster Price Index. Shredded Auto Scrap closed the week at $400 per MT, recording an increase of $15 per MT from the beginning of the week. The HMS 80/20 prices were up by 3.70%. Also, the price of # Busheling increased by 2.53% week-on-week.

USA West Coast Steel Scrap Prices

#1 HMS’s price on the Scrap Monster Price Index was up by 5.97% as of Thursday, January 15, 2026. Shredded Auto Scrap witnessed a jump of 3.90%, closing the at $400 per MT. By the end of the week, the price of HMS 80/20 had increased by 3.70%. #1 Busheling prices also edged higher by 2.53% over the previous week.

International Comparison

China Flat

China Steel Scrap Prices

- All the steel scrap categories held steady on the Scrap Monster Price Index.

- #1 HMS and Cast Iron Scrap prices were flat at $1,630 and $1,730 per MT respectively.

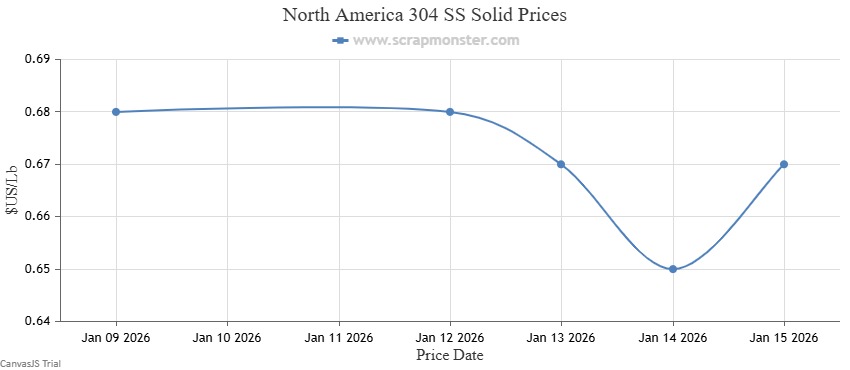

STAINLESS STEEL SCRAP PRICES

Market Highlights

North America Stainless Steel Scrap Prices: Over the previous week, stainless steel scrap prices declined on the Scrap Monster Price Index. 304 SS Solid scrap prices recorded dip on a week-on-week basis, edging lower from $0.68 per pound to $0.67 per pound.

Chart

The table below provides weekly price fluctuations in 304 SS Solid scrap.

Category | Price Change ($) | % Change |

0.01 | ↓1.47% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Stainless Steel Scrap Prices

The price of 304 SS Solid on the Scrap Monster Price Index recorded a decline of ↓1.47% as of Thursday, January 15, 2026.

USA Midwest Stainless Steel Scrap Prices

304 SS Solid prices registered a marginal dip on the Scrap Monster Price Index. The price of the commodity fell by $0.01 per Lb to end the week at $0.67 per Lb.

USA West Coast Stainless Steel Scrap Prices

The price of 304 SS Solid on the Scrap Monster Price Index recorded a downward movement, dropping by $0.01 per Lb to $0.67 per pound during the week ended Thursday, January 15, 2026.

International Comparison

China ↑5.56%

China Stainless Steel Scrap Prices

- All the stainless steel scrap categories recorded increase on the Scrap Monster Price Index.

- Top gainers: 201 SS ↑8.26%, 304 SS Turning ↑5.96%

See all Stainless steel daily reports → | Stainless Steel Price Index → | Related Stainless steel news →

Weekly Market Drivers

- Mills & buy programs- U.S. Raw Steel Output Up 3.1% for the Week Ending Jan 10, 2026

- Export/Import/Tariff- China Steel Exports Hit December High Ahead of 2026 Licence Rule

- Import/policy- U.S. Steel Import Permits Up in November, 2025 Volumes Lag Last Year

- Scrap Market Trends- Scrap will remain a strategic raw material in the future

- Shipments/Trade- U.S. Steel Shipments Up 4.6% in November 2025 Despite Monthly Dip

Global Comparison & Policy Impact

USA vs. China/India

Steel: ↑4.03%

- Stainless Steel: U.S.-↓1.47% ; China- ↑5.56%

Expert Quote:

“Ferrous scrap markets this week have reflected a cautious buying stance from mills amid uneven downstream demand and variable export interest, with recent deep-sea CFR Turkey deals underscoring how international freight and regional price spreads continue to shape trade flows.” — Market observers tracking weekly ferrous scrap deal activity.

Market Outlook

- Modest Price Pressure Persisting- In the near term, ferrous scrap prices are likely to remain under mild downward or sideways pressure due to limited mill buying interest and persistent inventory levels. Buyers are exercising caution amid soft finished steel demand, tempering upward price momentum.

- Seasonal Demand Fluctuations- Seasonal patterns—such as slower construction activity in early months—may further suppress domestic scrap consumption in the short term. However, improved activity in spring could support a rebound in demand.

- Infrastructure and Stimulus Activity- Medium-term support for ferrous scrap demand could arise from increased infrastructure spending and manufacturing investment in key regions. Policy-led construction programs may bolster scrap consumption as steel demand strengthens.

- Cost Inputs and Logistics Dynamics- Volatility in energy, fuel, and transportation costs will shape processing economics and buyers’ willingness to pay. Elevated logistics costs may restrain price gains, while any moderation in these costs could relieve some upward pressure on scrap pricing.

- Quality Segmentation Trends- Demand differentials between premium, clean grades and lower-quality mixed scrap will likely widen. Mills focusing on EAF and specialty steel production will sustain higher bids for quality material, while lower grades may see weaker pricing due to excess supply.

In the near to medium term, ferrous scrap prices are expected to remain largely range-bound, with mild pressure driven by cautious mill buying, seasonal demand softness, and cost-related constraints. Export demand, infrastructure activity, and stronger interest in premium scrap grades may provide selective support as market conditions gradually improve.

Daily Reports | Scrap Monster Price Index | US Scrap Metal Prices

Register now for free daily alerts → Sign Up

Related Resources

Copper Scrap Prices | Aluminum Scrap Prices | Steel Scrap Prices | Brass Scrap Prices | Scrap Yard Directory | Company Directory | Daily Market Report

Full pricing details, yard finder, market analysis, and live price charts available at ScrapMonster.com. Trusted by 100,000+ recycling professionals. Sign up for daily alerts—your competitive edge starts here.

Subscribe to Scrap Monster Live Scrap Prices

People Also Ask

Q: What factors are driving copper scrap price increases this week?

A: Improved market sentiment supported broad increases in copper scrap prices across North America. Specifically, #1 Copper Bare Bright rose by 1.72%, #1 Copper Wire and Tubing increased 1.75%, and #2 Copper Wire and Tubing edged higher by 1.79% during the week of January 9-15, 2026.

Q: Why did steel scrap prices show significant gains this week?

A: Steel scrap prices showed upward movement indicating a recovery in market environment. #1 HMS jumped by 5.97%, Shredded Auto Scrap prices edged higher by 3.90%, HMS 80/20 prices increased by 3.70%, and #1 Busheling prices increased by 2.53%. The recovery was driven by better mill demand and improved market conditions.

Q: Which scrap metal categories remained flat this week?

A: Aluminum and lead scrap markets remained largely stable. Aluminum scrap prices were generally flat with only E.C. Aluminum Wire recording a modest 0.70% increase. Lead scrap prices stayed completely flat throughout the week, with Scrap Auto Battery prices unchanged, reflecting stable market conditions.

Q: What was the market outlook for ferrous scrap prices?

A: Despite short-term price support from exports, infrastructure activity, and premium-grade demand, ferrous scrap markets are expected to remain largely range-bound in the near to medium term. Ongoing mill buying caution, seasonal softness, and cost pressures are expected to keep the market pressured with mild downward or sideways pressure.

Q: How did international scrap metal prices compare to North American markets?

A: International markets showed mixed trends. In China, copper scrap prices rose by 1.09%, while aluminum declined by 1.25% and steel remained flat. Indian markets were generally stronger, with copper up 2.50%, aluminum up 1.95%, and brass/bronze up 1.48%. Chinese stainless steel showed robust gains of 5.56%, contrasting with North American declines of 1.47%.

POLL

Which scrap category is likely to show the most price volatility in the coming weeks?

Frequently Asked Questions

- What was the overall trend in scrap metal prices last week?

Scrap prices showed mixed movement, with gains in copper, brass, zinc, and steel, while aluminum and lead were mostly flat and stainless steel declined.

- Which scrap segment showed the strongest momentum?

Copper scrap led the market, supported by improved sentiment and week-on-week price increases across major grades.

- Why did aluminum scrap prices remain largely unchanged?

Stable supply-demand conditions and limited buying activity kept aluminum scrap prices mostly flat, with only marginal upside.

- How can I track scrap metal prices in real time?

For up-to-date data, use tools like the Scrap Monster Price Index and the US Scrap Price Index, then review daily and weekly reports in the Scrap Monster portal to monitor trends, percentage moves, and grade-specific performance.

Combining index data with structured weekly commentary helps scrap yards, traders, and generators refine their buying and selling strategies.

By

By