This is the Global Economic, Commodities, Scrap Metal and Recycling Report, by our BENLEE Roll off Trailers and Lugger Trucks, December 6th, 2021.

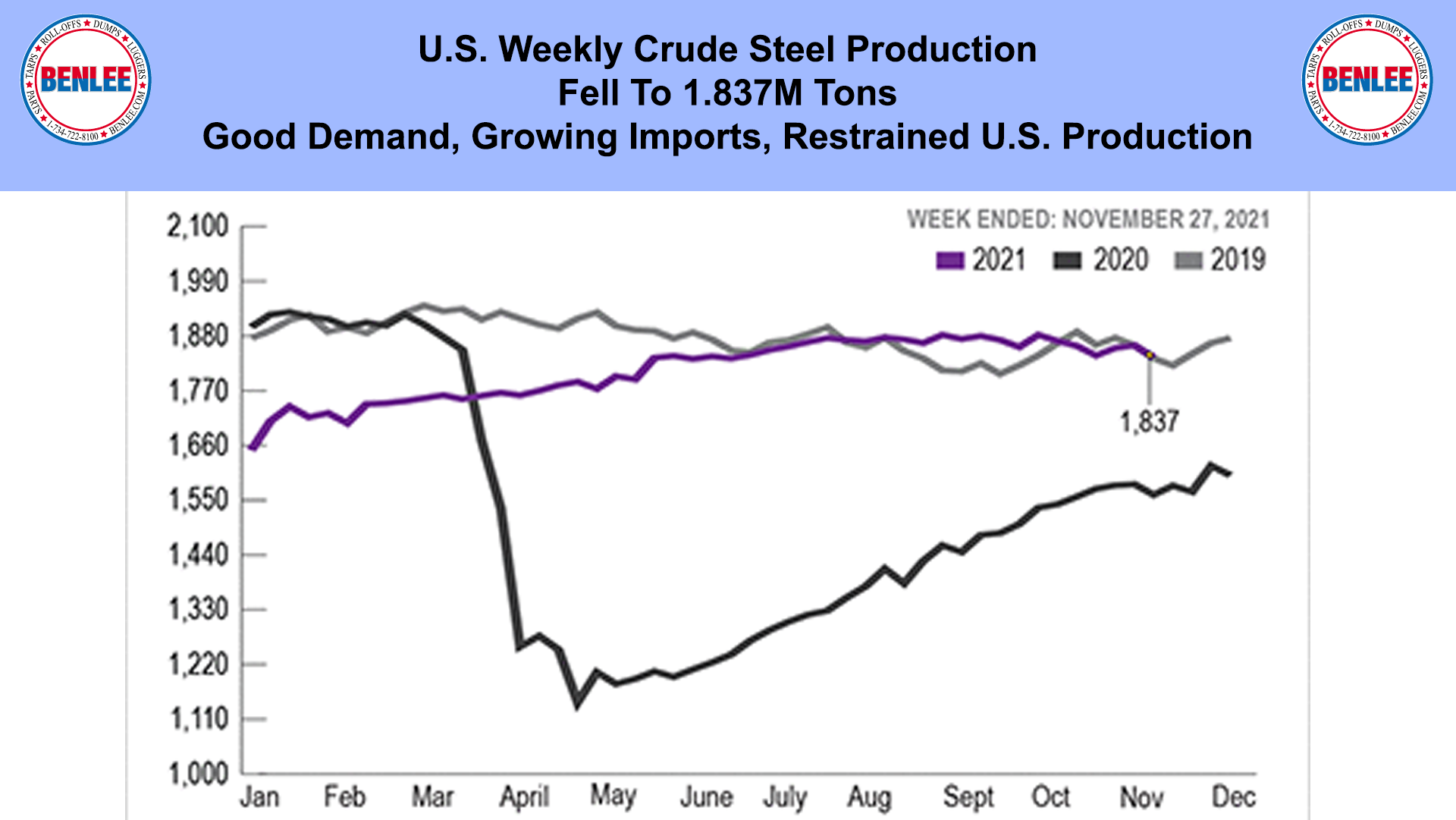

U.S. Weekly crude steel production fell to 1.837M tons. This was on good demand, growing imports and restrained production.

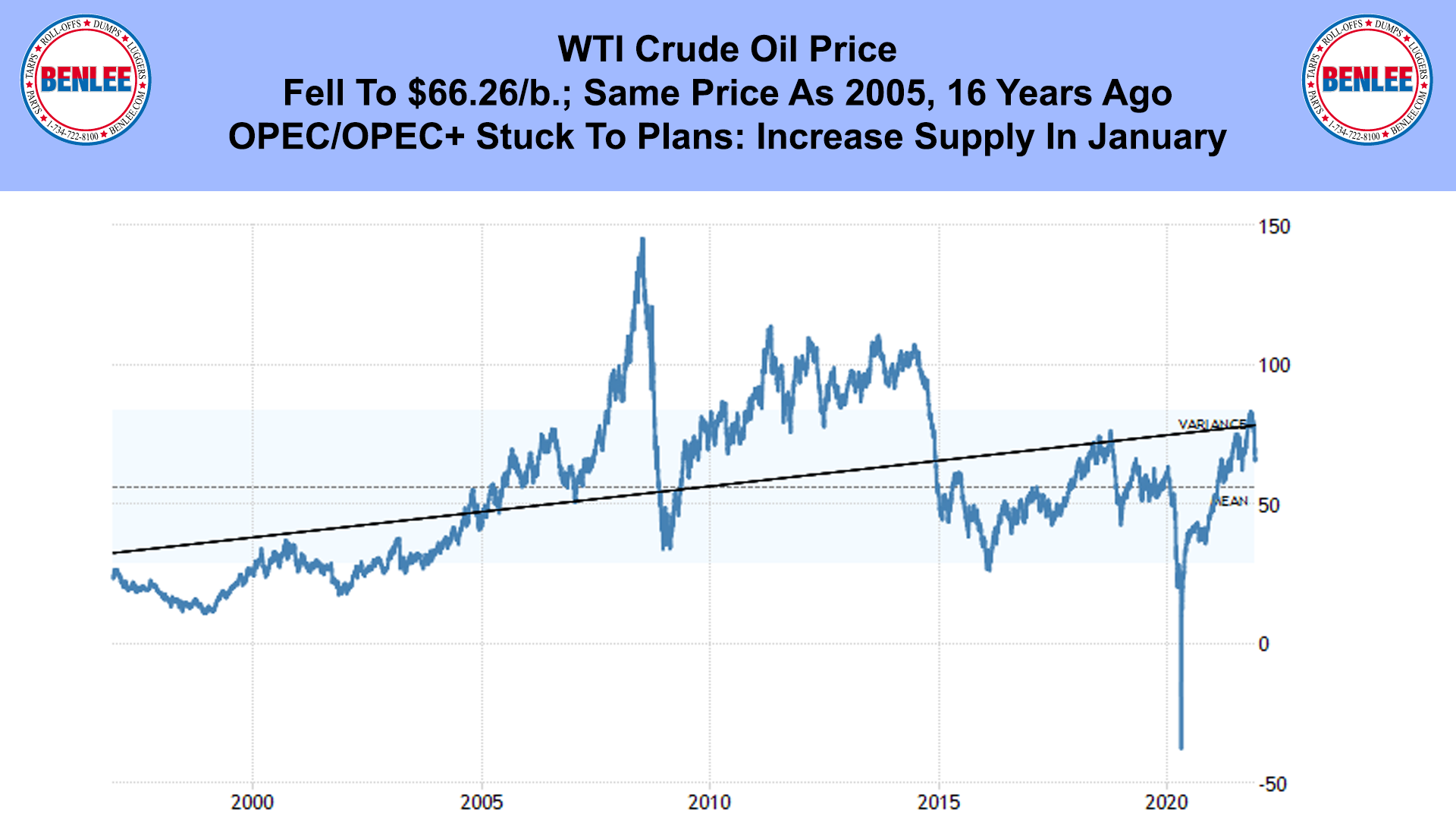

WTI Crude oil price fell to $66.26/b., the same price level as 2005, 16 years ago. This was as OPEC and OPEC+ stuck to plans to increase supply in January.

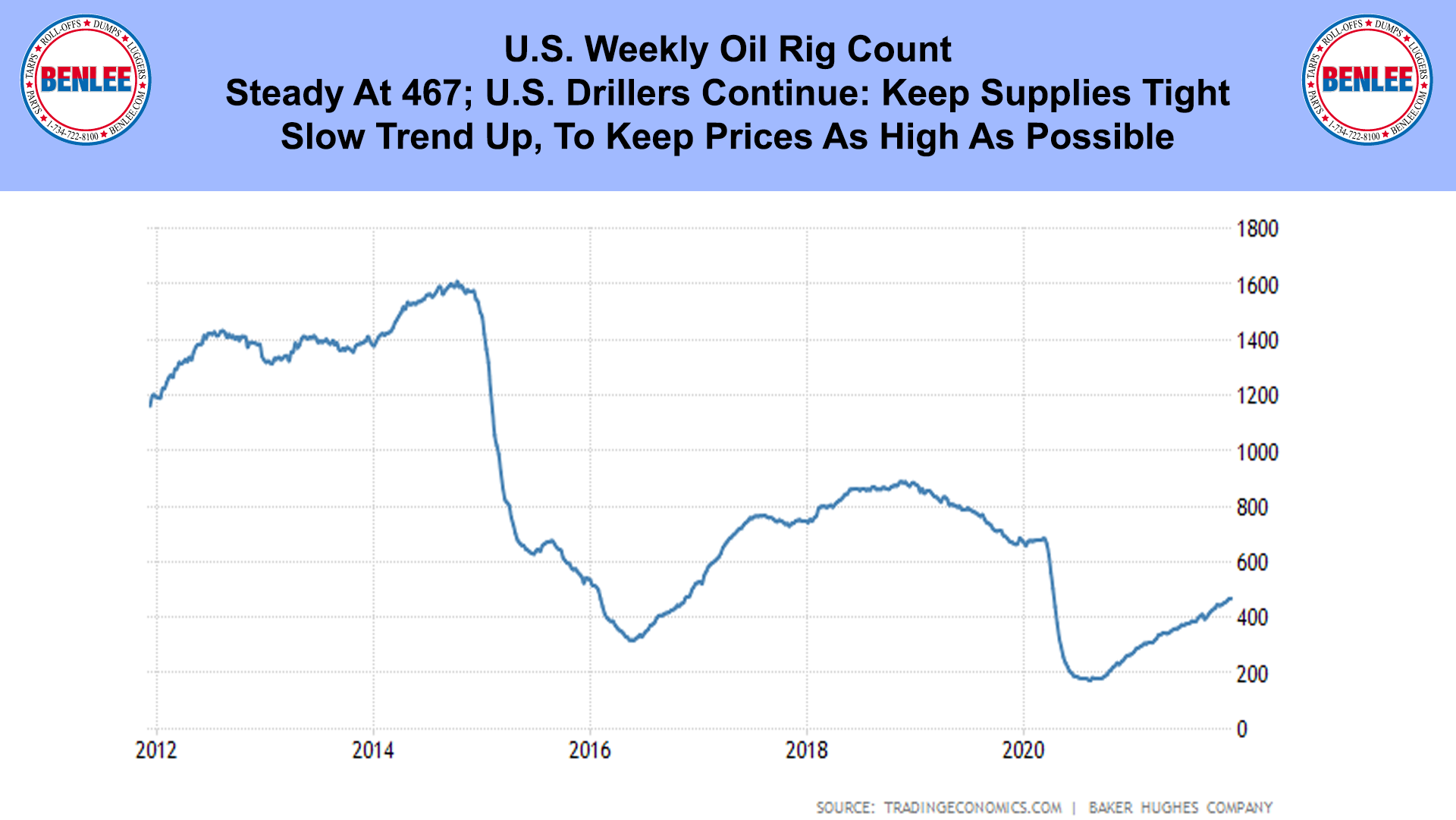

The U.S. Weekly Oil rig count was steady at 467 as U.S. drillers kept supplies tight. The slow trend up is to keep prices as high as possible.

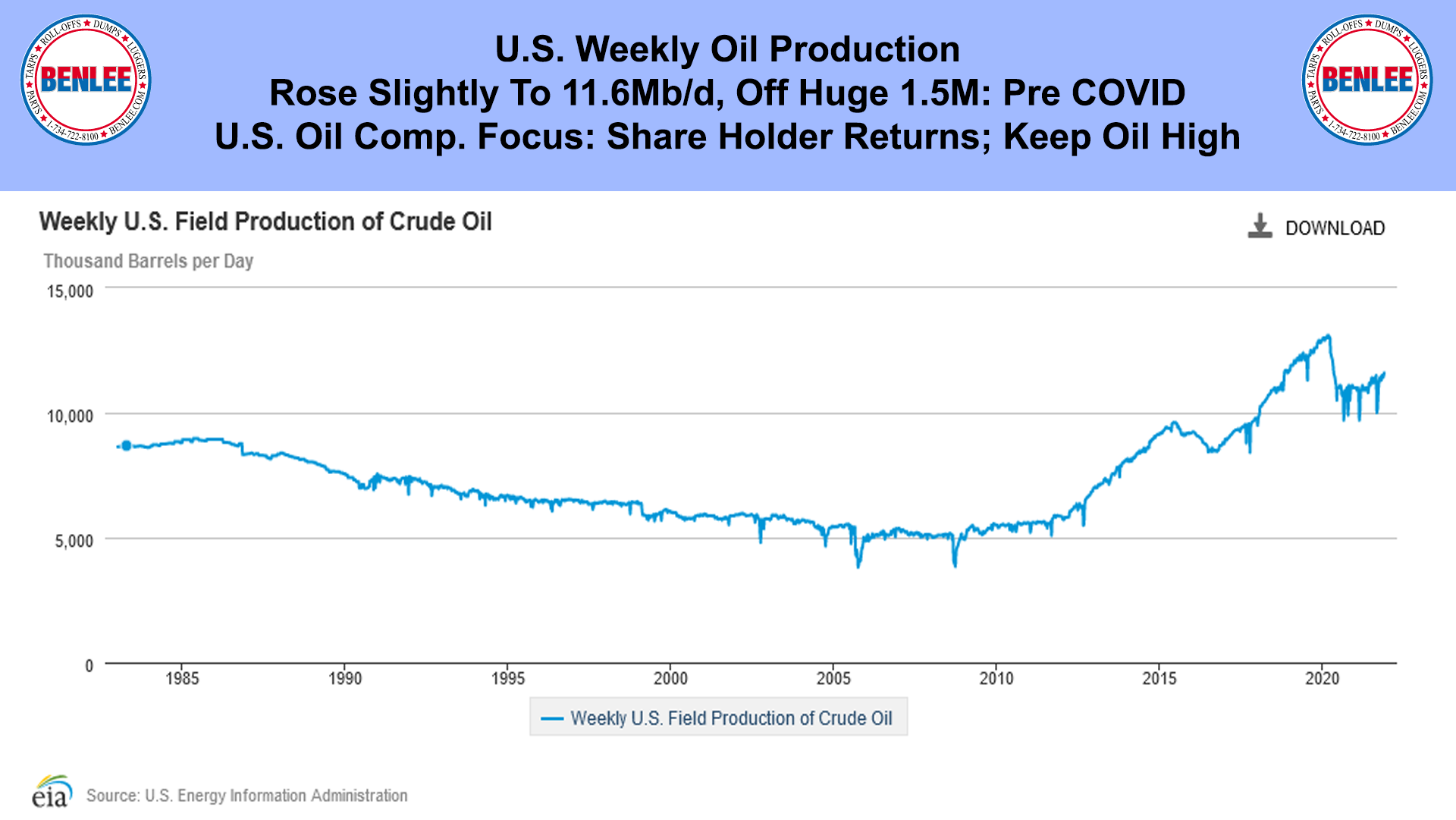

U.S. weekly oil production, rose slightly to 11.6Mb/d, off a huge 1.5Mb/d, pre COVID. U.S. companies are focused on shareholder returns, so they are keeping production low, and prices high.

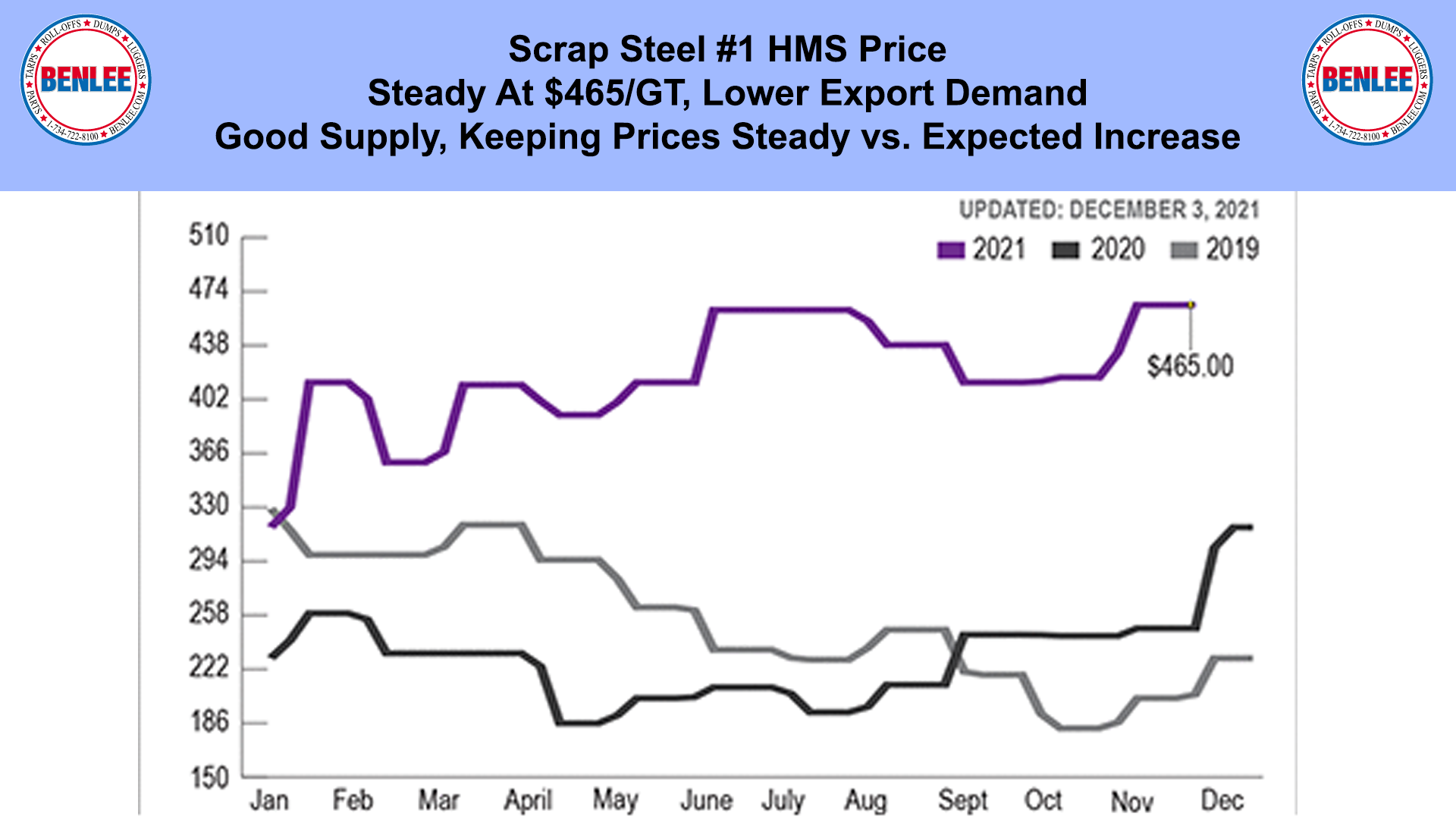

Scrap steel #1 HMS price was steady at $465/GT on lower export demand. Good supply is keeping prices steady vs. the expected increase.

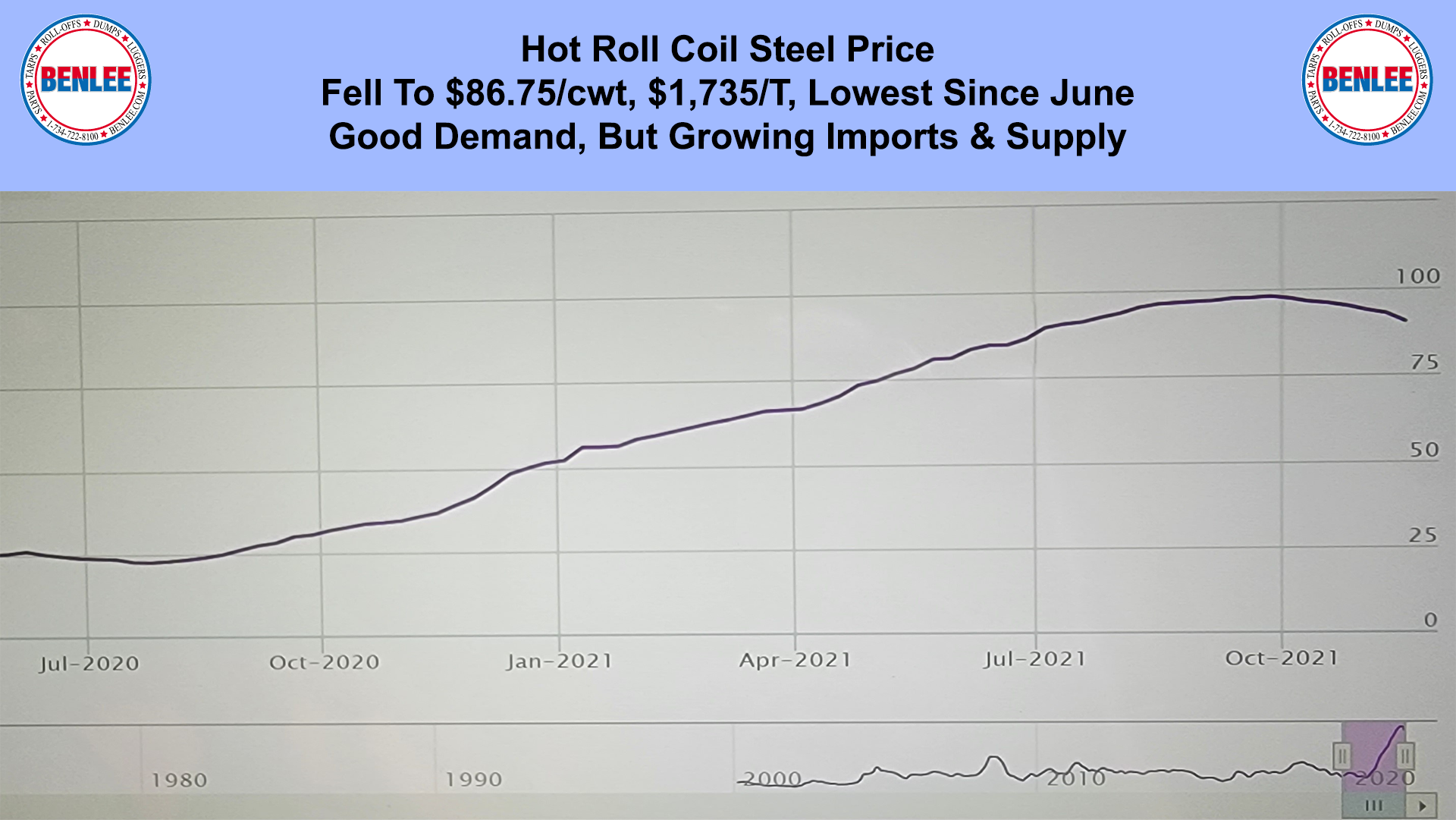

Hot Roll Coil Steel Price fell to $86.75/cwt, $1,735/T. This was the lowest price since June on good demand, with growing imports and supply.

Copper price fell to $4.27/lb., the lowest in 8 weeks. This was driven by weak Chinese demand, but a high 2024 electric vehicle forecast.

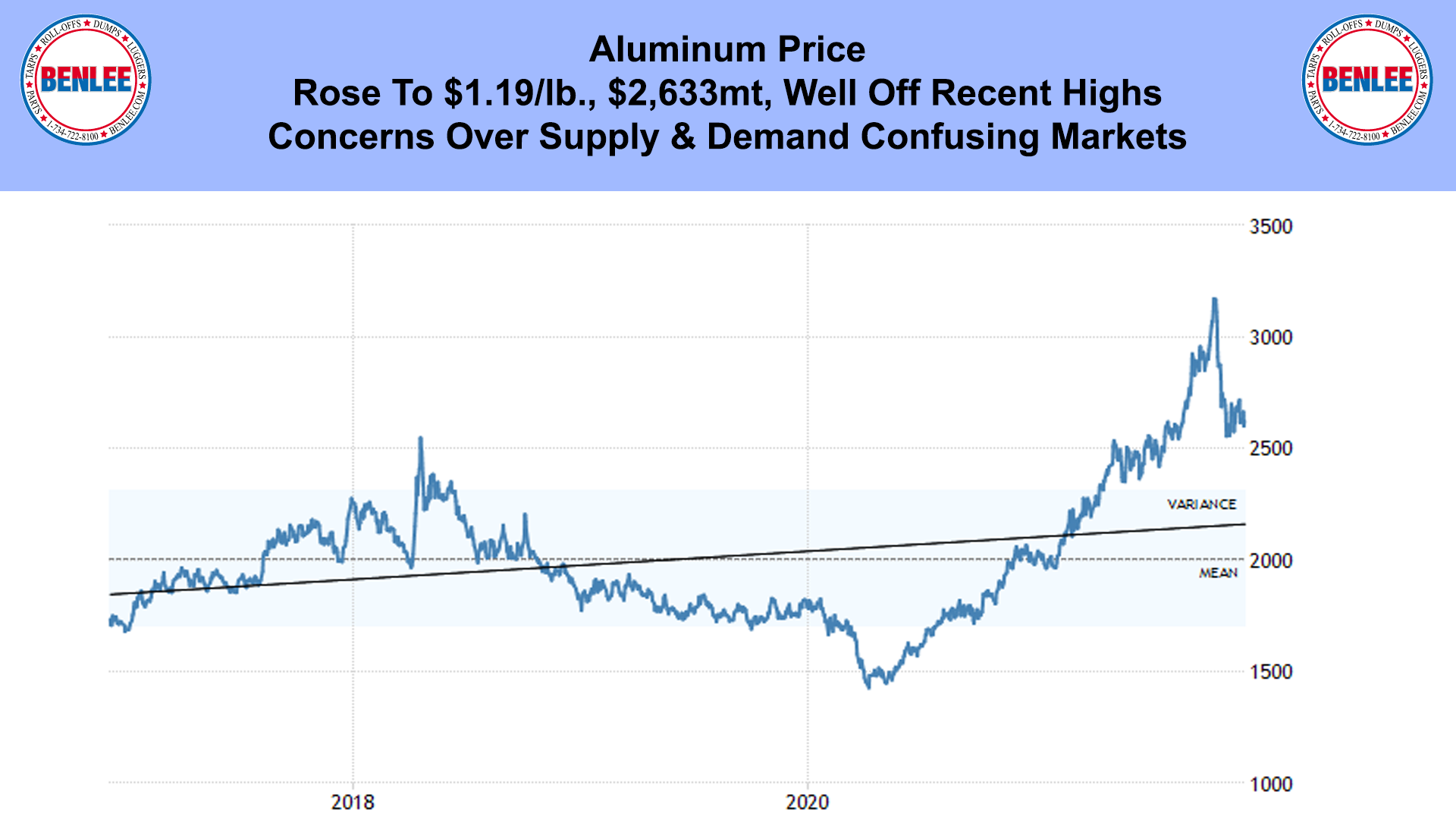

Aluminum price rose to $1.19/lb., $2,633/mt well off recent highs. Concerns over supply and demand are confusing markets.

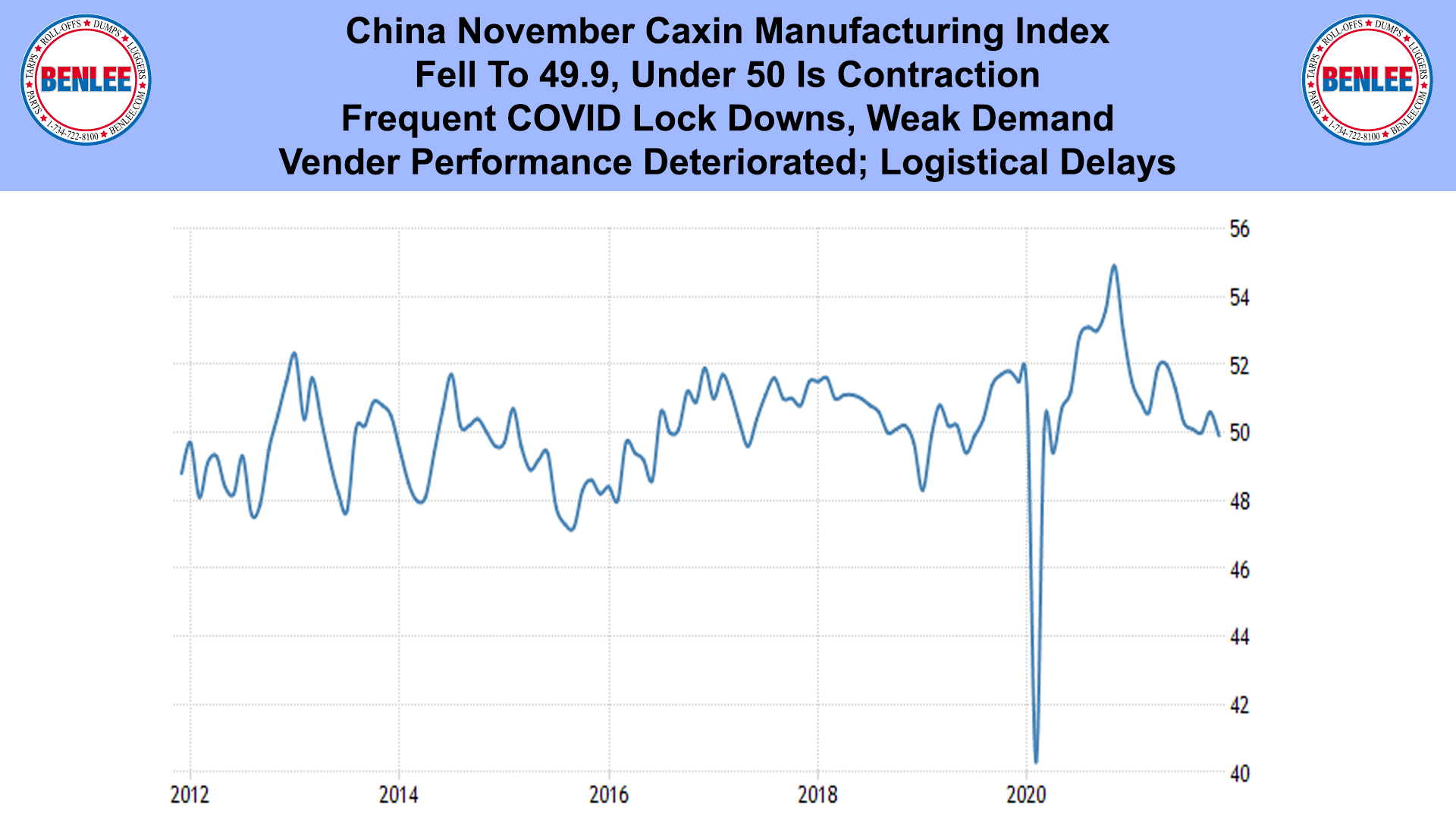

China November Caixin manufacturing index, fell to 49.9 with under fifty being contraction. This was on frequent COVID lockdowns and weak demand. Also, vender performance deteriorated and there remain logistical delays.

U.S. November new jobs report, added 210,000 jobs. This was low due to it being difficult to hire workers. Professional services gained the most, as retail fell.

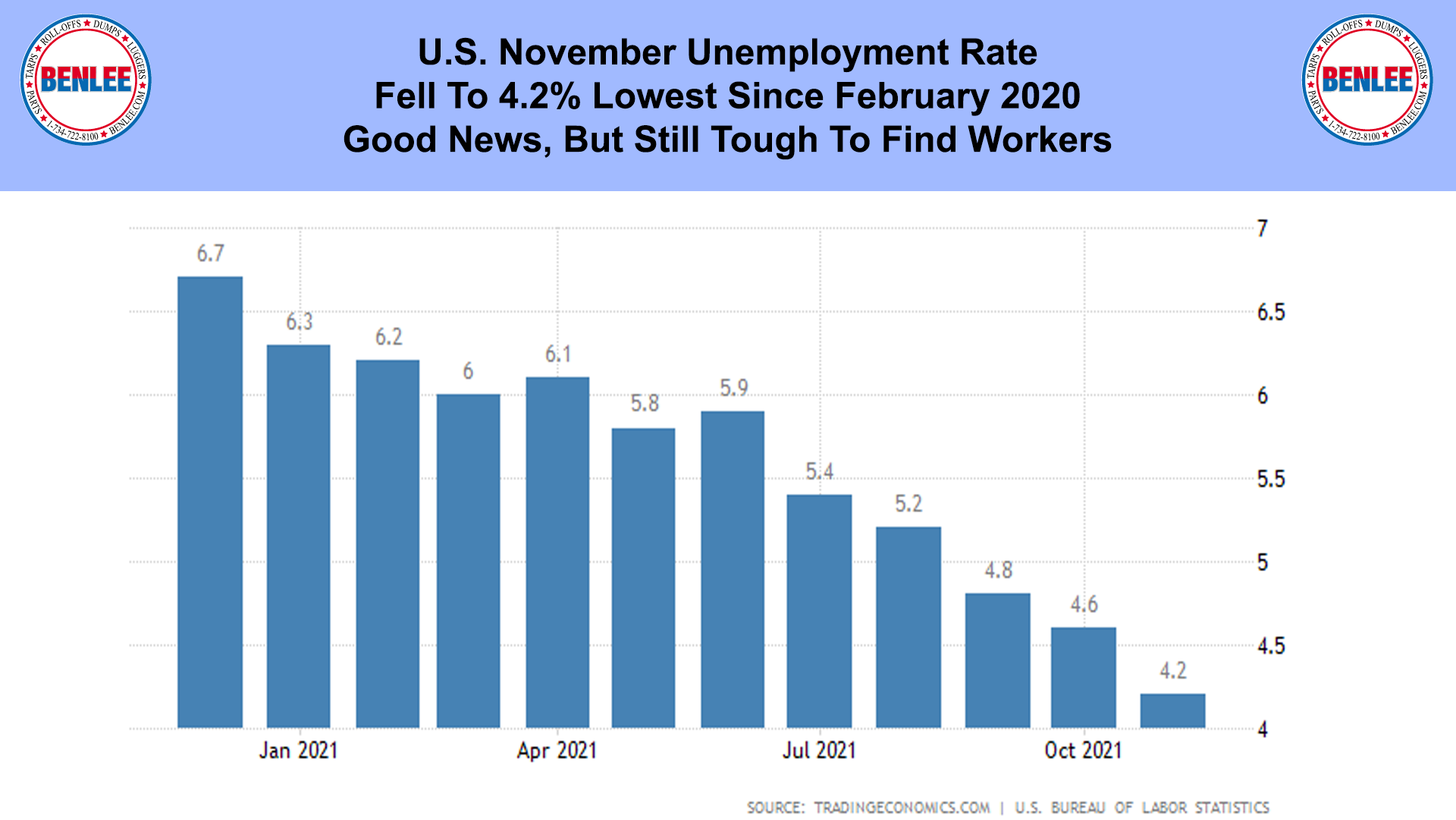

U.S. November unemployment rate fell to 4.2%, the lowest since February 2020. This was good news, but it is still tough to find workers.

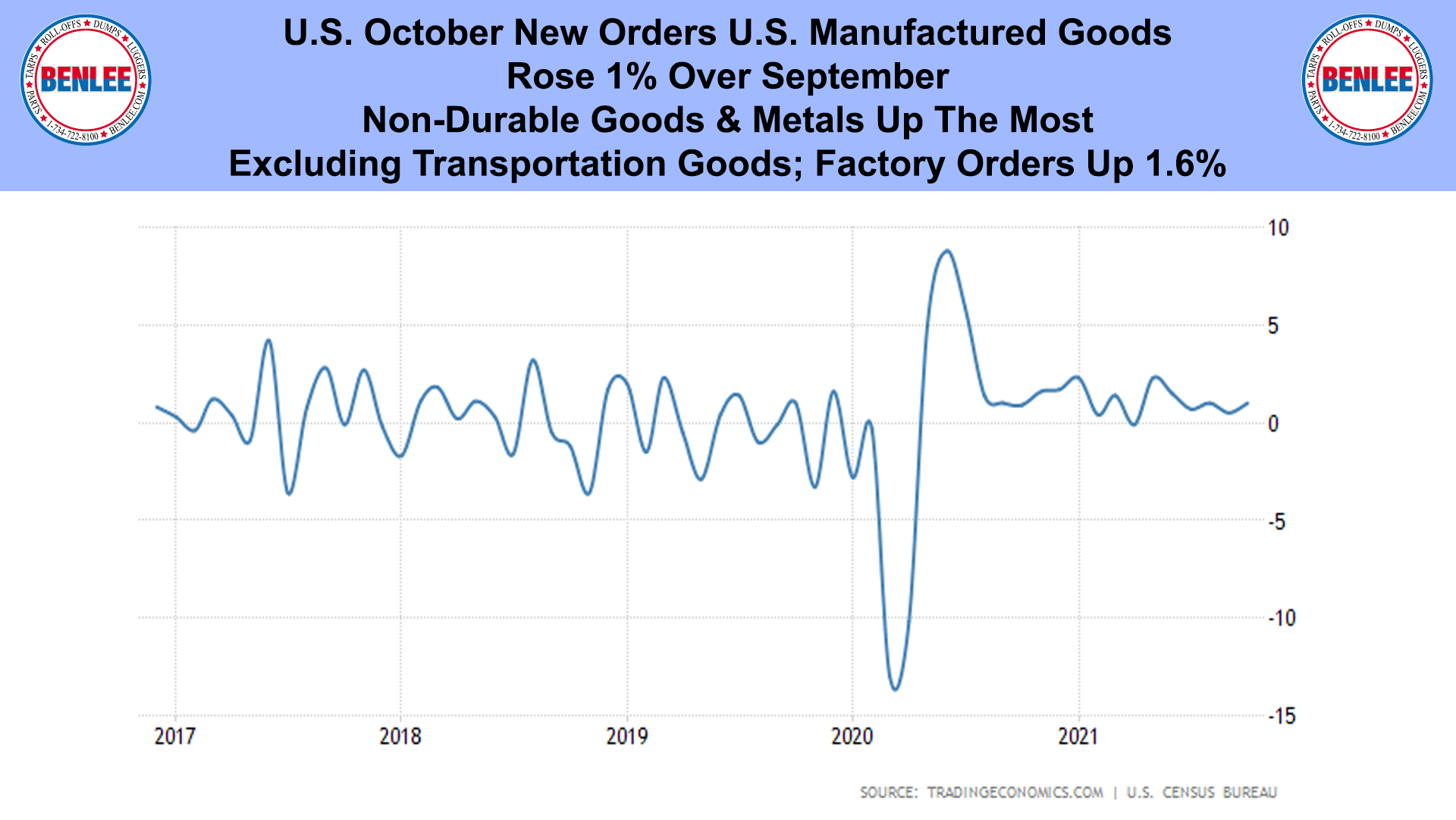

U.S. October New orders for U.S. manufactured goods, rose 1% over September. Non-durable goods and metals were up the most. Excluding transportation goods, factory orders were up 1.6%.

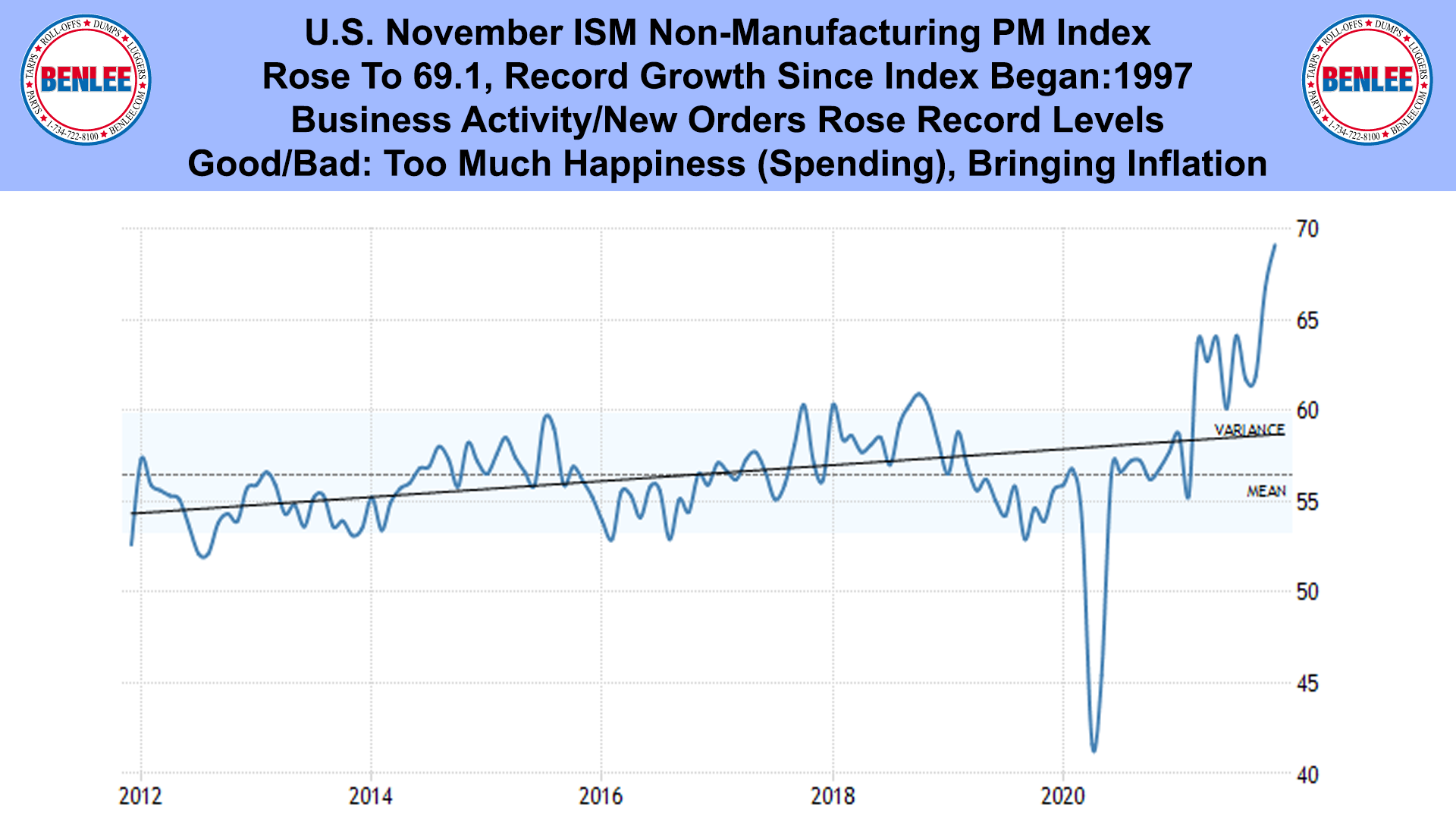

U.S. November ISM non-manufacturing purchasing manager’s index. It rose to 69.1, a record growth since the index began in 1997. Business activity and new orders rose to record levels. Crazy, but this is good news and bad news. Too much happiness (people spending at record levels), is creating shortages and therefore bringing inflation.

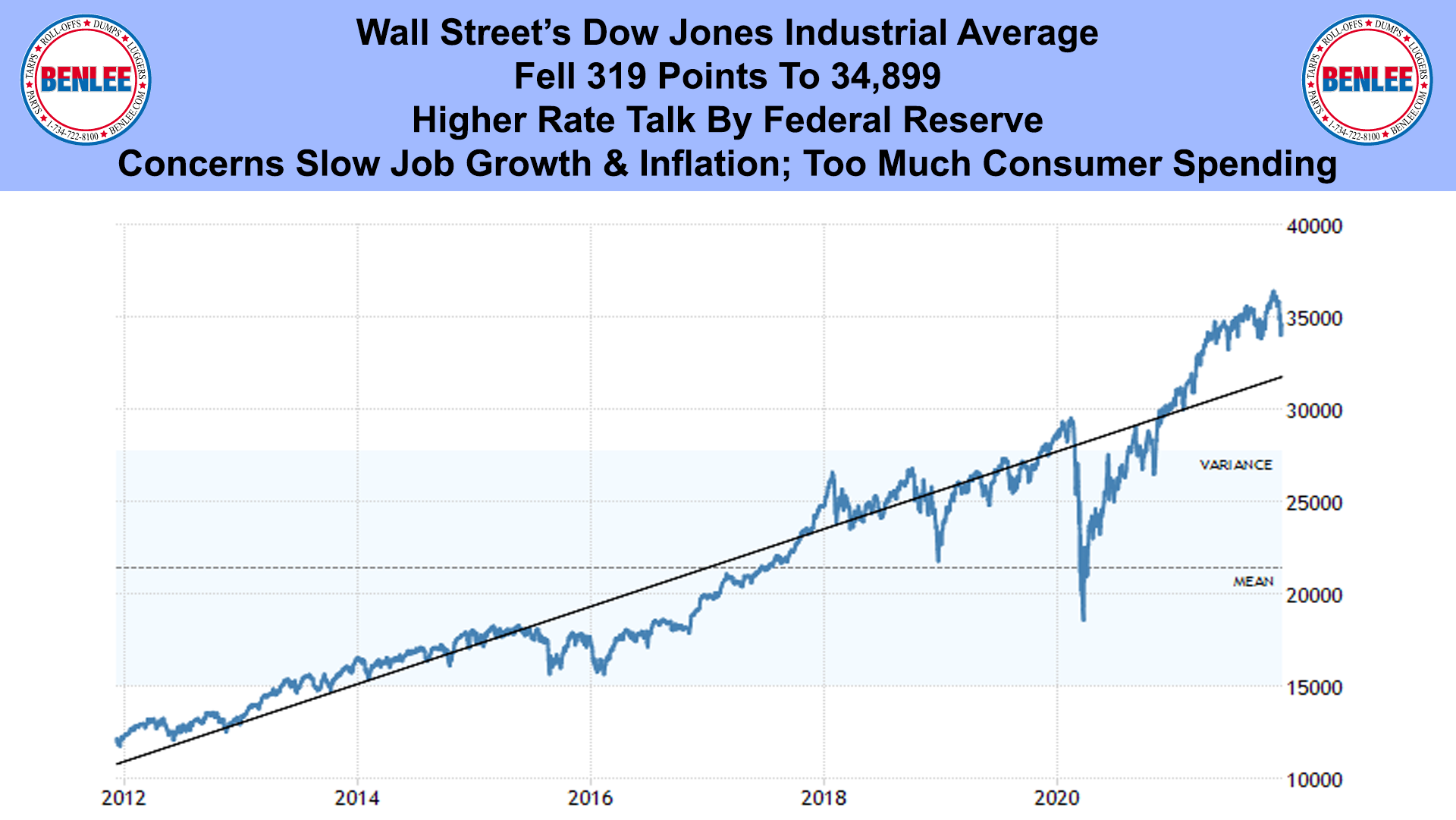

Wall Street’s Dow Jones Industrial Average fell 319 points to 34,899 on higher interest rate talk by the Federal Reserve. There were also concerns over slow job growth and inflation driven by too much consumer spending.