Scrap Metal Prices: Weekly Market Report- January 2-8, 2026

Weekly Metal Price Report | 2026-01-30 01:47:29

In the meantime, the top gainer was Aluminum Transformers, whose prces were up by 5.56% over the previous week's prices.

MONTREAL (Scrap Monster): The weekly market price trends in North America for various scrap metal categories on the Scrap Monster Price Index for the week of January 2-8, 2026 are given in the report that follows:

Copper scrap markets recorded a broadly positive week-on-week trend, with prices rising across most categories, while Alternators, Scrap Electric Motors, Sealed Units, Starters, and Xmas Lights remained unchanged on the index. Cu/Al Radiators/Fe posted the strongest performance, registering a 4.2% increase over the previous week.

Aluminum scrap prices recorded notable jump across-the-board on the Scrap Monster Price Index. All scrap varieties registered increase, upon comparision with the prior week. In the meantime, the top gainer was Aluminum Transformers, whose prces were up by 5.56% over the previous week's prices.

Brass and bronze scrap prices moved higher across all categories last week, with Brass Radiator Ends leading the advance after posting a 3.13% week-on-week increase.

By comparison, lead scrap markets remained stable, showing no price changes across key trading regions.

Zinc scrap prices edged up marginally in several categories, while global steel scrap benchmarks stayed flat amid subdued market conditions.

Stainless steel scrap prices exhibited positive momentum on the Index.

In short, scrap metal markets showed broadly positive momentum last week, led by strong gains in copper, aluminum, brass, bronze, and stainless steel scrap, while zinc posted marginal increases. Cu/Al Radiators/Fe, Aluminum Transformers, and Brass Radiator Ends emerged as top gainers in their respective segments.

In contrast, lead scrap prices and global steel scrap benchmarks remained flat, reflecting stable market conditions with no significant week-on-week movements.

For full market breakdowns, visit the Daily Scrap Metal Price Report Hub or track real-time prices via the US Scrap Price Index.

NON-FERROUS SCRAP

Market Drivers

- Strength in Industrial Demand – Improved activity in manufacturing, construction, and electrical sectors is supporting higher consumption of copper, aluminum, and brass scrap.

Supply Tightness in Scrap Availability – Lower collection rates and logistical constraints are limiting scrap inflows, putting upward pressure on prices.

Global Metal Price Movements – Firm LME and international benchmark prices are influencing domestic scrap markets, particularly for copper and aluminum.

- Infrastructure and Grid Investments – Ongoing investments in power transmission, renewables, and electrification are boosting demand for copper- and aluminum-bearing scrap.

- Export Market Demand– Steady buying interest from overseas consumers is tightening local supply and supporting price gains in key non-ferrous grades.

- Currency Fluctuations – Exchange rate movements are impacting import-export economics, influencing pricing decisions and trade flows.

COPPER SCRAP PRICES

Market Highlights

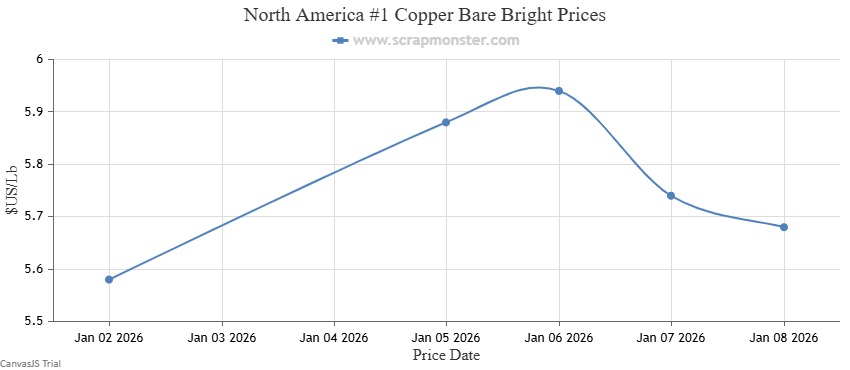

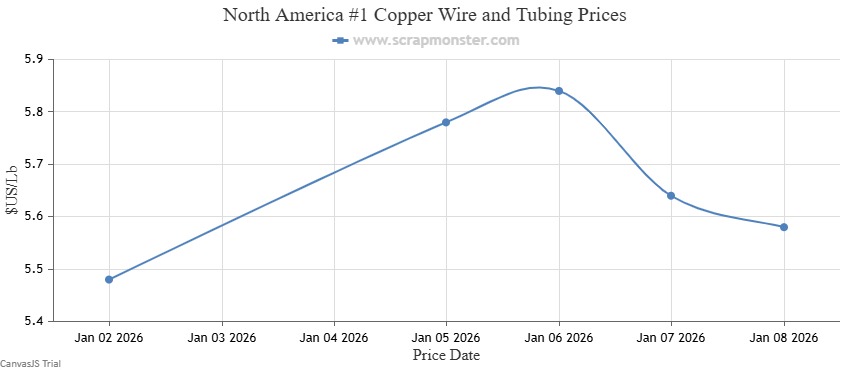

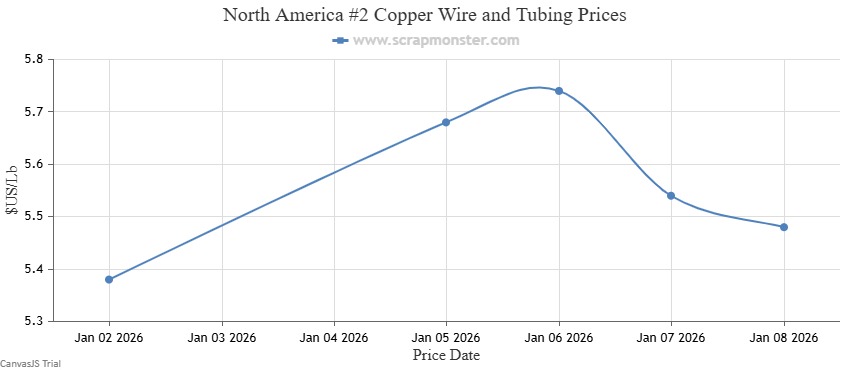

North America Copper Scrap Prices: Copper scrap prices moved higher over the past week on improved market sentiment, with #1 Copper Bare Bright prices moving higher by 1.79%. #1 Copper Wire and Tubing climbed to $5.58 per pound, up by 1.82%, while #2 Copper Wire and Tubing inched up by 1.86%, advancing to $5.48 per pound.

Charts

The table below outlines the week-on-week price movements for #1 Copper Bare Bright, #1 Copper Wire and Tubing, and #2 Copper Wire and Tubing.

| Category | Price Change ($) | % Change |

| #1 Copper Bare Bright | 0.10 | +1.79% |

| #1 Copper Wire and Tubing | 0.10 | +1.82% |

| #2 Copper Wire and Tubing | 0.10 | +1.86% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Copper Scrap Prices

The price of #1 Copper Bare Bright on the Scrap Monster Price Index increased by $0.10 per pound as of Thursday, January 8, 2026, a weekly jump of ↑1.79%. #1 Copper Wire & Tubing went higher by $0.10 per pound, registering an increase by ↑1.82% from the prior week. By the end of the week, the price of #2 Copper Wire and Tubing had recorded a rise by ↑1.86% , moving from $5.38 per pound to $5.48 per pound on the Index.

USA Midwest Copper Scrap Prices

The price of #1 Copper Bare Bright on the Scrap Monster Price Index inched up by $0.10 per pound as of Thursday, January 8, 2026, a weekly jump of ↑1.86%. #1 Copper Wire & Tubing edged higher by $0.10 per pound, registering an increase by ↑1.89% from the prior week. By the end of the week, the price of #2 Copper Wire and Tubing had edged higher by ↑1.93% to close the week at $5.28 per pound.

USA West Coast Copper Scrap Prices

#1 Copper Bare Bright’s prices on the Scrap Monster Price Index increased by $0.10 per pound as of Thursday, January 8, 2026, a weekly increase of ↑1.78%. #1 Copper Wire & Tubing inched higher by $0.10 per pound, registering a jump by ↑1.81% from the prior week. #2 Copper Wire and Tubing prices had recorded an increase by ↑1.84% as at the end of the week.

International Comparison

China Copper Scrap Prices

- Most of the copper scrap categories recorded upmove on the Scrap Monster Price Index.

- Top Gainer: #1 Copper Bare Bright ↑2.25%

- Copper Transformers Scrap prices held steady.

- Scrap Electric Motors and Sealed Units recorded decline.

India Copper Scrap Prices

- All copper scrap categories recorded week-over-week decline on the Scrap Monster Price Index.

ALUMINUM SCRAP PRICES

Market Highlights

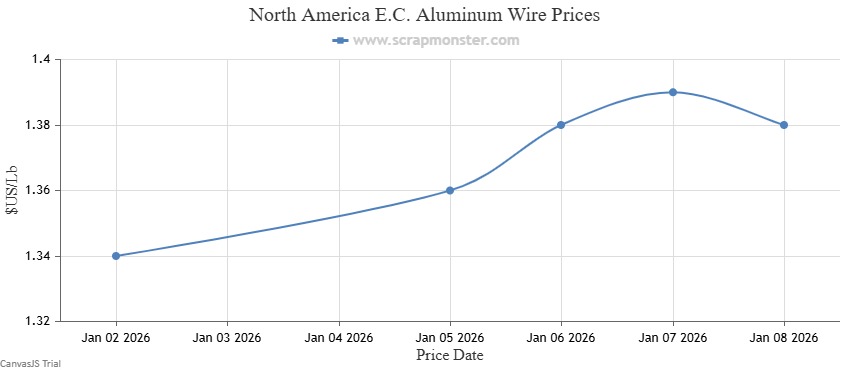

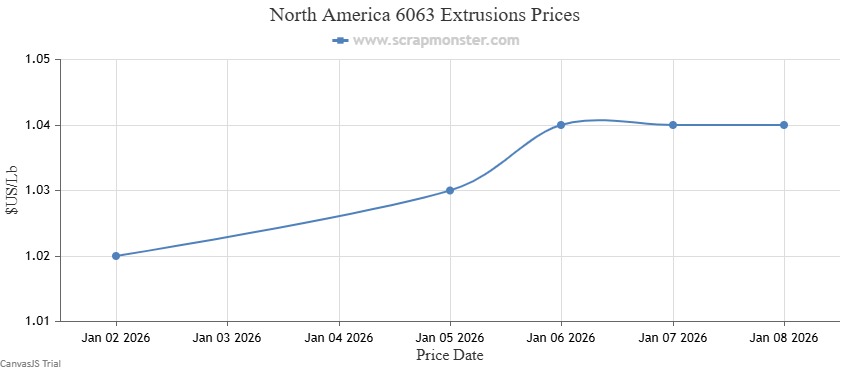

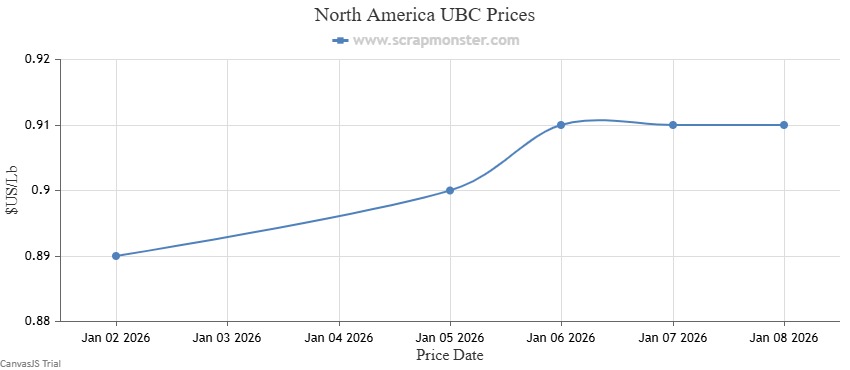

North America Aluminum Scrap Prices: Over the previous week, E.C. Aluminum Wire recorded positive variation in prices. The prices of the commodity edged higher modestly by 2.99% to close the week at $1.38 per Lb on the Scrap Monster Price Index. 6063 Extrusions ended the week at $1.04 per pound, edging higher marginally by 1.96% from the prior week, while Old Cast prices inched up to close the week at $0.90 per pound. UBC prices also registered week-on-week increase by 2.25%.

Charts

The table below provides weekly price fluctuations in E.C. Aluminum Wire, 6063 Extrusions, Old Cast and UBC.

Category | Price Change ($) | % Change |

0.04 | +2.99% | |

0.02 | +1.96% | |

0.02 | +2.27% | |

0.02 | +2.25% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Aluminum Scrap Prices

The price of E.C. Aluminum Wire on the Scrap Monster Price Index recorded a jump of 2.99% as of Thursday, January 8, 2026. 6063 Extrusions edged higher by 1.96% compared with the previous week. Old Cast prices increased from $0.88 per Lb to $0.90 per Lb during the week, while UBC prices also increased by 2.25% on a week-on-week basis.

USA Midwest Aluminum Scrap Prices

Aluminum scrap prices recorded increase over the past week. E.C. Aluminum Wire ended the week at $1.38 per Lb, up by $0.04 per Lb during the course of the week, while 6063 Extrusions inched up by 2%. Old Cast prices reported an increase of 2.35% week-on-week, whereas UBC prices were up by 2.3% to end the week at at $0.89 per pound.

USA West Coast Aluminum Scrap Prices

The price of E.C. Aluminum Wire on the Scrap Monster Price Index recorded an increase of 2.99% as of Thursday, January 8, 2026. 6063 Extrusions were up by 1.96%, upon comparison with the prior week. By the end of the week, the price of Old Cast increased by $0.02 per Lb. Also, UBC prices recorded a week-on-week jump by 2.22%.

International Comparison

China Aluminum Scrap Prices

- All aluminum scrap categories recorded increase from the previous week's prices on the Scrap Monster Price Index. Old Cast and Old Sheet prices recorded the biggest jumps, rising by ↑3.90% each on the Index.

India Aluminum Scrap Prices

- All aluminum scrap categories edged higher on the Scrap Monster Price Index.

- Aluminum ingots prices witnessed a jump of INR 4,000 per MT to close at INR 304,000 per Ton.

- The price of Aluminum utensil scrap was up by ↑1.37% during the week ended January 8, 2026.

BRASS/BRONZE SCRAP PRICES

Market Highlights

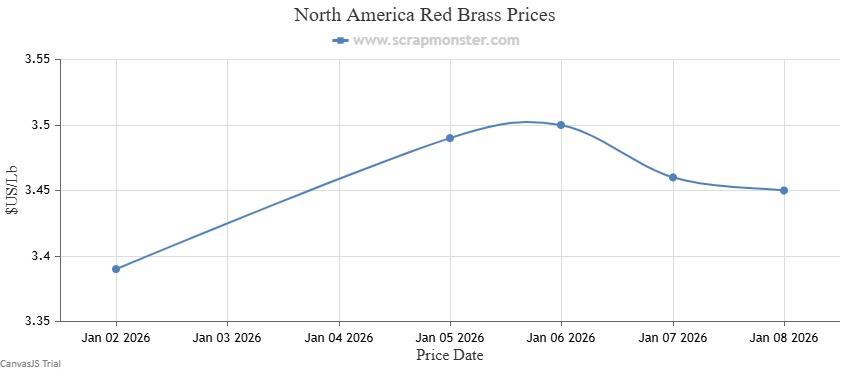

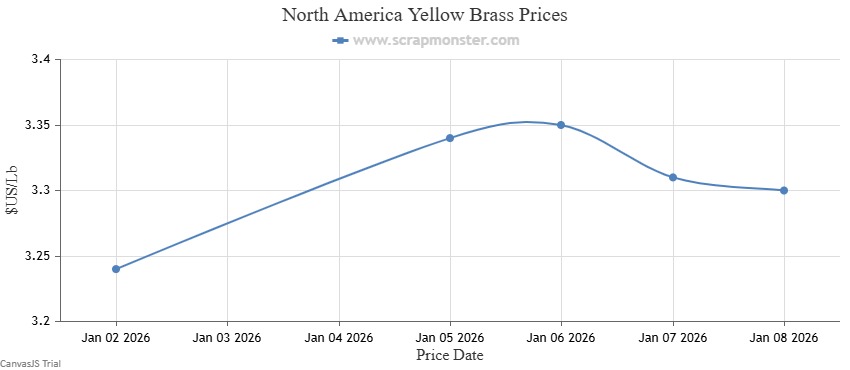

North America Brass/Bronze Scrap Prices: Over the previous week, there was a jump in brass/bronze scrap prices. Yellow Brass’s prices increased by 1.85% to close at $3.30 per Lb . Red Brass closed at $3.45 per pound, rising by 1.77% during the week.

Charts

The table below provides weekly price fluctuations in Yellow Brass and Red Brass.

Category | Price Change ($) | % Change |

0.06 | +1.77% | |

0.06 | +1.85% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Brass/Bronze Scrap Prices

The price of Red Brass on the Scrap Monster Price Index recorded an increase of 1.77% as of Thursday, January 8, 2026. Yellow Brass prices also jumped higher on the Index, to close at $3.30 per Lb.

USA Midwest Brass/Bronze Scrap Prices

By the conclusion of the week ended January 8, 2026, the price of Red Brass had recorded a jump of 1.80% from $3.33 per Lb. Additionally, Yellow Brass prices edged higher by 1.90% week-on-week.

USA West Coast Brass/Bronze Scrap Prices

Red Brass went higher by $0.06 per pound, witnessing a jump of ↑1.71% from the prior week. By the end of the week, the price of Yellow Brass had increased by 1.81% to close the week at $3.37 per Lb.

International Comparison

China Brass/Bronze Scrap Prices

- All brass/bronze scrap categories recorded increase on the Scrap Monster Price Index.

- Top Gainer: Yellow Brass ↑0.51%

India Brass/Bronze Scrap Prices

- All brass/bronze scrap categories recorded week-over-week decline on the Scrap Monster Price Index.

LEAD SCRAP PRICES

Market Highlights

North America Lead Scrap Prices: Lead scrap prices stayed flat throughout the week, reflecting stable market conditions. Scrap Auto Battery prices also remained unchanged, closing the week at $0.24 per pound with no movement.

Chart

The table below provides weekly price fluctuations in Scrap Auto Batteries.

Category | Price Change ($) | % Change |

0 | Nil |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Lead Scrap Prices

The price of Scrap Auto Batteries on the Scrap Monster Price Index held steady as of Thursday, January 8, 2026.

USA Midwest Lead Scrap Prices

By the conclusion of the week ended January 8, 2026, the price of Scrap Auto Batteries maintained previous week’s price level.

USA West Coast Lead Scrap Prices

The prices of Scrap Auto Batteries recorded no change on the Scrap Monster Price Index as of Thursday, January 8, 2026.

International Comparison

China Lead Scrap Prices

- Soft Lead and #2 Lead scrap prices posted week-over-week increase on the Scrap Monster Price Index. The prices of these categories were up by 1.07% and 1.09% respectively over the prior week.

- Auto Battery prices were up by 1.49% to end the week at CNY 6,800 per MT.

India Lead Scrap Prices

- All lead scrap categories recorded week-over-week jump on the Scrap Monster Price Index.

- Top Gainer: Lead ingot ↑3.85%

ZINC SCRAP PRICES

Market Highlights

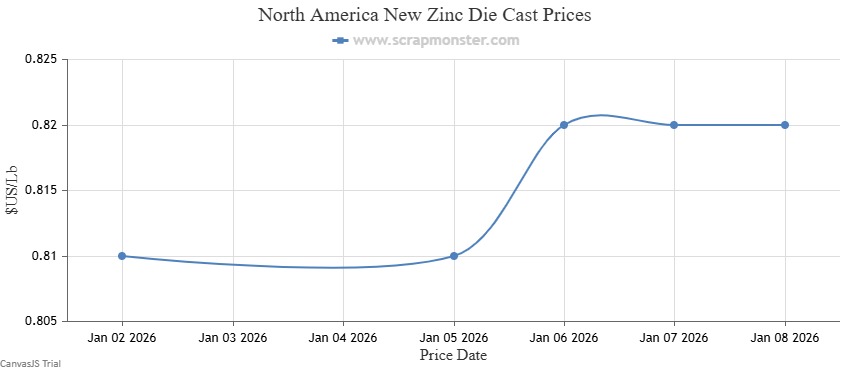

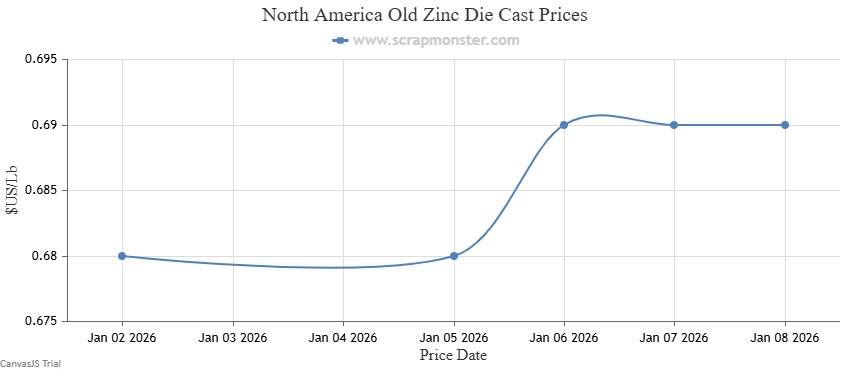

North America Zinc Scrap Prices: Zinc scrap prices edged higher upon comparison with the previous week's prices. New Zinc Die Cast prices were up by 1.23%. Also, Old Zinc Die Cast prices posted a jump of 1.47% during the week.

Charts

The table below provides weekly price fluctuations in New Zinc Die Cast and Old Zinc Die Cast.

Category | Price Change ($) | % Change |

0.01 | +1.23% | |

0.01 | +1.47% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Zinc Scrap Prices

The price of New Zinc Die Cast on the Scrap Monster Price Index recorded a jump by 1.23% as of Thursday, January 8, 2025. Also, Old Zinc Die Cast prices were up by 1.47% over the previous week.

USA Midwest Zinc Scrap Prices

By the conclusion of the week ended January 8, 2026, the prices of New Zinc Die Cast and Old Zinc Die Cast recorded increase from the previous week’s price levels.

USA West Coast Zinc Scrap Prices

The prices of New Zinc Die Cast witnessed week-over-week jump of 1.23% on the Scrap Monster Price Index as of Thursday, January 8, 2026. Similarly, the Old Zinc Die Cast prices closed at $0.69 per Lb, higher by 1.47% week-over-week.

International Comparison

- Shred zinc scrap prices recorded a jump of ↑1.83% on the Scrap Monster Price Index. The commodity's price closed at CNY 16,700 per MT during the week ended January 8, 2026, recording a jump of CNY 300 per MT.

- Tin Slab prices held steady week-over-week on the Scrap Monster Price Index.

- Zinc slab prices recorded a modest decline of ↓0.33% over the previous week

FERROUS SCRAP

Market Drivers

Steel Production and Demand Trends – Global steel production levels remain a principal driver of ferrous scrap consumption. Sluggish finished steel demand or capacity utilization directly weakens scrap intake by mills, while expansion in steelmaking supports higher scrap usage.

Electric Arc Furnace (EAF) Adoption – The increasing shift from traditional blast furnaces to EAF technology boosts scrap demand because EAFs use a high proportion of ferrous scrap as feedstock compared to conventional processes.

Supply Chain and Collection Efficiency – The effectiveness of scrap collection, transportation, and processing infrastructure shapes available supply. Inefficient systems or bottlenecks raise costs and constrain market activity.

Economic Cycles and Construction Activity – Macroeconomic conditions, particularly activity in construction, manufacturing, and infrastructure investment, influence steel demand and, consequently, scrap consumption. Slower economic growth typically dampens scrap pricing.

- Regulatory and Sustainability Policies – Environmental regulations and sustainability mandates (e.g., recycling incentives, carbon emissions reduction goals) elevate scrap’s strategic importance and can expand long-term demand, especially for recycled content in low-carbon steelmaking.

- International Trade and Import-Export Dynamics - Trade flows of scrap and steel products influence local market conditions. Import competition, export demand, and geopolitical developments can alter local supply balances and price levels. Export restrictions or shifts in international scrap availability can reverberate domestically.

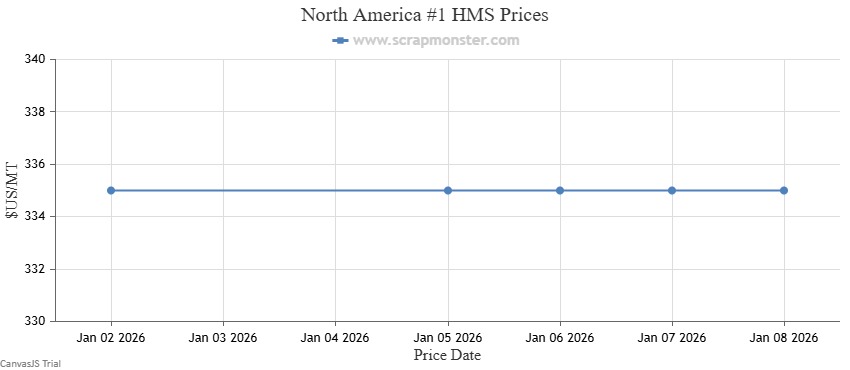

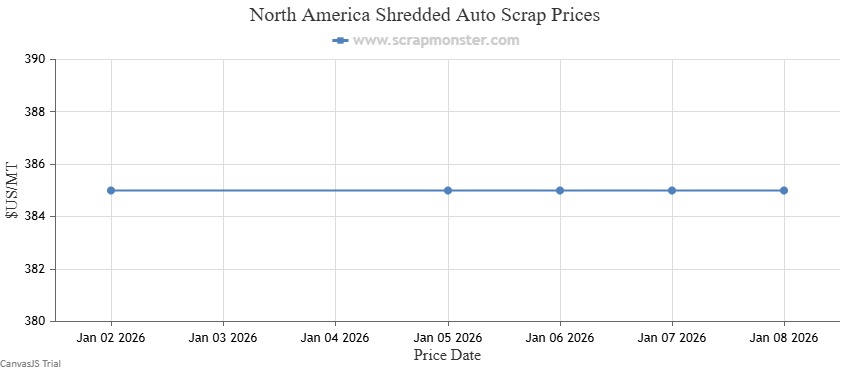

STEEL SCRAP PRICES

Market Highlights

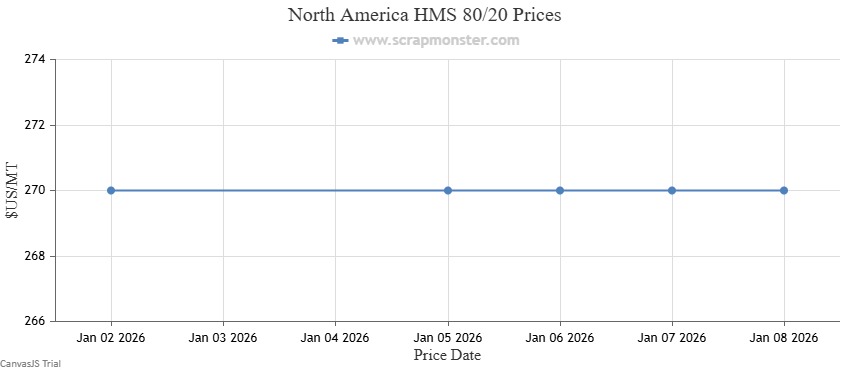

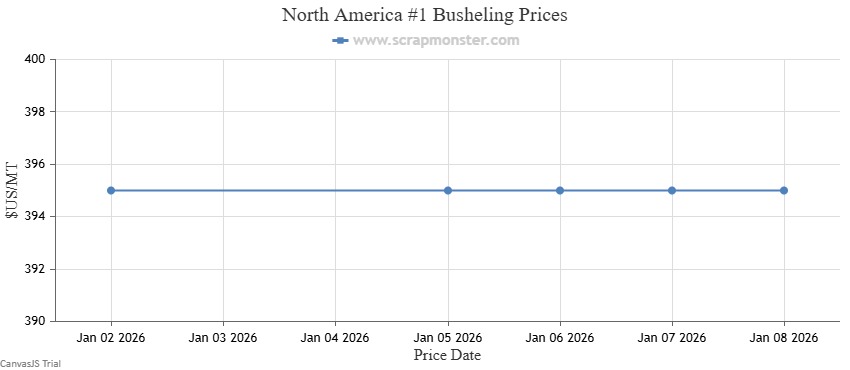

North America Steel Scrap Prices: Steel scrap prices showed little movement over the past week, indicating a steady market environment. #1 HMS remained unchanged at $335 per metric ton, while Shredded Auto Scrap held firm at $385 per metric ton. HMS 80/20 continued to trade at $270 per metric ton, and #1 Busheling stayed flat at $395 per metric ton.

Charts

The table below provides weekly price fluctuations in #1 HMS, Shredded Auto Scrap, HMS 80/20, and #1 Busheling.

Category | Price Change ($) | % Change |

0 | Nil | |

0 | Nil | |

0 | Nil | |

0 | Nil |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Steel Scrap Prices

The price of #1 HMS on the Scrap Monster Price Index reported no change as of Thursday, January 8, 2026. Shredded Auto Scrap prices were unchanged on the Index upon comparison with the prior week. By the end of the week, the price of HMS 80/20 had recorded no change. #1 Busheling prices also were flat over the previous week.

USA Midwest Steel Scrap Prices

#1 HMS prices held steady on the Scrap Monster Price Index. Shredded Auto Scrap closed the week at $385 per MT, recording no variation from the beginning of the week. The HMS 80/20 prices were stable. Also, the price of # Busheling recorded no weekly fluctuation.

USA West Coast Steel Scrap Prices

#1 HMS’s price on the Scrap Monster Price Index was flat as of Thursday, January 8, 2026. Shredded Auto Scrap witnessed no movement, closing the at $385 per MT. By the end of the week, the price of HMS 80/20 had recorded no fluctuation. #1 Busheling prices also held steady over the previous week.

International Comparison

China Flat

China Steel Scrap Prices

- All the steel scrap categories held steady on the Scrap Monster Price Index.

- #1 HMS and Cast Iron Scrap prices were flat at $1,630 and $1,730 per MT respectively.

STAINLESS STEEL SCRAP PRICES

Market Highlights

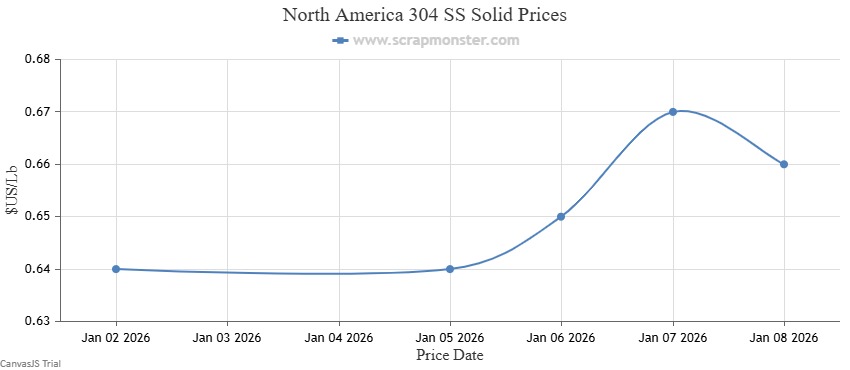

North America Stainless Steel Scrap Prices: Over the previous week, stainless steel scrap prices increased on the Scrap Monster Price Index. 304 SS Solid scrap prices recorded jump on a week-on-week basis, edging higher from $0.64 per pound to $0.66 per pound.

Chart

The table below provides weekly price fluctuations in 304 SS Solid scrap.

Category | Price Change ($) | % Change |

0.02 | +3.13% |

Access our Daily Scrap Metal Price Report Hub

Track real-time prices via our US Scrap Price Index

USA East Coast Stainless Steel Scrap Prices

The price of 304 SS Solid on the Scrap Monster Price Index recorded a jump of ↑3.13% as of Thursday, January 8, 2026.

USA Midwest Stainless Steel Scrap Prices

304 SS Solid prices registered a marginal increase on the Scrap Monster Price Index. The price of the commodity increased by $0.02 per Lb to end the week at $0.66 per Lb.

USA West Coast Stainless Steel Scrap Prices

The price of 304 SS Solid on the Scrap Monster Price Index recorded an upward movement, rising by $0.02 per Lb to $0.66 per pound during the week ended Thursday, January 8, 2026.

International Comparison

China ↑7.56%

China Stainless Steel Scrap Prices

- All the stainless steel scrap categories recorded increase on the Scrap Monster Price Index.

- Top gainers: 201 SS ↑11.40%, 304 SS Turning ↑8.13%

See all Stainless steel daily reports → | Stainless Steel Price Index → | Related Stainless steel news →

Weekly Market Drivers

- Mills & buy programs- U.S. Raw Steel Output Ticks Up in Early January: AISI

- Export/Import/Tariff- Korea steel industry faces triple shock from structural slump, tariffs and weak construction

- Trade/policy- 'Come down hard to check unlawful scrap metal deals'

- Scrap Market Trends- U.S. Ferrous Scrap Market Bolstered by EAF Capacity Growth

- Regional Trade- Latin America Hot-Rolled Steel Bar & Rod Market to Hit 26M Tons by 2035

Global Comparison & Policy Impact

USA vs. China/India

Steel: Nil

- Stainless Steel: U.S.-↑3.13% ; China- ↑7.56%

Expert Quote:

“Global ferrous scrap markets have remained largely range-bound in recent trading, with subdued demand from downstream steelmakers and cautious buying keeping prices flat to mildly soft, even as supply tightness in select regions offers limited support.” — Market analysis from SteelMint’s weekly global scrap report.

Market Outlook

- Flat to Neutral Near-Term Price Sentiment- Market sentiment for ferrous scrap remains broadly neutral, with trend indicators showing little directional conviction and modest expectations for price movement in the short term. This reflects balanced forces between supply and demand fundamentals.

- EAF Adoption Supporting Long-Term Demand- The continued global shift toward electric arc furnaces (EAFs) in steelmaking is expected to bolster scrap demand, as EAFs rely more heavily on recycled ferrous feedstock compared with traditional blast furnace operations. This supports a structural uplift in scrap consumption over time.

- Sluggish Global Steel Demand Limiting Immediate Growth- Softness in finished steel output and subdued construction activity in key regions has constrained ferrous scrap consumption, tempering near-term pricing power and demand elasticity.

- Regional Demand Divergence- Geographic disparities in demand are emerging, with some regions (e.g., North America) expected to see modest scrap demand growth due to EAF expansions, while others face weaker steel production and competitive alternatives.

- Sustainability and Policy Tailwinds- Long-term policy emphasis on decarbonization, circular economy initiatives, and regulatory support for recycling infrastructure is expected to underpin future demand for ferrous scrap as steelmakers pursue lower-carbon production pathways and higher scrap utilization rates.

These drivers suggest a market that is stable with modest upside over the medium term, driven by structural shifts in steelmaking technology and sustainability preferences, though constrained in the near term by macroeconomic and supply-side dynamics.

Daily Reports | Scrap Monster Price Index | US Scrap Metal Prices

Register now for free daily alerts → Sign Up

Related Resources

Copper Scrap Prices | Aluminum Scrap Prices | Steel Scrap Prices | Brass Scrap Prices | Scrap Yard Directory | Company Directory | Daily Market Report

Full pricing details, yard finder, market analysis, and live price charts available at ScrapMonster.com. Trusted by 100,000+ recycling professionals. Sign up for daily alerts—your competitive edge starts here.

POLL

Which scrap metal segment shows the strongest price momentum through Q1 2026?

Frequently Asked Questions

- Which scrap metals performed best during the week?

Aluminum, copper, brass/bronze, and stainless steel scrap showed the strongest momentum, with aluminum transformers and Cu/Al radiators posting notable gains.

- What factors are driving non-ferrous scrap price increases?

Improved industrial demand, tight scrap availability, firm global metal prices, infrastructure spending, and steady export demand supported higher prices.

- How did international markets compare?

China generally recorded price increases across several scrap categories, while India saw mixed trends, including declines in some copper and brass/bronze grades.

- How can I track scrap metal prices in real time?

For up-to-date data, use tools like the Scrap Monster Price Index and the US Scrap Price Index, then review daily and weekly reports in the Scrap Monster portal to monitor trends, percentage moves, and grade-specific performance.

Combining index data with structured weekly commentary helps scrap yards, traders, and generators refine their buying and selling strategies.

- What is the difference between #1 copper scrap and #2 copper scrap?

#1 copper scrap (also known as bright and shiny copper) is clean, uncoated, and unalloyed copper wire or pipe with minimum 98% purity, commanding premium prices. #2 copper scrap contains oxidation, coatings, soldered joints, or minor impurities, typically trading $0.20-$0.50 below #1 copper prices per pound. Learn more about copper scrap grades and current pricing at https://www.scrapmonster.com/scrap-material/copper-scrap

- How much energy is saved by recycling aluminum scrap compared to producing new aluminum?

Recycling aluminum scrap saves approximately 95% of the energy required to produce primary aluminum from bauxite ore. This makes aluminum one of the most valuable recyclable materials. Current aluminum scrap pricing reflects both metal value and environmental benefits. Visit https://www.scrapmonster.com/scrap-material/aluminum-scrap for current market rates on aluminum transformers, radiators, and other aluminum scrap grades.

- What are the main grades of stainless steel scrap and how do their prices differ?

The primary stainless steel scrap grades include 304 (18-8 stainless with chromium and nickel), 316 (marine-grade with molybdenum for higher corrosion resistance), and 430 (ferritic stainless with no nickel). 316 typically commands the highest prices due to its nickel and molybdenum content, followed by 304. Ferritic grades like 430 trade at lower values because they lack nickel. Check https://www.scrapmonster.com/scrap-material/stainless-steel-scrap for daily pricing on 304, 316, 430, and other stainless grades.

- Why are brass and bronze scrap prices higher than other non-ferrous metals?

Brass and bronze scrap command premium prices because they contain copper as their base metal, typically 60-90% depending on the alloy. Yellow brass (high copper content) and red brass/bronze (even higher copper) trade near copper prices with an additional value from zinc or tin content. These alloys are widely used in plumbing fixtures, valves, fittings, and industrial components that require corrosion resistance. Compare current https://www.scrapmonster.com/scrap-material/brass-scrap and bronze prices to understand market dynamics.

- How can scrap yards and recyclers use weekly market reports to improve profitability?

Weekly market reports help scrap businesses optimize buy-sell timing, inventory decisions, and pricing strategies. By tracking trends across multiple material categories using tools like the https://www.scrapmonster.com/scrap-metal-prices, scrap yards can identify which materials are gaining value and adjust procurement focus accordingly. Understanding weekly percentage changes allows operators to time purchases when prices dip and sales when prices peak, maximizing margins. Consistent review of weekly reports also helps identify seasonal patterns, enabling better cash flow management and strategic planning for the year ahead.

By

By