Precious Metal Scrap Prices: Weekly Market Report (January 2-8, 2026)

Weekly Metal Price Report | 2026-01-09 11:22:59

9-carat gold scrap posted a marginal week-on-week increase of 3.02 percent.

SEATTLE (Scrap Monster): The North American scrap gold, silver and platinum prices - hallmarked and non- hallmarked witnessed jump during the period from January 2-8, 2026 on the ScrapMonster Price Index.

Hallmarked Precious Metals Market

Scrap gold prices in the hallmarked segment posted a slight week-on-week uptick, with multiple purity grades registering gains on the ScrapMonster Price Index, supported by steady demand across major scrap categories during the period.

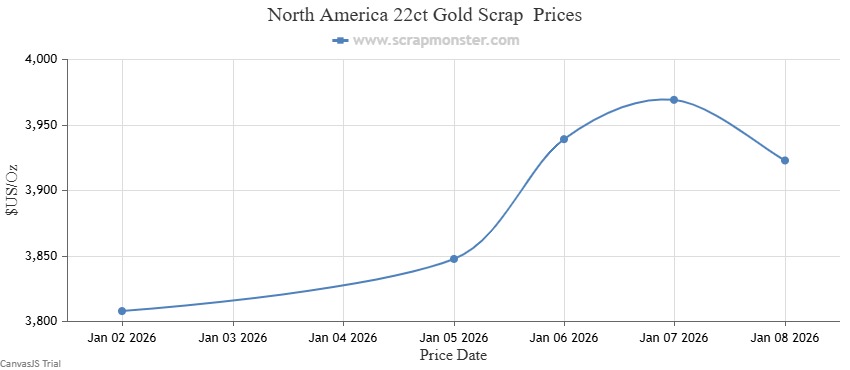

14-carat gold scrap prices rose by $73.42 per ounce, signaling a modest pickup in buying interest. 18-carat gold scrap recorded a stronger weekly gain, increasing by $94.13 per ounce. Meanwhile, 22-carat gold scrap posted the largest advance among gold categories, jumping $114.96 per pound, as reflected in the weekly price trend chart provided below.

9-carat gold scrap prices also edged higher, posting a modest week-on-week increase of 3.02 percent.

The silver scrap market delivered the strongest performance among precious metals. Silver scrap prices jumped sharply by 9.72% to close the week at $59.50 per ounce.

Platinum scrap prices also moved slightly higher, gaining 3.02 percent to settle at $1,606.00 per ounce.

See all Precious Metals Price Reports

Non-Hallmarked Precious Metals Market

14-carat gold scrap prices rose by $69.43 per ounce during the week. 18-carat and 22-carat gold scrap also recorded modest gains, increasing by $89.00 and $108.70 per ounce, respectively. 9-carat gold scrap posted a marginal week-on-week increase of 3.02 percent.

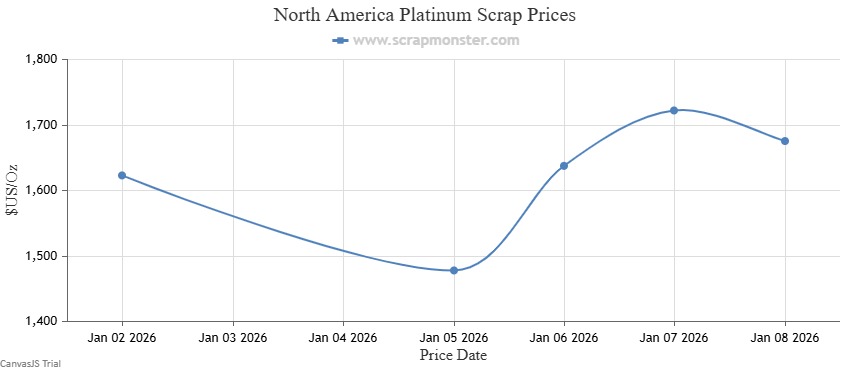

The platinum scrap market delivered a strong performance over the reporting period. Platinum scrap prices surged by 3.23% to close the week at $1,675.52 per ounce, compared with an opening price of $1,623.03 per ounce, as shown in the accompanying chart.

Silver scrap prices also strengthened, edging up by 9.72 percent from the previous week, reflecting strong improvement in buying sentiment across the precious metals scrap market.

Access our Daily Scrap Metal Price Report Hub

POLL

Which precious metal scrap showed the strongest price momentum during January 2–8, 2026?

Frequently Asked Questions

- How did scrap gold prices perform during January 2–8, 2026?

Scrap gold prices moved higher across most purity grades in both hallmarked and non-hallmarked markets, with 22-carat gold recording the largest absolute gains.

- Which precious metal recorded the strongest weekly performance?

Silver scrap delivered the strongest performance, with prices jumping by nearly 9.7% week-on-week in both market segments.

- Did platinum scrap prices rise during the week?

Yes. Platinum scrap prices posted moderate gains in the hallmarked segment and stronger increases in the non-hallmarked market.

By

By