This is the Commodities, Scrap Metal, Recycling and Economic Report, March 4th, 2024.

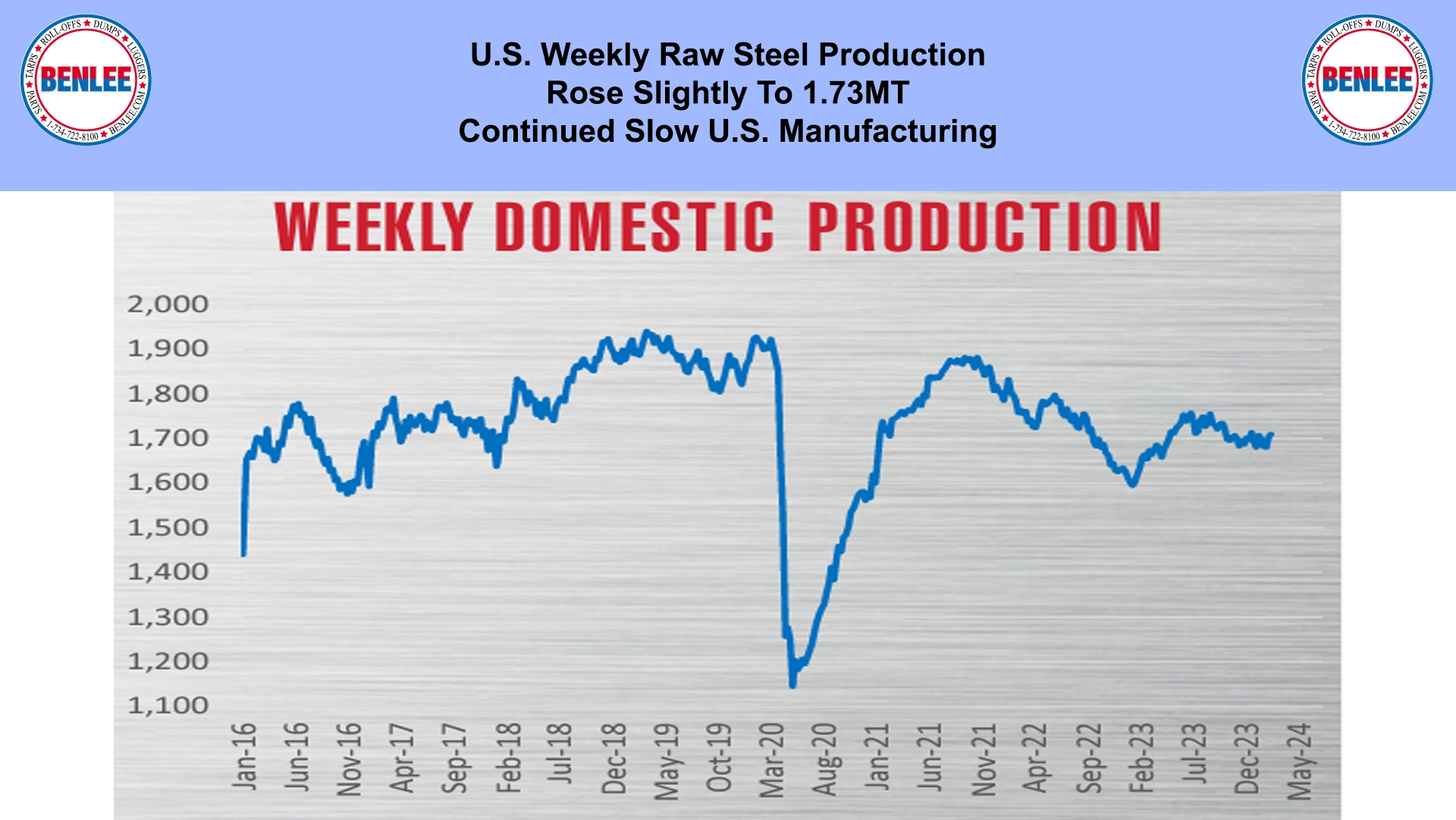

U.S. weekly raw steel production rose slightly to 1.73MT on continued slow U.S. manufacturing.

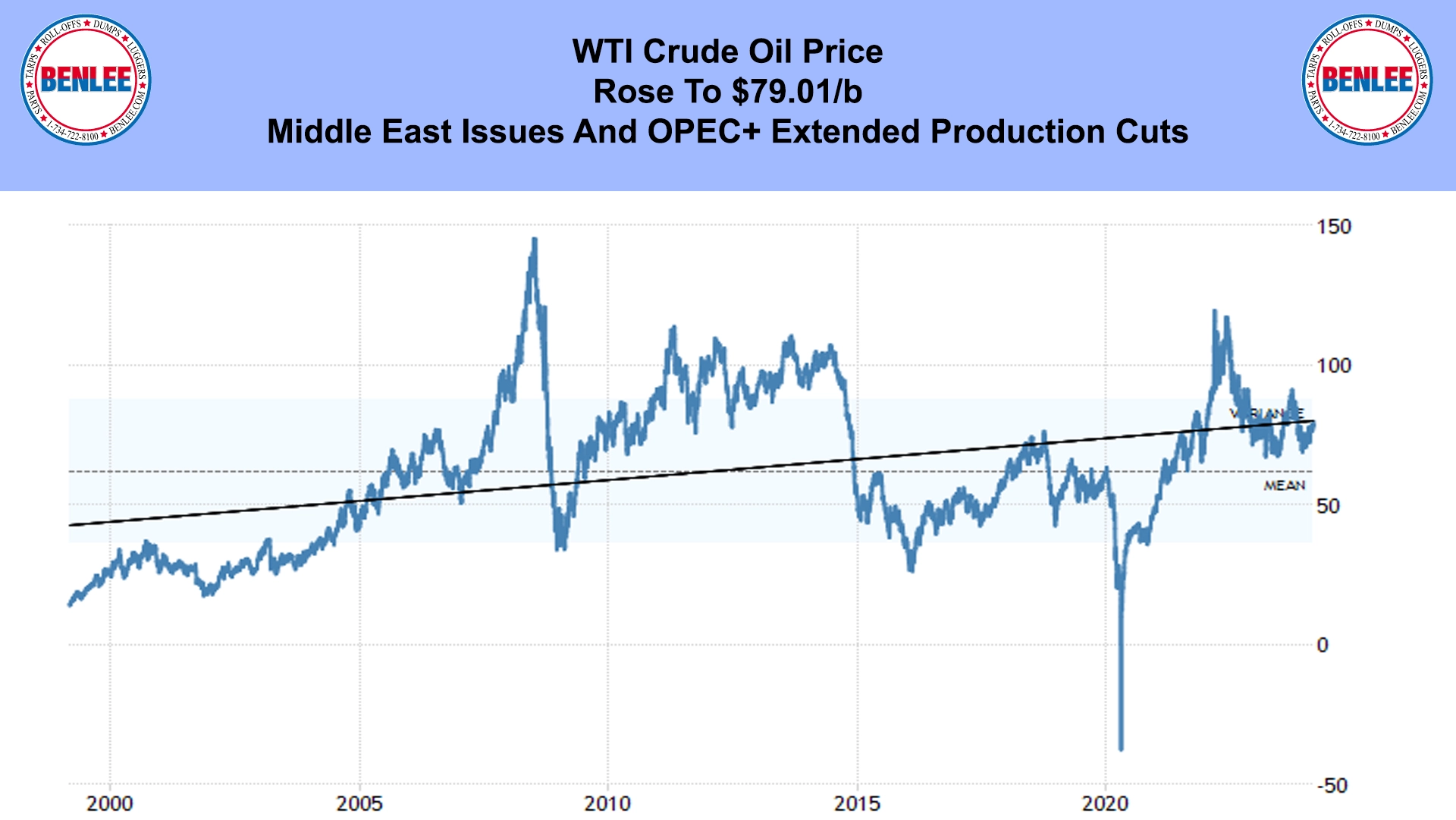

WTI crude oil price rose to $79.01/b., on Middle East issues and OPEC+ extended production cuts.

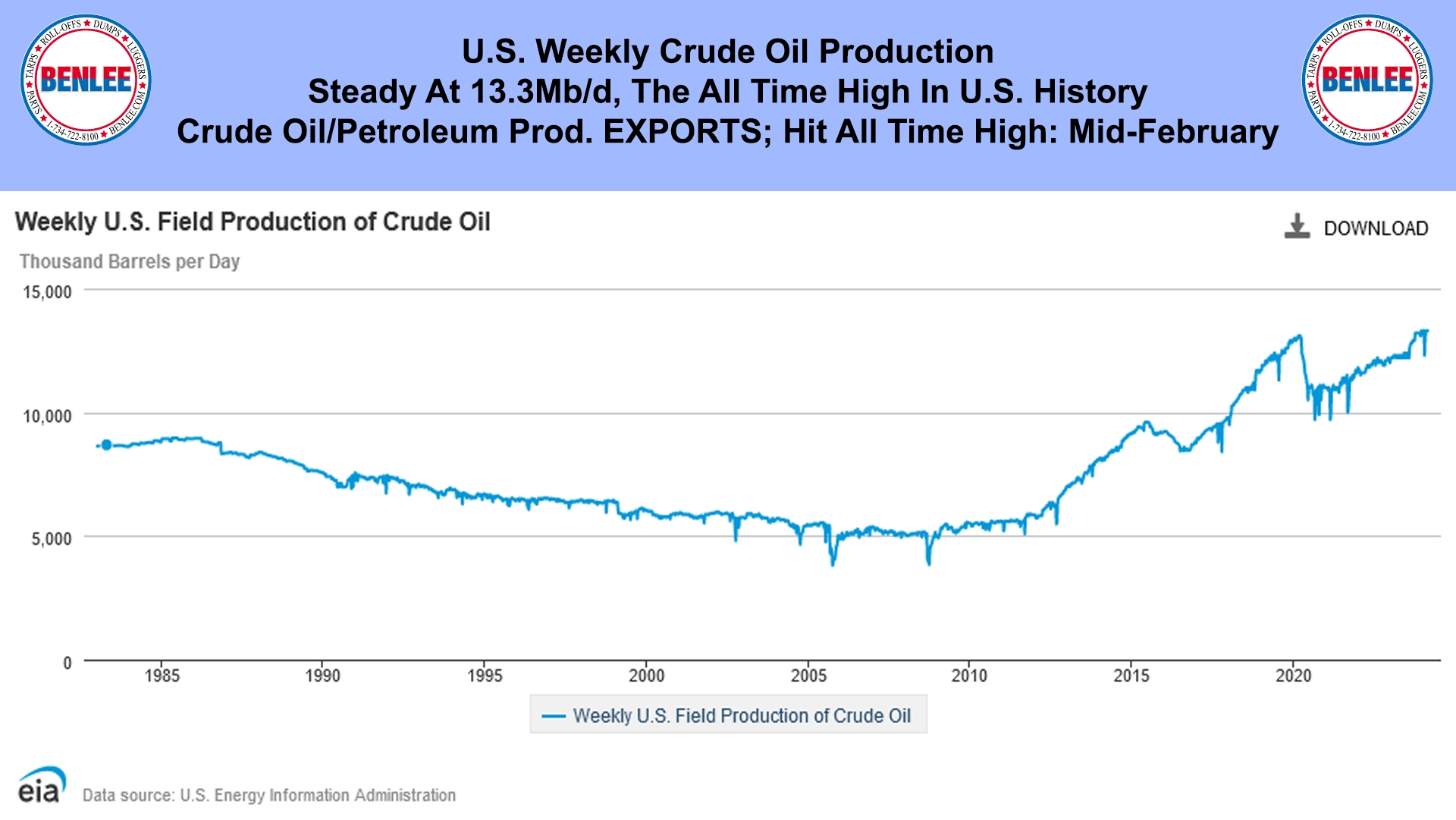

U.S. weekly crude oil production was steady at 13.3Mb/d., the all time high in U.S. history. Crude oil and petroleum product exports, yes exports hit an all time high in history, in mid-February.

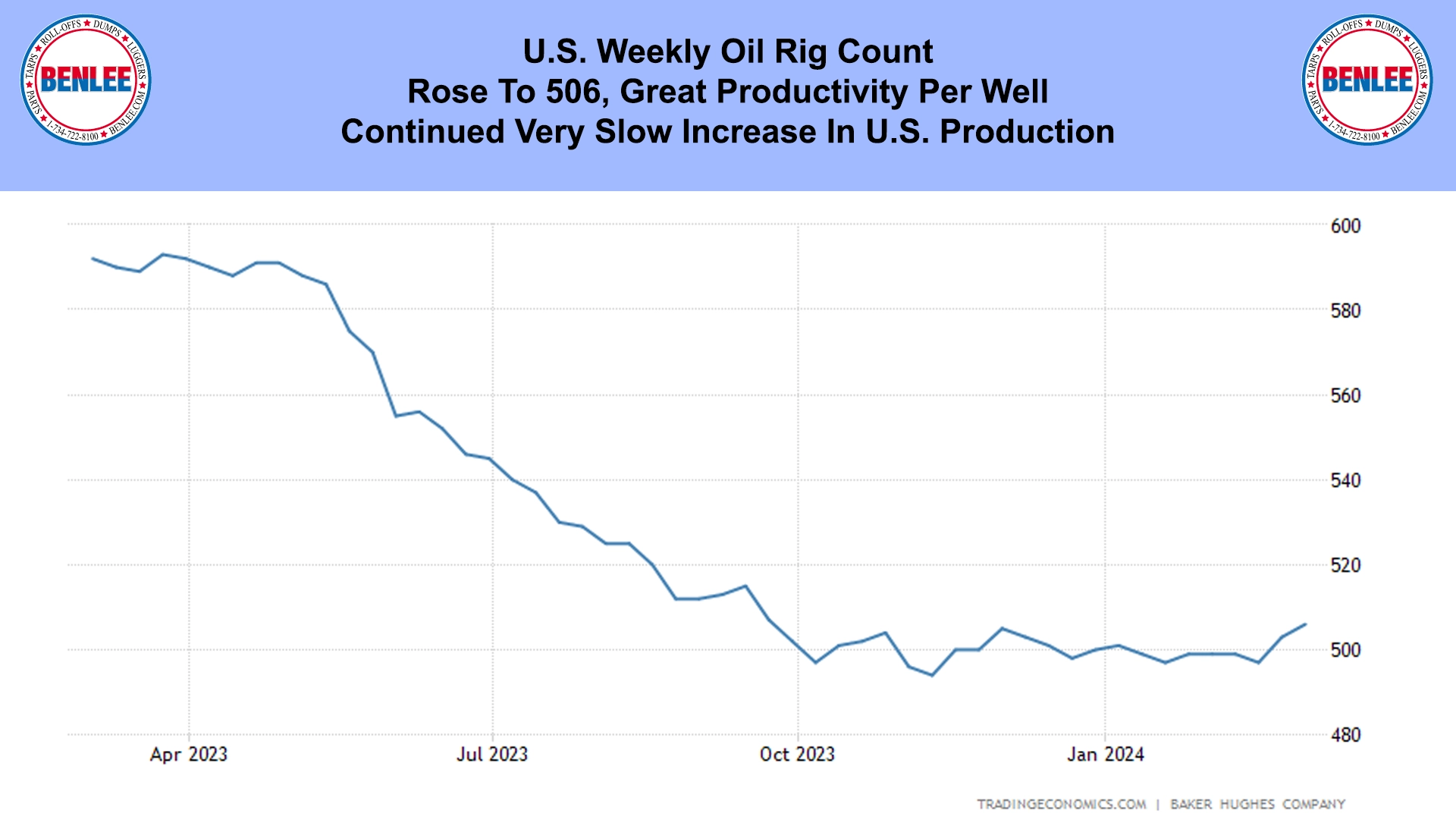

The U.S. weekly oil rig count rose to 506 on great productivity per well and continued very slow increase in U.S. production.

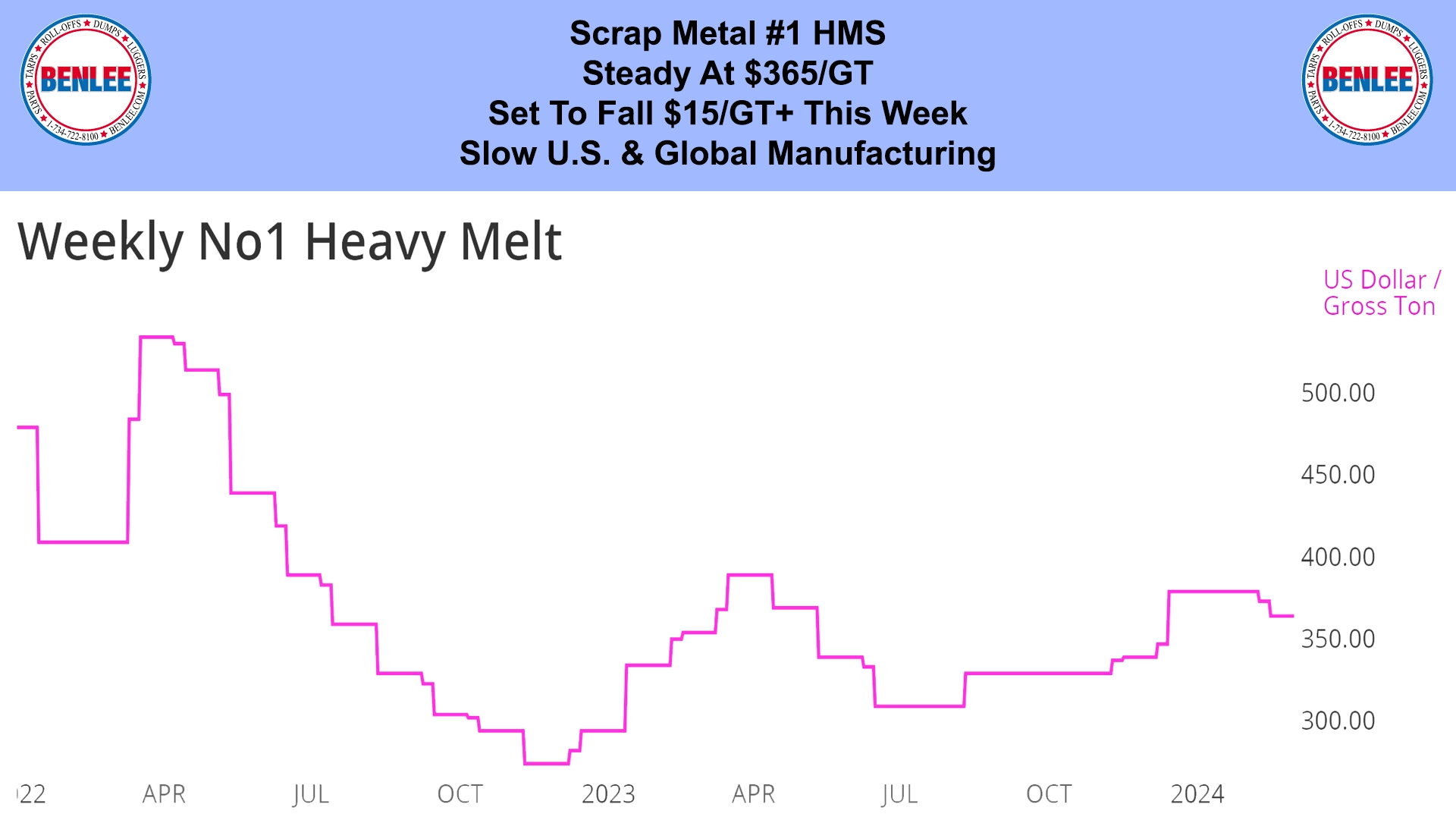

Scrap steel #1 HMS price was steady at $365/GT and is set to fall by $15/GT or more this week on slow U.S. and global manufacturing.

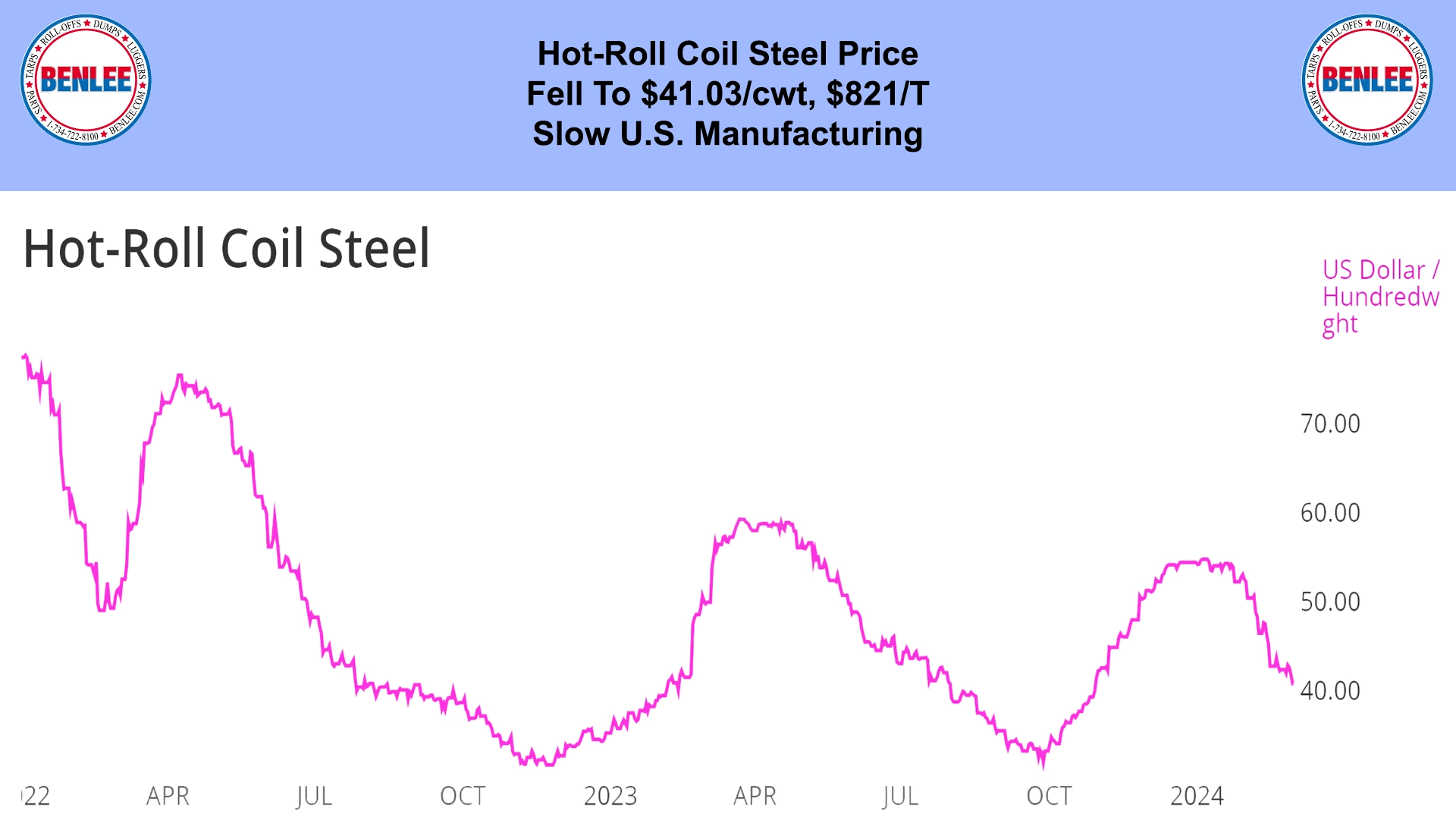

Hot-roll coil steel price fell to $41.03/cwt., $821/T on the same slow U.S. manufacturing.

Copper price fell slightly to $3.86/lb., as Chinese economic stimulus has not yet been effective. Also, copper inventories are still rising.

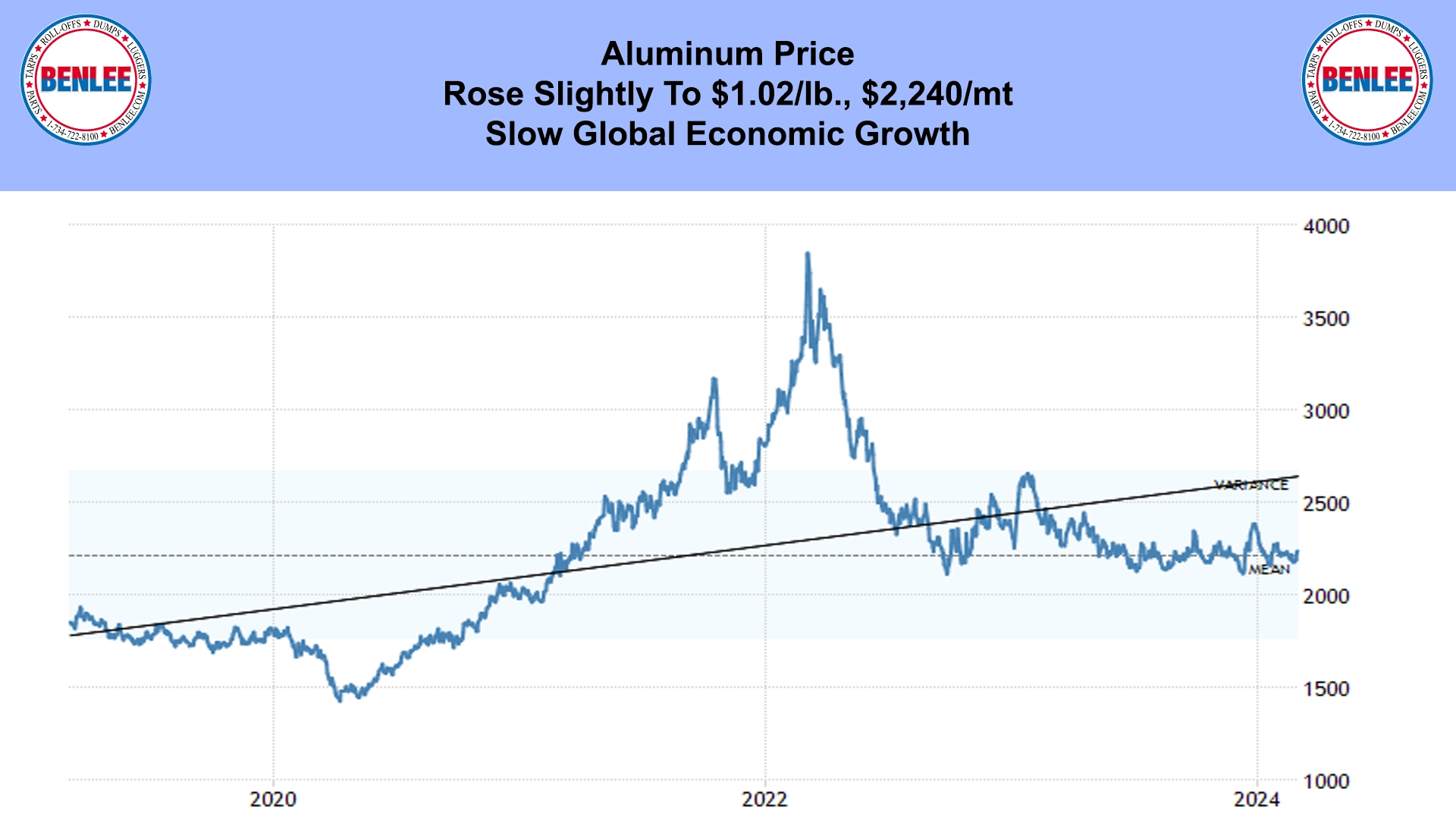

Aluminum price rose slightly to $1.02/lb., $2,240/mt on slow global growth.

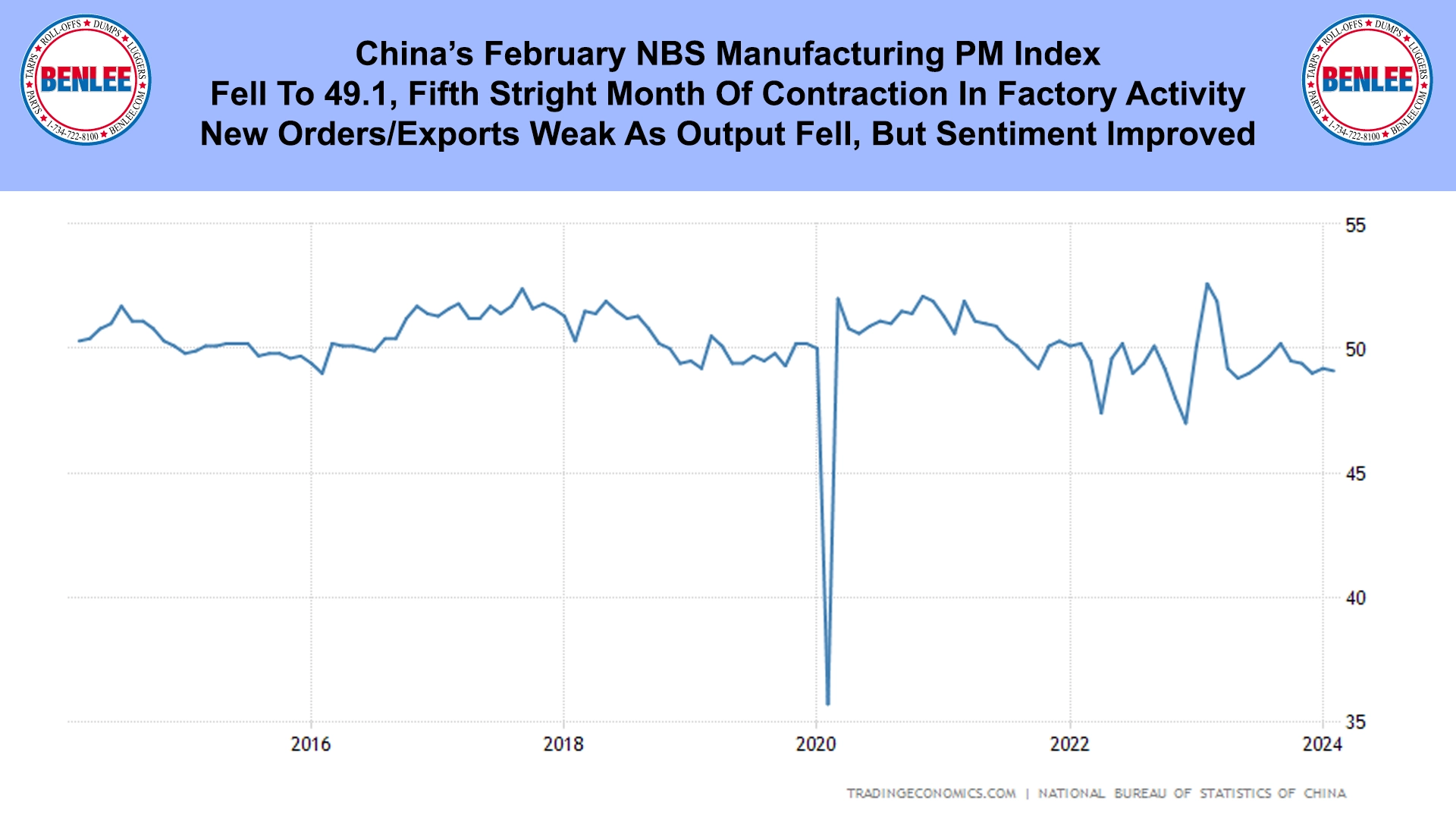

China’s February NBS manufacturing PM index fell to 49.1 the fifth straight month of contraction in factory activity. New orders and exports were weak as output fell, but sentiment improved.

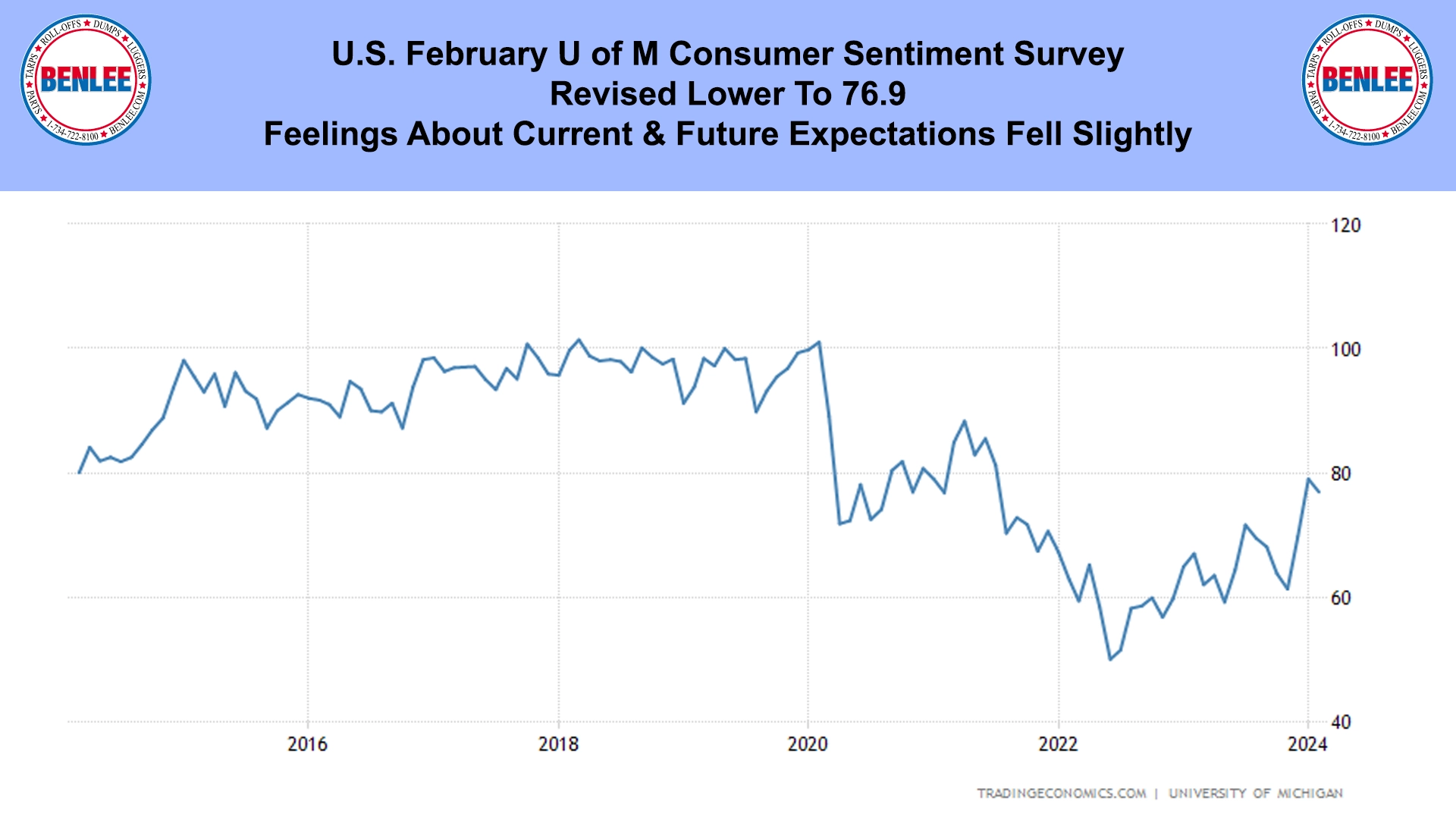

U.S. February U of M Consumer Sentiment survey was revised lower to 76.9. Feelings about current and future expectation fell slightly.

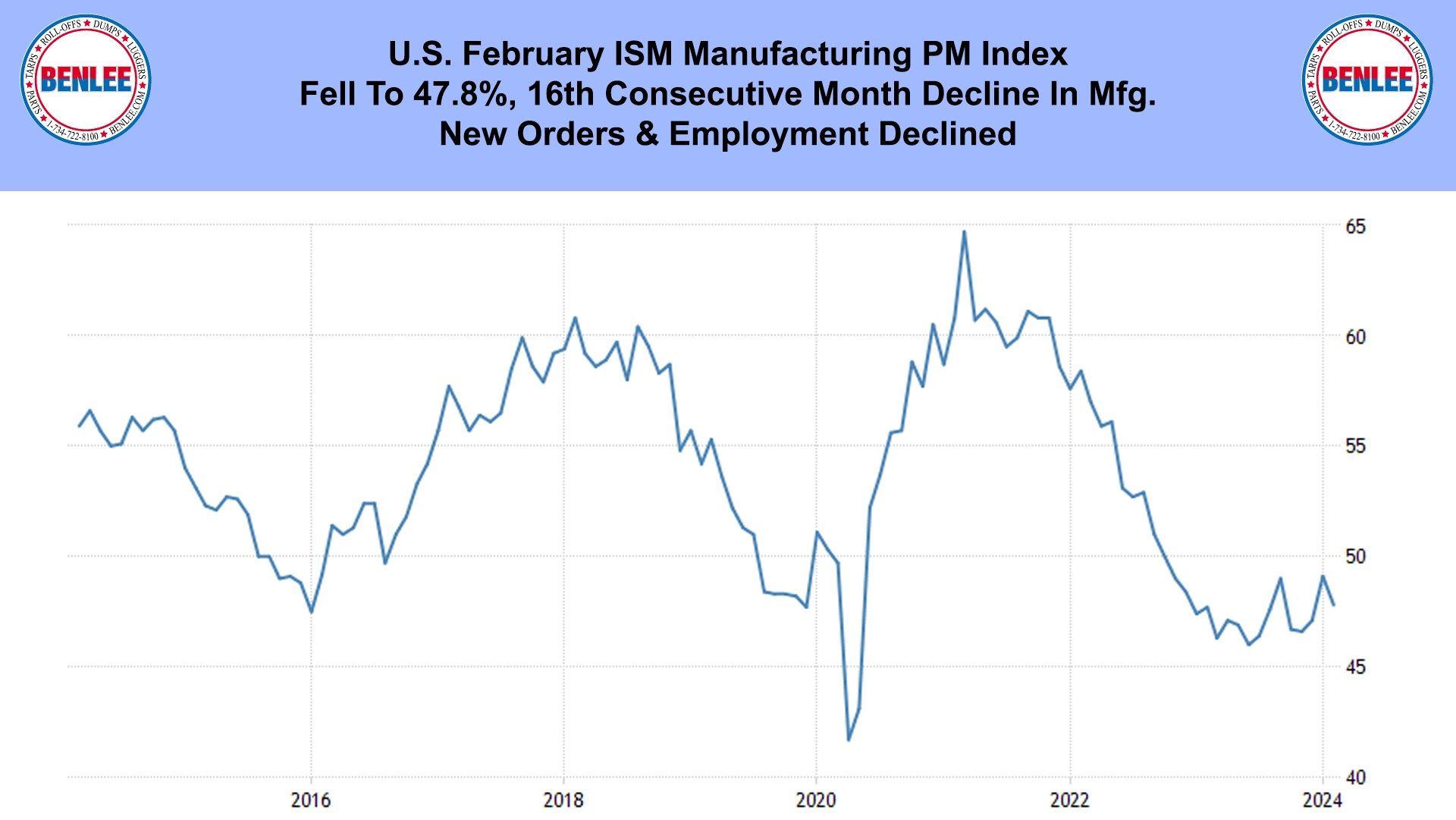

U.S. February ISM manufacturing PM index fell to 47.8, the16th consecutive month of a decline in manufacturing. New orders and employment fell.

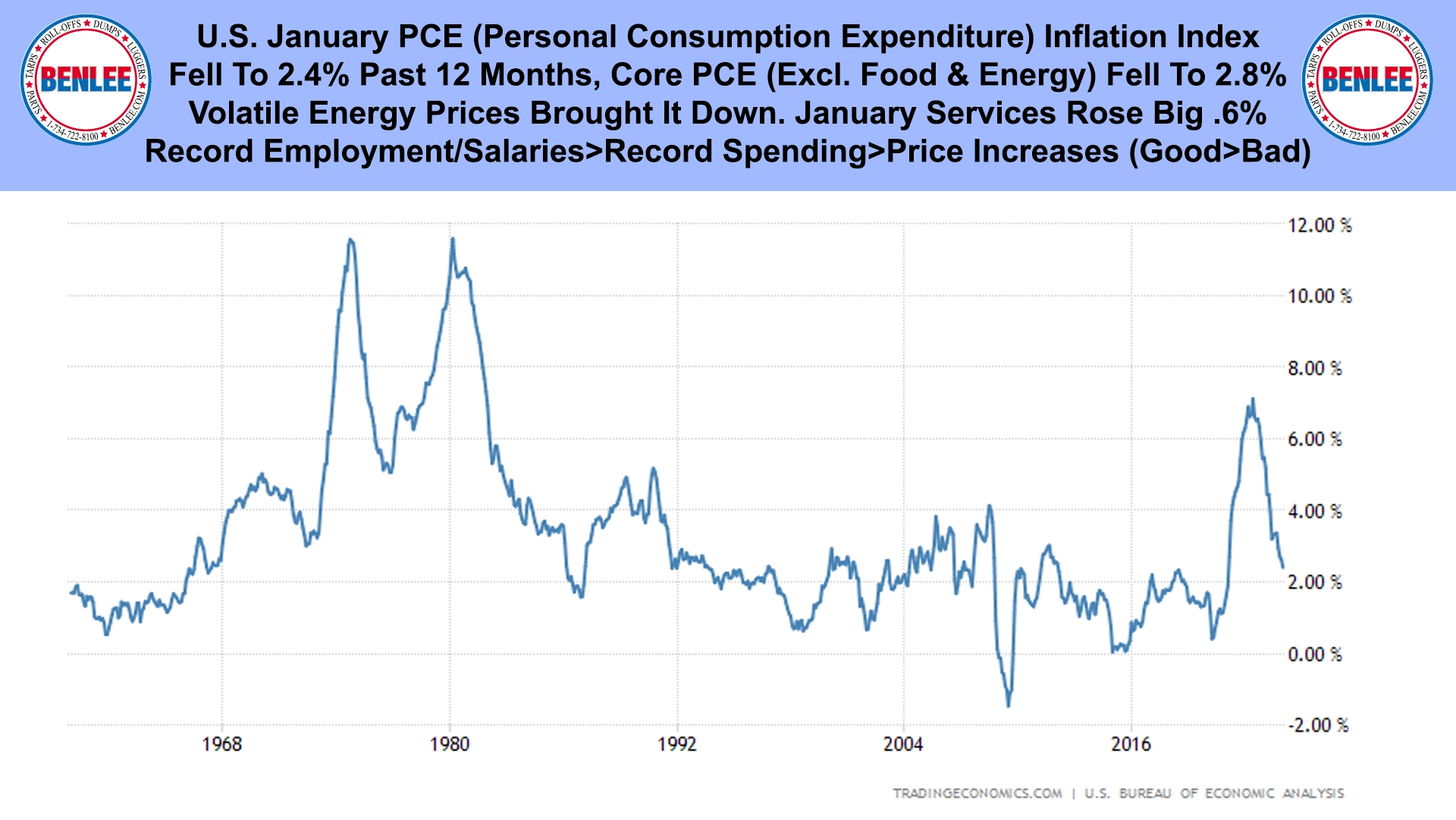

U.S. January PCE (Personal Consumption Expenditure) inflation index. It fell to 2.4% for the past 12 months. Core inflation, excluding food and energy fell to 2.8%. Volatile energy prices brought it down. January services rose a big .6%. Record employment, record salaries and record spending is bringing price increases, so all the good news in bringing bad news on inflation.

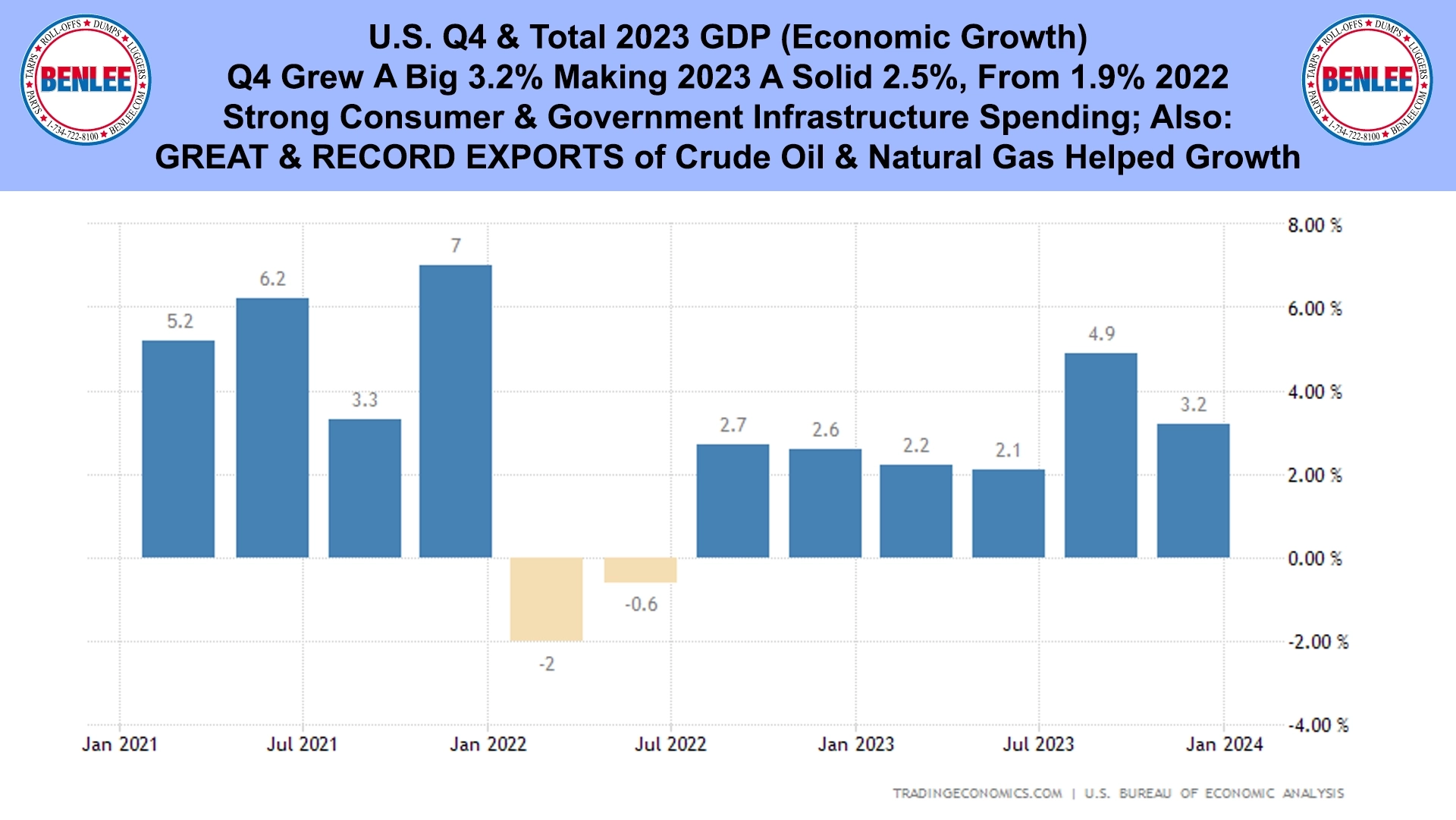

U.S. Q4 & Total 2023 GDP, economic growth. Q4 grew a big 3.2%, making 2023 a solid 2.5% from 1.9% in 2022. This was on strong consumer and government infrastructure spending. Also, great record exports of crude oil/petroleum products and natural gas helped growth.

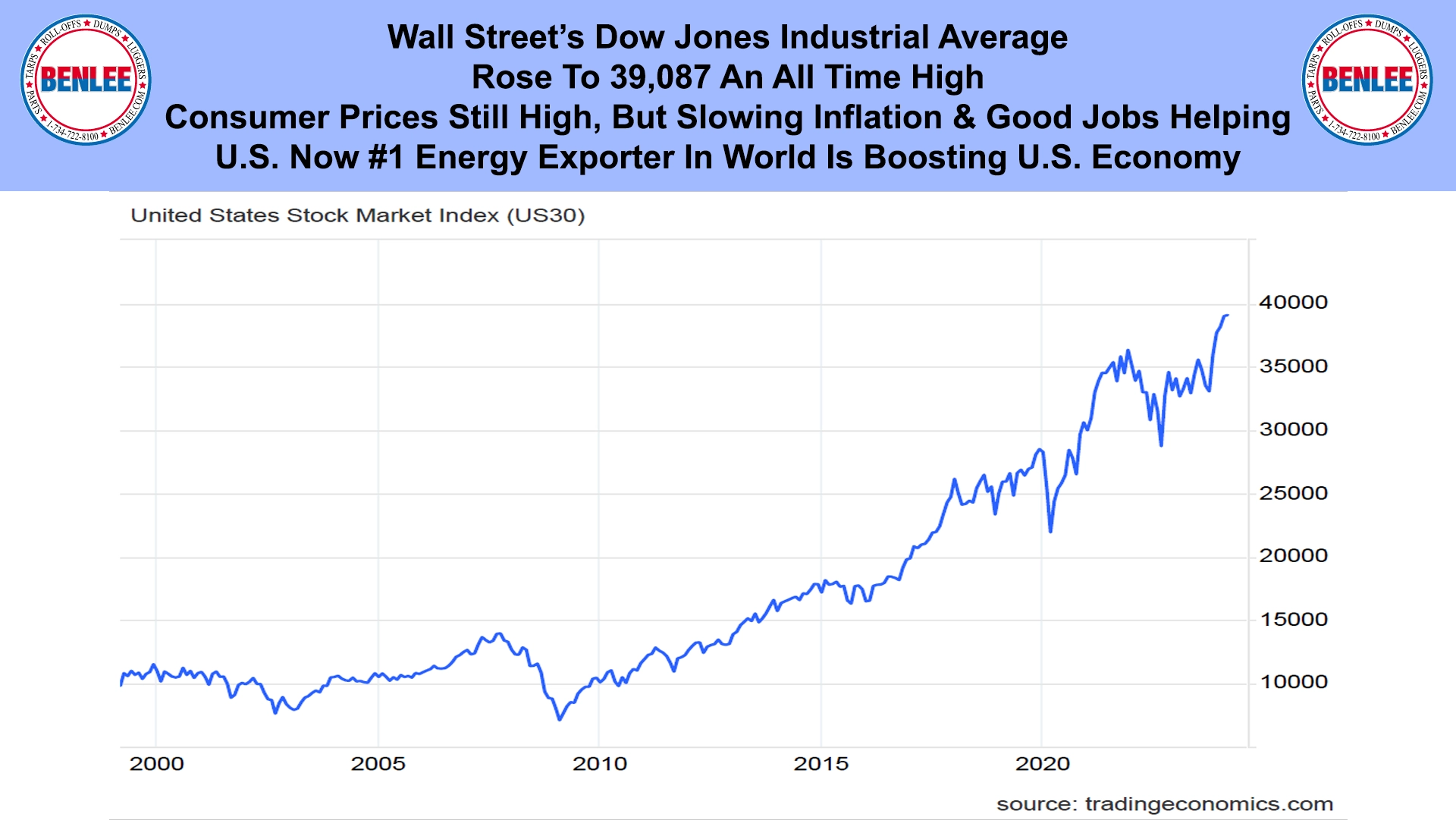

Wall Street’s Dow Jones Industrial Average rose to 39,087 an all-time high. Consumer prices are still high, but slowing inflation and good jobs helping the markets. Also, with the U.S. now the #1 energy exporter in the world, which is boosting the economy.

Safety remains #1 at BENLEE. Hitting bridges and power lines with roll offs remains a key problem. All BENLEE roll off trailers come with hoist up alarms and warning signs. Refit your older BENLEE or other manufacturers trailers with our alarm and sign. Order the sign and alarm/strobe sensor online or call 734-722-8100.

This report by Greg Brown is brought to you by BENLEE roll off trailers, gondola trailers, crushed car trailers, lugger trucks, roll off trailer parts and roll off truck parts.