This is the Commodities, Scrap Metal, Recycling and Economic Report. Brought to you by BENLEE roll off trailers, gondola trailers and roll off truck parts, January 30th, 2023.

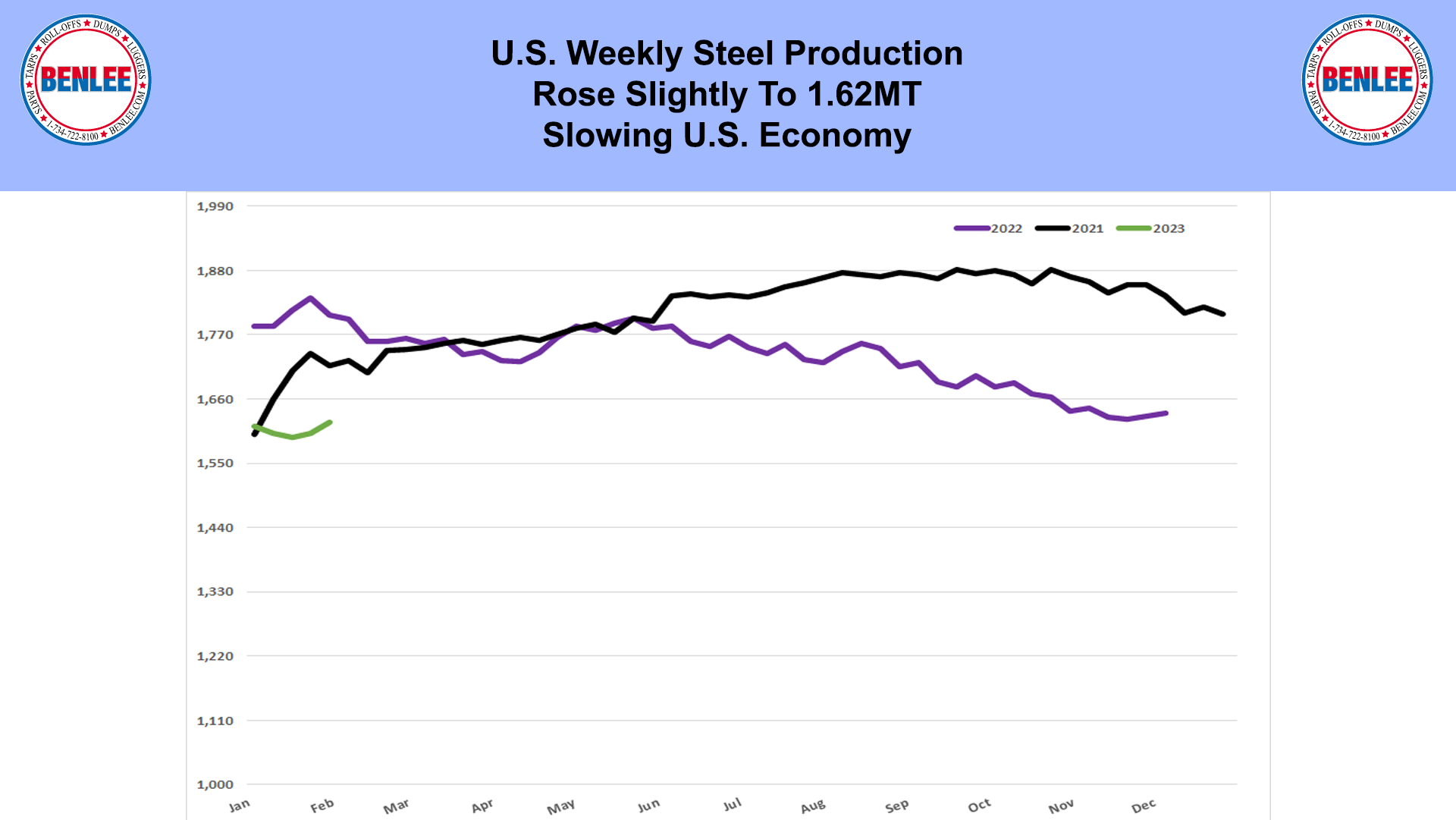

U.S. weekly raw steel production rose slightly to 1.62MT on the slowing U.S. economy.

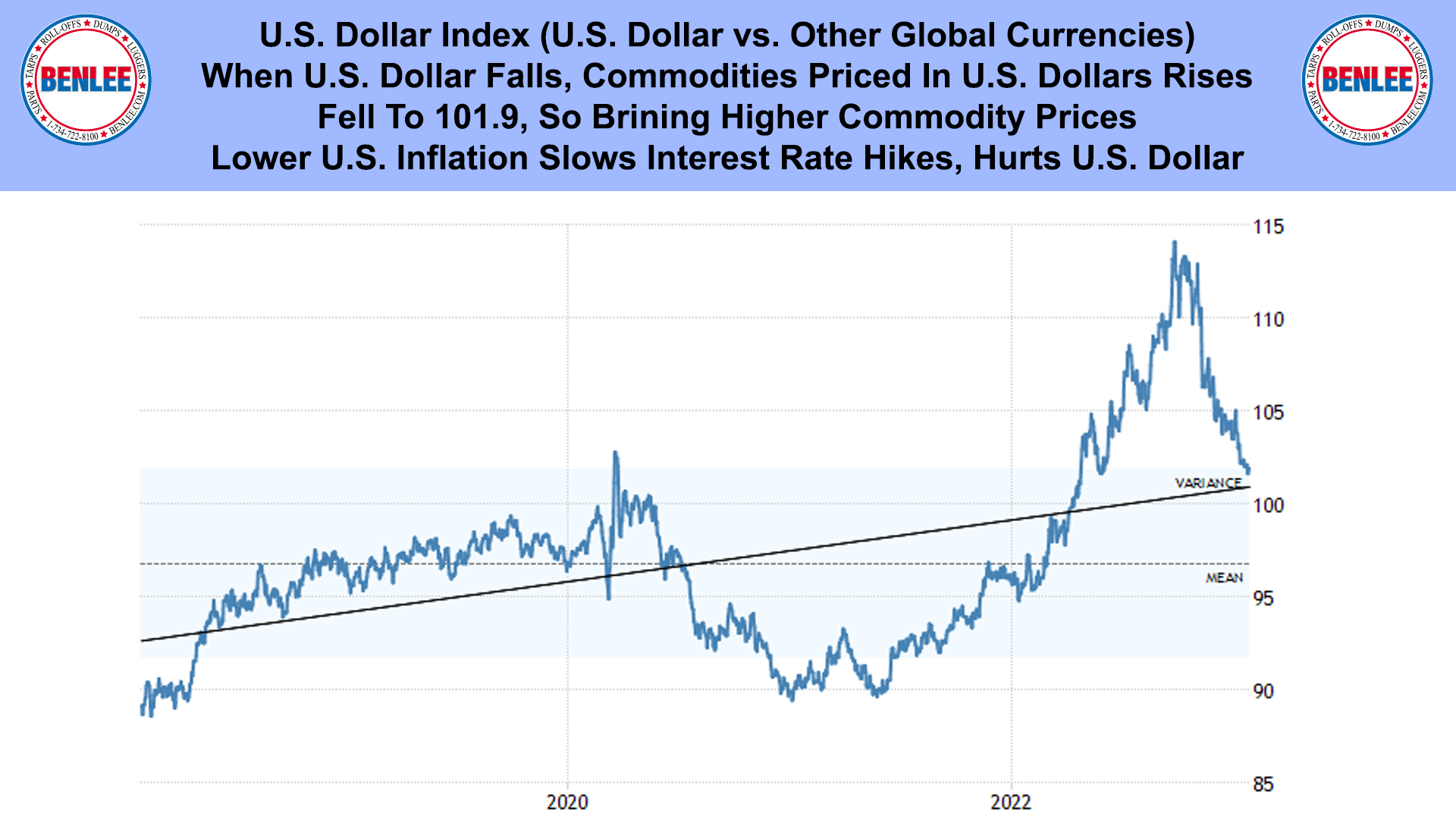

U.S. Dollar index. The U.S. dollar vs. other global currencies. When the U.S. dollar falls, commodities priced in U.S. dollars rises. It fell to 101.9, so bringing higher commodity prices. Lower U.S. inflation slows interest rate hikes, which hurts the U.S. dollar.

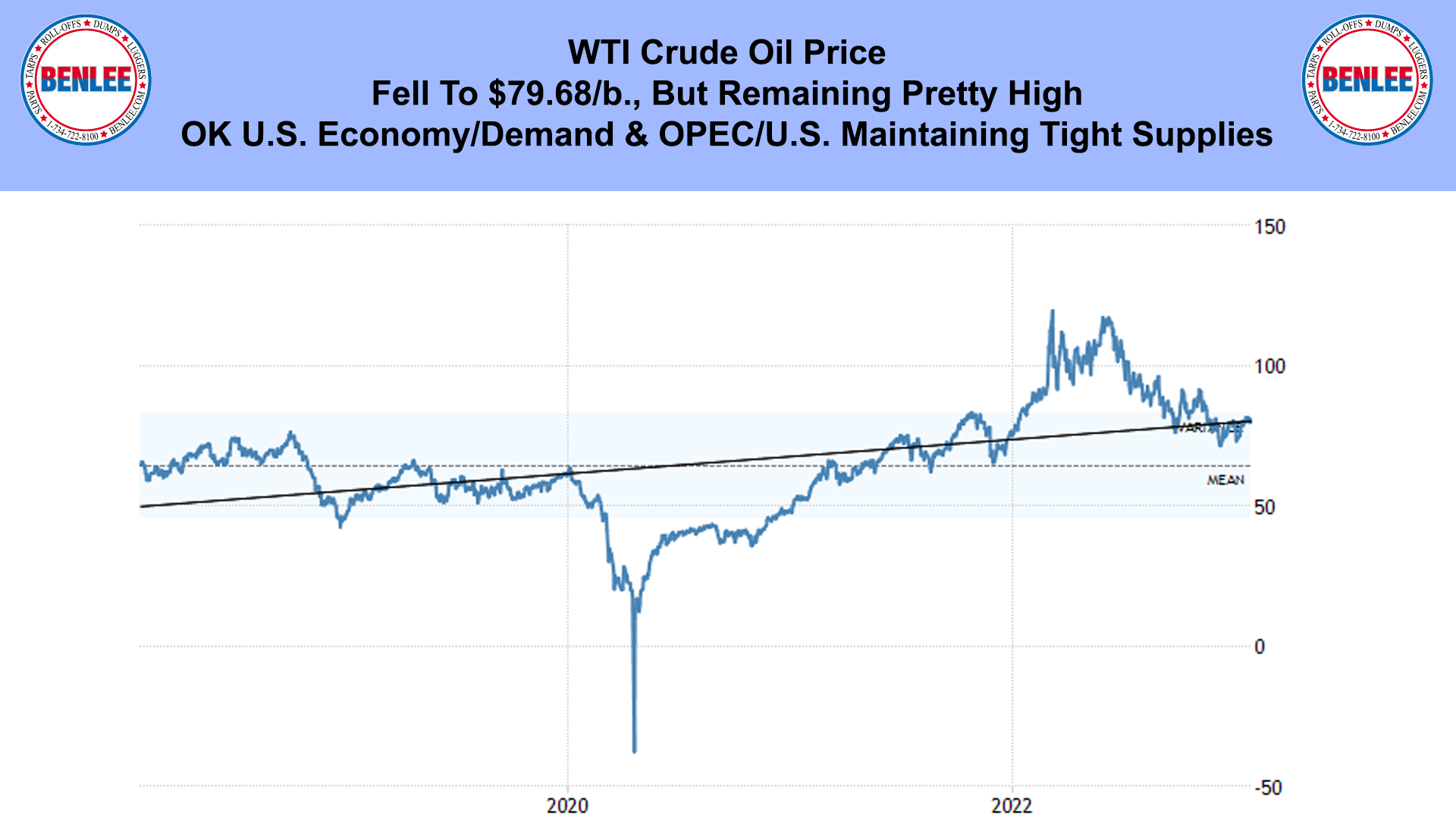

WTI crude oil price fell to $79.68/b. but remaining pretty high. This was on an OK U.S. economy and good oil demand, while OPEC and the U.S., maintaining oil tight supplies.

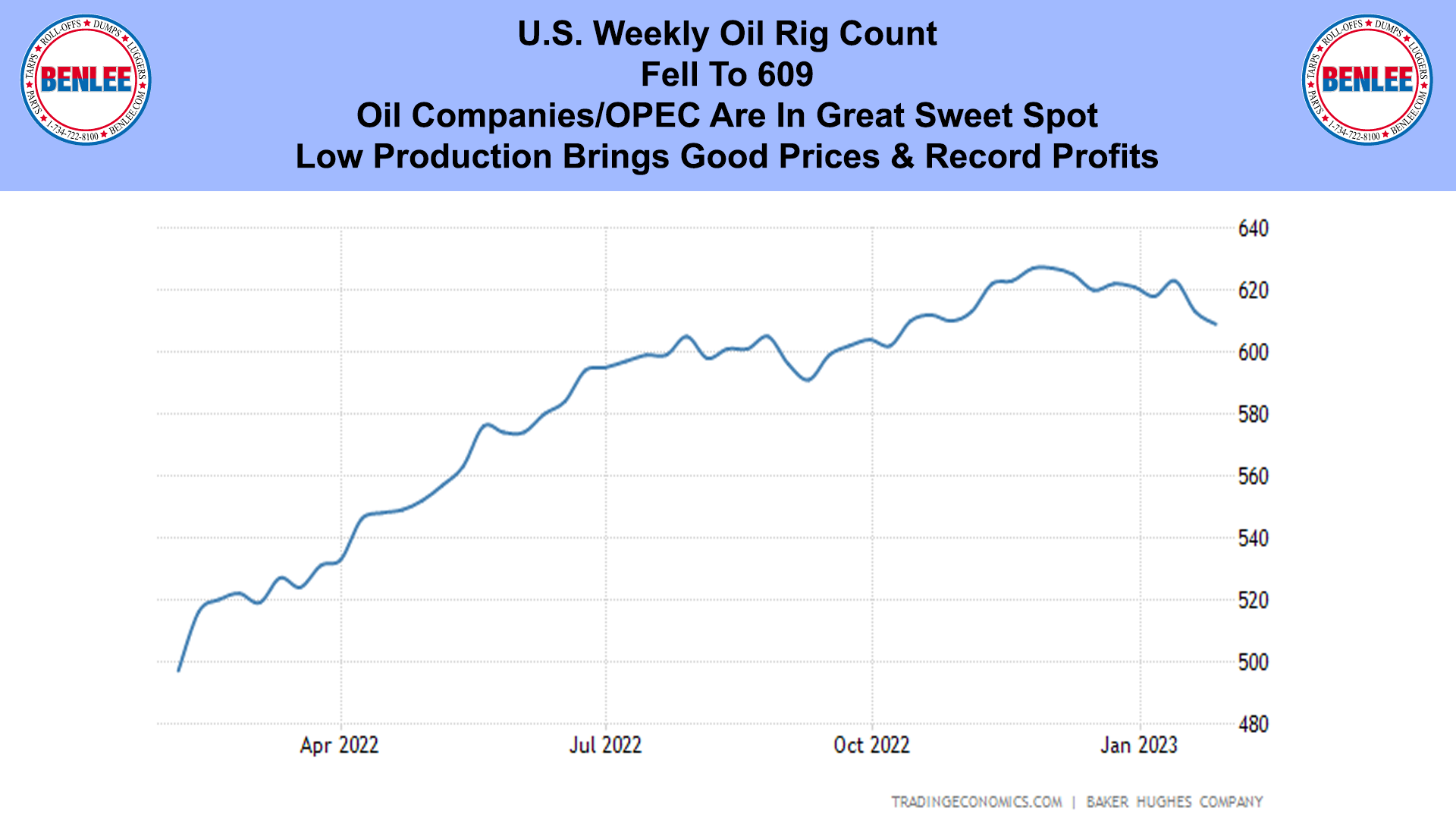

The U.S. weekly oil rig count fell to 609 as oil companies and OPEC are in a great sweet spot of low production, bringing good prices and record profits.

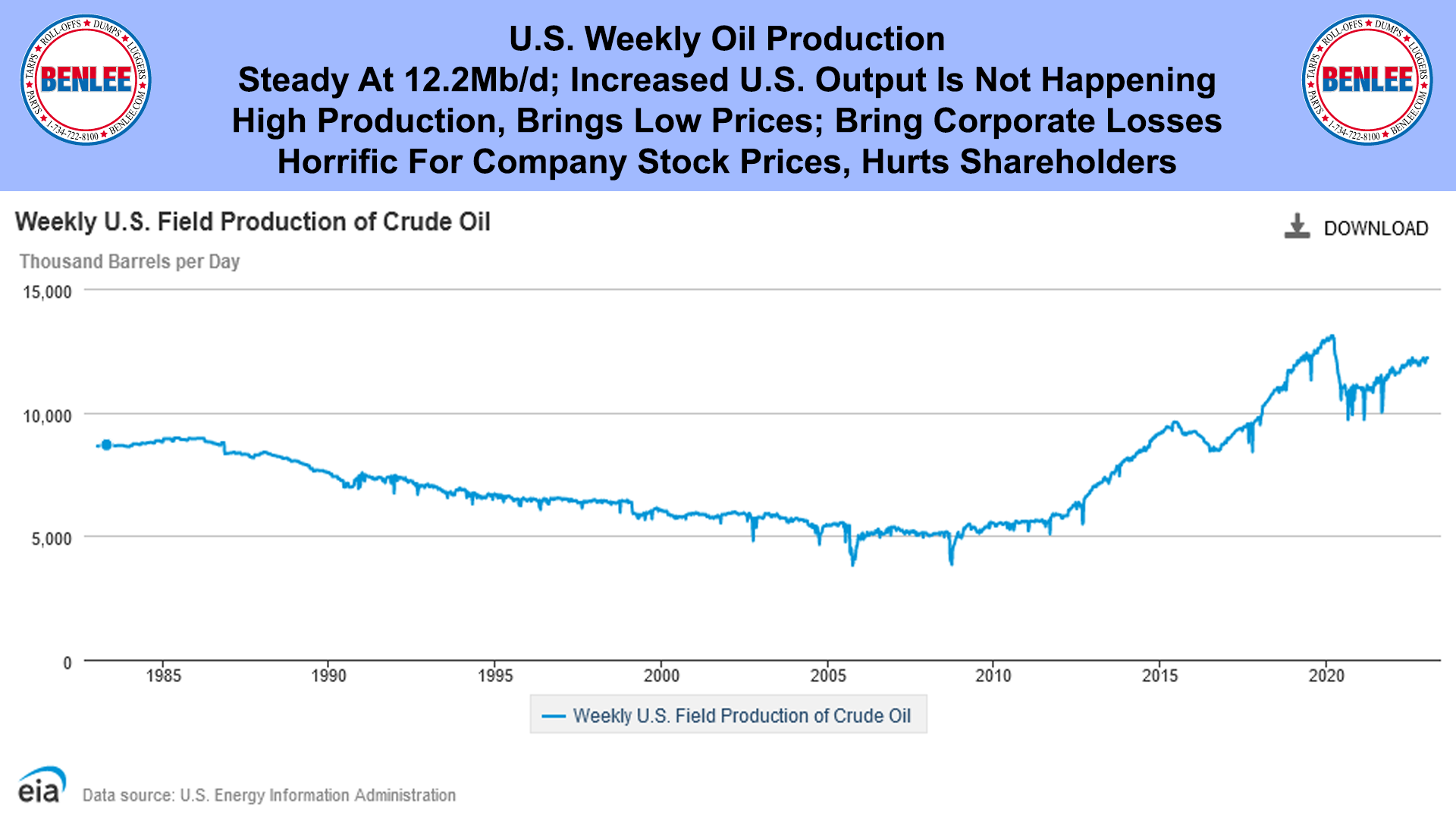

U.S. weekly crude oil production was steady at 12.2Mb/d> Increased U.S. output that was discussed is not yet happening. High production brings low prices, that brings corporate losses. That is horrific for company stock prices and hurts shareholders.

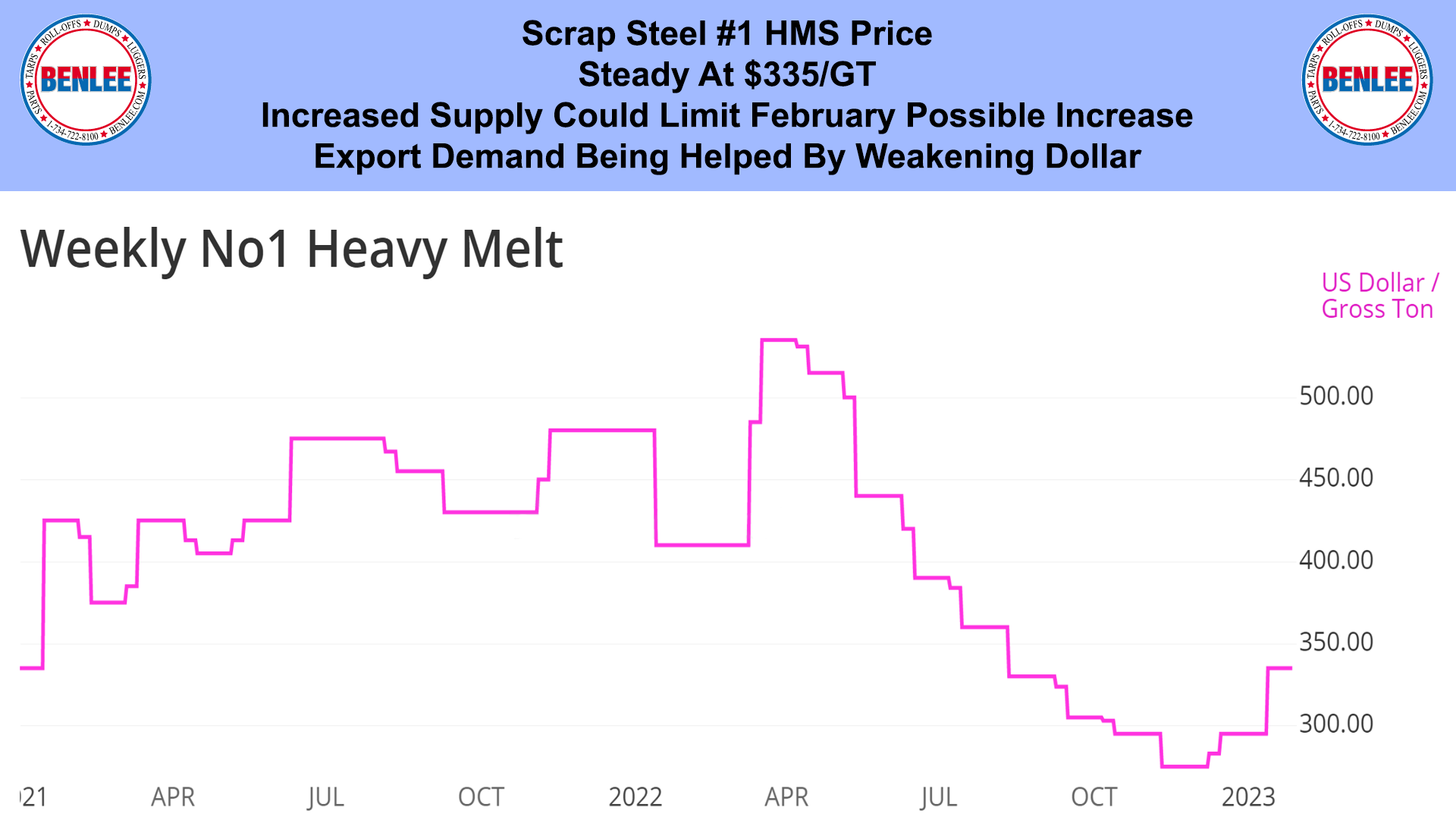

Scrap steel #1 HMS price was steady at $335/GT. Increased supply could limit a February possible increase. Export demand is being helped by the weaking dollar.

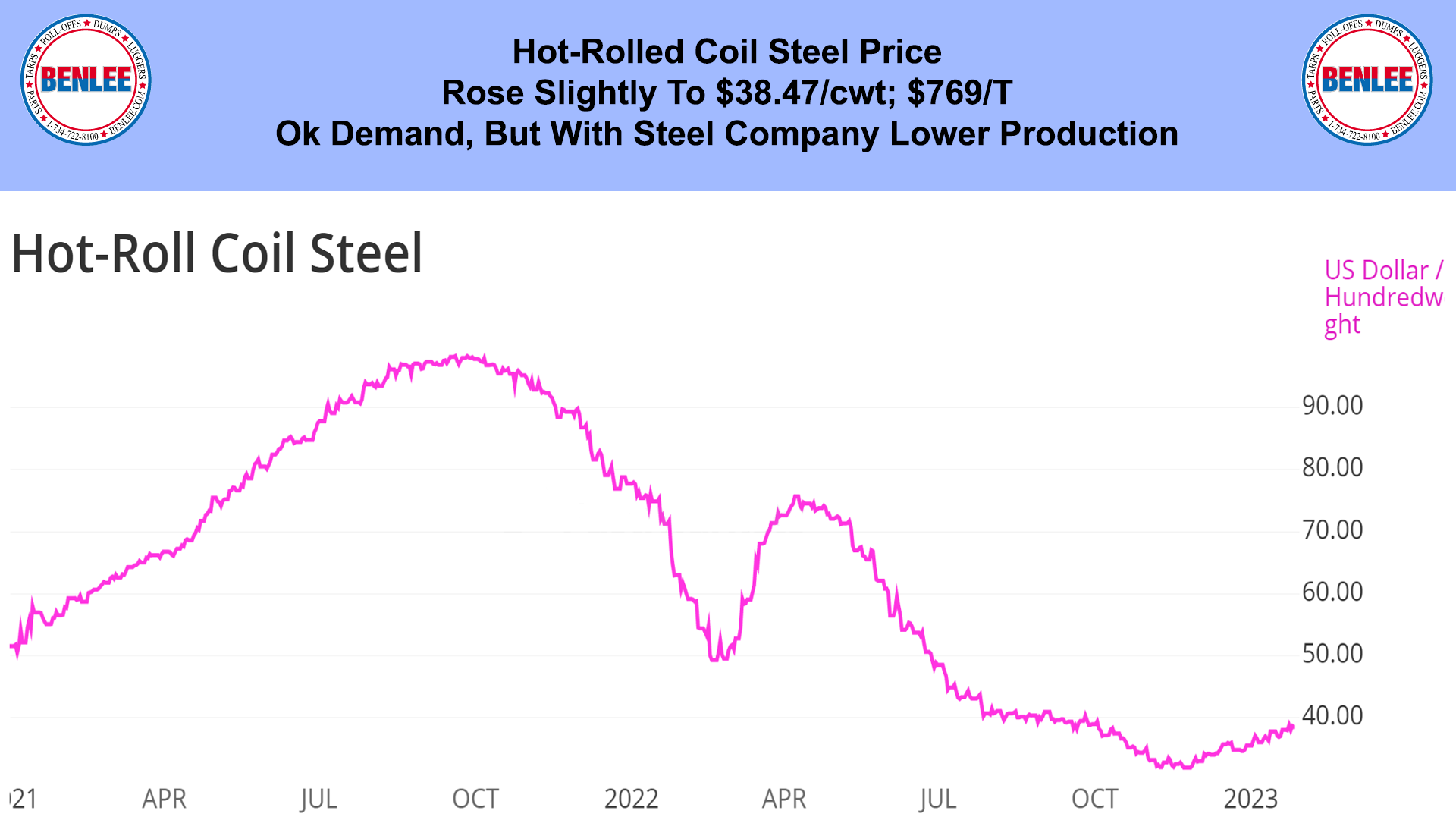

Hot-rolled coil steel price rose to $38.47/cwt., $769/T on OK demand, but with steel company lower production.

Copper price fell slightly to $4.23/lb., remaining high. This was on strong Chinese growth and supply problems from Peru.

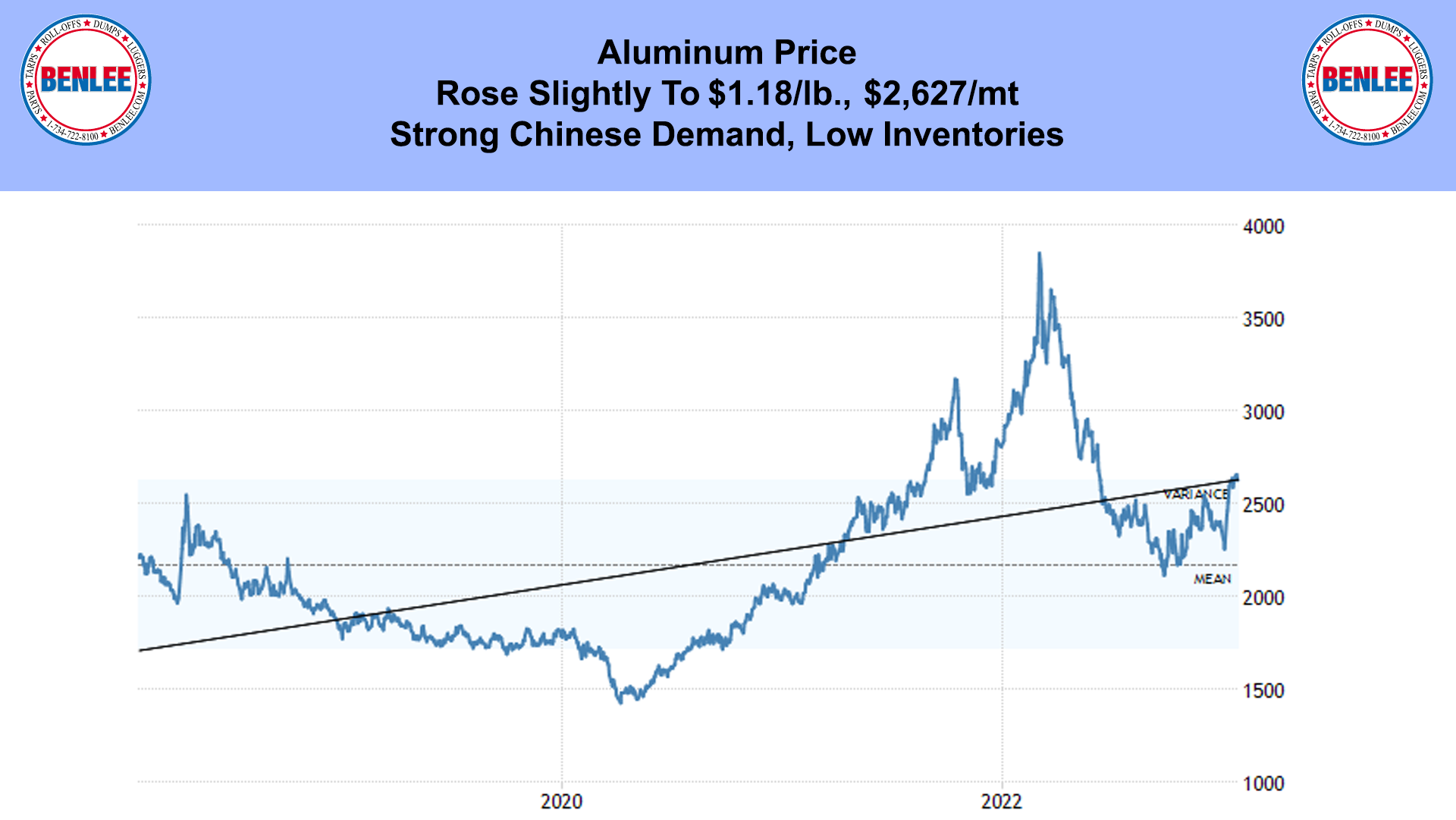

Aluminum price rose to $1.18/lb., $2,602/mt., on strong Chinese demand and low inventories.

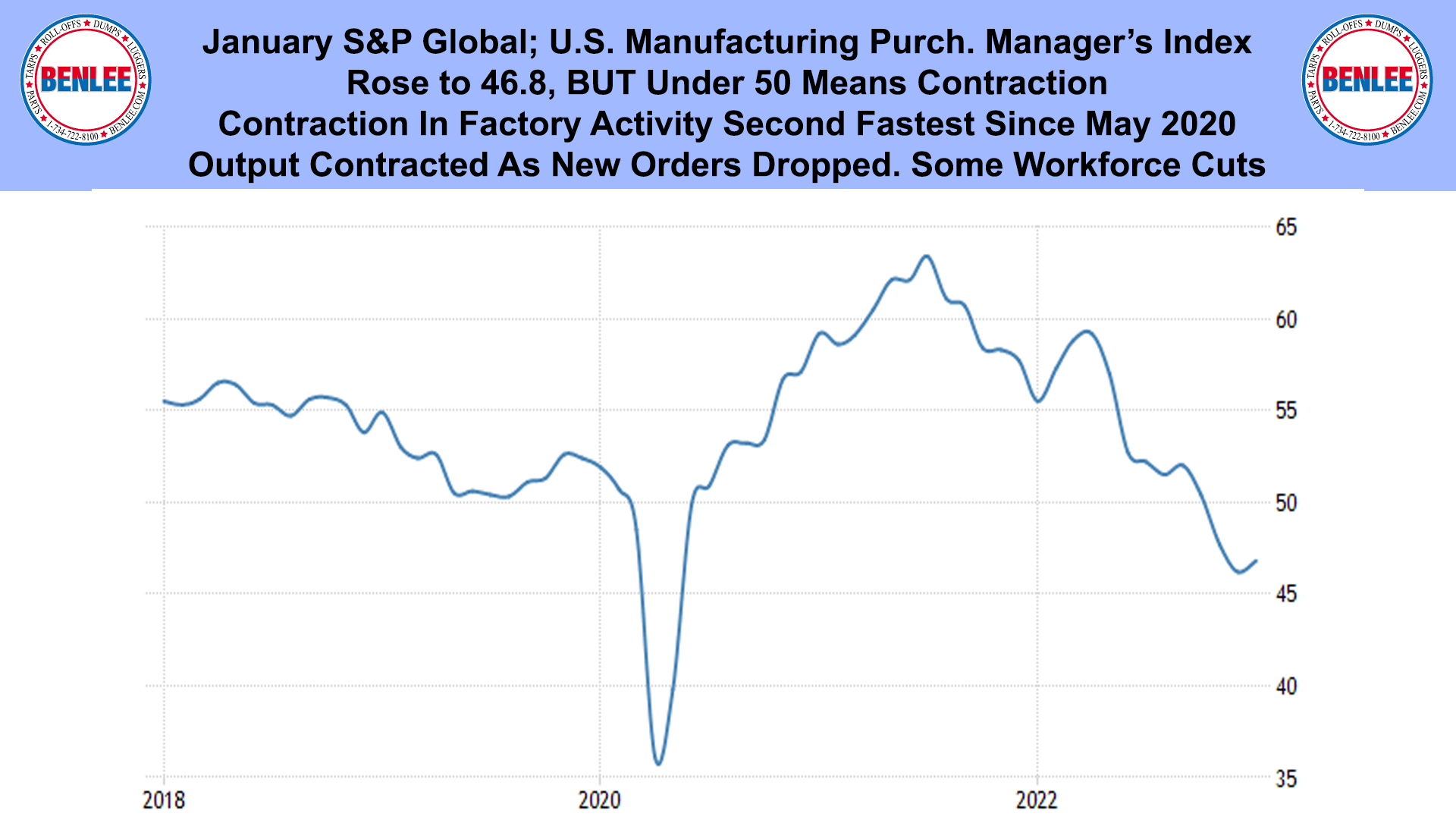

January S&P global U.S. Manufacturing purchasing manager’s index. It rose to 46.8, but under 50 is contraction. Contraction in factory activity was the second fastest since May 2020. Output contracted as new orders dropped and there were some workforce cuts.

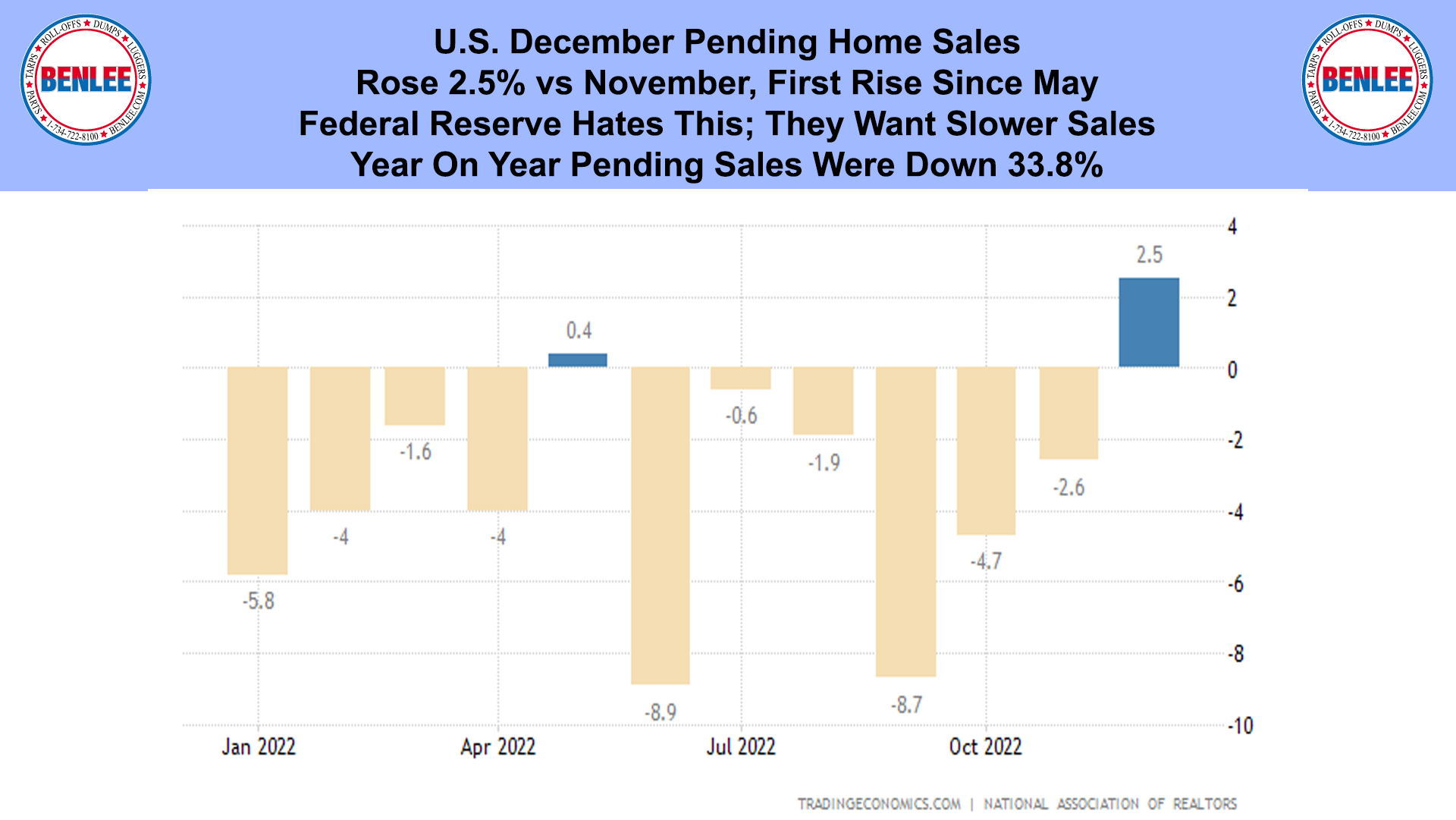

U.S. December pending home sales rose 2.5% vs November, the first rise since May. The Federal Reserve hates this. They want slower sales. Year on year pending sales were down 33.8%.

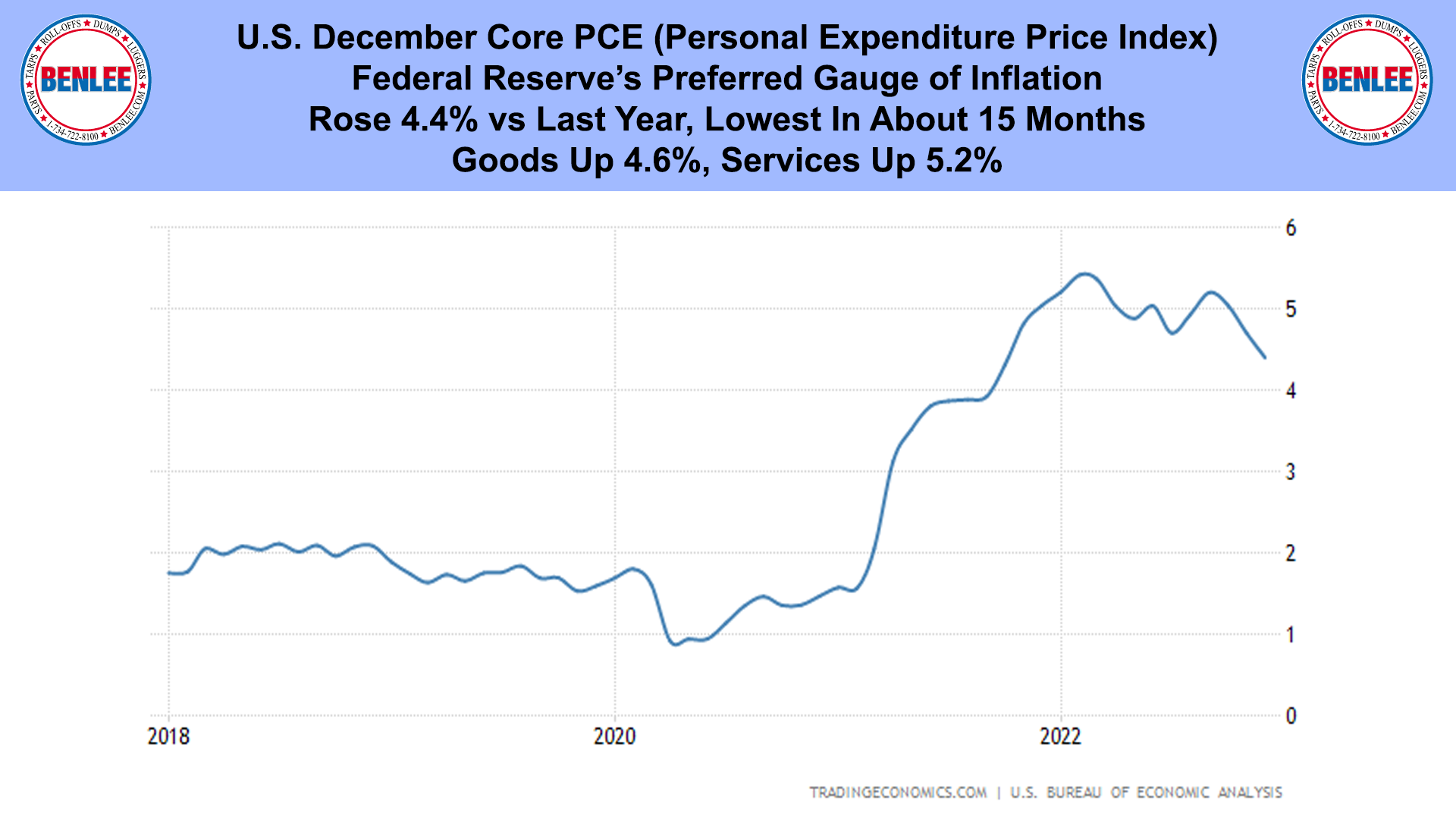

U.S. December Core PCE, Personal Consumer Expenditure Index. This is the Federal Reserve’s preferred gauge of inflation. It rose 4.4% vs last year, the lowest in about 15 months. Goods were up 4.6% and services were up 5.2%.

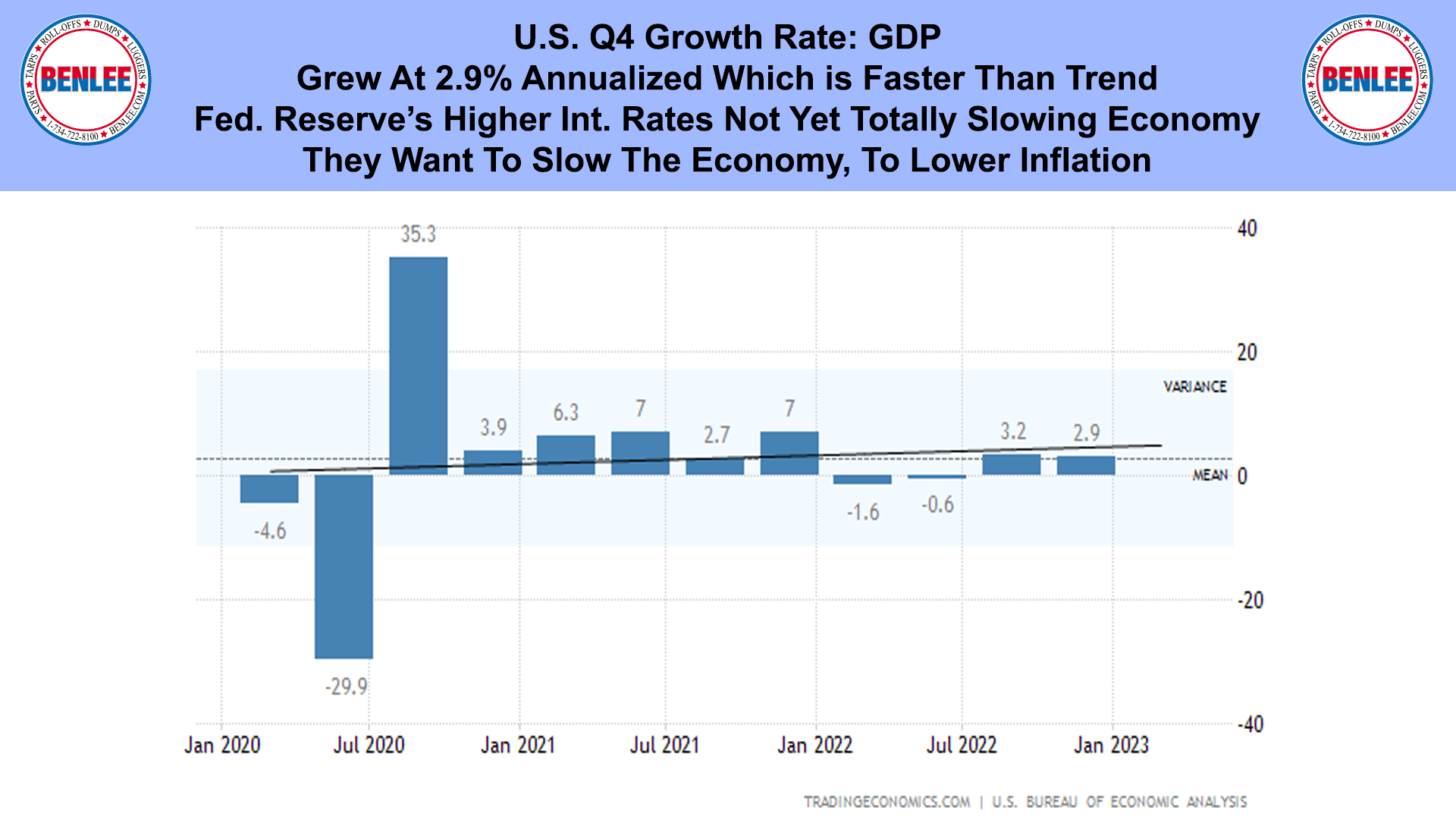

U.S. Q4 growth rate, GDP. The economy grew at 2.9% annualized, which is faster than trend. The Federal Reserve’s higher interest rates are not yet totally slowing the economy. They want to slow the economy to lower inflation.

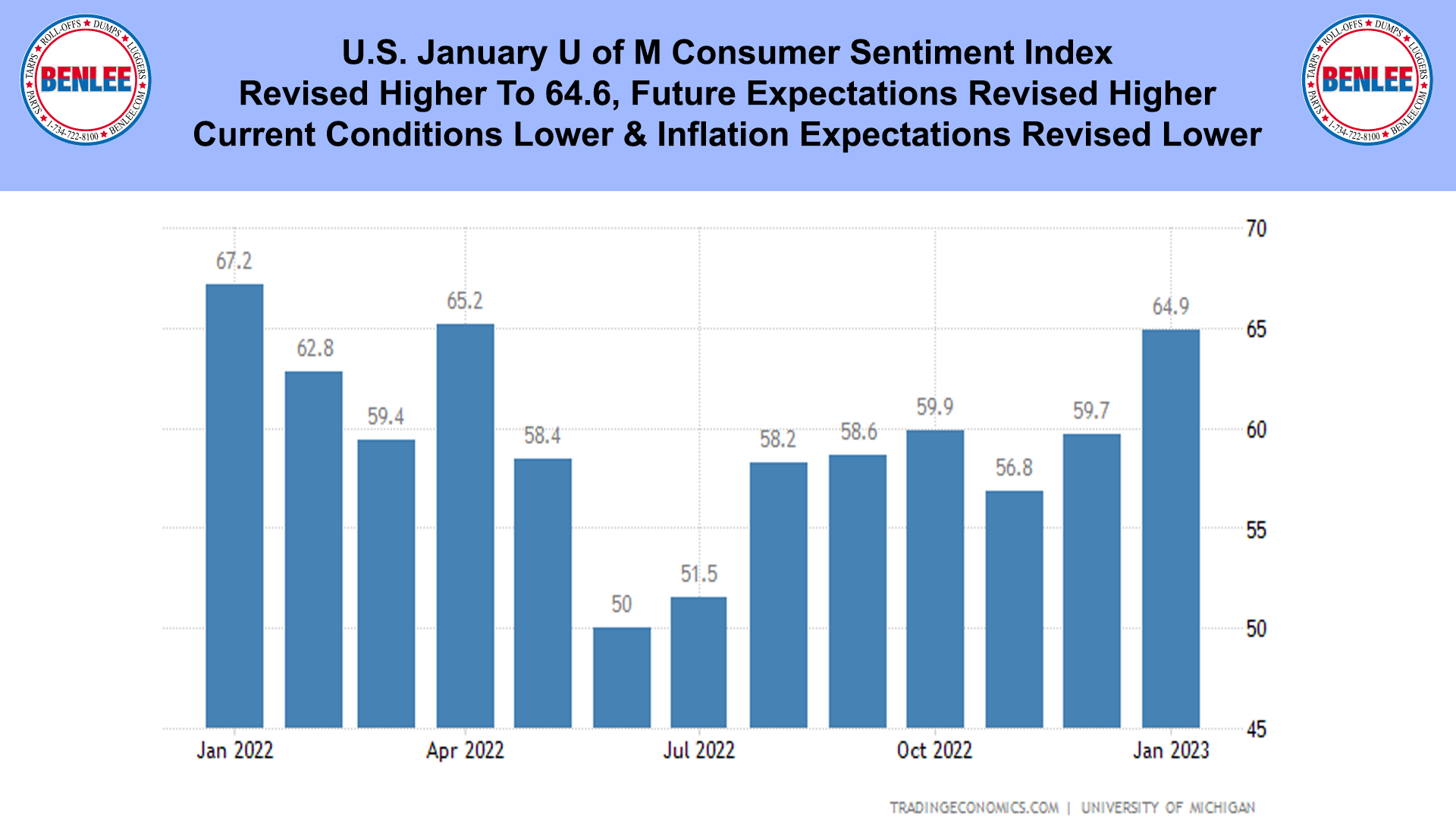

U.S. January, U of M consumer sentiment index was revised higher to 64.6. Future expectations were revised higher, while current conditions were revised lower as inflation expectations were also revised lower.

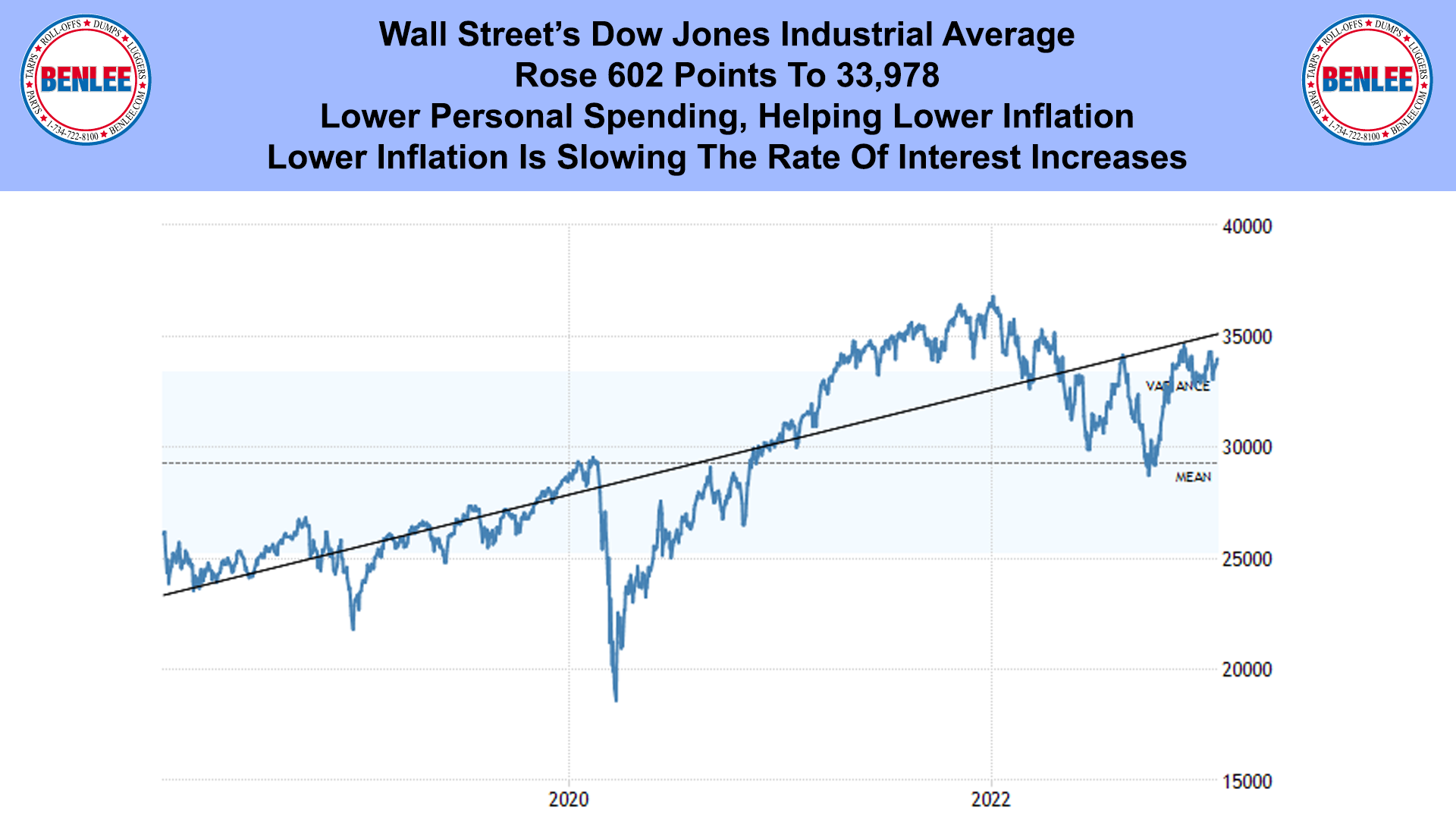

Wall Street’s Dow Jones Industrial Average rose 602 points to 33,978. Lower personal spending is helping lower inflation. Lower inflation is slowing the rate of interest rate increases.