ISRI Monday Report-For the week beginning Monday April 1st

ISRIs Commodity Update | 2013-05-21 14:27:23

Commodities got off to a sluggish start this week as manufacturing readings for China and the U.S. came in below most expectations

Commodities got off to a sluggish start this week as manufacturing readings for China and the U.S. came in below most expectations — while continuing to indicate expansion, helping to pull the DJ-UBS Commodity Futures Index 0.8% lower today. The London Metal Exchange is closed today for the Easter holiday but copper prices in Shanghai weakened further as SHFE copper for July delivery settled 1.8% lower today amid concerns about slower growth and rising stock levels there. In New York, COMEX May copper was down nearly 3 cents today to $3.37/1b. as crude oil futures slipped below $97/bbl. On Wall Street, the Dow Industrials and S&P 500 remained in negative territory early this afternoon after having reached record heights in the first quarter, while the yield on 10-year Treasury notes dipped to 1.83%.

April 1, 2013 | Last | CHG | % CHG | Prior Settle | Open | High | Low |

COMEX Copper May ($/lb.) | 3.374 | -0.028 | -0.8% | 3.402 | 3.4 | 3.403 | 3.34 |

COMEX Gold Jun ($/to) | 1,600.8 | 5.1 | 0.3% | 1,595.7 | 1,598.1 | 1,601.6 | 1,595.2 |

COMEX Silver May ($/to) | 28.0 | -0.4 | -1.3% | 28.3 | 28.2 | 28.4 | 27.8 |

NYMEX Light Sweet Crude May ($/bbl) | 96.78 | -0.45 | -0.5% | 97.23 | 97.36 | 97.8 | 95.92 |

SHFE Aluminum Jul (RMB/mt) | 14,590 | -55 | -0.4% | 14,645 | 14,625 | 14,625 | 14,575 |

SHFE Copper Jul (RMB/mt) | 54,040 | -990 | -1.8% | 55,030 | 54,480 | 54,500 | 53,600 |

SHFE Zinc Jul (RMB/mt) | 14,695 | -120 | -0.8% | 14,815 | 14,775 | 14,775 | 14,645 |

The ISM report out this morning signaled the fourth consecutive month of expansion in the manufacturing sector in March but came in lower than expected, while growth in construction spending in February beat the consensus forecast at a healthy 1.1%. Figures on factory orders, light vehicle sales, trade and consumer credit are all due out this week, but the big release of the week is the Labor Department's jobs report, and the consensus forecast is for a gain of +190,000 in nonfarm payrolls but steady 7.7% unemployment rate. We'll have the latest economic, commodity and scrap market highlights, as well as an ISRI convention update, in this week's Friday Report. Please note the Monday and Friday Reports will not be published next week due to the fast approaching and best-ever 2013 ISRI Convention & Expo.

Date | Time | Release | Period | Consensus | Prior |

Apr 01 | 10:00 | ISM Index | Mar | 54.0 | 54.2 |

Apr 01 | 10:00 | Construction Spending | Feb | 0.9% | -2.1% |

Apr 02 | 10:00 | Factory Orders | Feb | 2.6% | -2.0% |

Apr 02 | 14:00 | Auto Sales | Mar | NA | 5.5M |

Apr 02 | 14:00 | Truck Sales | Mar | NA | 6.7M |

Apr 03 | 07:00 | MBA Mortgage Index | 03/30 | NA | 7.7% |

Apr 03 | 08:15 | ADP Employment Change | Mar | 197K | 198K |

Apr 03 | 10:00 | ISM Services | Mar | 55.5 | 56.0 |

Apr 03 | 10:30 | Crude Inventories | 03/30 | NA | 3.256M |

Apr 04 | 07:30 | Challenger Job Cuts | Mar | NA | 7.0% |

Apr 04 | 08:30 | Initial Claims | 03/30 | 345K | 357K |

Apr 04 | 08:30 | Continuing Claims | 03/23 | 3045K | 3050K |

Apr 04 | 10:30 | Natural Gas Inventories | 03/30 | NA | -95 bcf |

Apr 05 | 08:30 | Nonfarm Payrolls | Mar | 192K | 236K |

Apr 05 | 08:30 | Nonfarm Private Payrolls | Mar | 210K | 246K |

Apr 05 | 08:30 | Unemployment Rate | Mar | 7.7% | 7.7% |

Apr 05 | 08:30 | Hourly Earnings | Mar | 0.2% | 0.2% |

Apr 05 | 08:30 | Average Workweek | Mar | 34.5 | 34.5 |

Apr 05 | 08:30 | Trade Balance | Feb | -$44.7B | -$44.4B |

Apr 05 | 15:00 | Consumer Credit | Feb | $14.0B | $16.2B |

U.S. On-Highway Diesel Fuel Prices* (dollars per gallon) | ||||||

|

|

|

|

| Change from | |

| 03/11/13 | 03/18/13 | 03/25/13 |

| week ago | year ago |

U.S. | 4.088 | 4.047 | 4.006 |

| -0.041 | -0.141 |

East Coast | 4.120 | 4.082 | 4.050 |

| -0.032 | -0.140 |

New England | 4.243 | 4.204 | 4.171 |

| -0.033 | -0.092 |

Central Atlantic | 4.171 | 4.140 | 4.109 |

| -0.031 | -0.170 |

Lower Atlantic | 4.058 | 4.016 | 3.983 |

| -0.033 | -0.127 |

Midwest | 4.043 | 4.015 | 3.979 |

| -0.036 | -0.067 |

Gulf Coast | 4.036 | 3.989 | 3.935 |

| -0.054 | -0.120 |

Rocky Mountain | 4.010 | 3.971 | 3.935 |

| -0.036 | -0.201 |

West Coast | 4.227 | 4.162 | 4.101 |

| -0.061 | -0.332 |

West Coast less California | 4.165 | 4.105 | 4.046 |

| -0.059 | -0.337 |

California | 4.280 | 4.212 | 4.147 |

| -0.065 | -0.329 |

*prices include all taxes

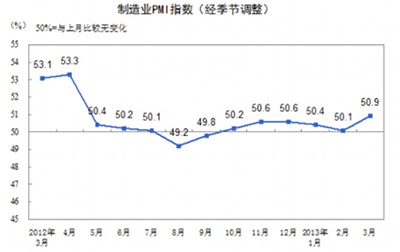

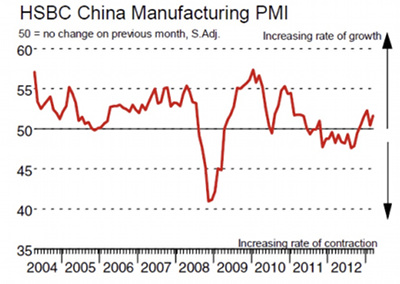

China PMI: on the up

When it comes to manufacturing indices, China is the big one. The question is which index to look at: the official state figures, or the widely-used HSBC/Markit index? They can often show different results.For March, it‟s relatively good news whichever index you pick. Official figures? Up, at 50.9. (50 is the mark that separates expansion from contraction), rising from 50.1 in February. HSBC/Markit? Up, at 51.6, higher than February’s 50.4.In fact, the official figure, although lower, is the more encouraging, being the highest reading for 11 months. The HSBC/Markit figure was something of a bounce back after a low February score – although the effect of the Chinese New Year, which falls in either January or February, makes data from those months hard to read.

Here’s the official chart

However, the plus-50 readings didn‟t cheer analysts. As Jamil Anderlini wrote in the FT, “the rise was slower than most economists had predicted, suggesting that China‟s economy may not rebound as quickly as many had hoped.” Liu Ligang, chief economist for Greater China at ANZ bank, noted that “The official PMI figures suggest that the current economic rebound remains fragile and could falter with tightened monetary policy conditions”.Andy Ji, analyst at Commonwealth Bank of Australia, noted about the official figures that “the increase had been widely expected, because manufacturing activity normally picks up strongly following the extensively celebrated Chinese New Year holiday that falls in the first two months of the year.”However, there is an encouraging detail according to Ji: “More specifically, while the PMI for large and state-owned enterprises was little changed, hovering comfortably above 50, the small and mostly private enterprises which have been the laggard in the past two years, registered its fastest improvement in March” – better news for a broader-based recovery. The HSBC/Markit reading also maintained the positive start to 2013, with a fifth consecutive monthly score above 50.

© 2013 Institute of Scrap Recycling Industries, Inc.

By

By