This is the Global Economic, Commodities, Scrap Metal and Recycling Report, by our BENLEE Roll off Trailers and Lugger Trucks, October 18, 2021. This is Brian Sides reporting while Greg Brown is out of the United States.

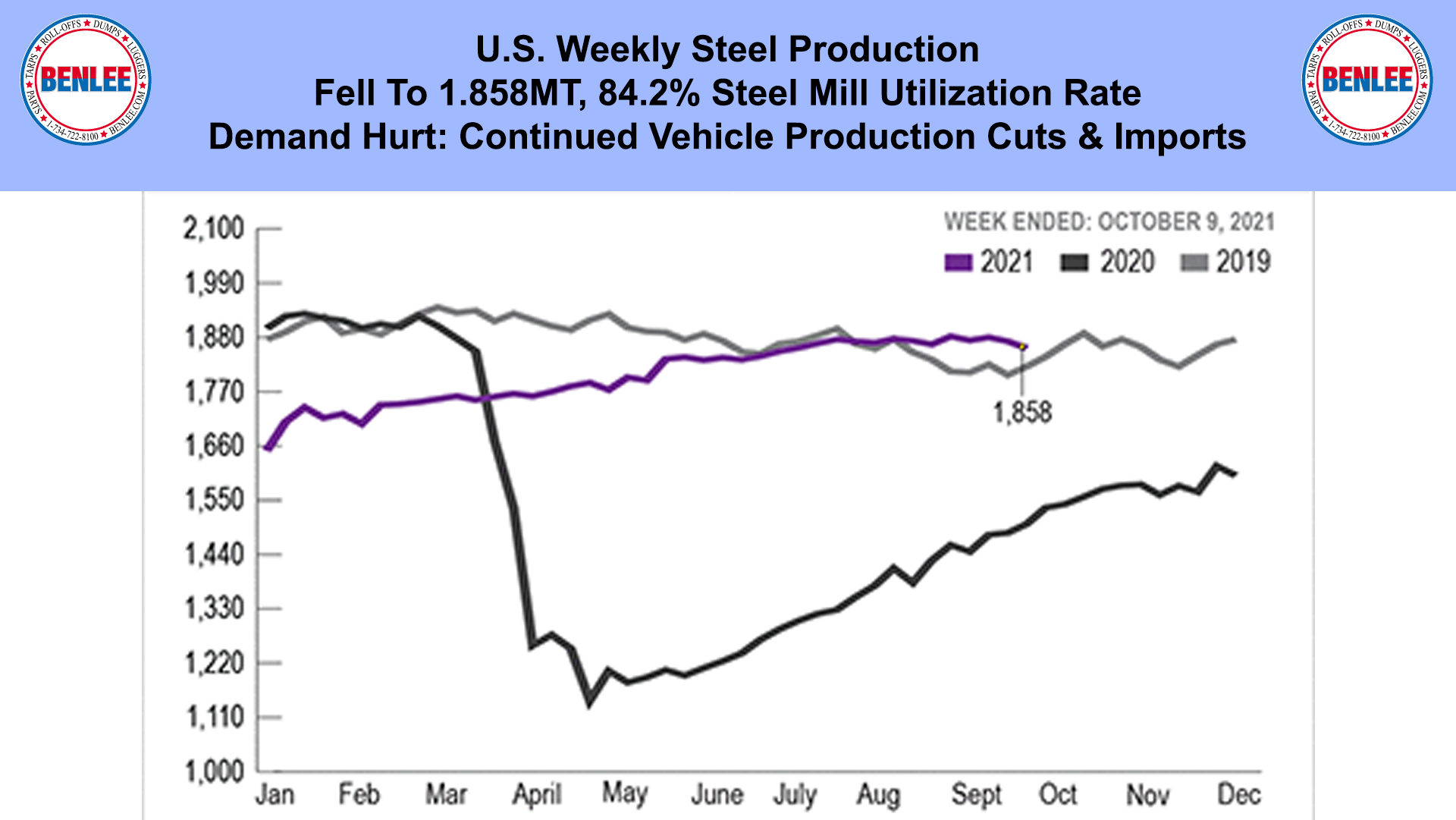

U.S. Weekly crude steel production fell to 1.858MT, an 84.2% steel mill utilization rate. Demand is being hurt by continued vehicle production cuts and steel imports.

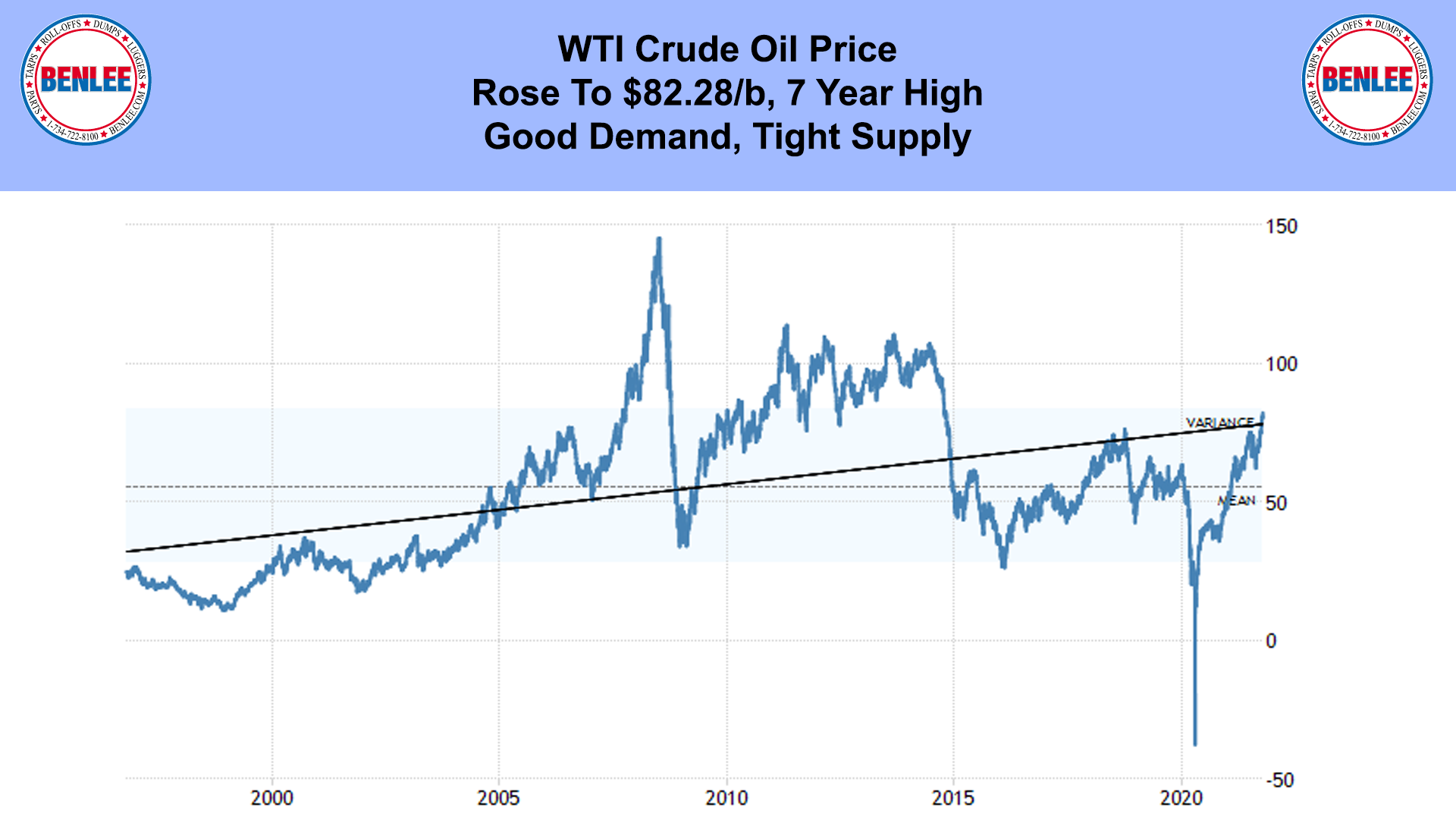

WTI Crude oil price rose to $82.28/b, a 7 year high. Importantly, this was on good demand and tight supply.

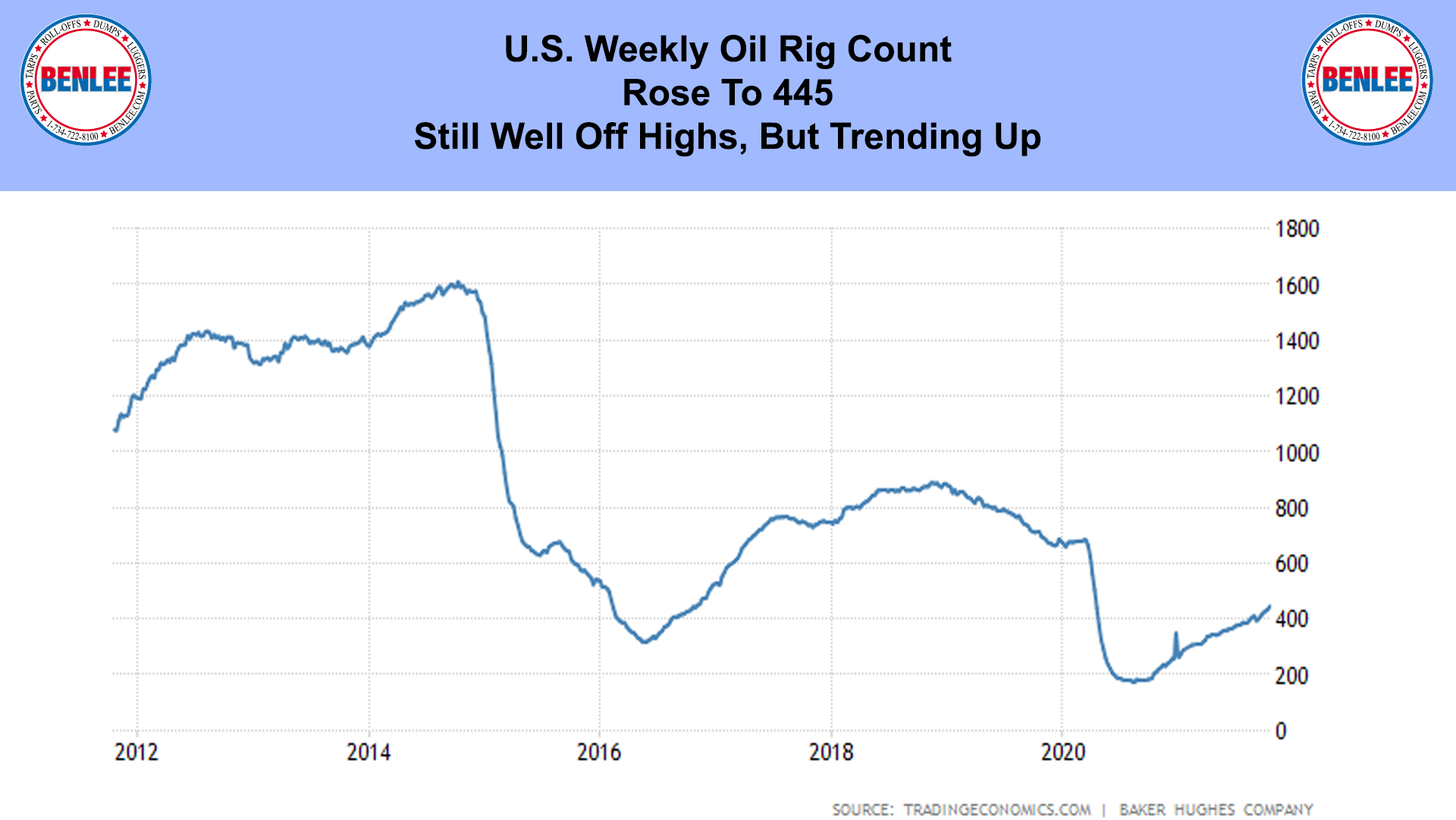

The U.S. Weekly Oil rig count rose to 445, still well off the highs, but is trending up.

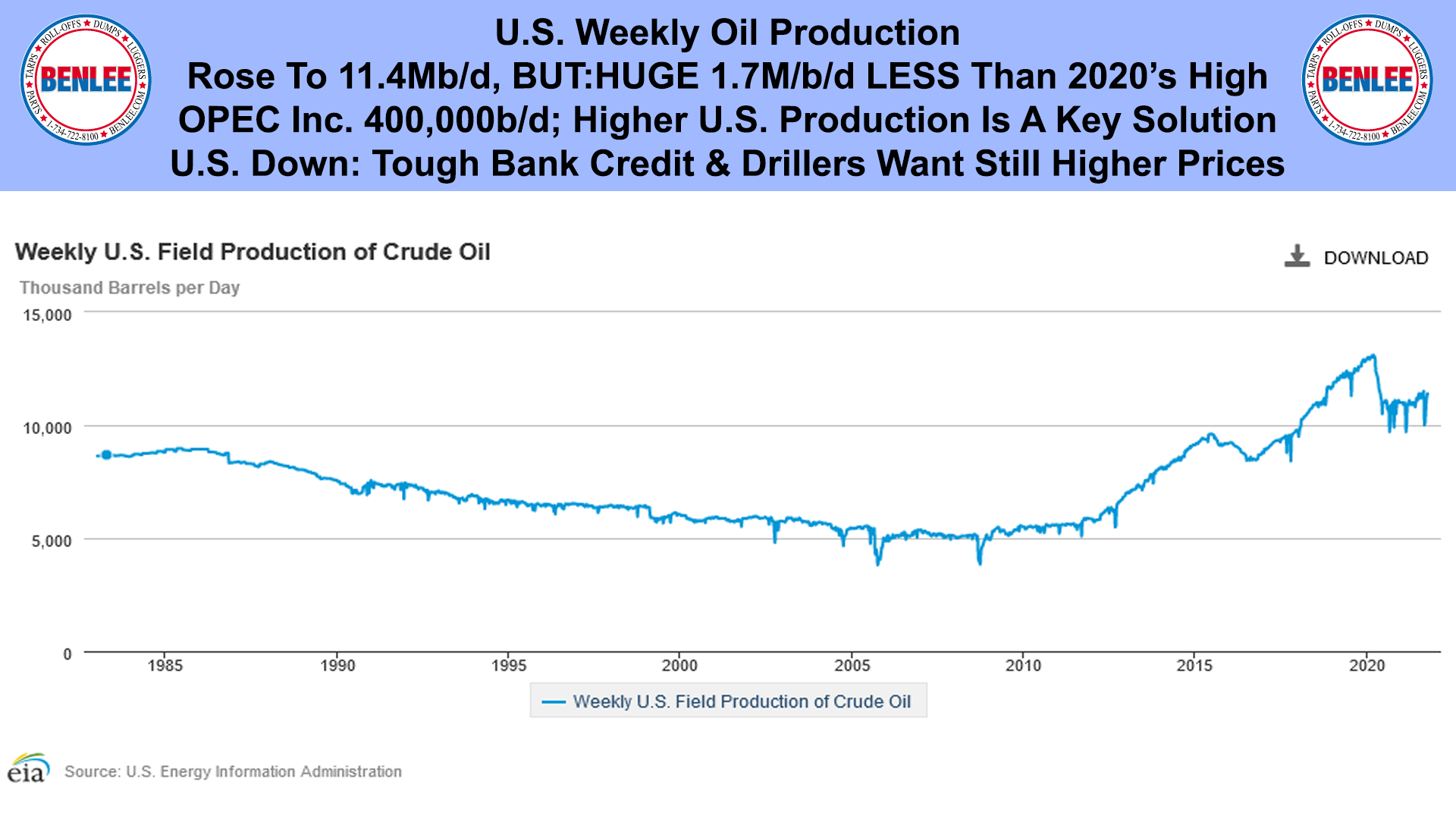

U.S. Weekly Oil production rose to 11.4Mb/d, but a huge 1.7Mb/d less than 2020. Note, OPEC increased production by 400,000b/d. Importantly, this means higher U.S. oil production is a key global solution to lower prices. U.S. production is down due to tough bank credit and drillers wanting still higher prices.

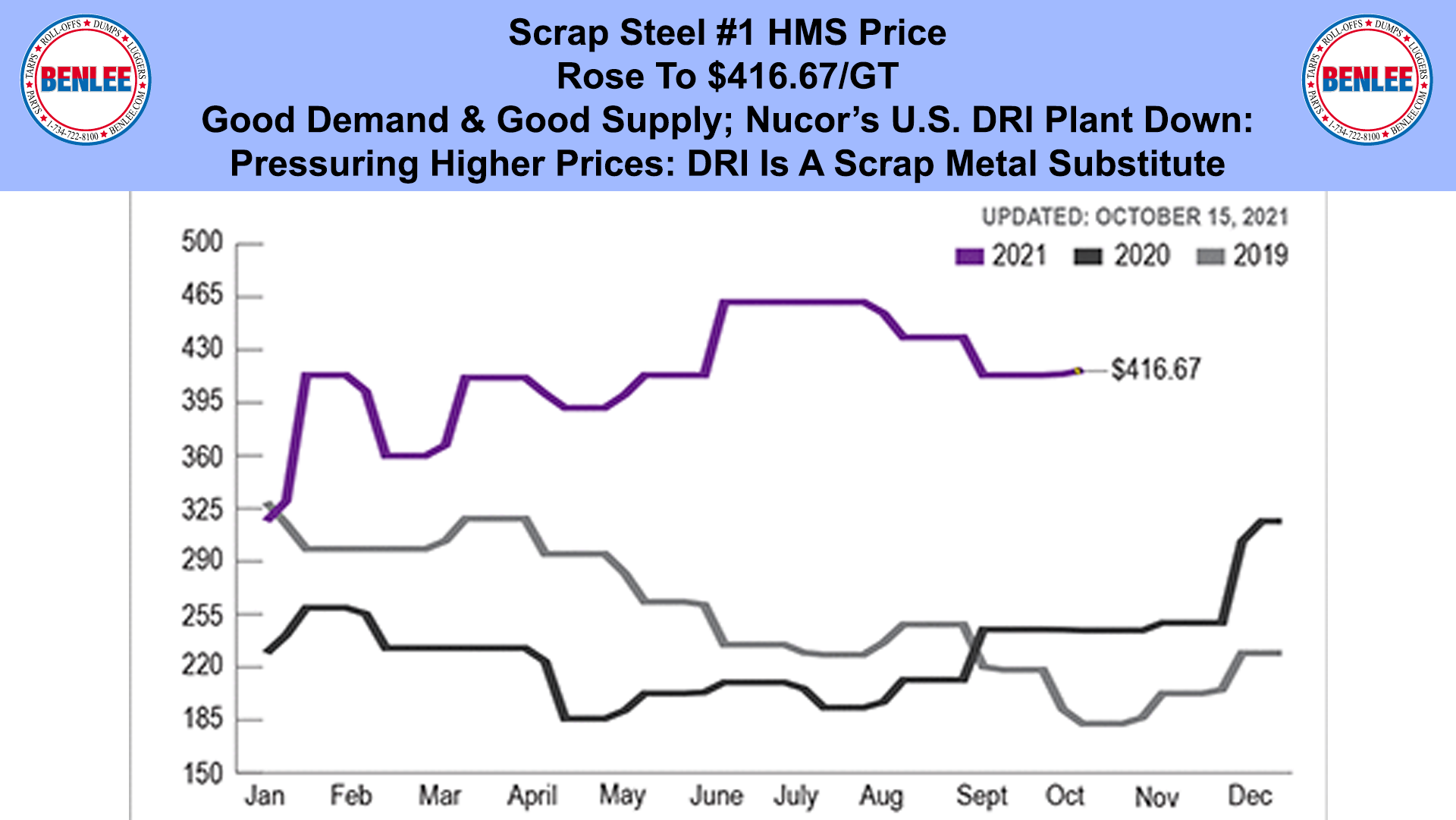

Scrap steel #1 HMS price rose to $416.67/GT on good demand and good supply. Nucor’s U.S. DRI plant is down, which is pressurizing higher scrap prices.

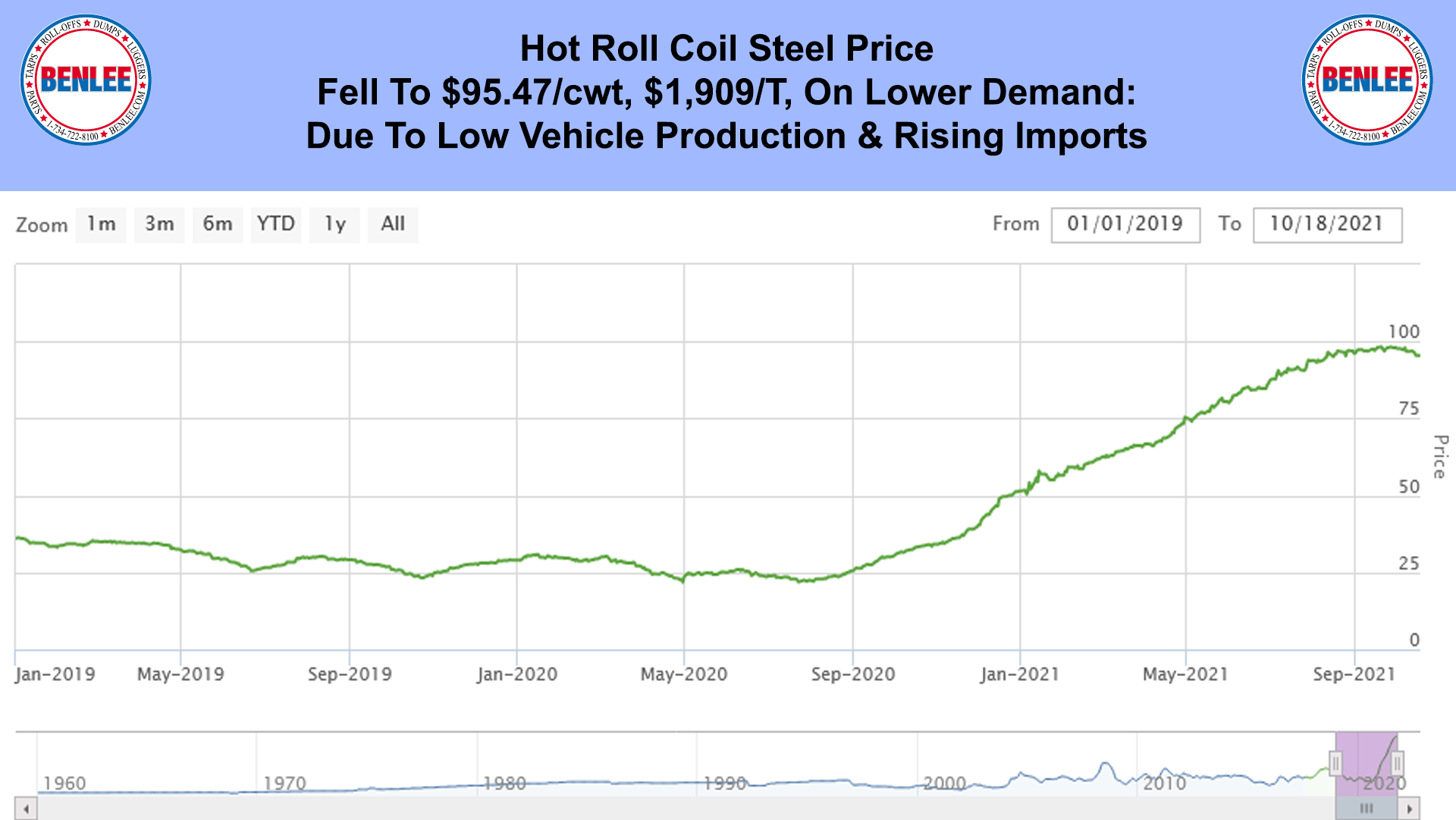

Hot Roll Coil Steel Price fell to $95.47/cwt, $1,909/T, on lower demand. Importantly, lower demand is due to low vehicle production and rising imports.

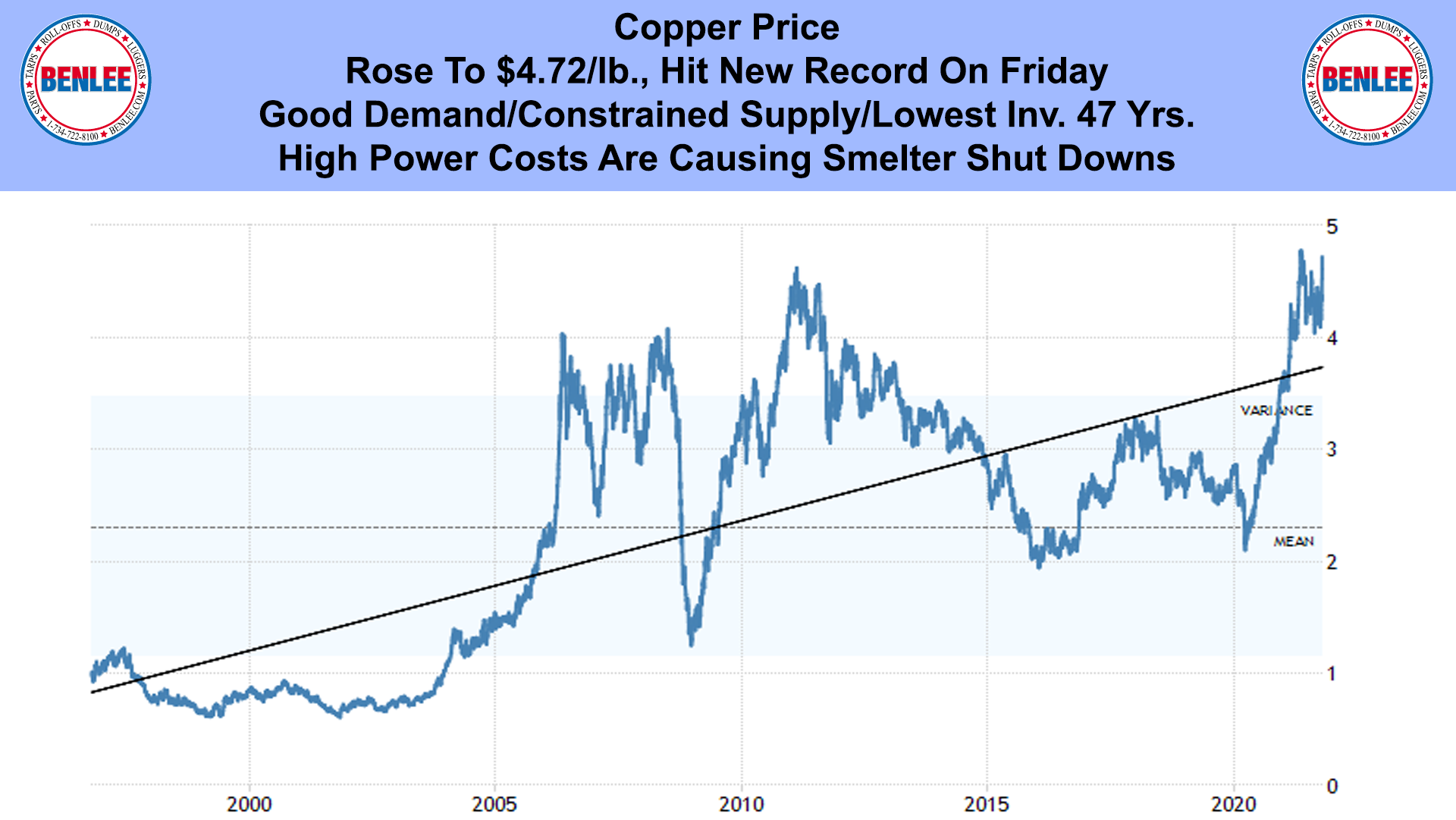

Copper price rose to $4.72/lb., hitting a new record on Friday. Moreover, this was on good demand and constrained supply with the lowest inventory in 47 years. High power costs are causing smelter shutdowns.

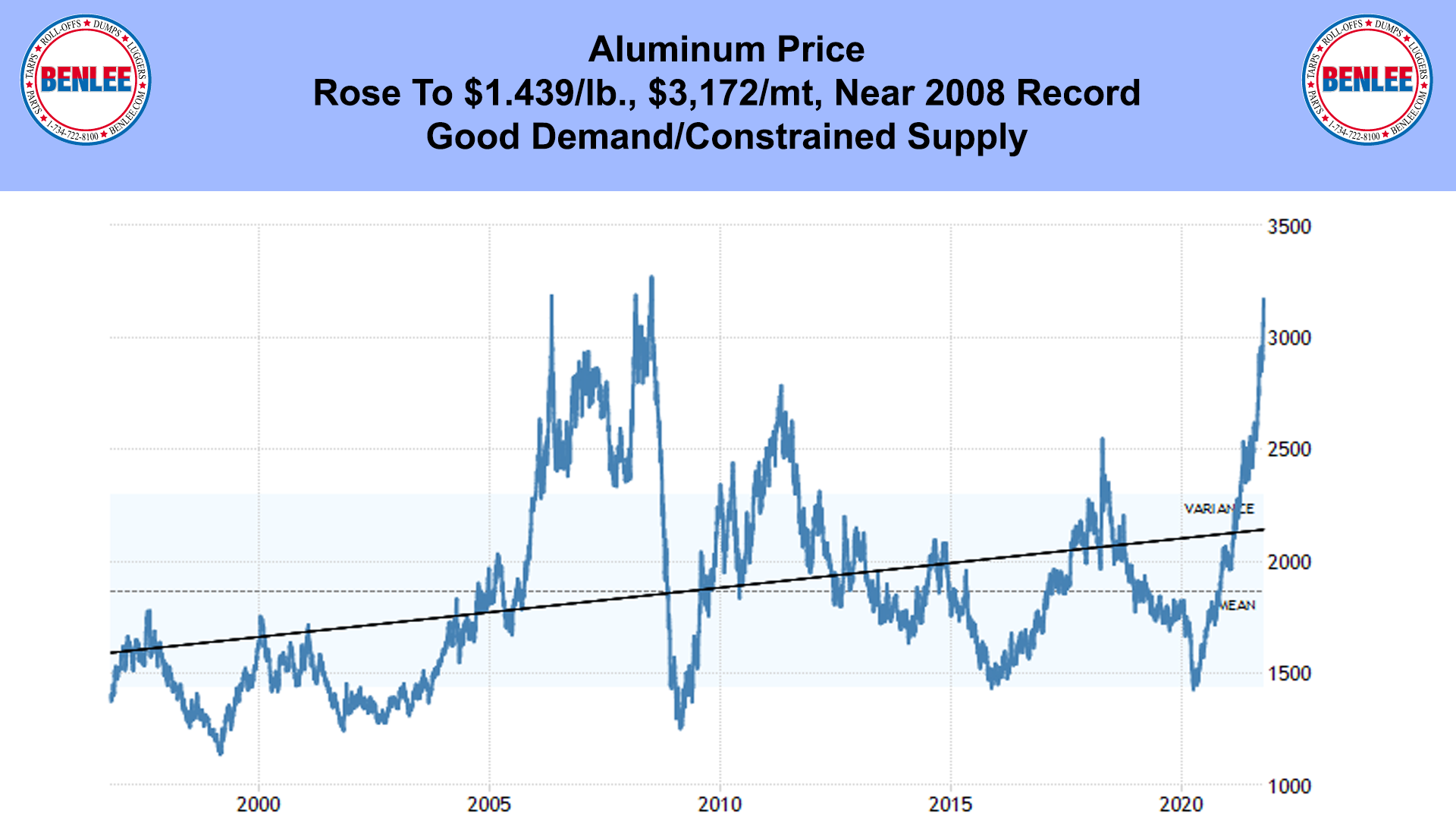

Aluminum price rose to $1.439/lb., $3,172/mt, near the 2008 record. This was on the same good demand and constrained supply.

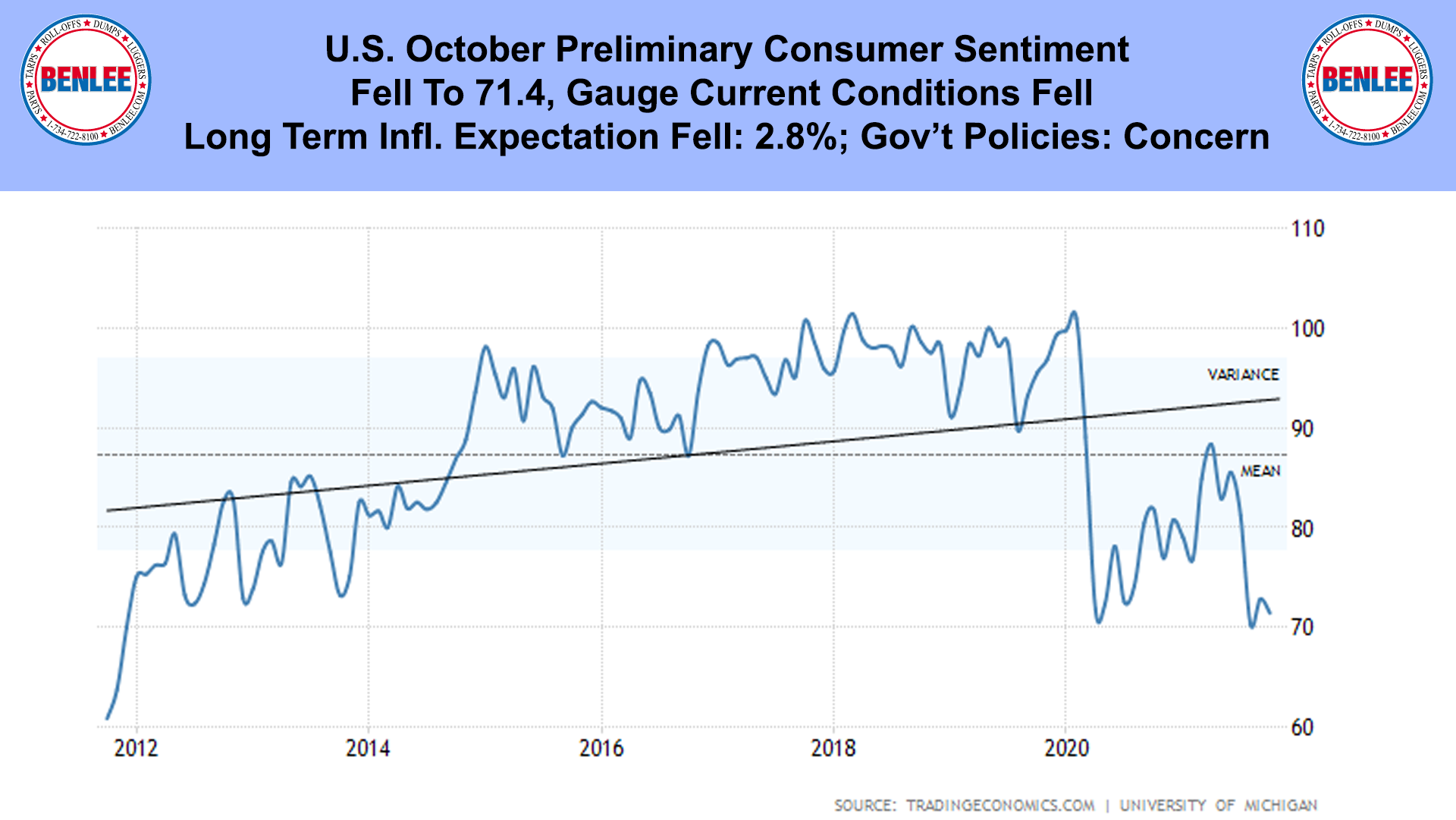

U.S. October preliminary consumer sentiment. It fell to 71.4, as the gauge of current conditions fell. On a positive, long term inflation expectations fell, while government policies were a concern.

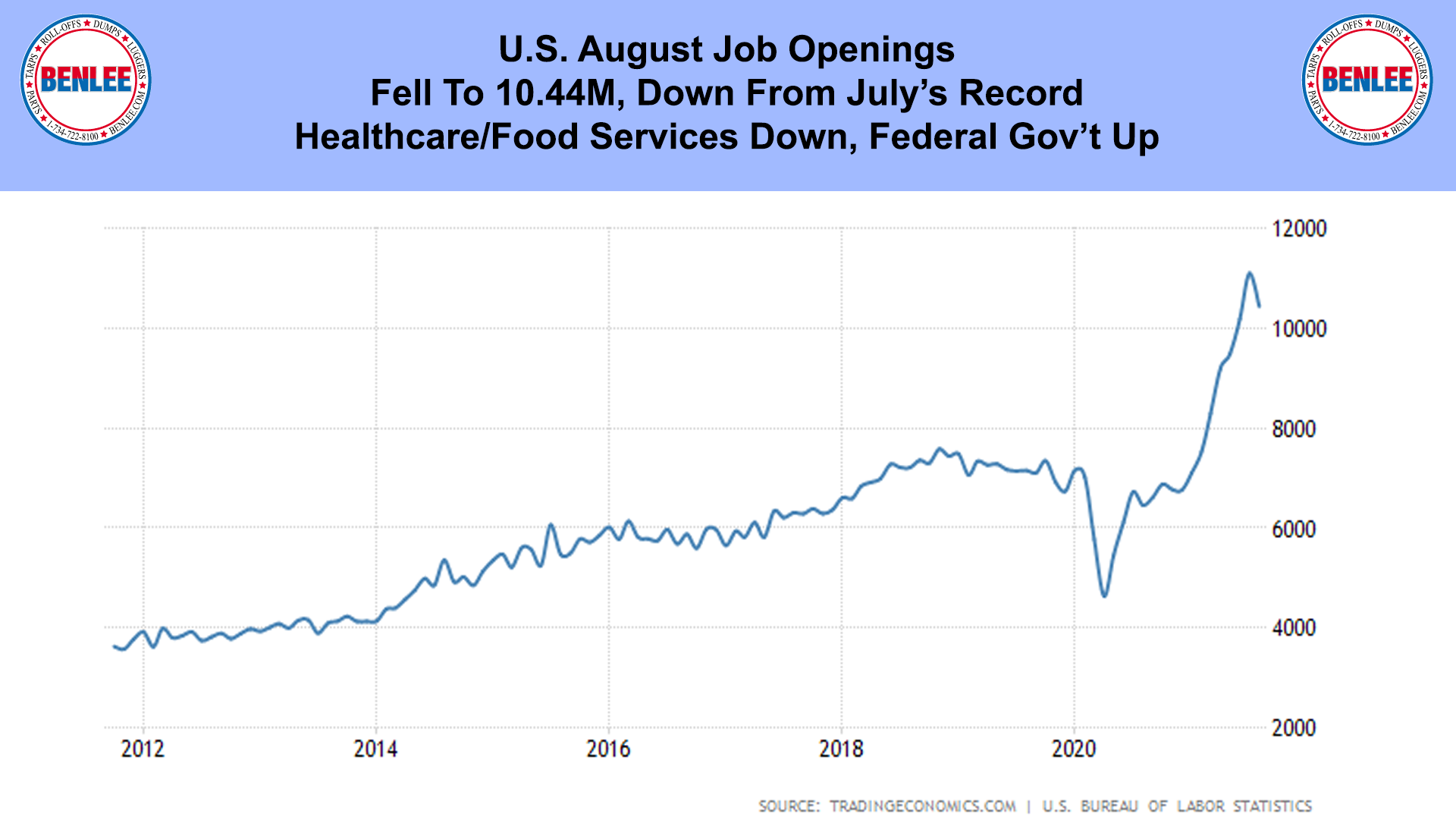

U.S. August job openings fell to 10.44M, down from July’s record. Healthcare and food services were down and open federal government jobs were up.

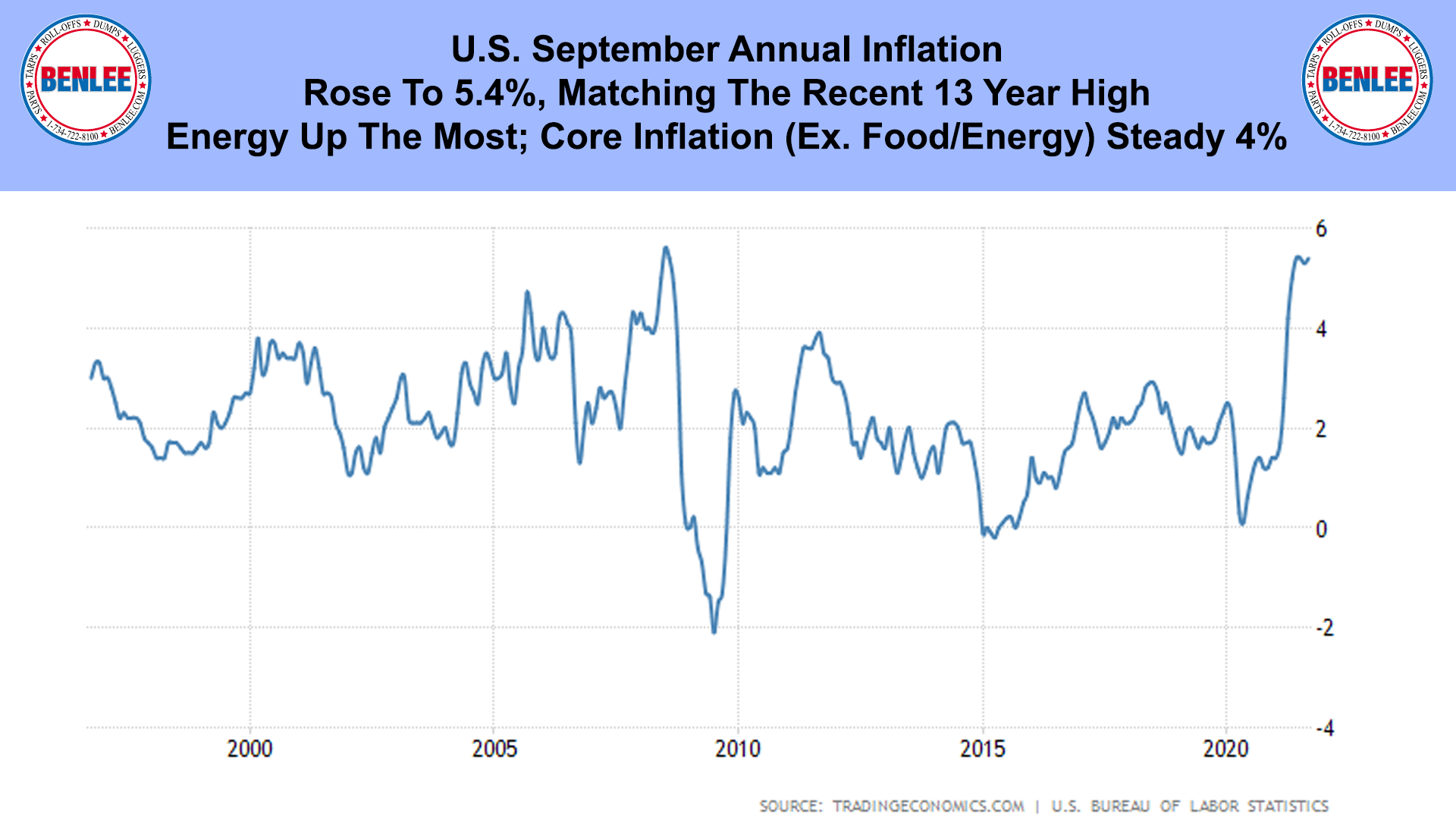

U.S. September annual inflation rose to 5.4%, matching the recent 13 year high. Importantly, note that energy was up the most. Core inflation which excludes food and energy was steady at 4%.

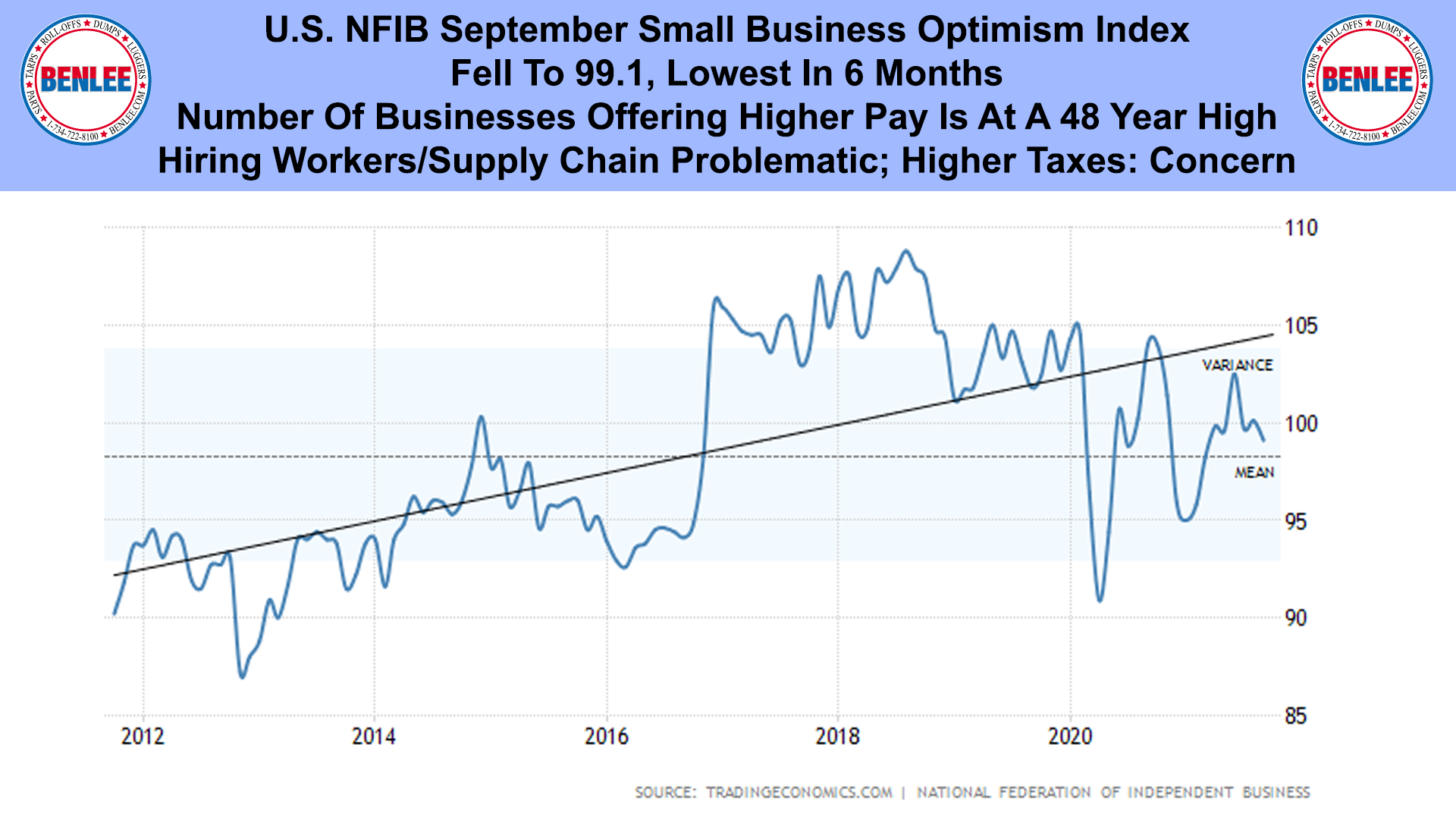

U.S. NFIB September small business optimism index. It fell to 99.1, the lowest in 6 months. The number of businesses offering higher pay is at a 48 year high. Hiring workers and supply chains remain problematic. Also, higher taxes remain a concern.

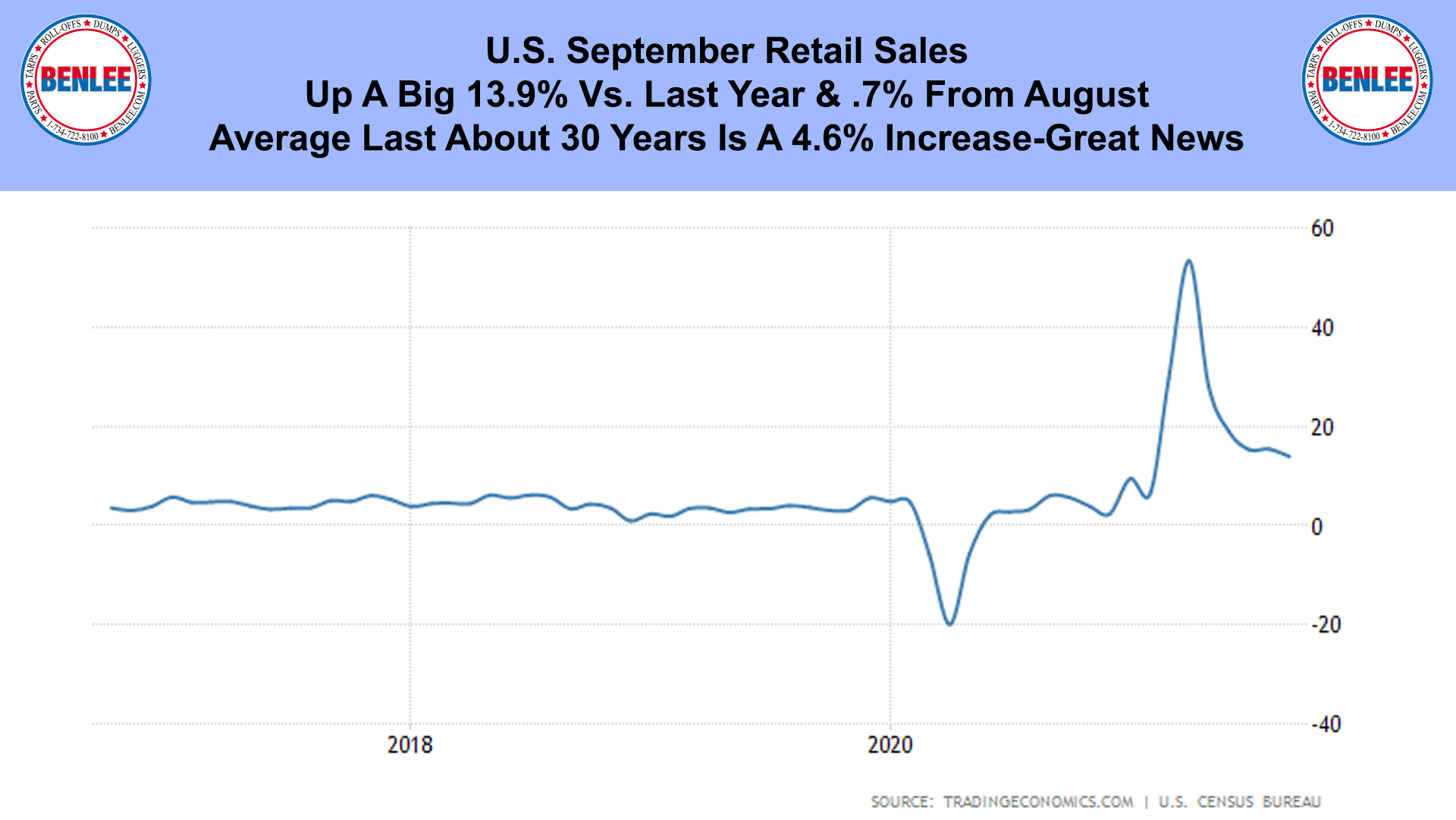

U.S. September retail sales. They were up a big 13.9% vs last year and .7% from August. The average for the about last 30 years was 4.6%, so, great news.

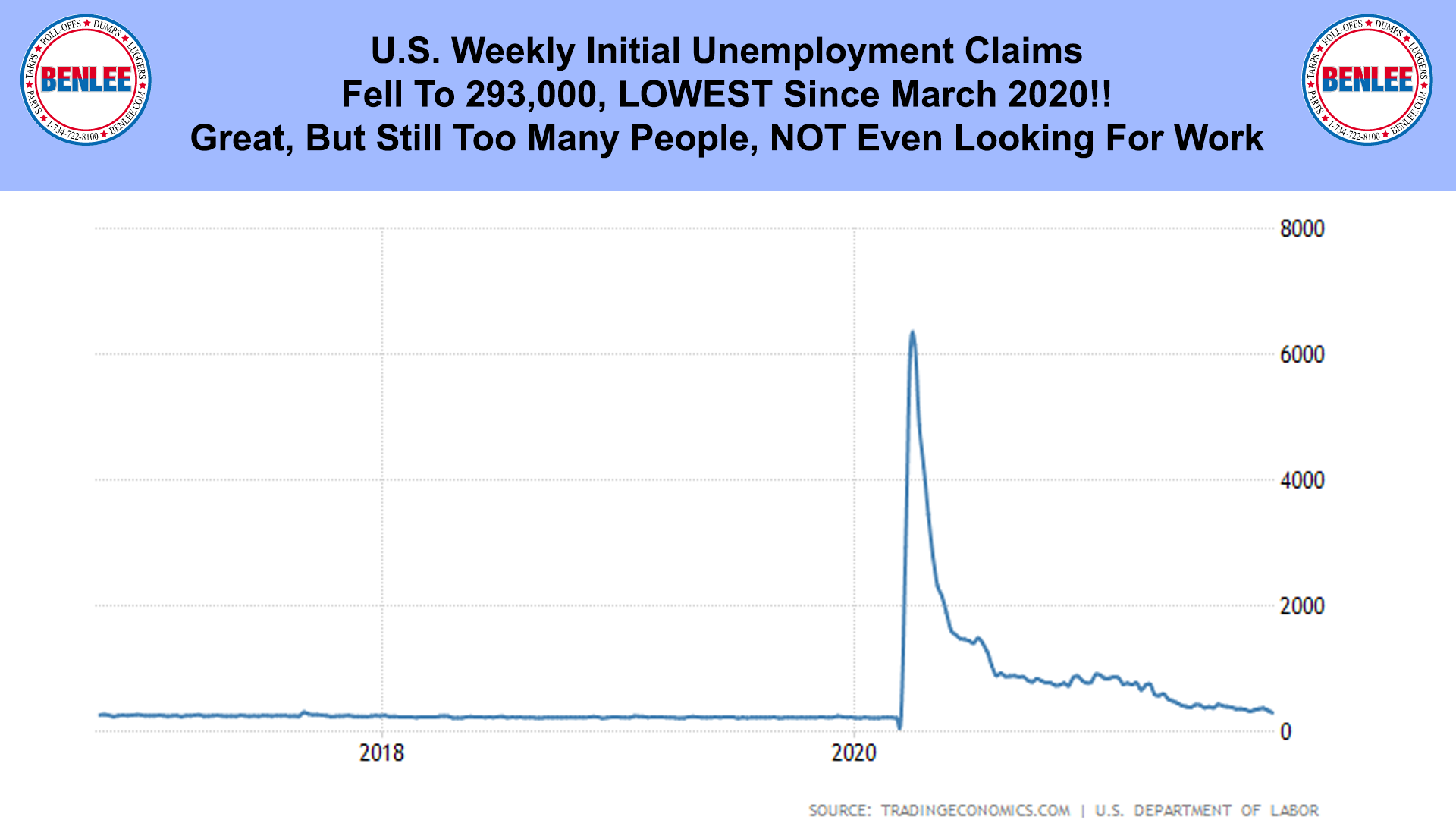

U.S. weekly initial unemployment claims fell to 293,000, the lowest since March 2020. Great news, but there are still too many people not even looking for work.

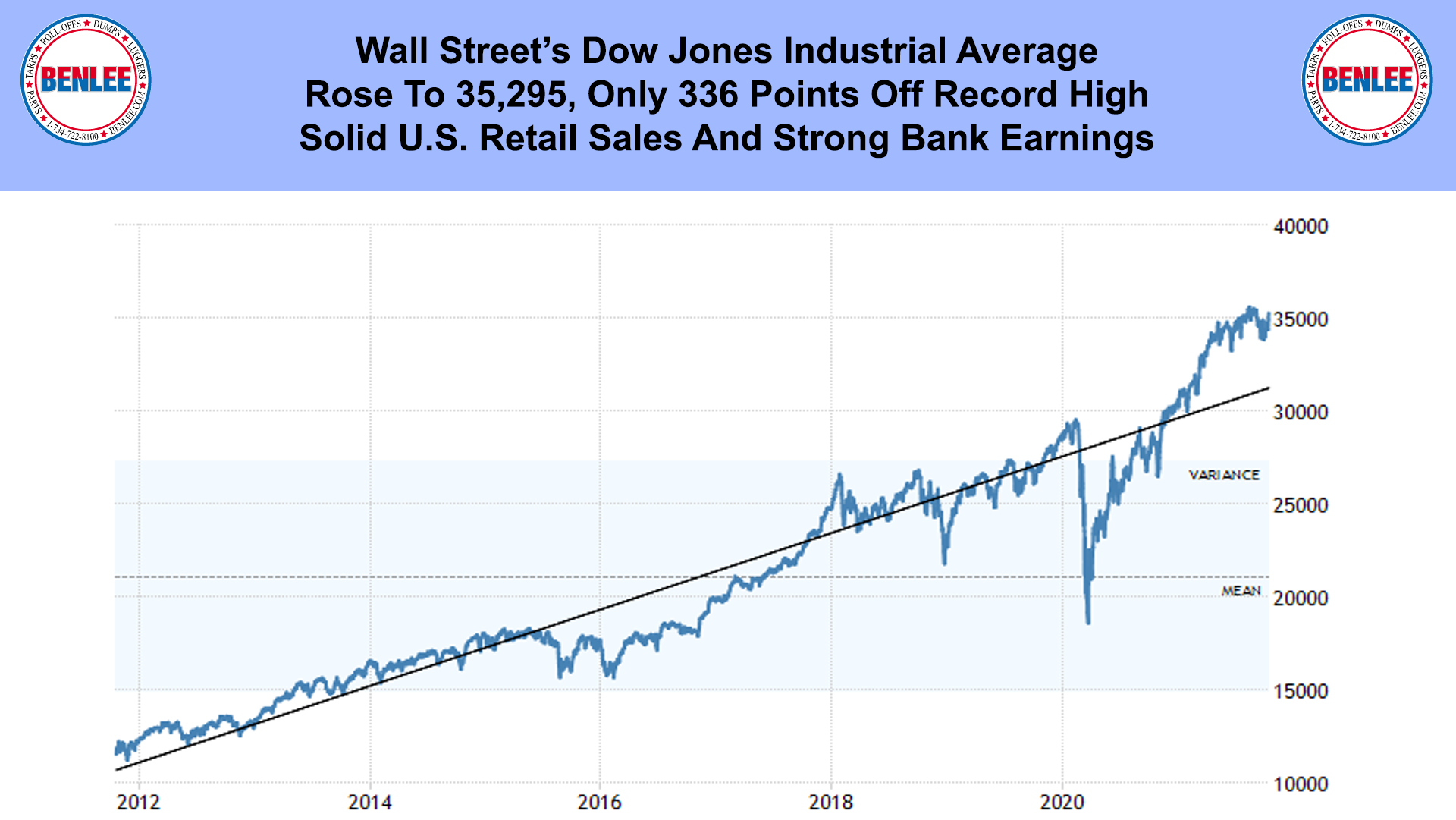

Wall Street’s Dow jones industrial average, rose to 35,295, only 336 points off the record high. Importantly, this was on solid U.S. retail sales and strong bank earnings.