Scrap Metal, Recycling, Global Economic and Commodities Report 5/19/25

This is the Recycling, Scrap Metal, Commodities and Economic Report, May 19th, 2025.

U.S. weekly raw steel production rose to 1.74MT up 1.8% from last year, but down .9% year to date. This was on the continued slow U.S. economy.

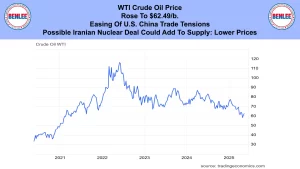

WTI crude oil price rose to $62.49/b., on easing of U.S. China trade tensions. A possible Iranian nuclear deal could add to supply, which would lower prices.

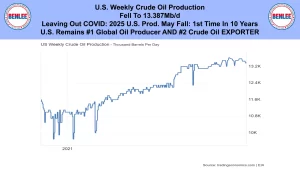

U.S. weekly crude oil production fell to 13.387Mb/d. Leaving out COVID 2025 U.S. production may fall for the first time in 10 years. The U.S. remains the #1 crude oil producer and the #2 crude oil exporter in the world.

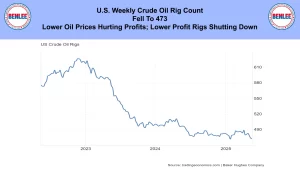

The U.S. weekly crude oil rig count fell to 473. Lower prices are hurting profits so lower profit rigs are shutting down.

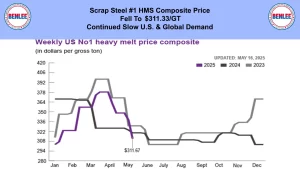

Scrap steel #1 HMS price composite fell to $311.33/GT on continued slow U.S. and global demand.

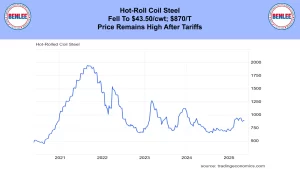

Hot-rolled coil steel price fell slightly to $43.50/cwt., $870/T. Price remains high after the tariffs.

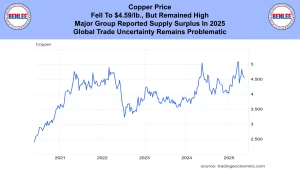

Copper price fell to $4.59/lb., but remained high. A major group reported there will be a supply surplus in 2025 and global trade uncertainty remains problematic.

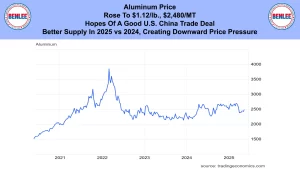

Aluminum price rose to $1.12/lb., $2,480/MT on hopes of a good U.S. China trade deal. Also, a better supply in 2025 vs 2024 is creating downward price pressure.

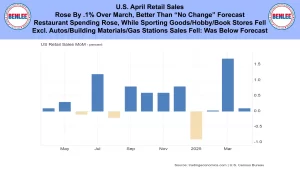

U.S. April retail sales rose by .1% over March which was better than the no change forecast. Restaurant spending rose, while Sporting goods, hobby and bookstores fell. Excluding Autos, building materials and gas stations, sales fell, which was below the forecast.

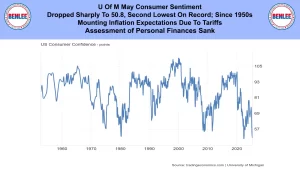

U of M May consumer sentiment dropped sharply to 50.8 the second lowest on record since the 1950s. This was on mounting inflation expectations due to tariffs and the assessment of person finances sank.

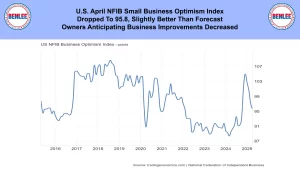

U.S. April NFIB small business optimism index dropped to 95.8, which was slightly better than forecast. Owners anticipating business improvement decreased.

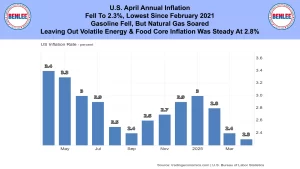

U.S. April annual inflation fell to 2.3%, the lowest since February 2021. Gasoline fell, but natural gas soared. Leaving out volatile energy and food, core inflation was steady at 2.8%.

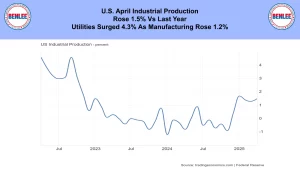

U.S. April industrial production rose 1.5% vs last year. Utilities surged 4.3% as manufacturing rose 1.2%.

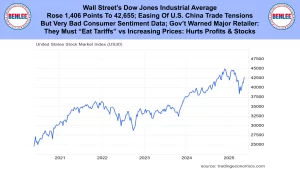

Wall Street’s Dow Jones Industrial Average rose 1,406 points to 42,655 on easing of U.S. China trade tensions, but on very bad consumer sentiment. The government warned a major retailer that they must eat the tariffs vs increasing prices, which will hurt profits and stocks.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.

Get an instant offer on your damaged car

Get an offer instantly

Just tell us a bit about your car and boom, there's your offer.

Free pickup

You have seven days to accept our offer and schedule pickup.

Get paid on the spot

Our pickup partner will do a quick inspection, and hand you a check.