Commodities, Scrap Metal, Recycling and Economic Report June 5, 2023

This is the Commodities, Scrap Metal, Recycling and Economic Report, brought to you by BENLEE roll-trailers, gondola trailers and roll-off truck parts, June 5th, 2023.

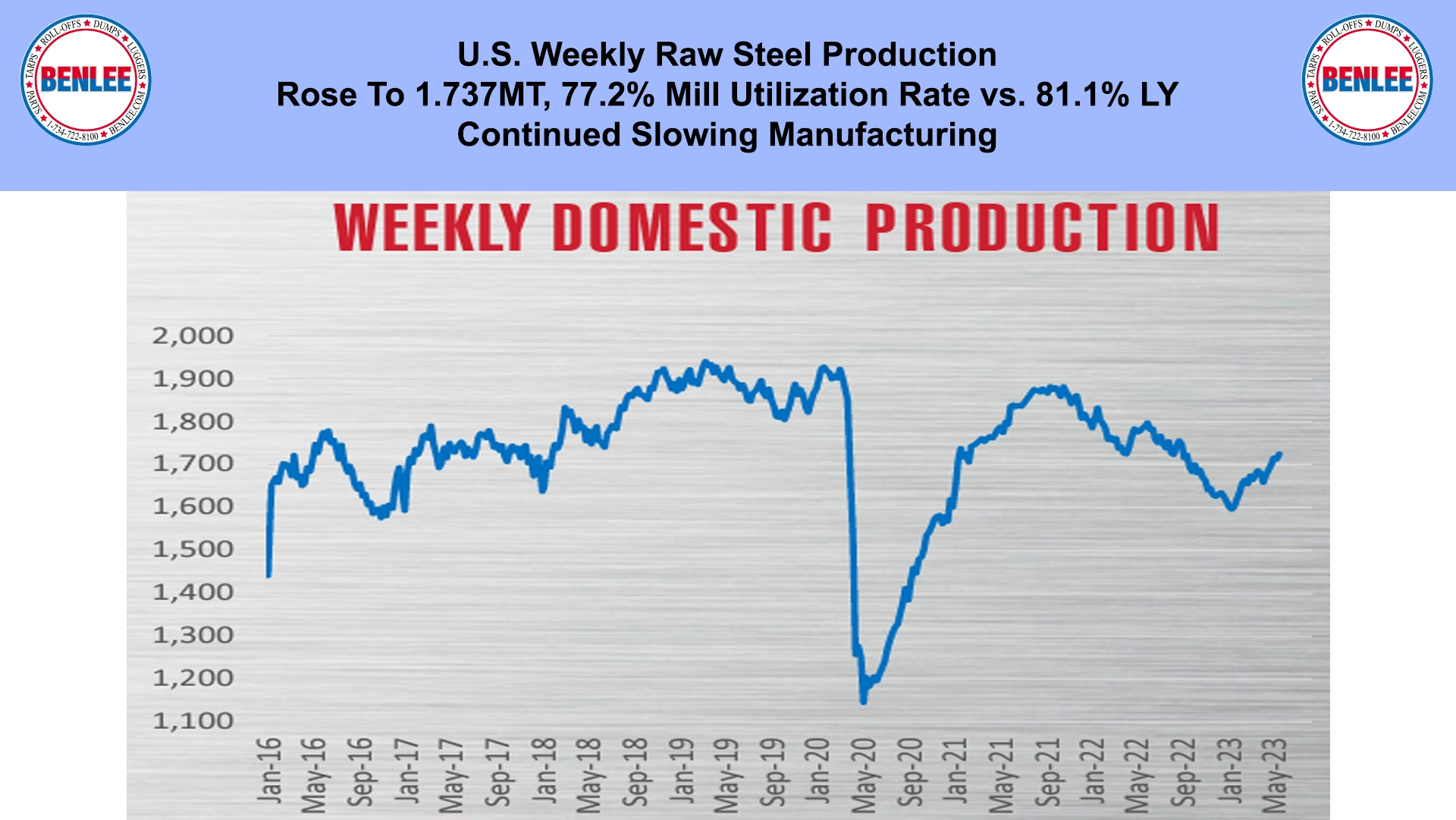

U.S. weekly raw steel production rose slightly to 1.737MT a 77.2% steel mill utilization rate vs. 81.1% last year. This was on continued slowing manufacturing.

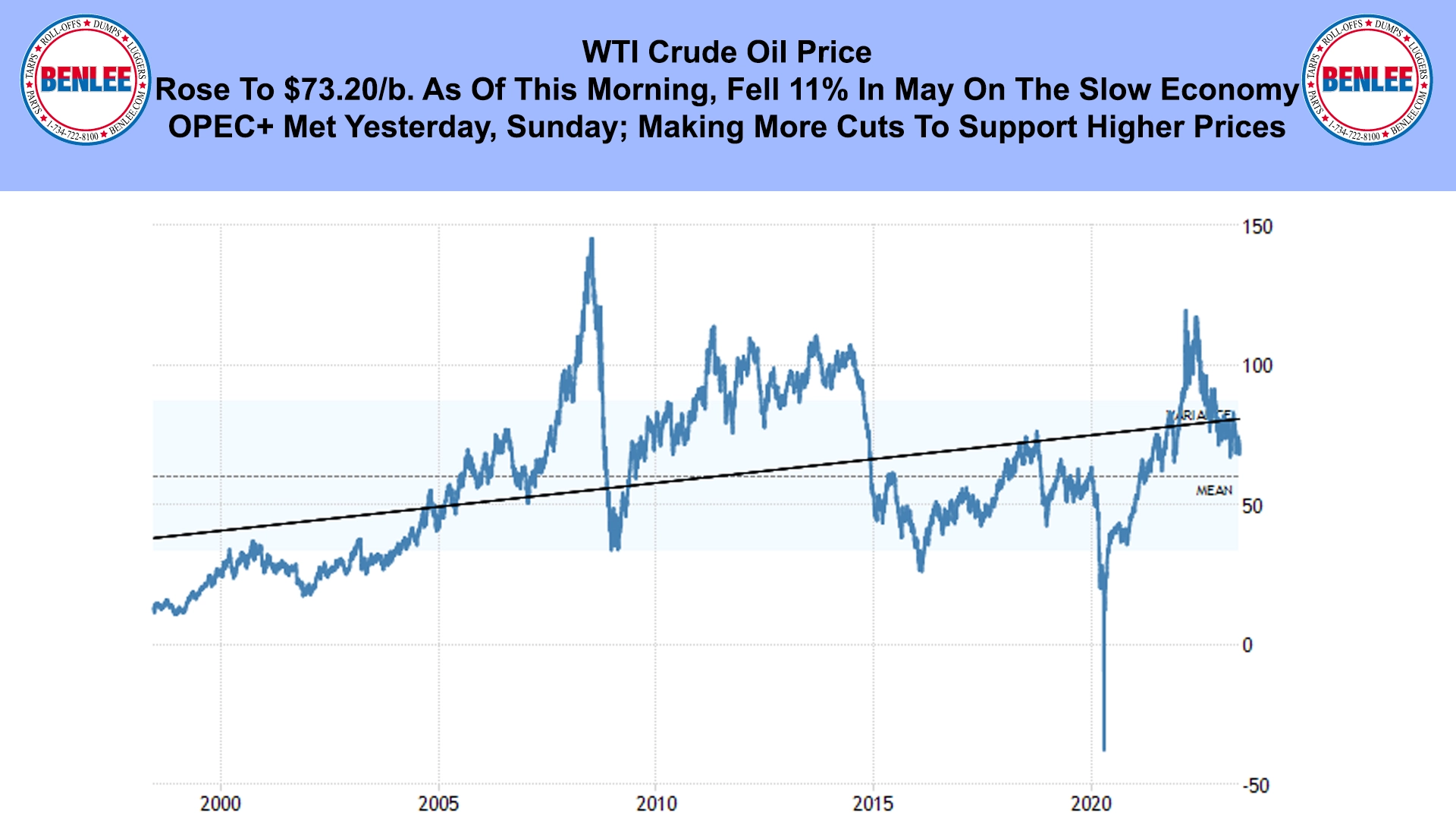

WTI crude oil price rose to $73.20/b. as of yesterday Sunday. Prices fell 11% in May on the slow economy. OPEC+ met yesterday, Sunday and agreed to make more production cuts to support higher prices.

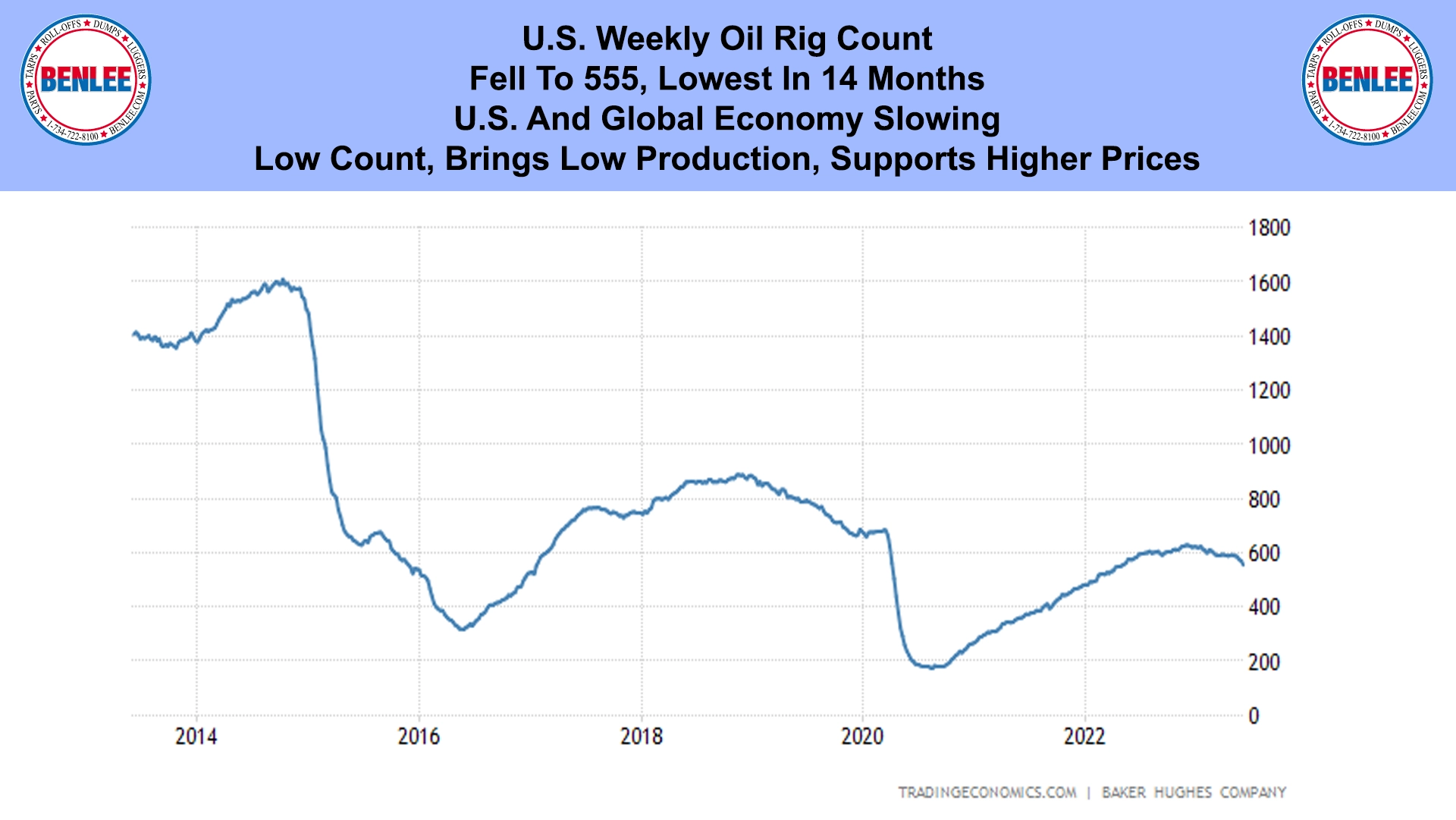

The U.S. weekly oil rig count fell to 555, the lowest in 14 months on the U.S. and global economy slowing. The low count brings low production that supports higher prices.

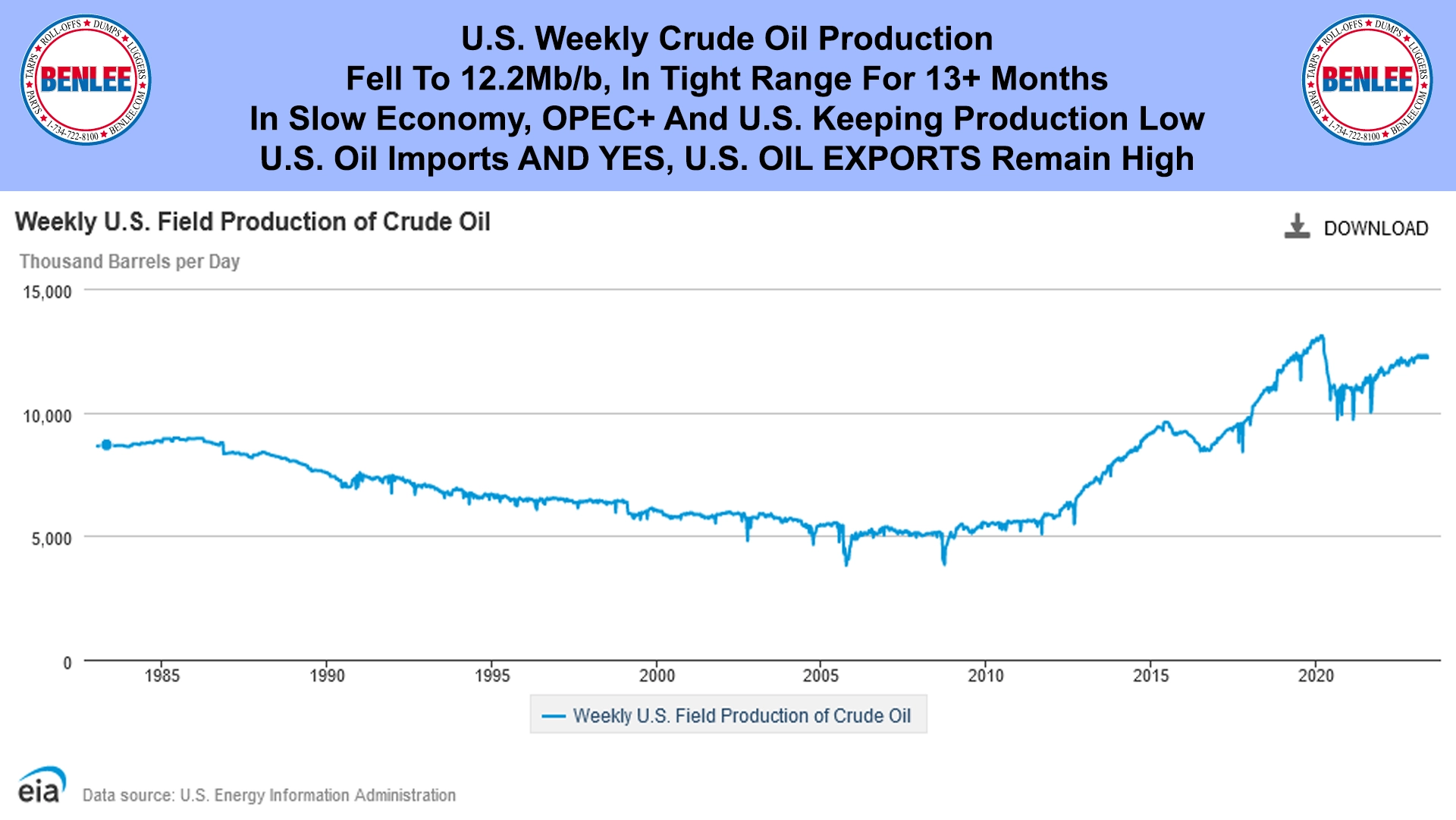

U.S. weekly crude oil production fell slightly to 12.2Mb/d in a tight range for 13 plus months. In the slow economy, OPEC+ and the U.S. are keeping production low. U.S. oil imports and exports, yes, U.S. oil exports remain high.

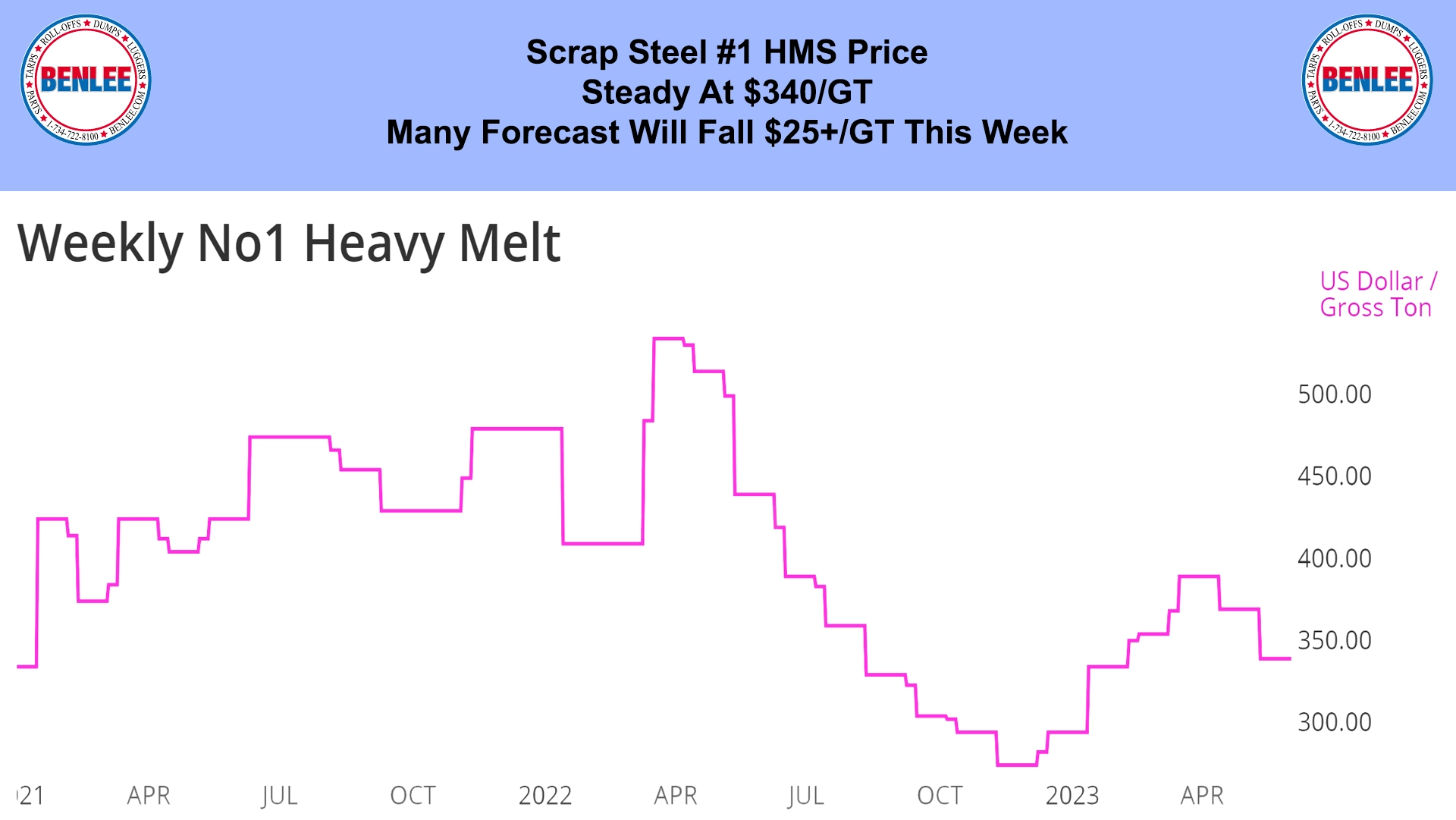

Scrap Steel #1 HMS price was steady at $340/GT. Many forecast prices will fall $25/GT or more this week.

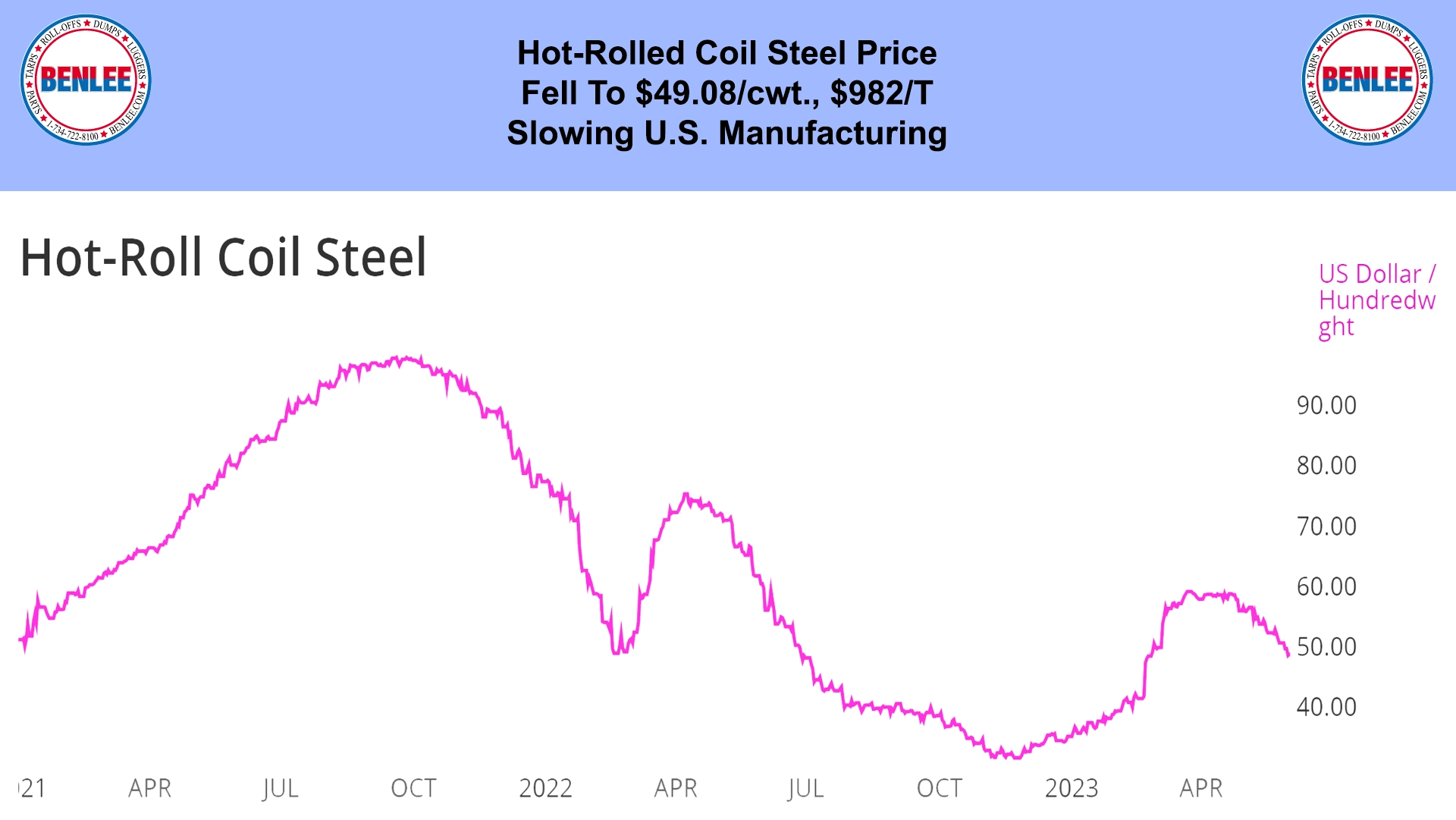

Hot-rolled coil steel price fell to $49.08/cwt, $982/T on the slowing U.S. economy.

Copper price rose to $3.73/lb., on tight supply concerns and on hopes of Chinese government economic stimulus.

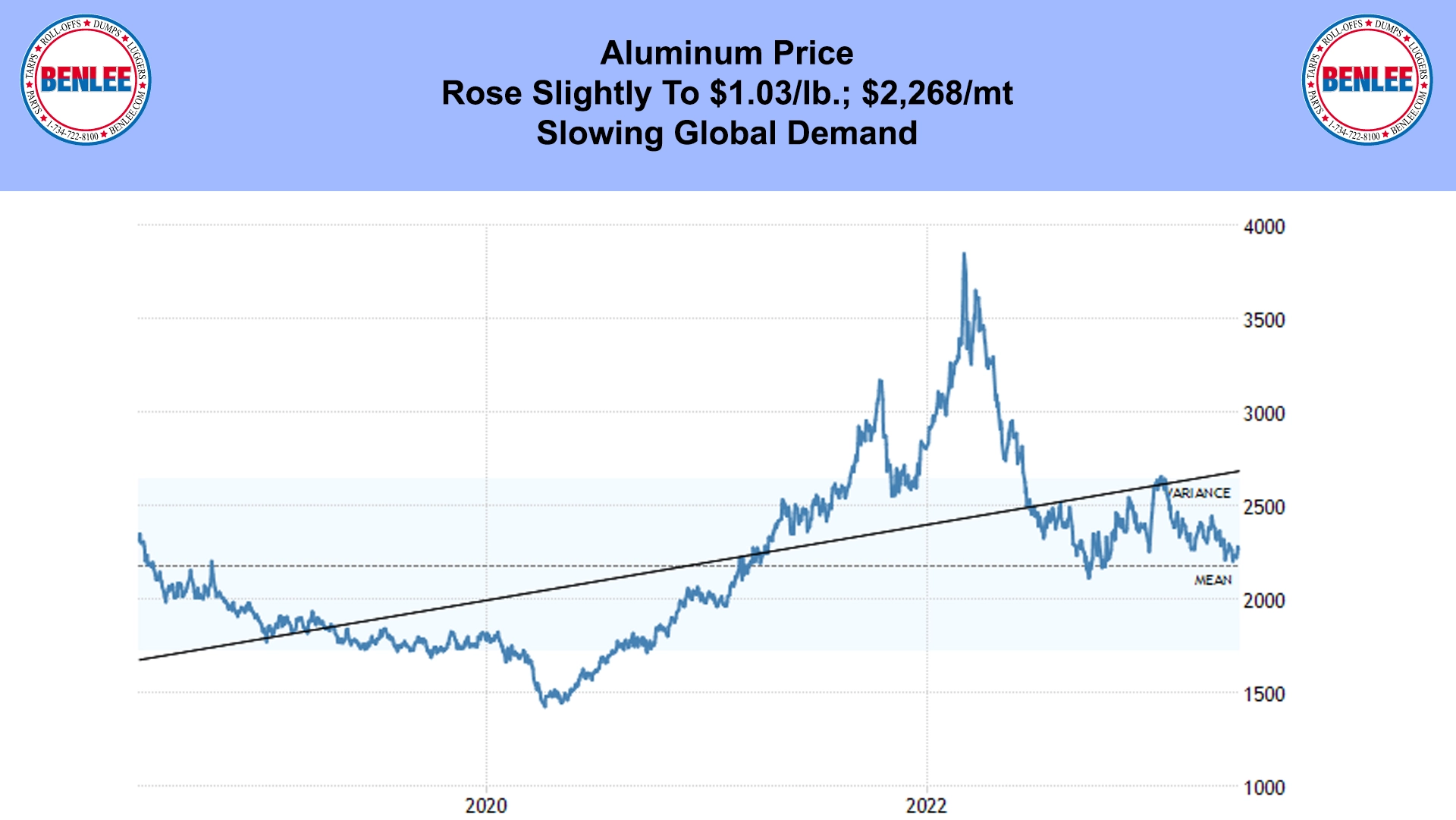

Aluminum price rose slightly to $1.03/lb., $2,268/mt on slowing global demand.

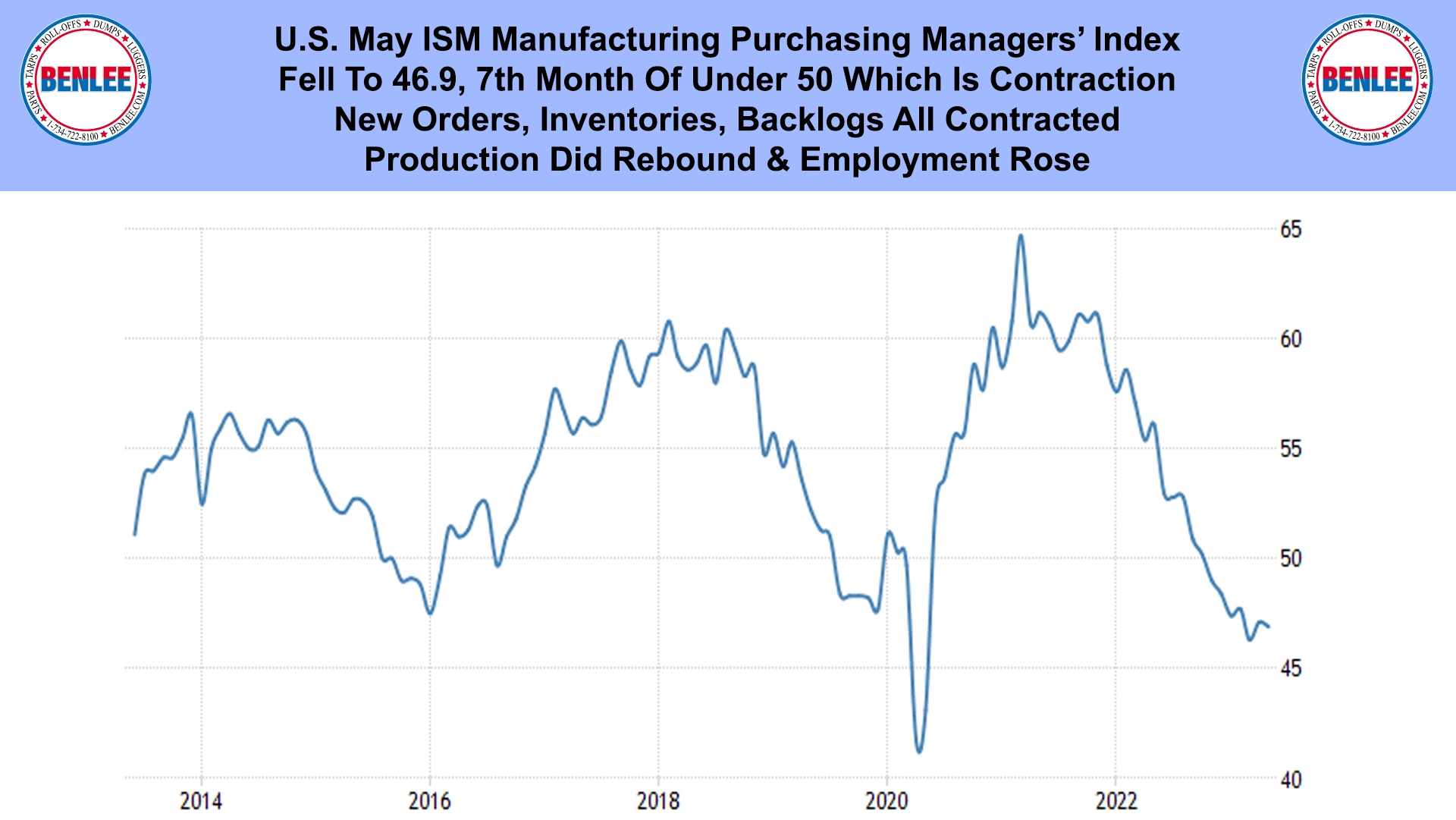

U.S. May ISM manufacturing purchasing managers’ index. It fell to 46.9 the 7th month of under 50, which is contraction. New orders, inventories and backlogs all contracted. Production did rebound and employment rose.

U.S. May average hourly earnings increased .3% over April and 4.3% vs. last year. Wage inflation is an important part of total inflation.

.webp)

U.S. May new jobs, non-farm payroll. They rose to 339,000, well ahead of forecast. Professional services, government and leisure rose the most. There was little change in manufacturing, retail, mining, and financial services.

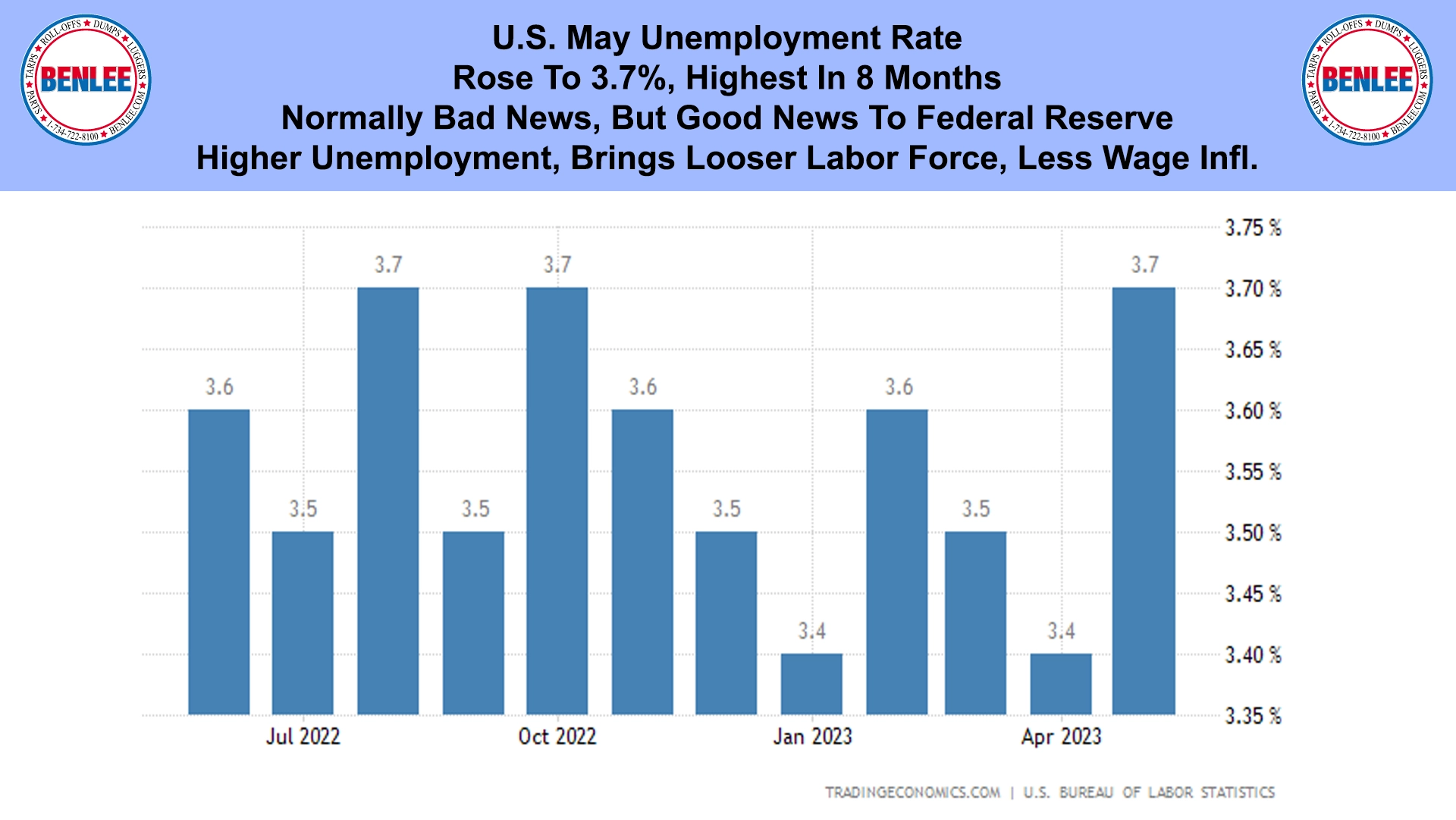

U.S. May unemployment rate rose to 3.7% the highest in 8 months. Normally this is bad news, but this is good news for the Federal Reserve. Higher unemployment brings a looser labor force and less wage inflation.

.webp)

U.S. May total employment, non-farm payrolls, rose to 156.1M people. This is the most in American history, which is great news. More workers could mean increased production and increased services, so less inflation.

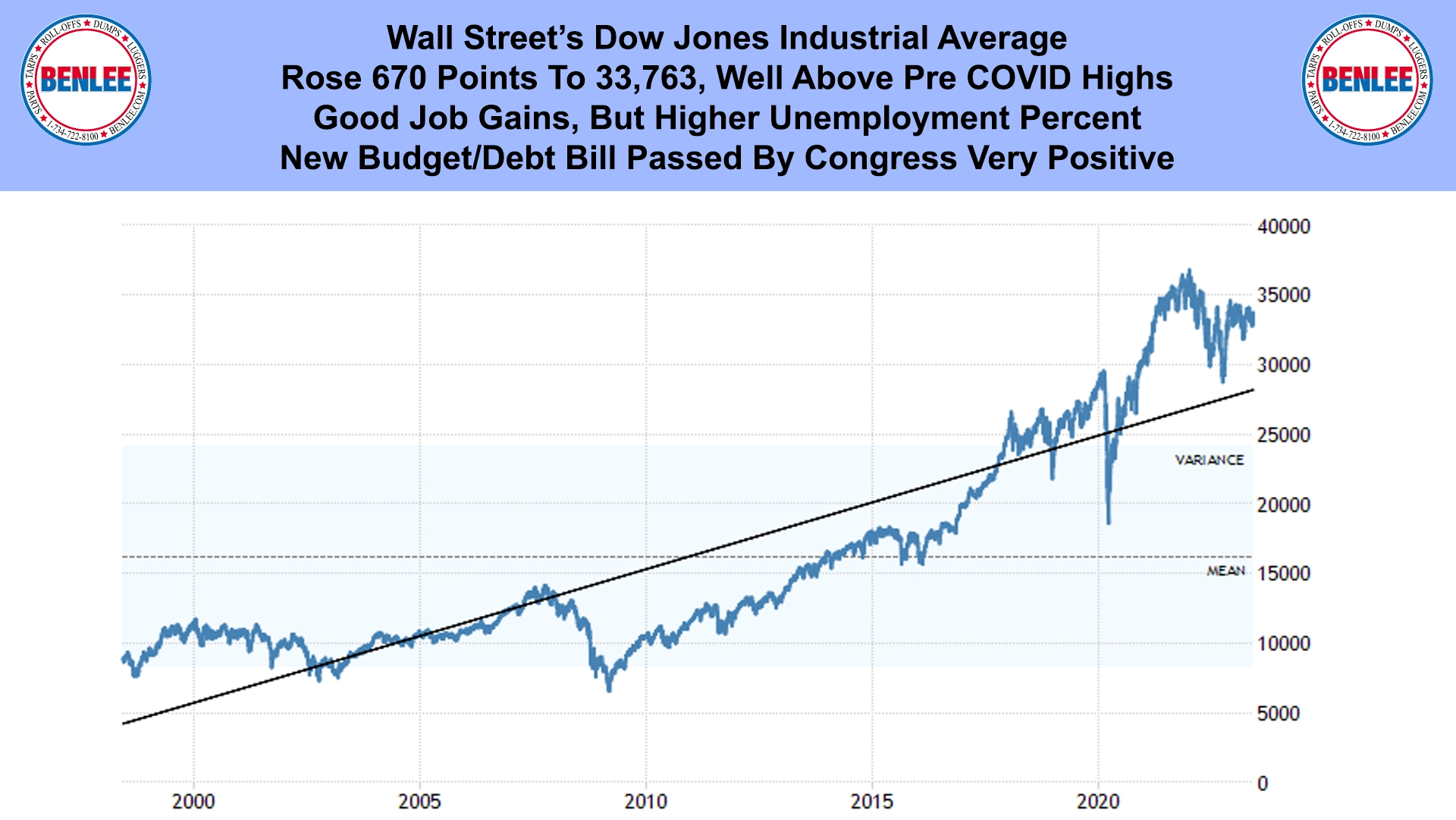

Wall Street’s Dow Jones Industrial Average rose 670 points to 33,763, well above pre COVID highs. This was on good job gains, but a higher unemployment percentage. Also, on the new budget/debt bill passed by congress, which was very positive.

Get an instant offer on your damaged car

Get an offer instantly

Just tell us a bit about your car and boom, there's your offer.

Free pickup

You have seven days to accept our offer and schedule pickup.

Get paid on the spot

Our pickup partner will do a quick inspection, and hand you a check.