Scrap Metal, Recycling, Global Economic and Commodities Report 3/3/25

This is the Recycling, Scrap Metal, Commodities and Economic Report, March 3rd, 2025.

U.S. weekly raw steel production fell to 1.66MT, down 3.9% from last year and down .8% year to date. This was on slow U.S. manufacturing and escalating steel prices. Tariffs are already helping steel company profits with higher prices, but tariffs should also shortly help production.

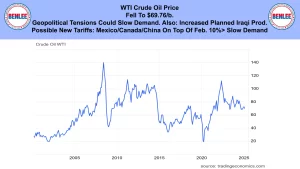

WTI crude oil price fell to $69.76/b. Geopolitical tensions could slow demand. Also, there is increased planned Iraqi production. Possible new tariffs on Mexico, Canada, and China, on top of the February’s 10% China tariffs, will slow demand.

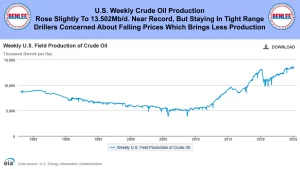

U.S. weekly crude oil production rose slightly to 13.502Mb/d near the record but staying in a tight range. Drillers are concerned about falling prices which brings less production.

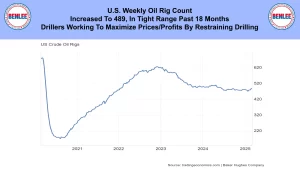

The U.S. weekly oil rig count rose to 489 also in a tight range for the past 18 months. Drillers are working to maximize prices and profits by restraining drilling.

Scrap steel #1 HMS composite price was steady at $356.67/GT. Bad weather is causing a lack of supply, so March’s price could be up $20/GT or a lot more.

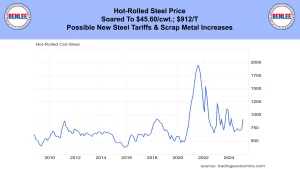

Hot-rolled coil steel price soared to $45.60/cwt., which is $912/T on possible new steel tariffs and scrap metal increases.

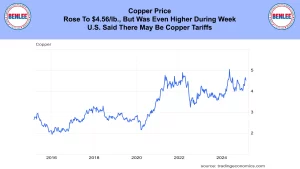

Copper price rose to $4.56/lb., but was even higher during the week as the U.S. said there maybe copper tariffs.

Aluminum price fell to $1.18/lb., $2,608/MT as the U.S. may relax Russian aluminum sanctions which would be great for the Russian economy. The largest Russian aluminum producer Rusal had its stock up 50% the 3rd week of February.

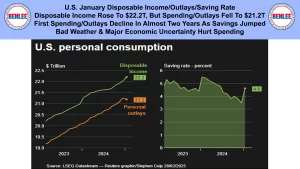

U.S. January disposable income, outlays and saving rate. Disposable income rose to $22.2T, but spending/outlays fell to $21.2T. This was the first spending/outlays decline in almost two years as savings jumped. Bad weather and major economic uncertainty hurt spending.

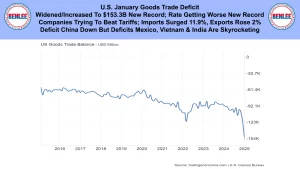

The U.S. January goods trade deficit widened as in increased to $153.3B a new record. Also, the rate of getting worse was a new record. This was as companies were trying to beat tariffs. Imports surged 11.9% as exports rose 2%. Deficits with China are down, but deficits with Mexico, Vietnam and India are skyrocketing.

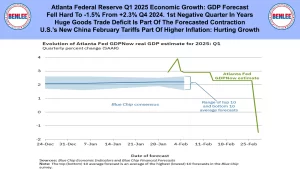

The Atlanta Federal Reserve Q1 2025 Economic Growth GDP forecast fell hard to -1.5% from +2.3% in Q4 2024. This would be the 1st negative quarter in years. The huge goods trade deficit is a part of the forecasted contraction. U.S.’s new China February tariffs are part of higher inflation that is hurting growth.

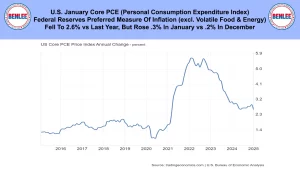

U.S. January core PCE which is the Personal Consumption Expenditure index. This is the Federal Reserve’s preferred measure of inflation that excludes volatile food and energy. It fell to 2.6% vs last year, but rose .3% in January, vs .2% in December.

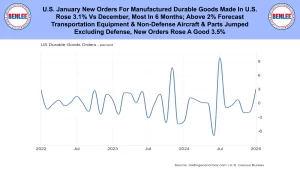

U.S. January new orders for manufactured durable goods made in the U.S. rose 3.1% vs December. This was the most in 6 months and above the 2% forecast. Transportation equipment and non-defense aircraft and parts jumped. Excluding defense, new orders rose a good 3.5%.

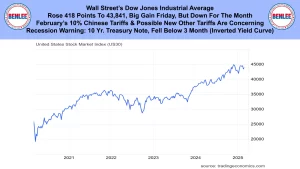

Wall Street’s Dow Jones Industrial average rose a big 418 points to 43,841 with a big gain Friday but down for the month. February’s 10% Chinese tariffs and possible new other tariffs are concerning. Also, there was a recession warning last week. The 10-Year Treasury note fell below the 3-Month note, which is called an inverted yield curve.

Get an instant offer on your damaged car

Get an offer instantly

Just tell us a bit about your car and boom, there's your offer.

Free pickup

You have seven days to accept our offer and schedule pickup.

Get paid on the spot

Our pickup partner will do a quick inspection, and hand you a check.