Precious Metal Scrap Prices: Weekly Market Report (January 16-22, 2026)

Weekly Metal Price Report | 2026-01-25 17:56:29

Lower-purity 9-carat scrap also registered a positive trend, recording a week-on-week rise of 5.54 percent.

SEATTLE (Scrap Monster): North American scrap prices for gold, silver, and platinum—across both hallmarked and non-hallmarked categories—recorded notable gains during the January 16–22, 2026 period on the ScrapMonster Price Index.

Hallmarked Precious Metals Market

Hallmarked scrap gold prices delivered a strong weekly performance, with multiple purity grades posting notable gains on the ScrapMonster Price Index, supported by steady demand across major recycling streams.

Fourteen-carat scrap gold recorded a weekly advance of $144.32 per ounce, reflecting improving buyer interest and firmer market sentiment. Prices for 18-carat material strengthened further, registering a rise of $185.02 per ounce over the period.

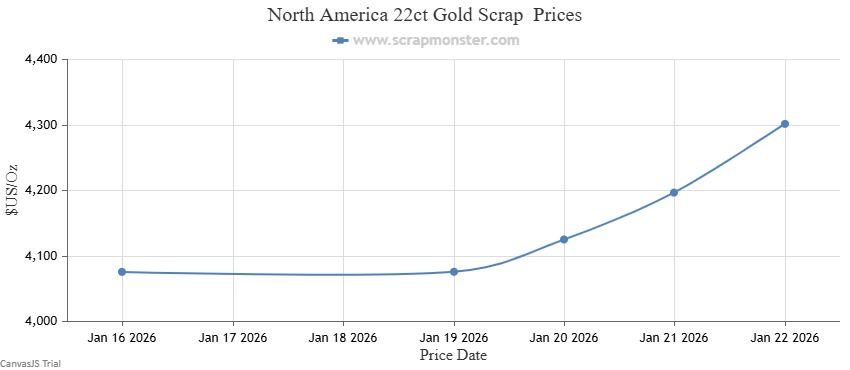

The most pronounced increase was seen in 22-carat scrap gold, which surged by $225.98 per pound, underscoring heightened demand for higher-purity material. The chart below provides the weekly price movement in 22-carat hallmarked gold:

Meanwhile, lower-grade 9-carat scrap gold also trended upward, posting a week-on-week gain of approximately 5.54 percent.

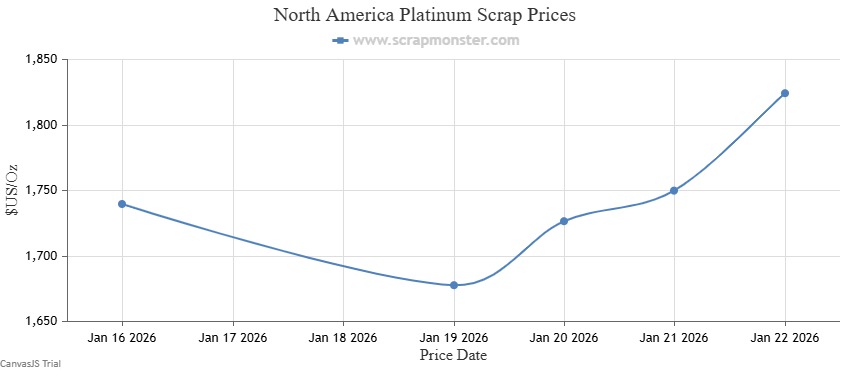

In the broader precious metals segment, silver scrap prices climbed sharply, advancing 3.93 percent to settle at $71.46 per ounce. Platinum scrap followed a similar trajectory, recording a solid increase of 4.86 percent to close the week at $1,824.27 per ounce, signalling continued strength across the precious metals scrap market.

See all Precious Metals Price Reports

Non-Hallmarked Precious Metals Market

Gold scrap prices across key purity segments moved higher during the week, supported by firm buying interest. Fourteen-carat scrap gold advanced by $136.47 per ounce, while 18-carat and 22-carat grades posted moderate gains of $174.96 and $213.69 per ounce, respectively. Lower-purity 9-carat scrap also registered a positive trend, recording a week-on-week rise of 5.54 percent.

Platinum scrap prices delivered a particularly strong performance over the period. Values climbed sharply by 4.86 percent, ending the week at $1,824.27 per ounce, up from the prior week’s opening level of $1,739.69 per ounce, as illustrated in the accompanying chart.

Silver scrap prices followed a similar upward trajectory, increasing by 3.94 percent compared with the previous week. The gains reflect strengthening market sentiment and renewed buying momentum across the precious metals scrap segment.

Access our Daily Scrap Metal Price Report Hub

Subscribe to Scrap Monster Live Scrap Prices

In-Depth Analysis: Gold and Silver's Historic Rally to $5,000 and $100

Gold has surged within striking distance of $5,000 per ounce while silver recently shattered the historic $100 barrier for the first time in history. Both metals delivered extraordinary gains in 2025—gold up 65-67% and silver up 144-161%—driven by structural factors including geopolitical tensions, fiscal imbalances, and record central bank diversification.

Read our full market analysis examining what powered the 2025 rally, the fundamentals supporting prices into 2026, and what major financial institutions are forecasting for year-end targets.

POLL

Which precious metal scrap segment is likely to outperform in the coming weeks?

Frequently Asked Questions

- How did North American precious metals scrap prices perform during January 16–22, 2026?

Scrap prices for gold, silver, and platinum recorded notable gains, supported by strong demand and positive market sentiment across hallmarked and non-hallmarked categories.

- Which gold scrap grade recorded the highest price increase?

Twenty-two-carat scrap gold posted the largest weekly rise, reflecting increased demand for higher-purity material.

- How did platinum scrap prices perform during the week?

Platinum scrap surged by nearly 5 percent, making it the strongest-performing precious metal scrap category during the period.

By

By