Commodities, Scrap Metal, Recycling and Economic Report March 6, 2023

This is the Commodities, Scrap Metal, Recycling and Economic Report by BENLEE roll off trailers, gondola trailers and roll off truck parts, March 6th, 2023.

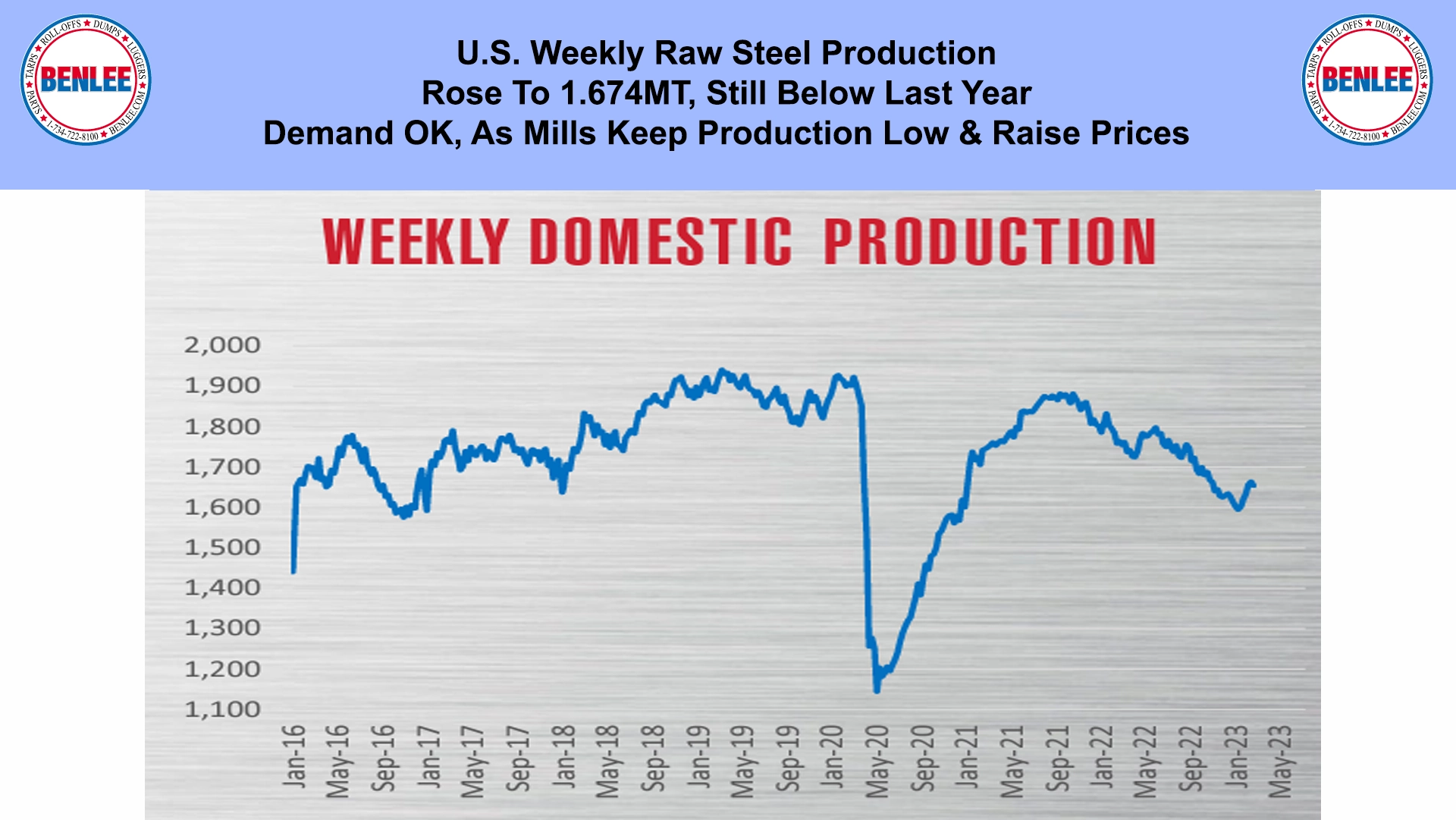

U.S. weekly raw steel production rose to 1.674MT, still below last year. Demand is OK as steel mills keep production low and raise prices.

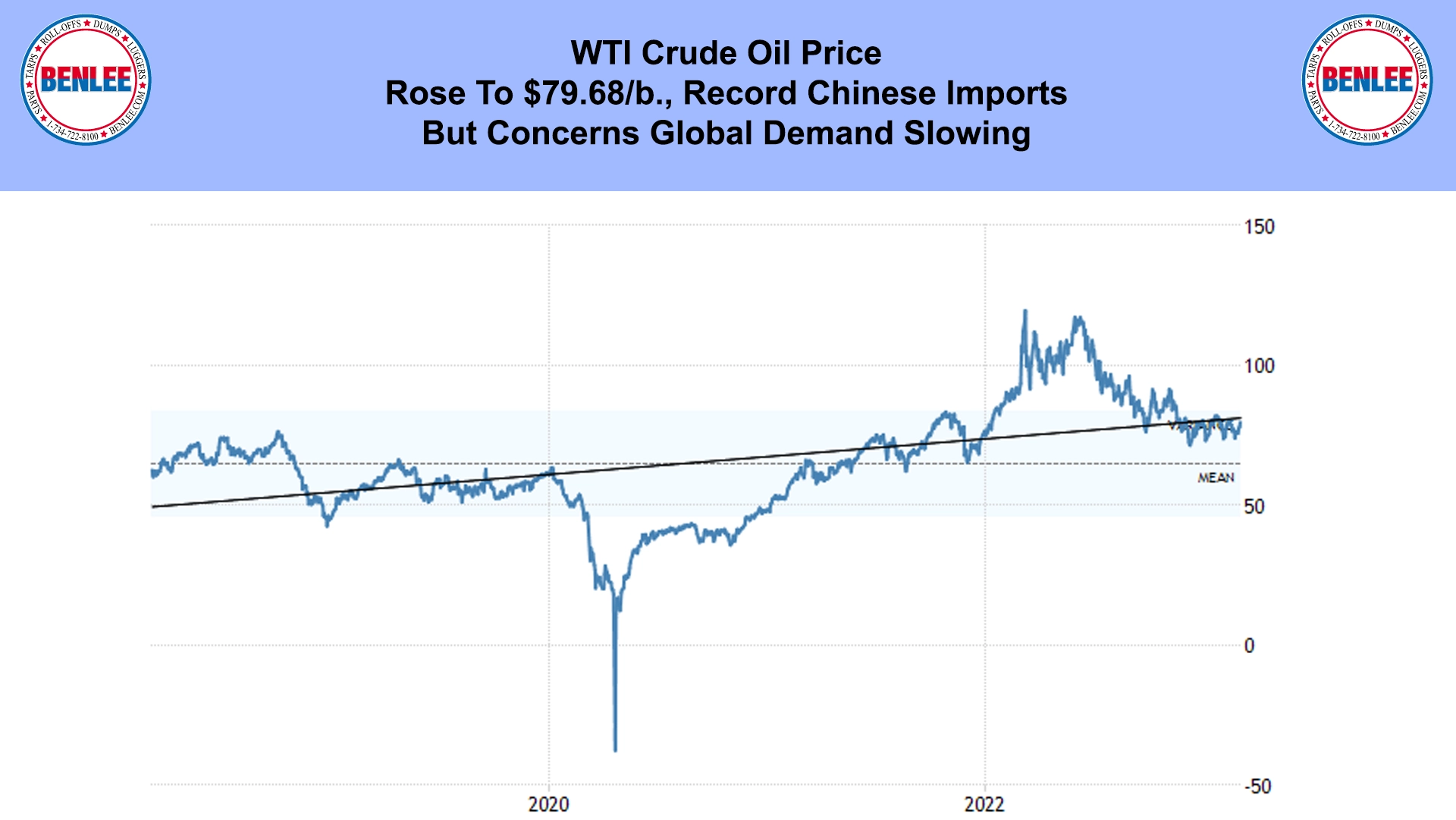

WTI crude oil price rose to $79.68/b., on record Chinese imports, but concerns over global demand is slowing.

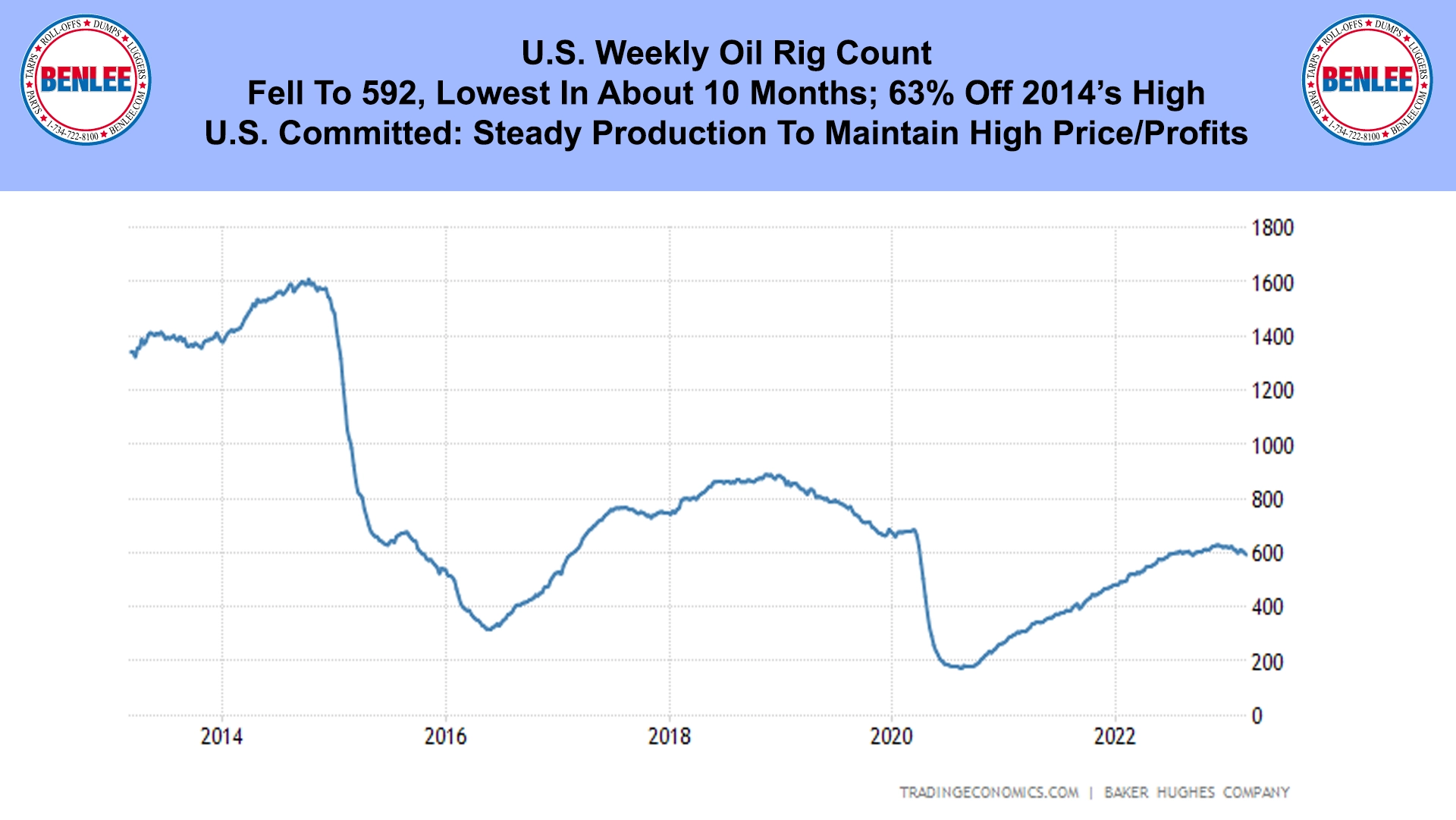

The U.S. weekly oil rig count fell to 592 the lowest in about 10 months, off 63% from 2014’s high. The U.S. is committed to steady production to maintain high prices and high profits.

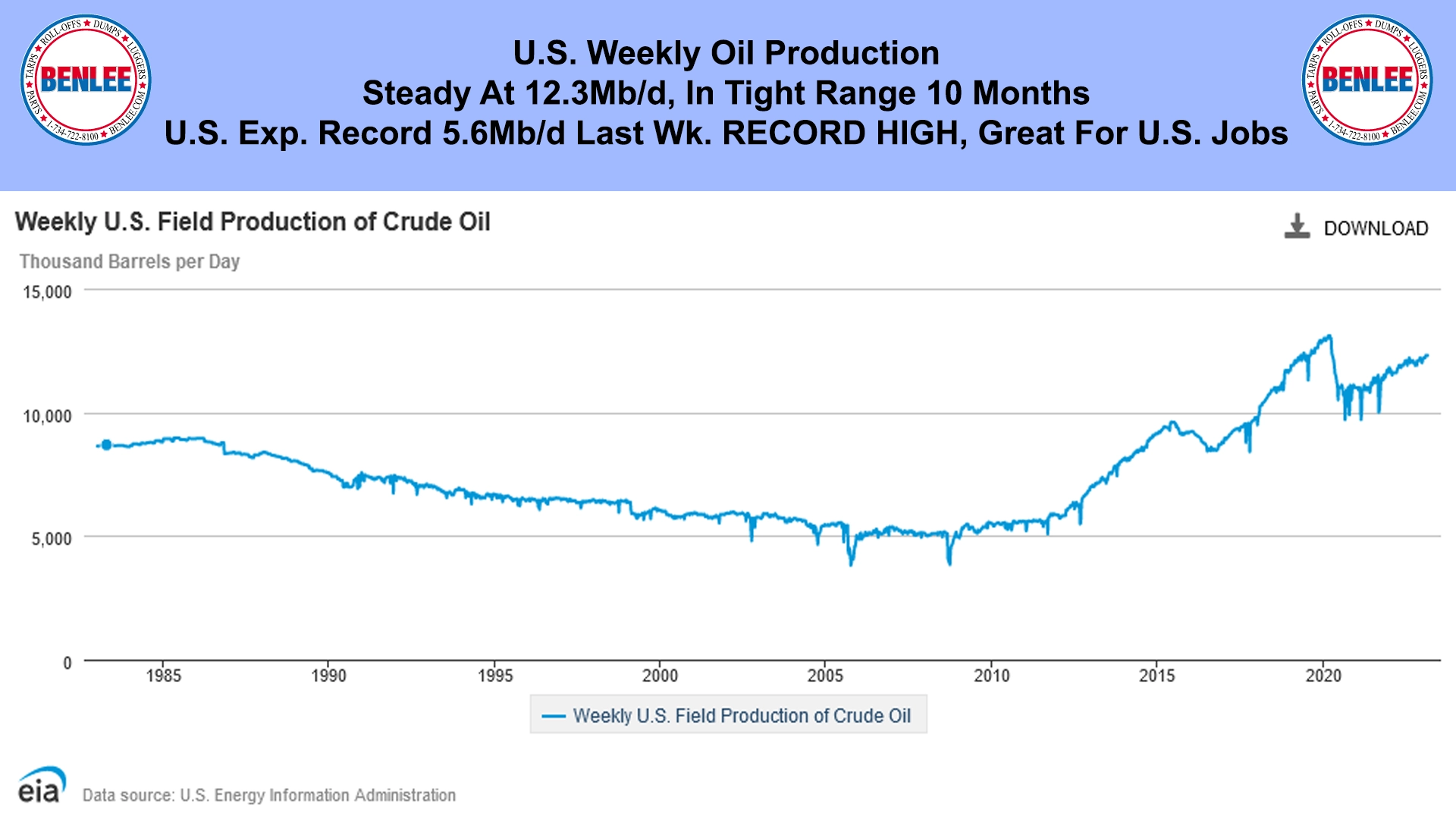

U.S. weekly crude oil production was steady at 12.3Mb/d., in a tight range for 10 months. U.S. exported, yes exported 5.6Mb/d last week a new record high, which is great for U.S. jobs.

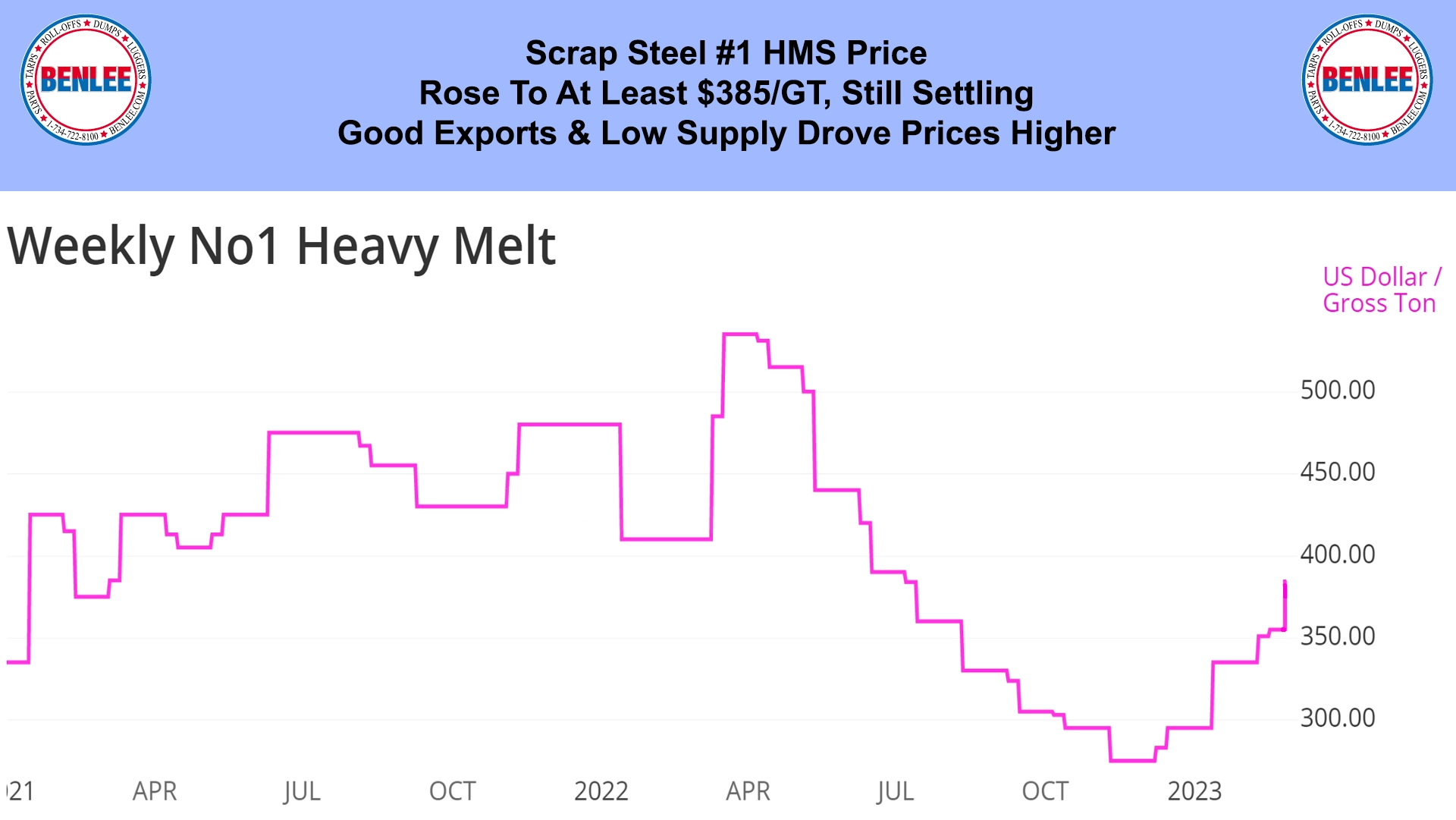

Scrap steel #1 HMS price rose to at least $385/GT and is still settling. This was as good exports and low supply drove prices higher.

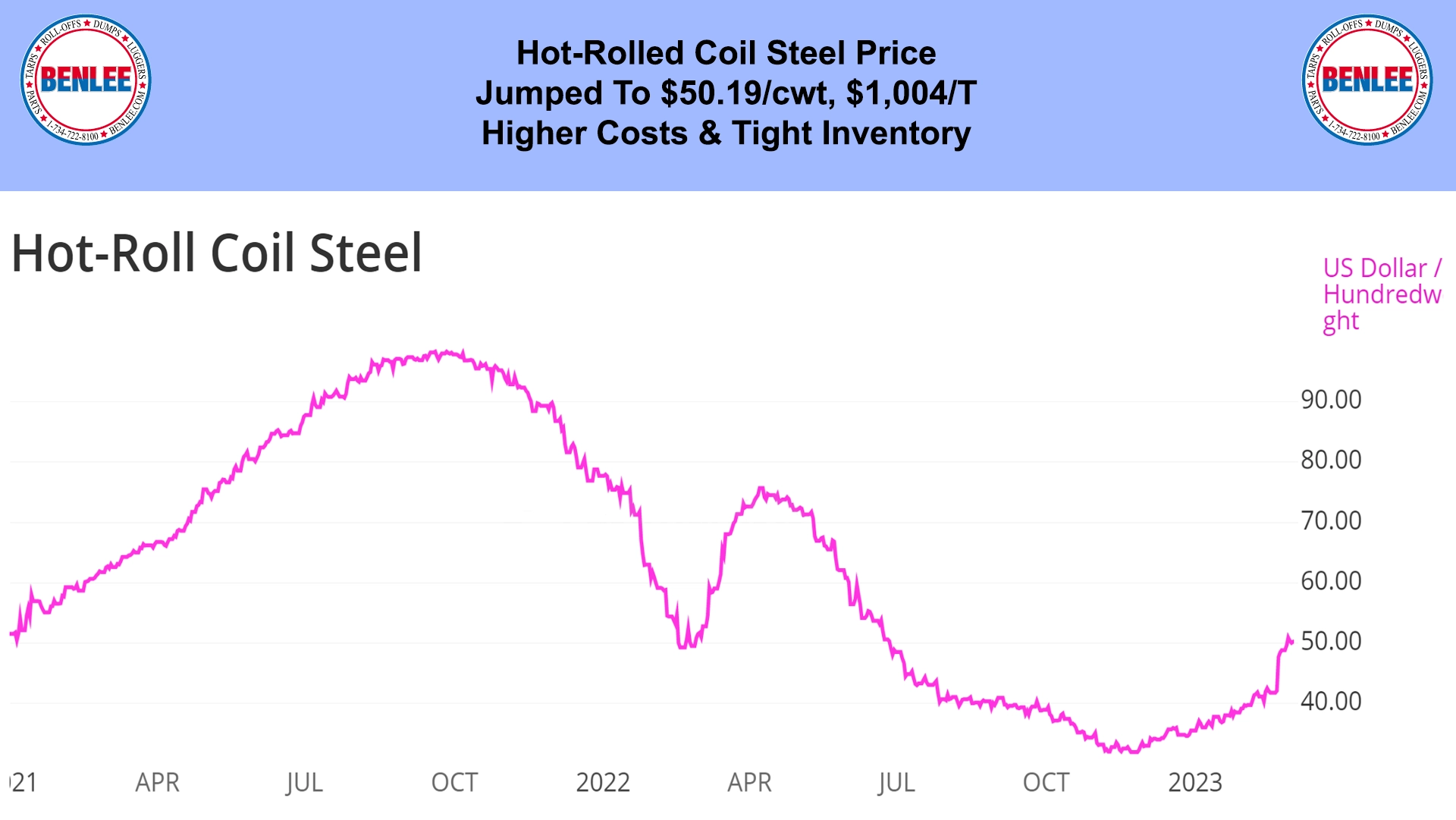

Hot-rolled coil steel price jumped to $50.19/cwt., $1,004/T on higher costs and tight inventory.

Copper price rose to $4.07/lb., off a recent two month low. This was on higher global interest rates slowing demand, but on China showing better growth.

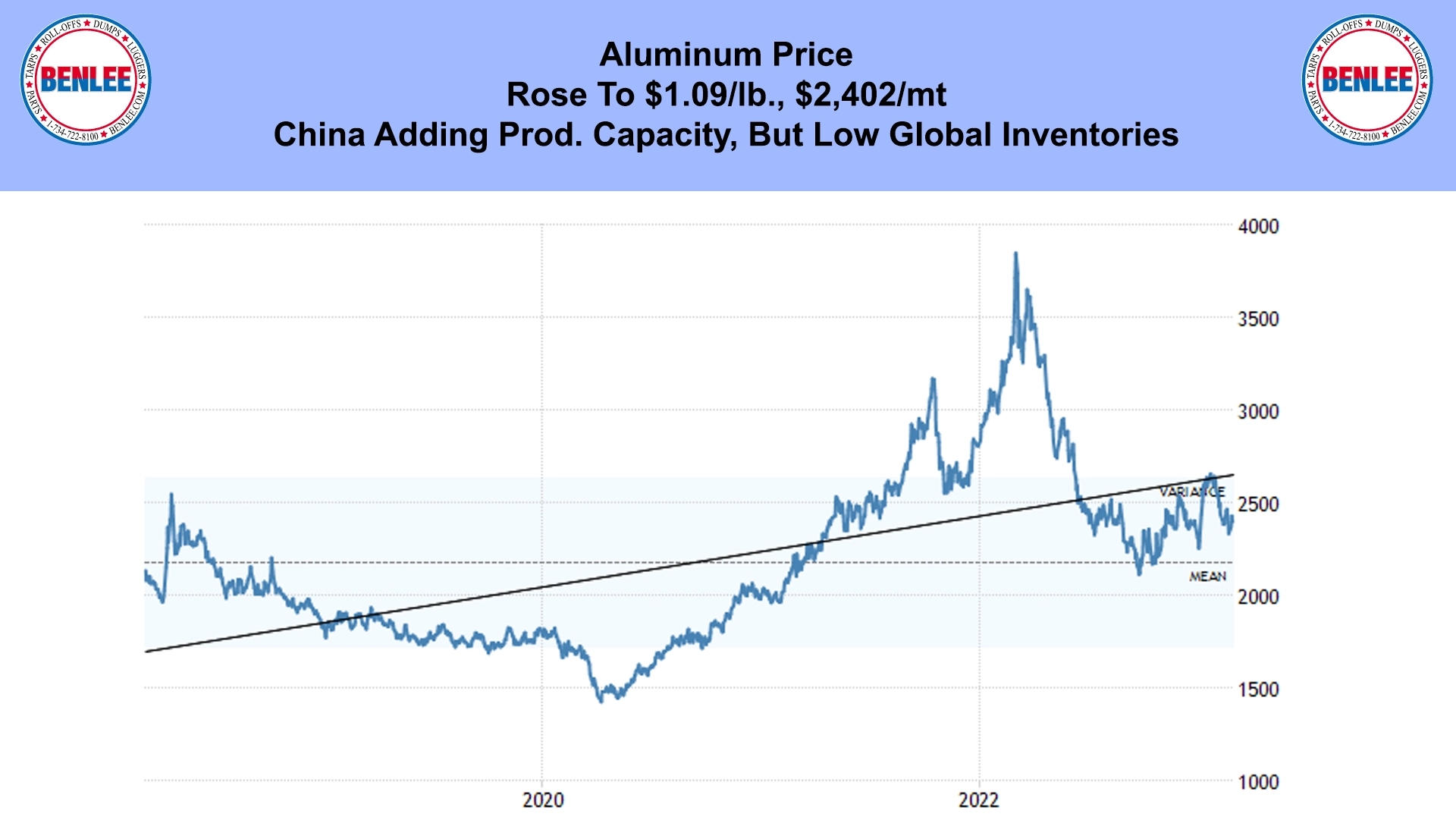

Aluminum price rose to $1.09/lb., $2,402/mt on China adding production capacity, but low global inventories.

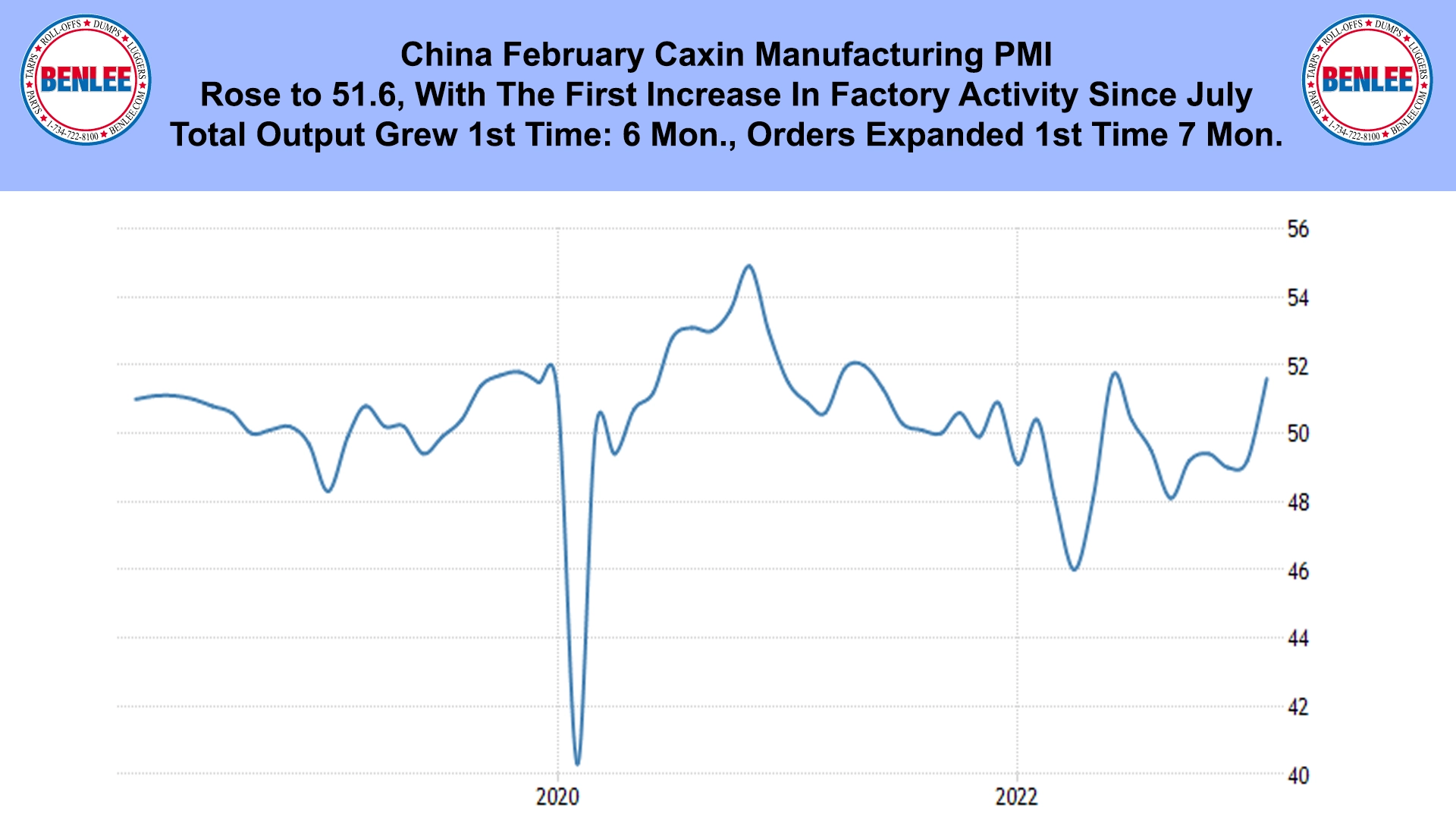

China February Caxin manufacturing PMI rose to 51.6, with the first increase in factory activity since July. Total output grew for the first time in 6 months and orders expanded for the first time in 7 months.

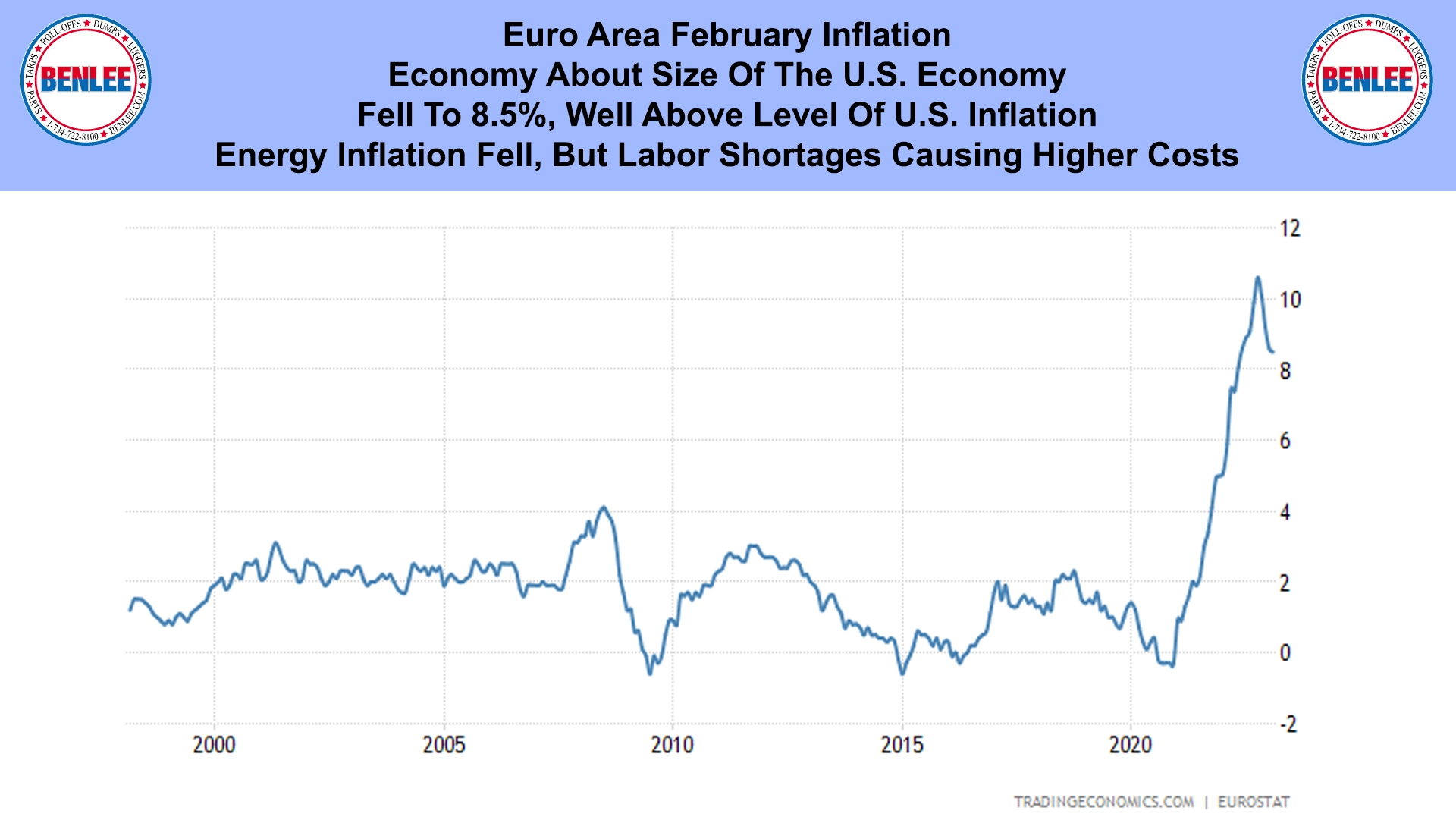

Euro area February inflation. Remember the Euro area’s economy is about the size of the U.S. economy. It fell to 8.5%, well above the level of U.S. inflation. Energy inflation fell, but labor shortages are causing higher costs.

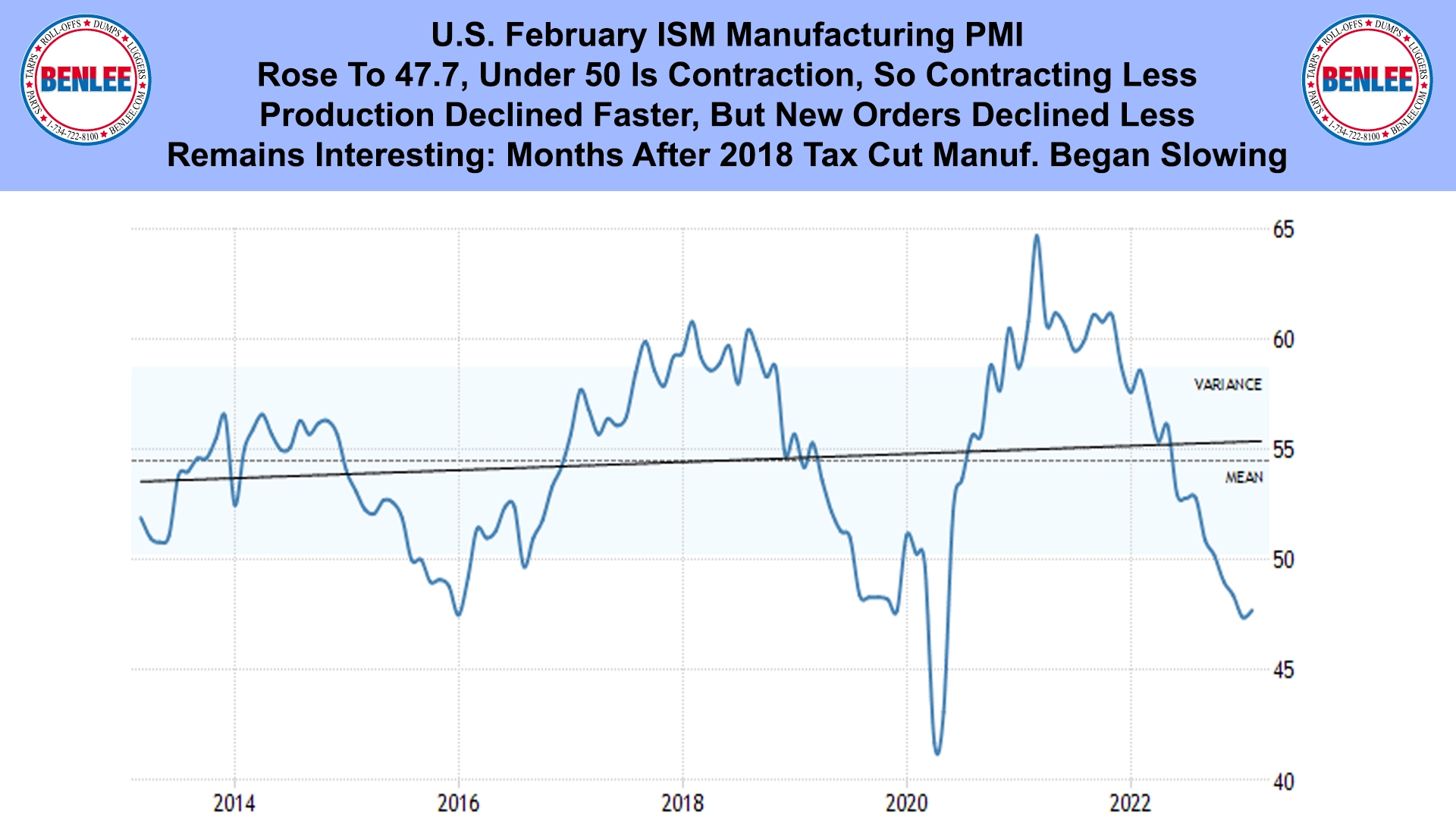

U.S. February ISM manufacturing PMI rose to 47.7, with under 50 being contraction, so contracting less. Production declined faster, but new orders declined less. It remains interesting that months after the 2018 tax cut, manufacturing began slowing.

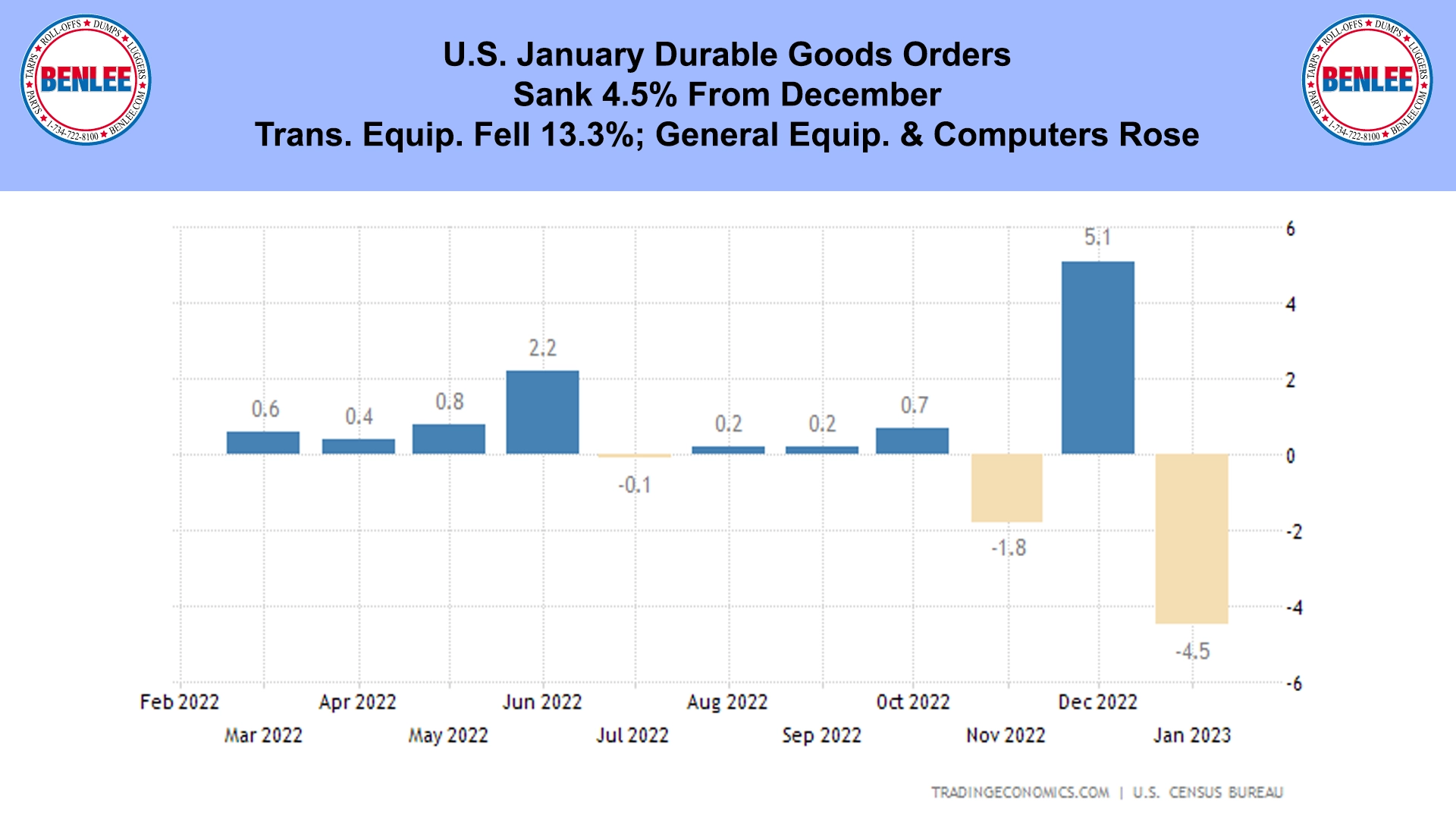

U.S. January durable goods orders sank 4.5% from December. Transportation equipment fell 13.3% as general equipment and computers rose.

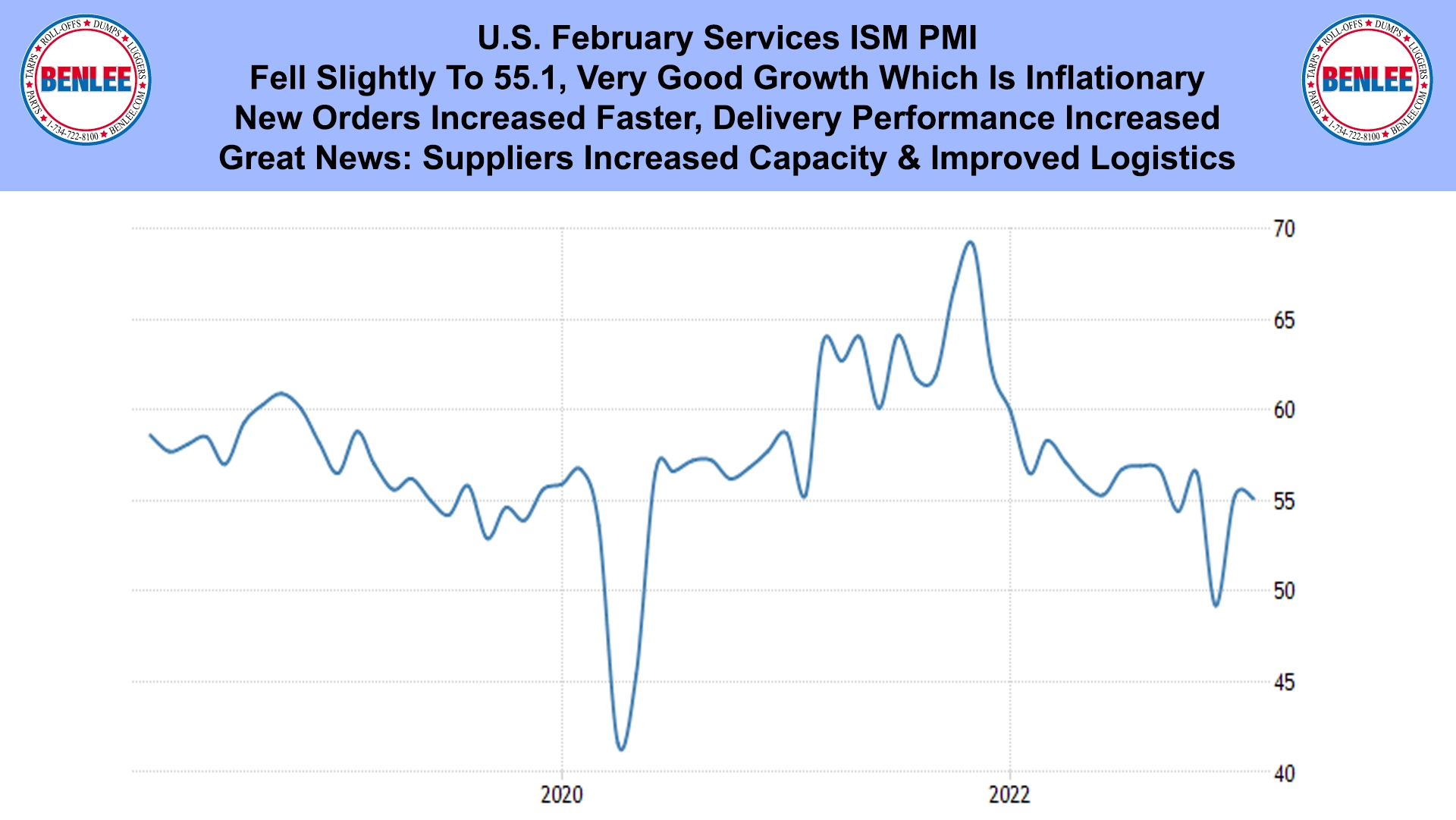

U.S. February services ISM PMI fell slightly to 55.1, very good growth, which is inflationary. New orders increased faster, as delivery performance increased. Great news is suppliers increased capacity and improved logistics.

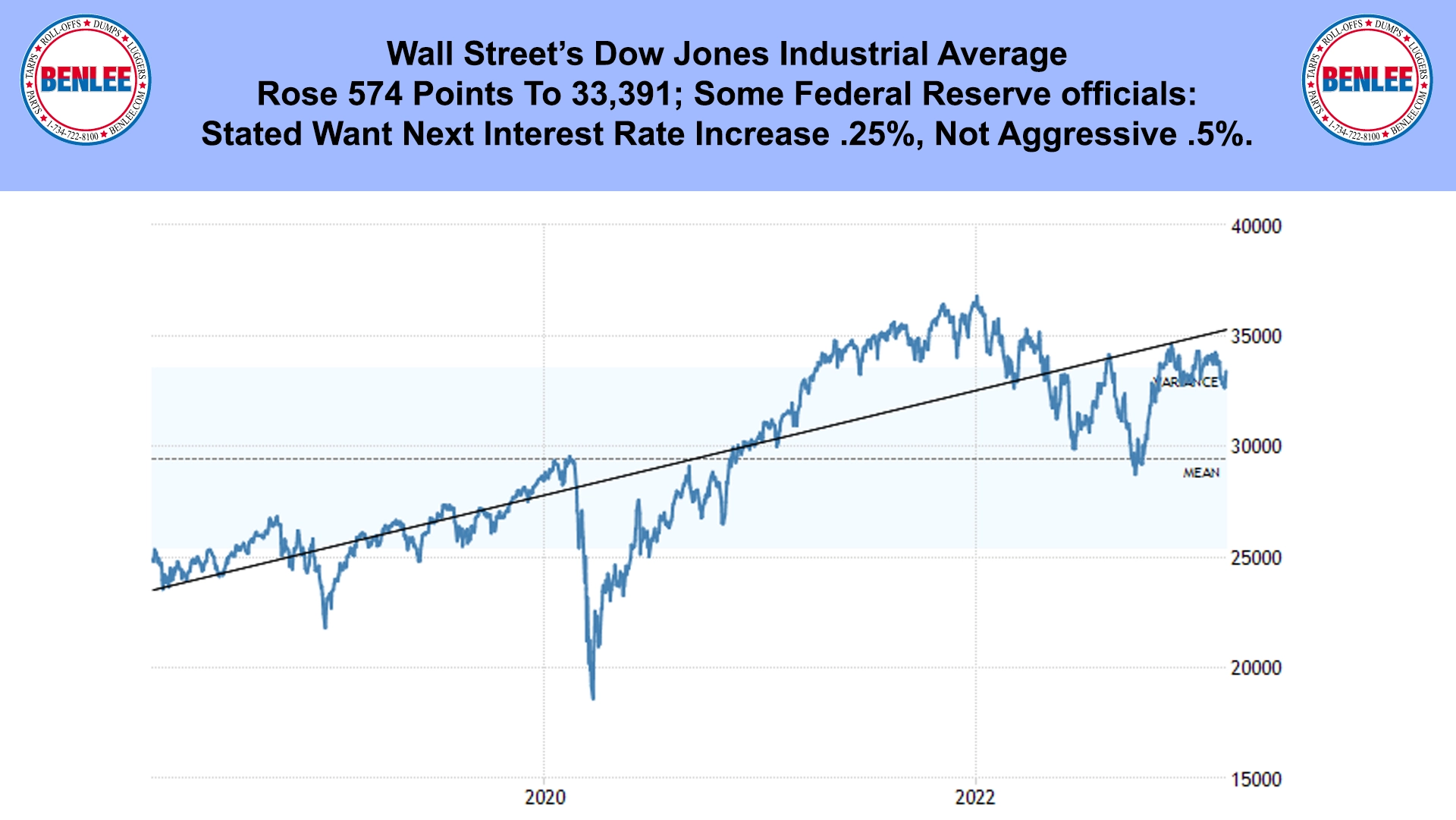

Wall Street’s Dow Jones Industrial Average rose 574 points to 33,391 as some Federal Reserve officials stated that they want the next interest rate increase to be .25%, not an aggressive .5%.

Get an instant offer on your damaged car

Get an offer instantly

Just tell us a bit about your car and boom, there's your offer.

Free pickup

You have seven days to accept our offer and schedule pickup.

Get paid on the spot

Our pickup partner will do a quick inspection, and hand you a check.