This is the Global Economic, Commodities, Scrap Metal and Recycling Report, by our BENLEE Roll off Trailer and Lugger Truck, June 14th, 2021.

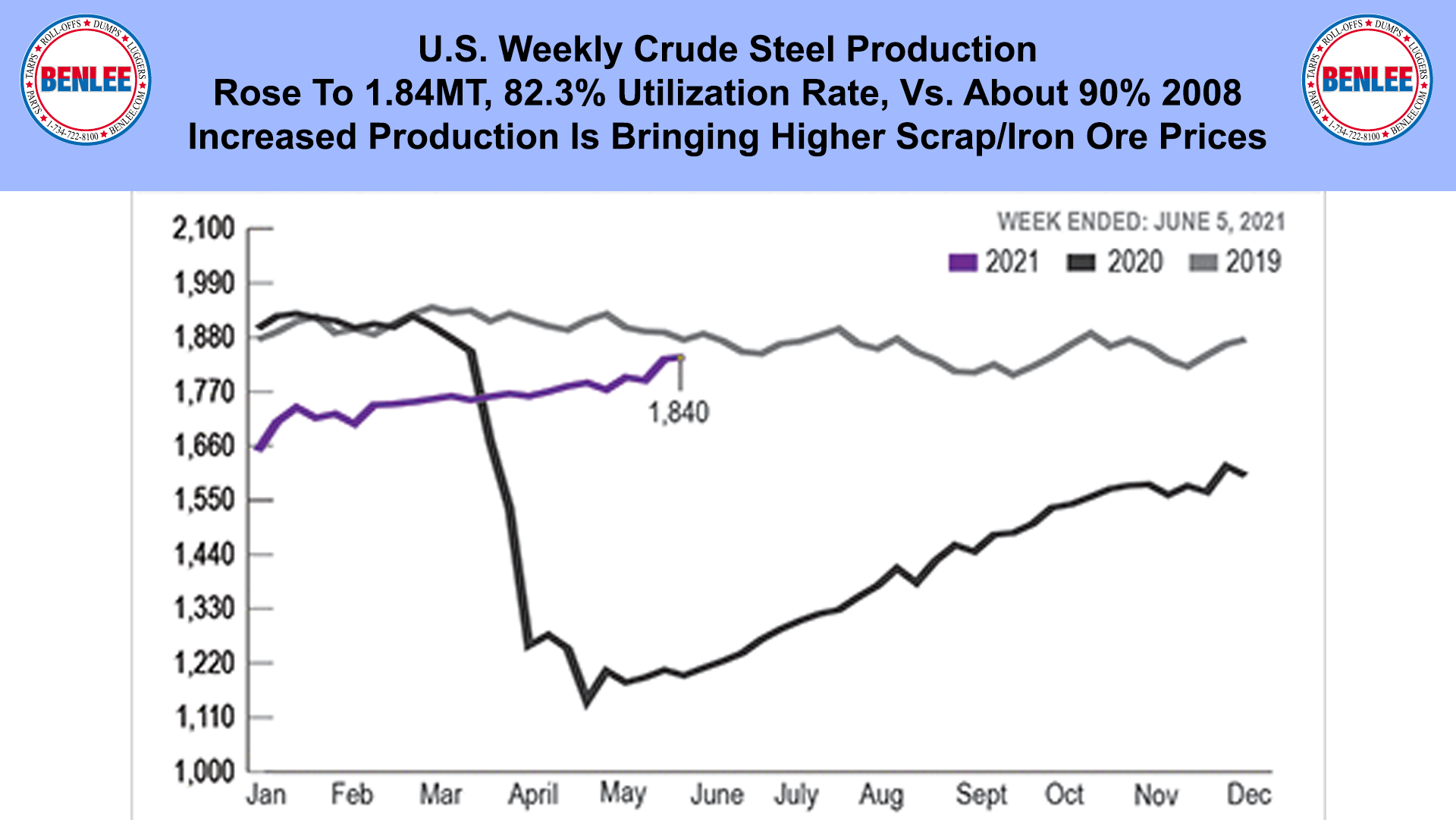

U.S. Weekly crude steel production rose to 1.84MT, an 82.3% utilization rate, vs. about 90% in 2008. Increased production is bringing higher scrap and iron ore prices.

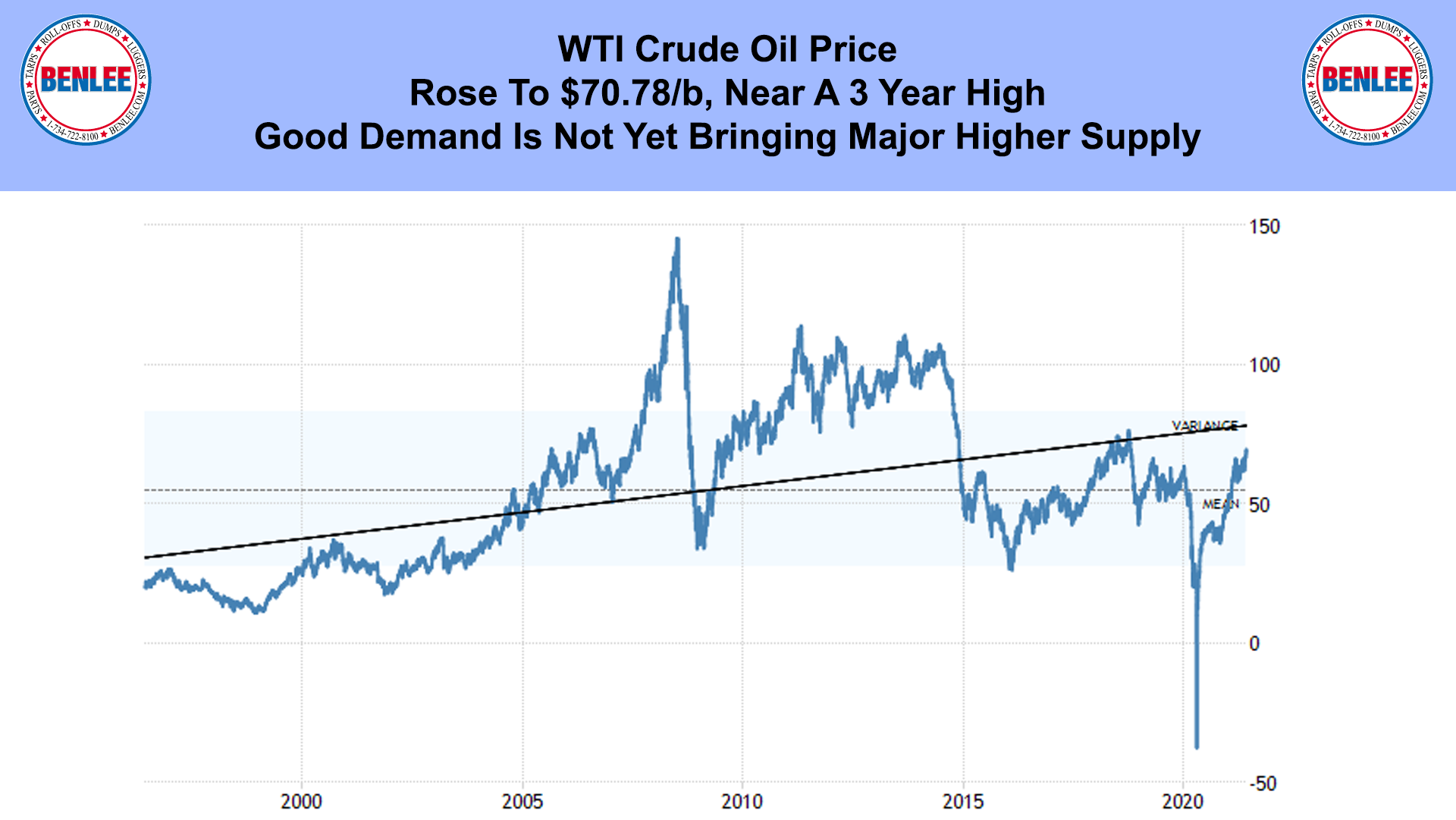

WTI Crude oil price rose to 70.78/b, near a 3 year high. Good demand is not yet bringing major higher supply.

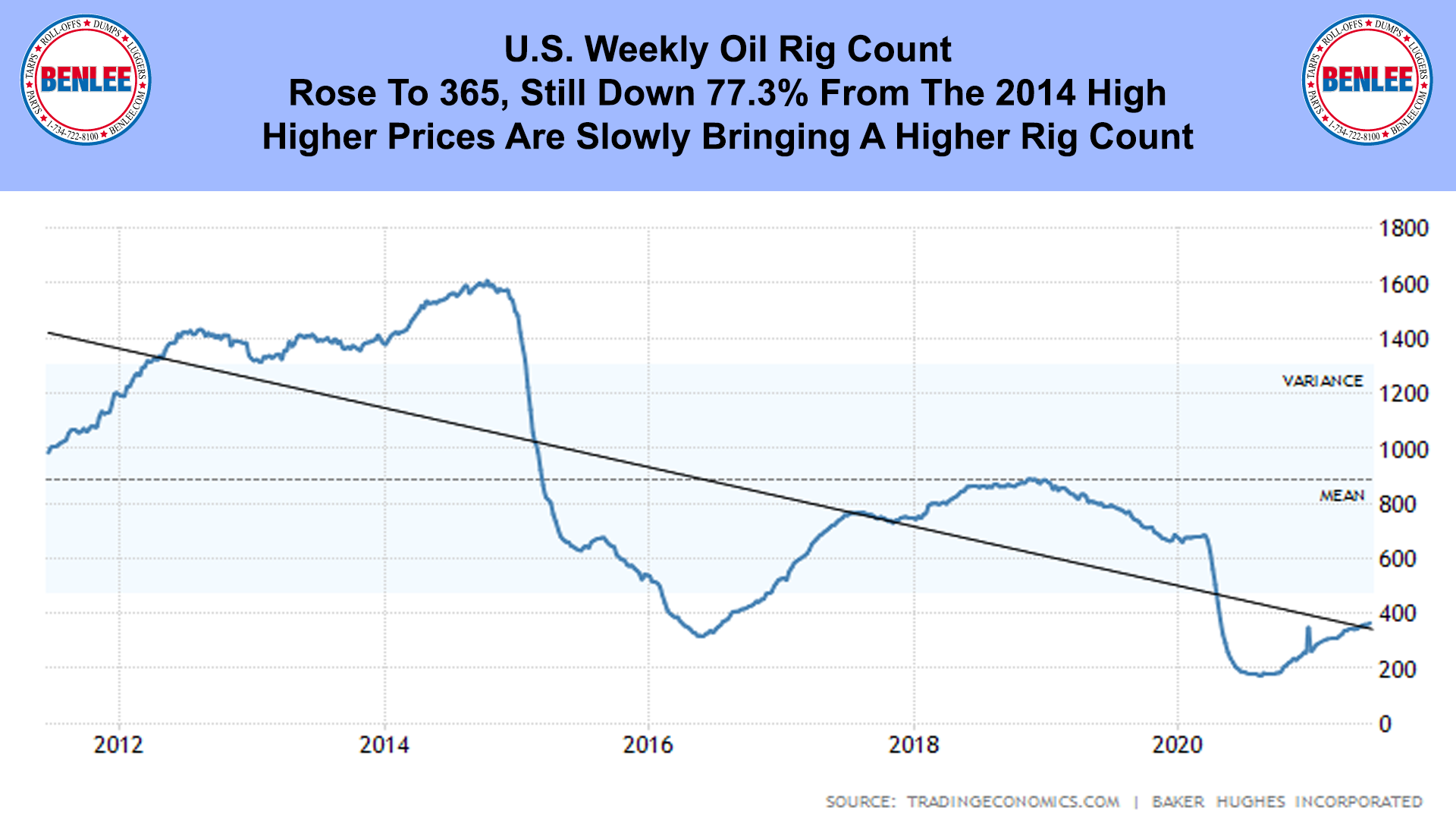

The U.S. Weekly Oil rig count rose to 365, still down 77.3% from 2014’s high. Higher prices are slowly bringing a higher rig count.

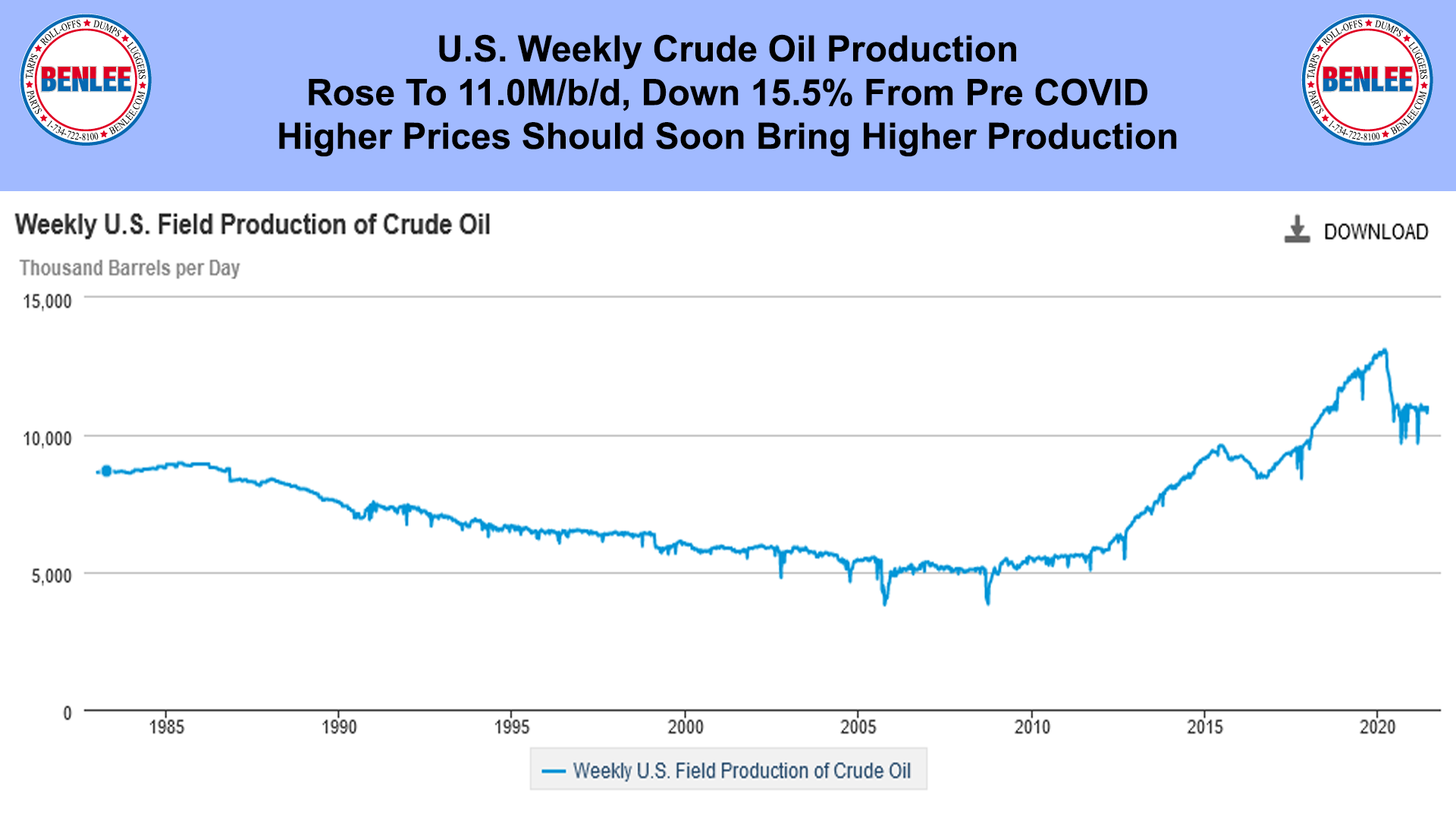

U.S. weekly crude oil production rose to 11.0M/b/d, down 15.5% from pre COVID. Higher prices should bring higher production soon.

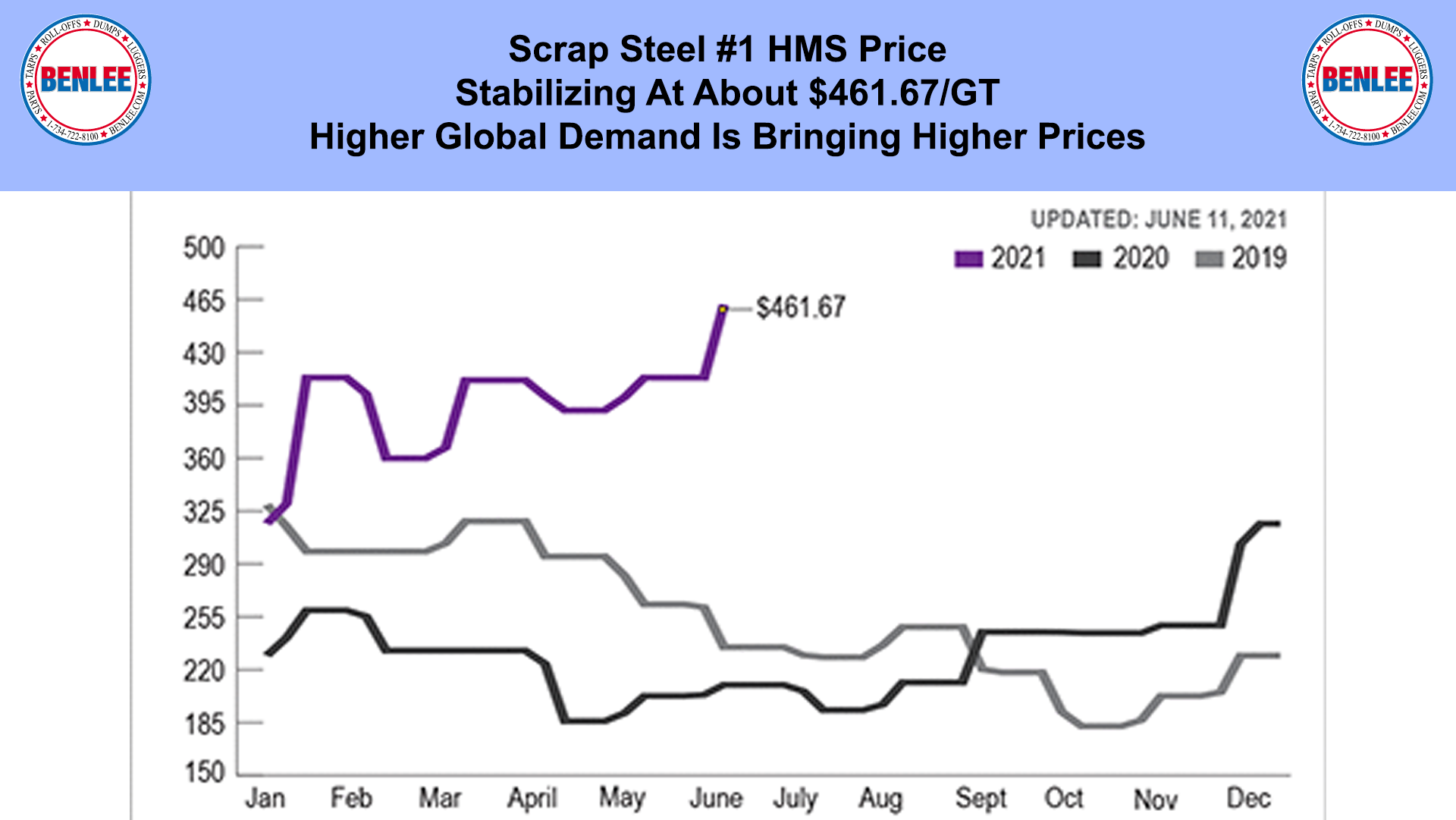

Scrap steel #1 HMS price is stabilizing at about $461.67/GT, as higher global demand is bringing higher prices.

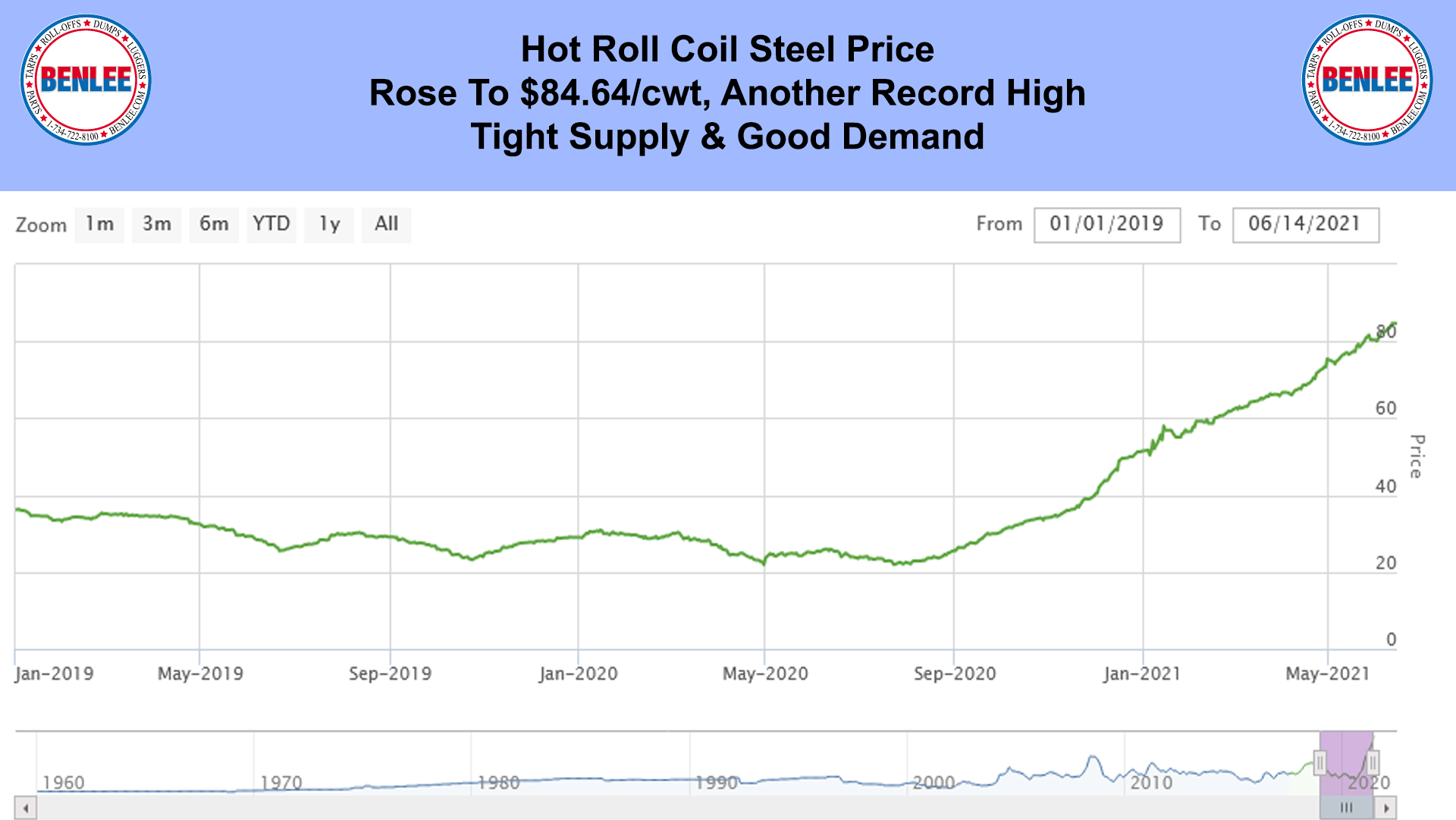

Hot roll coil steel price rose to $84.64/cwt, another record high on tight supply and good demand.

Copper price rose to $4.55/lb. on good demand, but low inventories. Demand increase includes the U.S. pubic, buying more bullets for guns.

Aluminum price rose to $1.12/lb., which is $2,475/mt, near a 3 year high on good demand and tightening supplies.

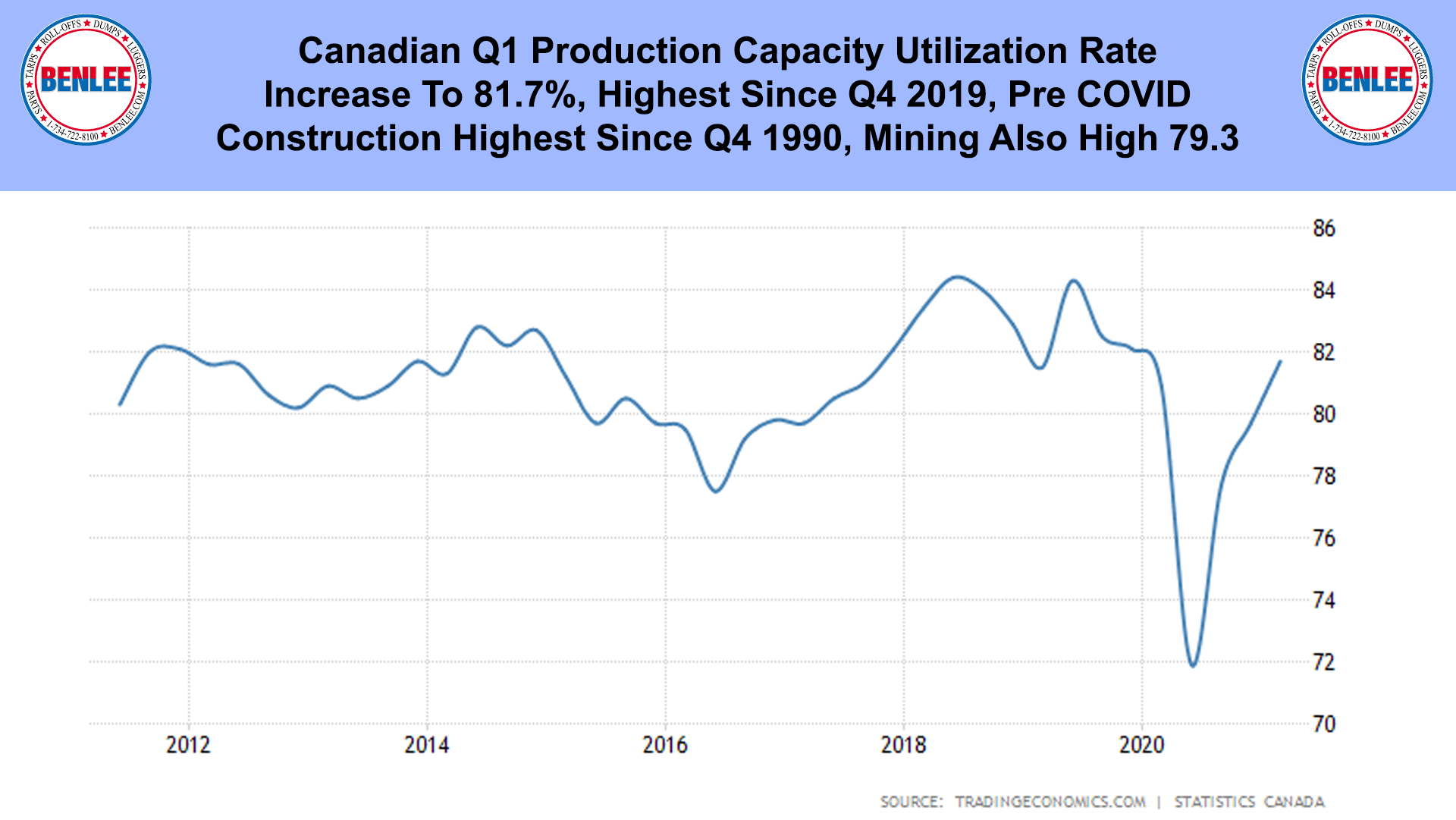

Canadian Q1 production capacity utilization rate increased to 81.7%, the highest since Q4 2019, pre COVID. Construction was the highest since Q4 1990, Mining was also high at 79.3.

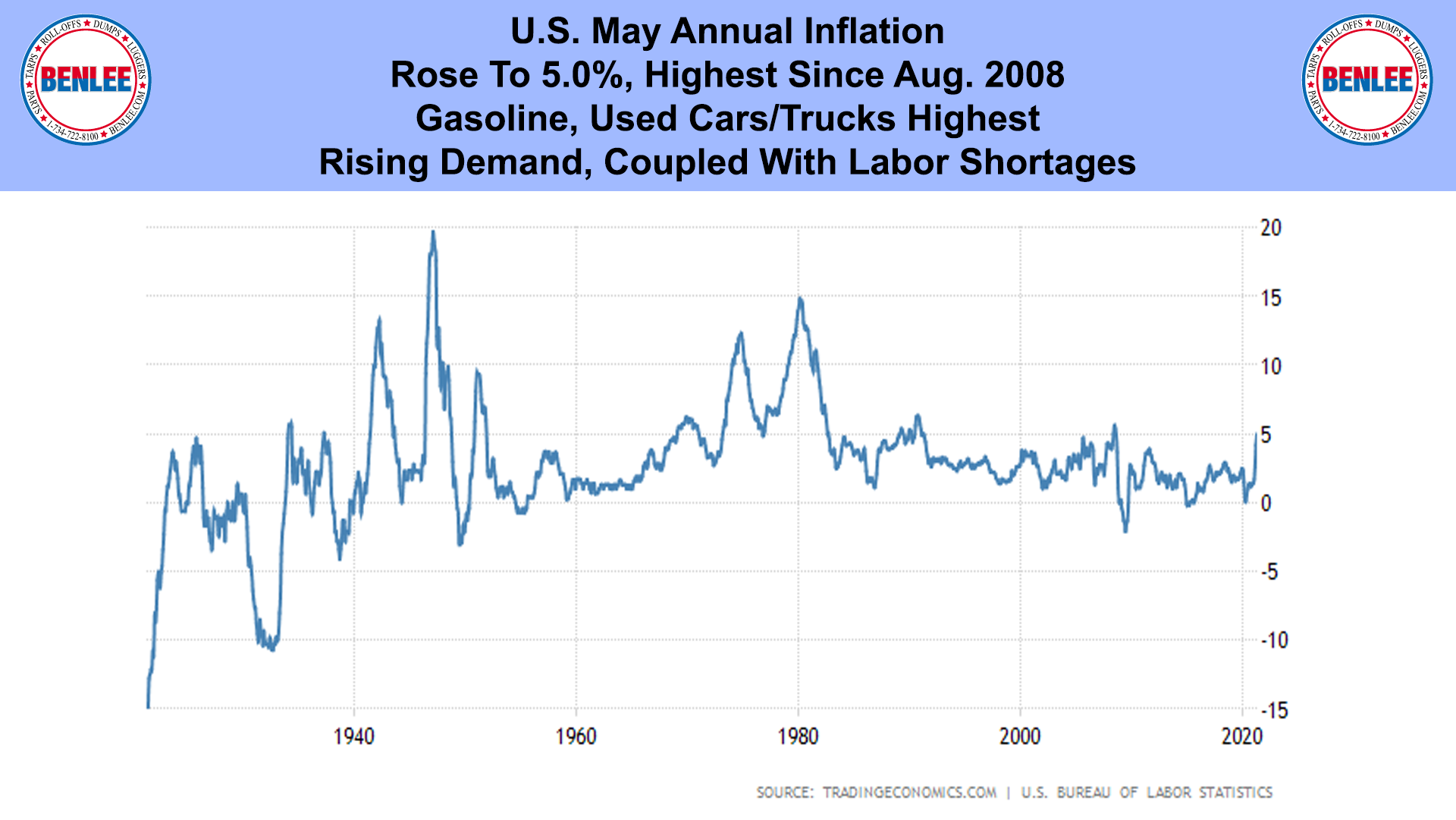

U.S. May annual inflation rose to 5.0%, the highest since August 2008. Gasoline and used cars and trucks were the highest. This was caused by rising annual demand, coupled with labor shortages.

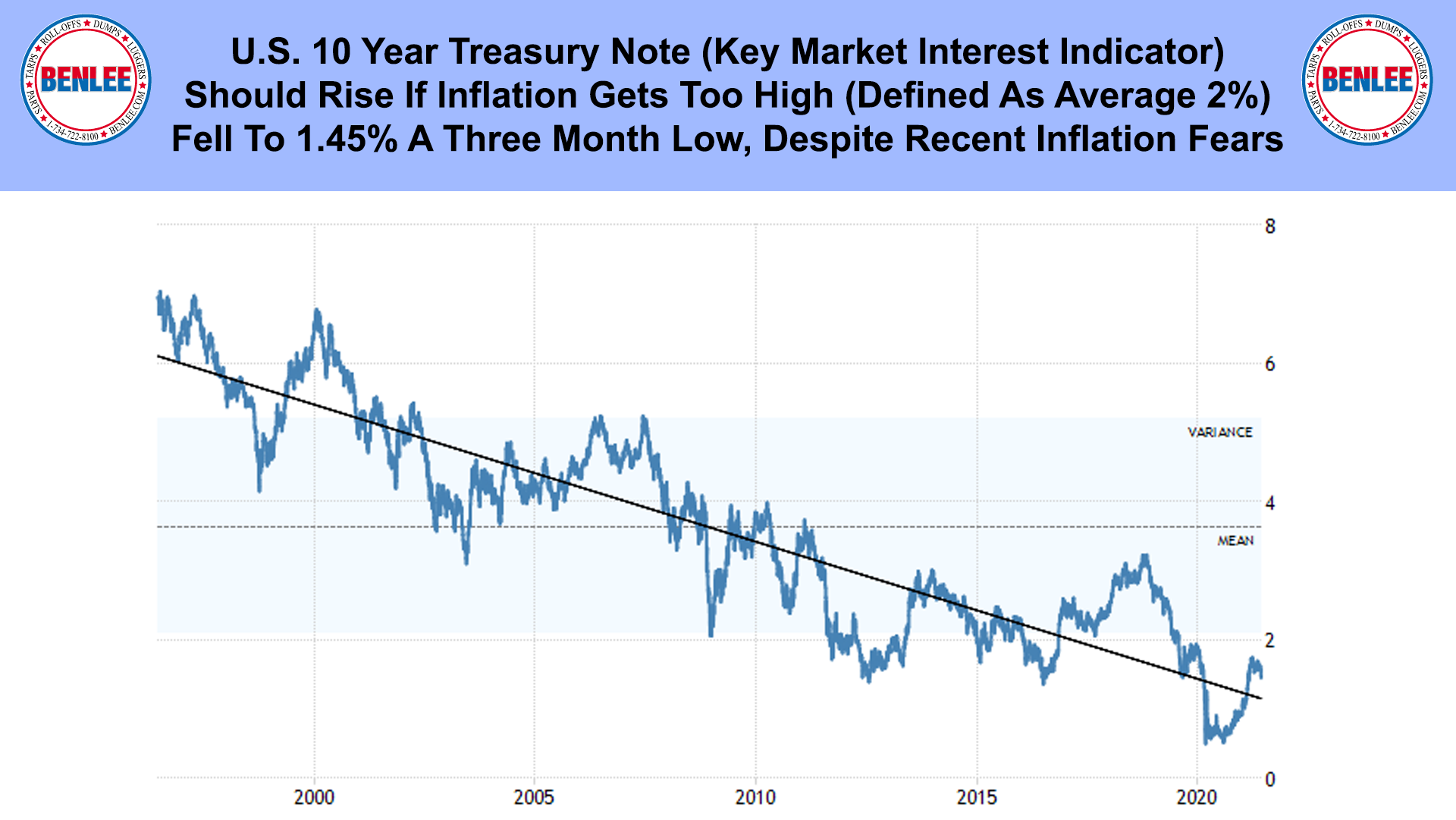

U.S. 10-year treasury note is a key market interest indicator, that should rise if inflation gets too high, which is defined as Average 2%. It fell to 1.45% a three-month low despite recent inflation fears.

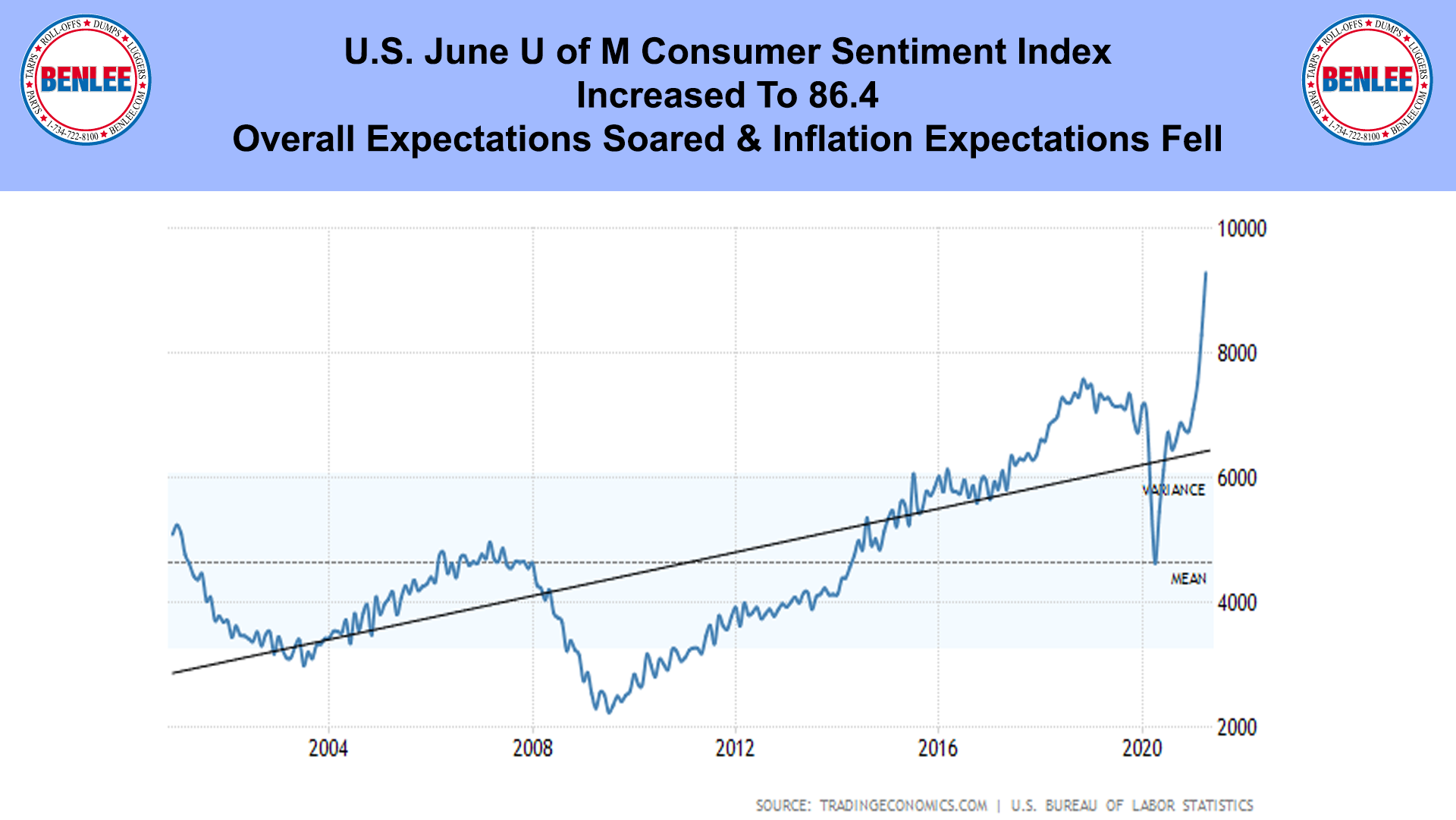

U.S. June U of M Consumer sentiment index increased to 86.4 as overall expectations soared and inflation expectations fell.

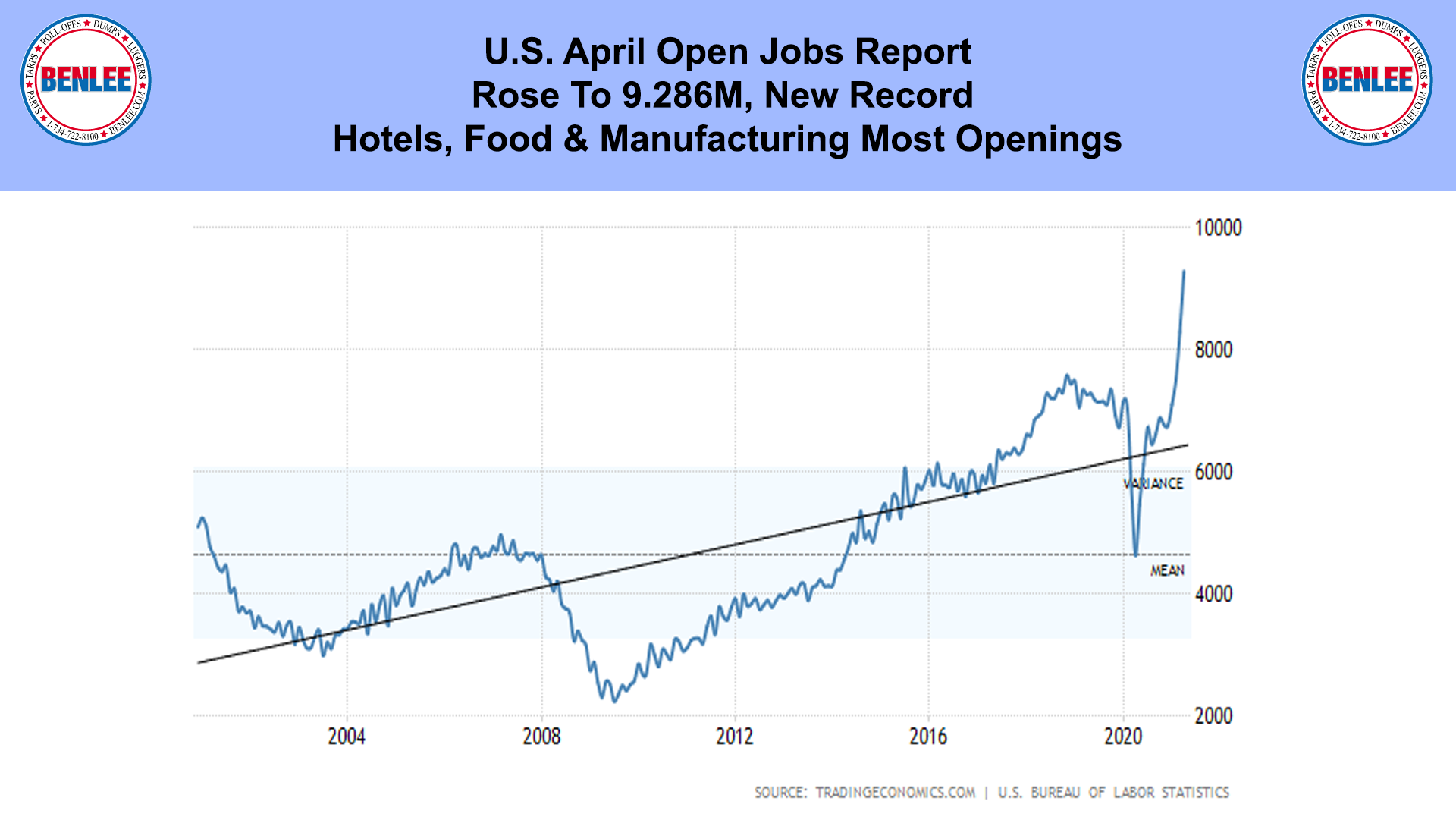

U.S. April Open jobs report rose to 9.286M a new record as hotels, food and manufacturing had the most openings.

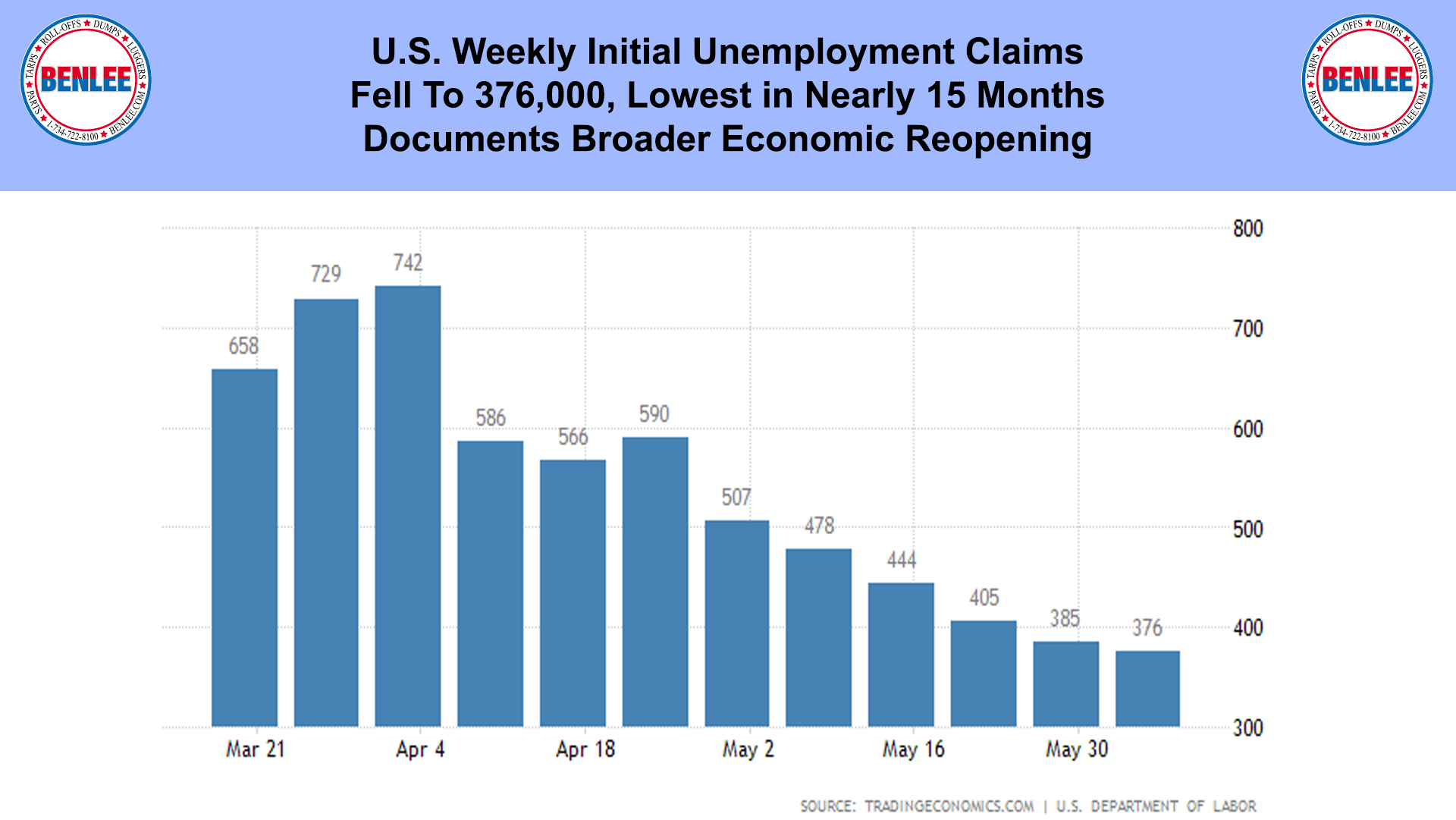

U.S. weekly initial unemployment claims fell to 376,000, the lowest in nearly 15 months, which documents a broader economic reopening.

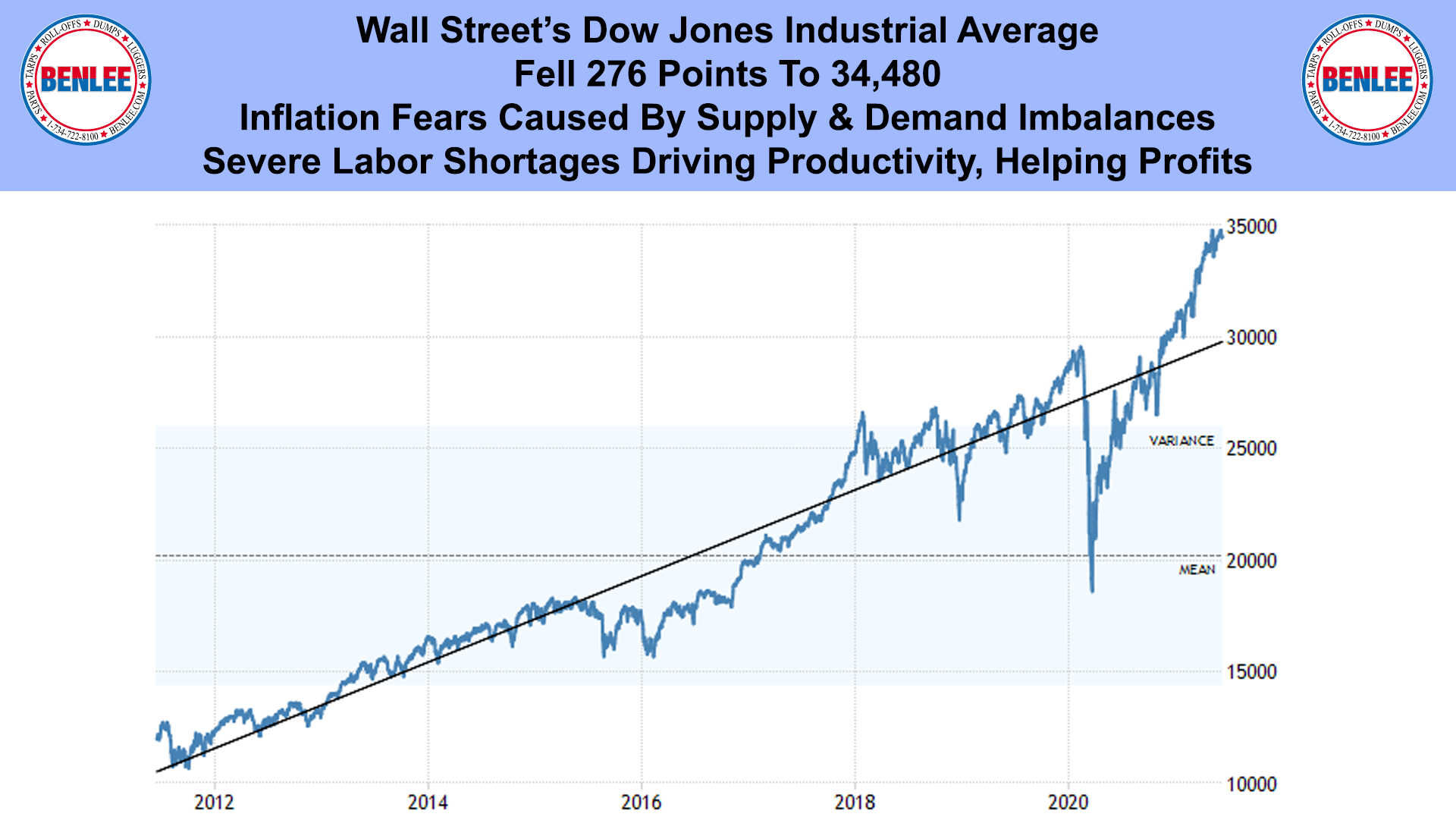

Wall Street’s Dow Jones Industrial Average fell 276 points to 34,480, on inflation fears mainly caused by supply and demand imbalances. Severe labor shortages are driving productivity which are helping profits and stock prices.