Precious Metal Scrap Prices: Weekly Market Report (February 13-19, 2026)

Weekly Metal Price Report | 2026-02-20 10:52:55

Broad-based dips were observed across multiple purity grades.

SEATTLE (Scrap Monster): North American precious metal scrap prices—covering gold, silver, and platinum in both hallmarked and non-hallmarked categories—registered modest declines on the ScrapMonster Price Indexduring the week of February 13–19, 2026.

Hallmarked Precious Metals Market

Hallmarked scrap gold prices recorded a strong week-on-week decline, driven by several factors including stronger U.S. dollar, rising bond yields, profit-taking after rally, reduced safe-haven demand, ETF outflows, weak physical demand, and weak central bank buying activity, as reflected on the ScrapMonster Price Index. Broad-based dips were observed across multiple purity grades.

Fourteen-carat scrap gold prices slipped by $22.50 per ounce, mirroring broader weakness in the bullion market. Likewise, eighteen-carat scrap prices fell by $28.85 per ounce during the period, pressured by muted trading activity and weaker buying sentiment.

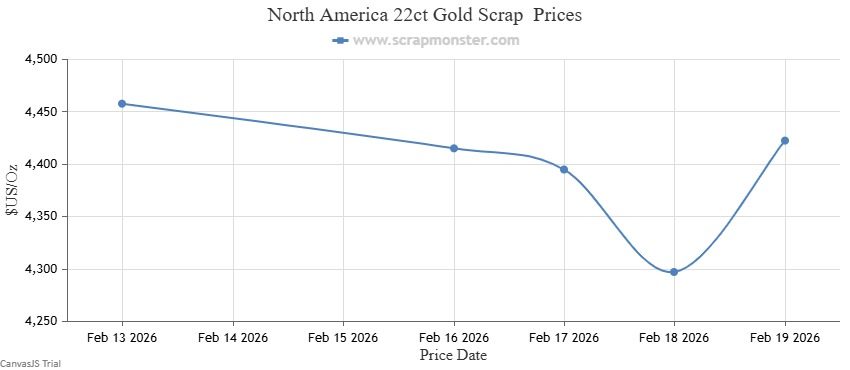

On a week-over-week basis, 22-carat scrap gold registered a decline of $35.23 per pound, pressured by macroeconomic headwinds and currency fluctuations. The pullback in international gold prices, coupled with tepid physical demand, weighed on valuations. The accompanying chart illustrates the weekly price trend for 22-carat hallmarked gold.

Lower-purity grades tracked the downward trajectory, with 9-carat scrap gold falling approximately 0.79% compared to the previous week.

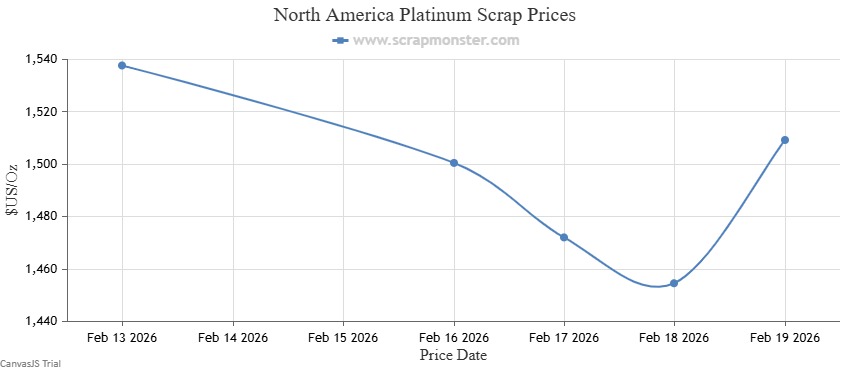

Within the broader precious metals scrap complex, silver recorded a pronounced decline of 9.66%, closing at $64.86 per ounce. Platinum also moved lower, posting a 1.85% weekly drop on the Index, reflecting softer momentum across the precious metals recycling market.

See all Precious Metals Price Reports

Non-Hallmarked Precious Metals Market

Scrap gold prices retreated across major purity segments during the week, in line with softer bullion-market fundamentals. Fourteen-carat scrap prices decreased by $21.27 per ounce, while 18-carat and 22-carat grades recorded declines of $27.27 and $33.31 per ounce, respectively. Lower-purity 9-carat material also moved lower, registering a 0.79% week-on-week drop.

Platinum scrap emerged as one of the weaker performers, posting a 1.85% decline to settle at $1,509.28 per ounce by the close of the week, as indicated in the accompanying chart.

Silver scrap prices recorded a steep 9.67% weekly fall, pressured by weaker international silver benchmarks, softening industrial demand indicators, and elevated scrap supply levels.

Access our Daily Scrap Metal Price Report Hub

POLL

Do you expect precious metal scrap prices to rebound next week?

Frequently Asked Questions

- What drove the decline in hallmarked scrap gold prices?

Stronger U.S. dollar, rising bond yields, profit-taking, ETF outflows, weak physical demand, and softer central bank buying weighed on prices.

- Which gold purity segment recorded the largest drop?

22-carat scrap gold posted the steepest decline among major grades during the week.

- Did non-hallmarked scrap follow the same trend?

Yes. Non-hallmarked gold, silver, and platinum mirrored the broader downward movement.

By

By