This is the Global Economic, Commodities, Scrap Metal and Recycling Report, by our BENLEE Roll off Trailer and Roll off Pup trailer, August 2nd, 2021.

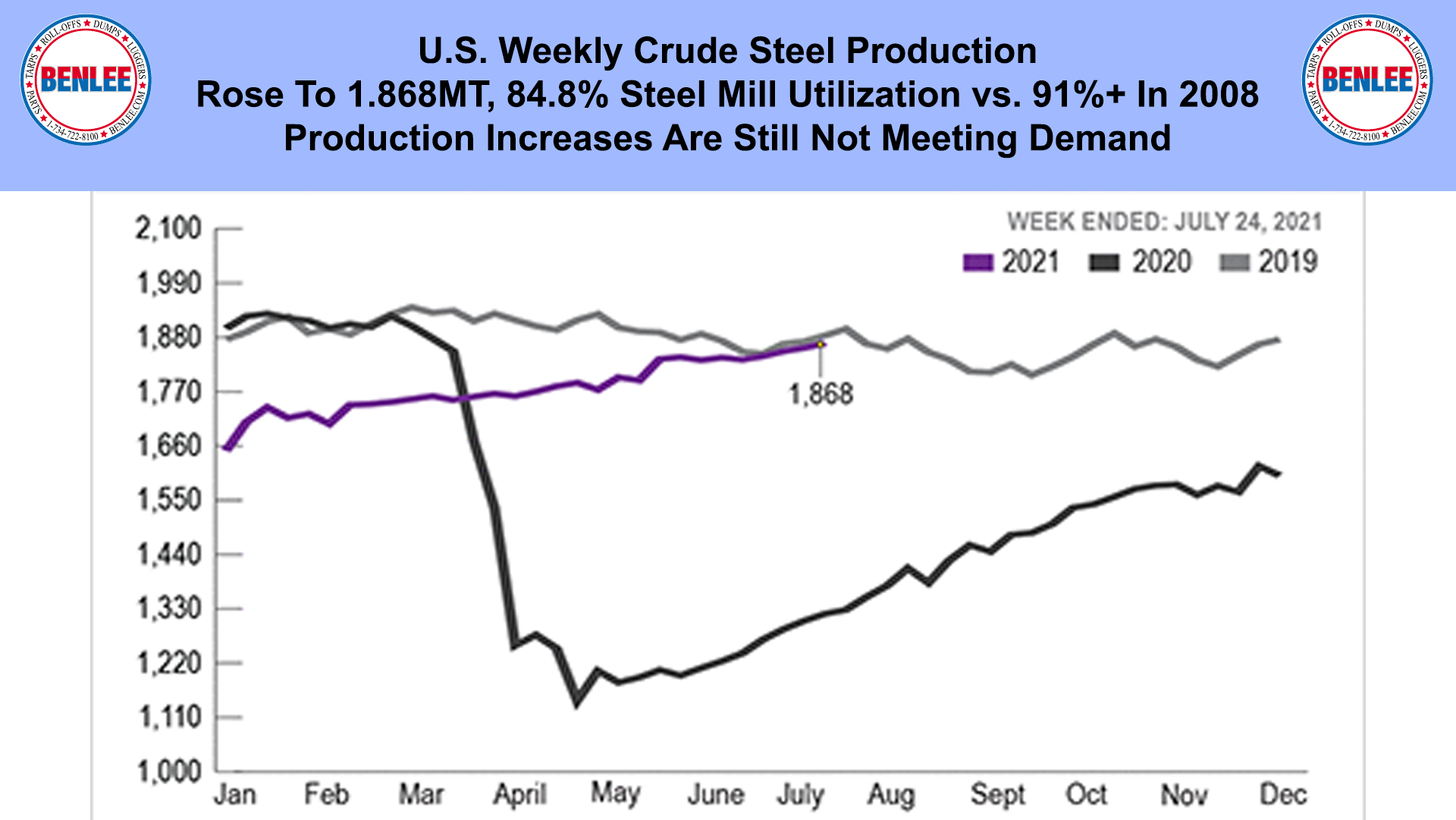

U.S. Weekly crude steel production rose to 1.868MT, an 84.8% steel mill utilization rate, vs. 91%+ in 2008. Production increases are still not meeting demand.

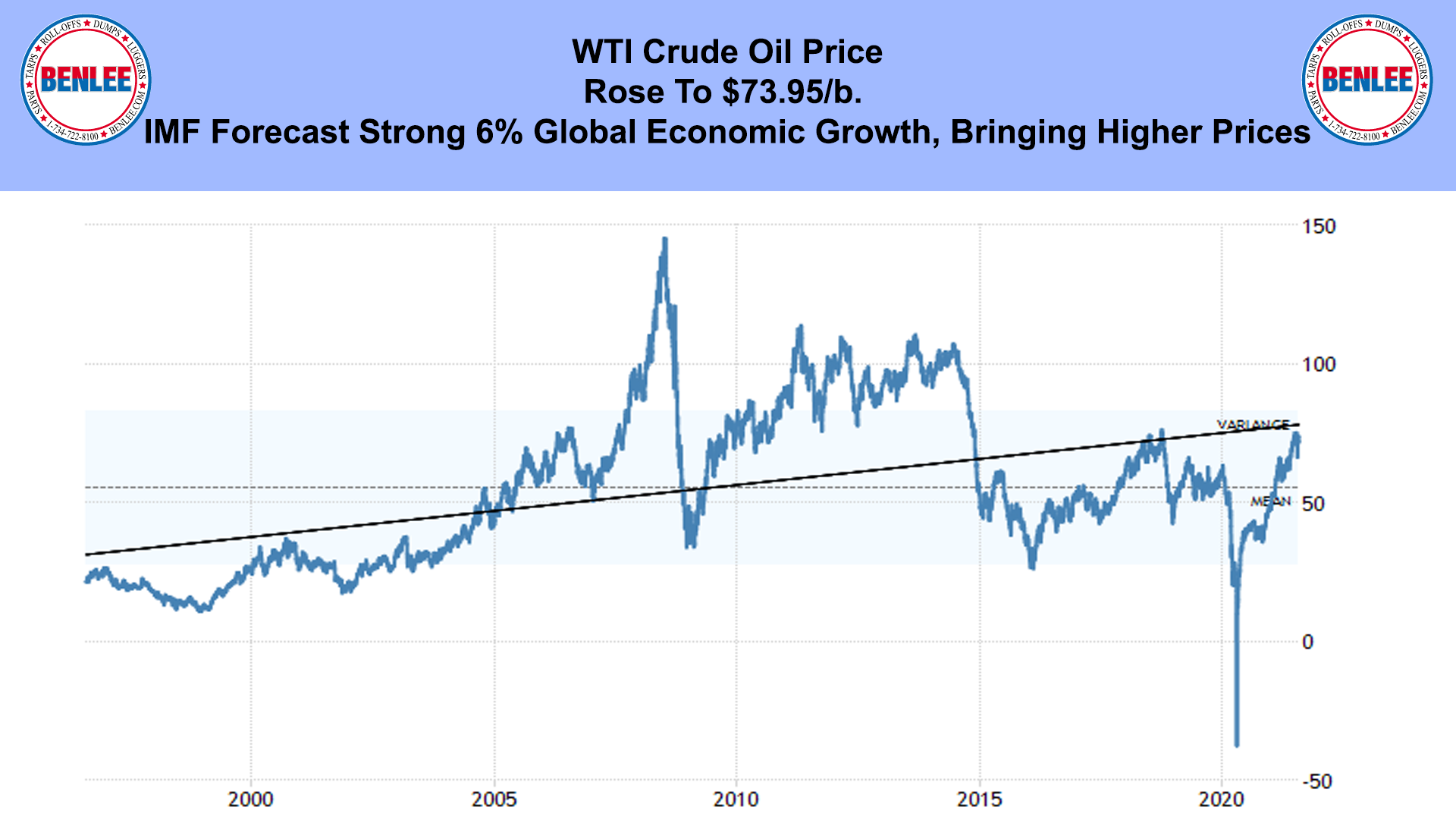

WTI Crude oil price rose to $73.95/b. The IMF forecast strong 6% global economic growth in 2021, bringing higher prices.

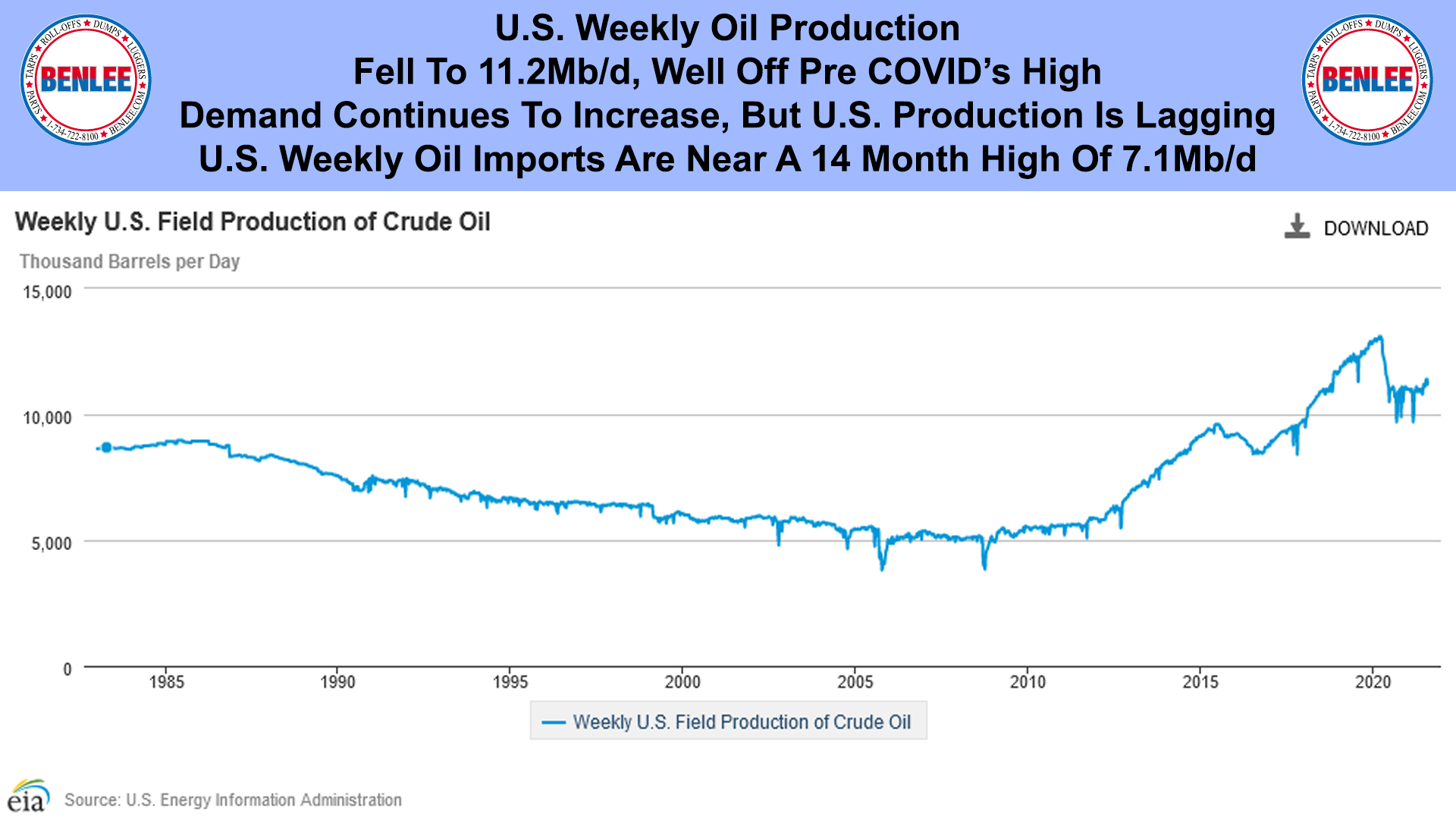

U.S. weekly crude oil production fell to 11.2Mb/d, well off pre COVID’s high. Demand continues to increase, but U.S. Production is lagging. This is as U.S. weekly oil imports, yes imports, are near a 14-month high of 7.1M/b/d.

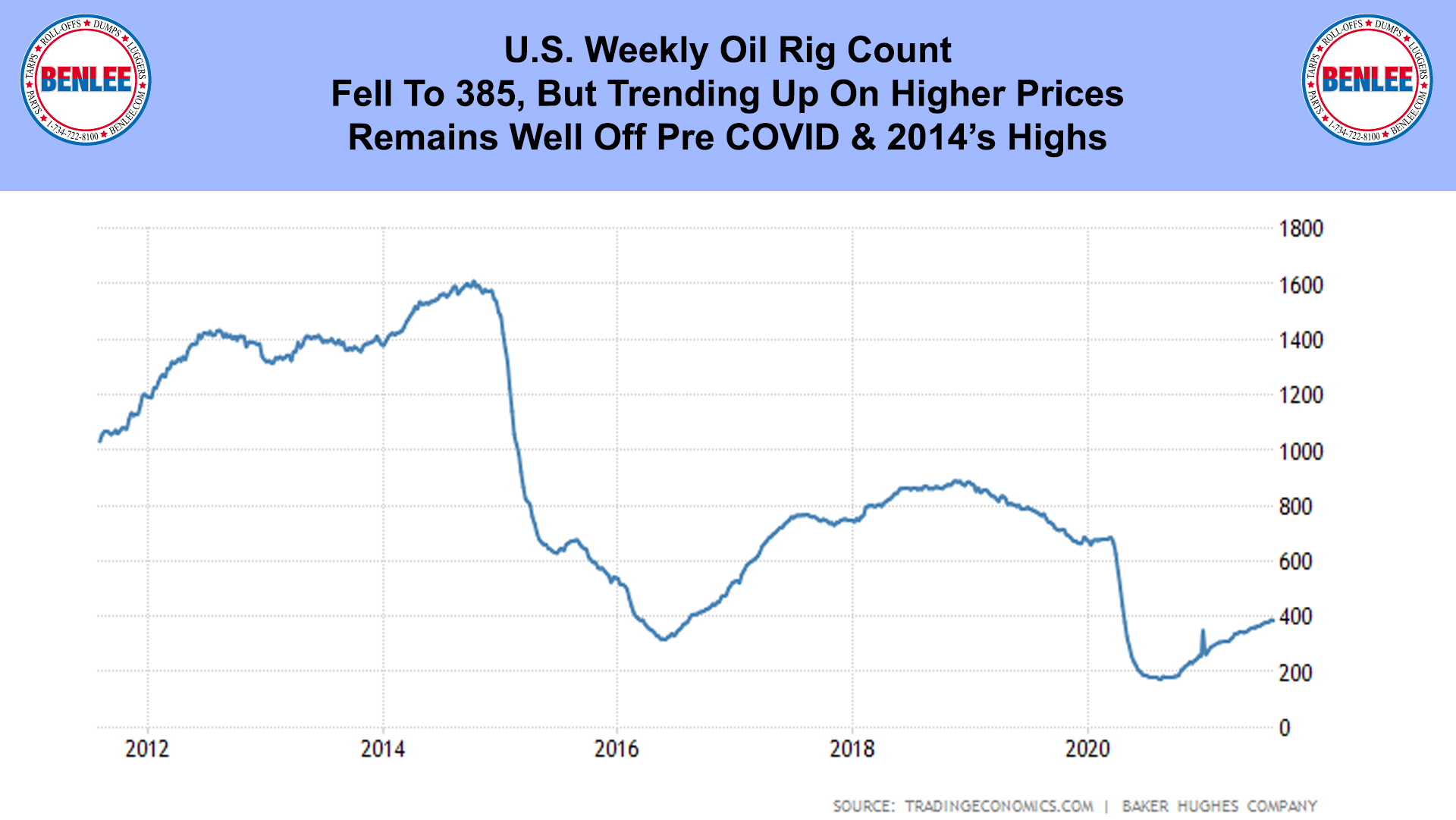

The U.S. Weekly Oil rig count fell to 385, but is trending up on higher prices. They remain well off pre COVID and 2014’s high.

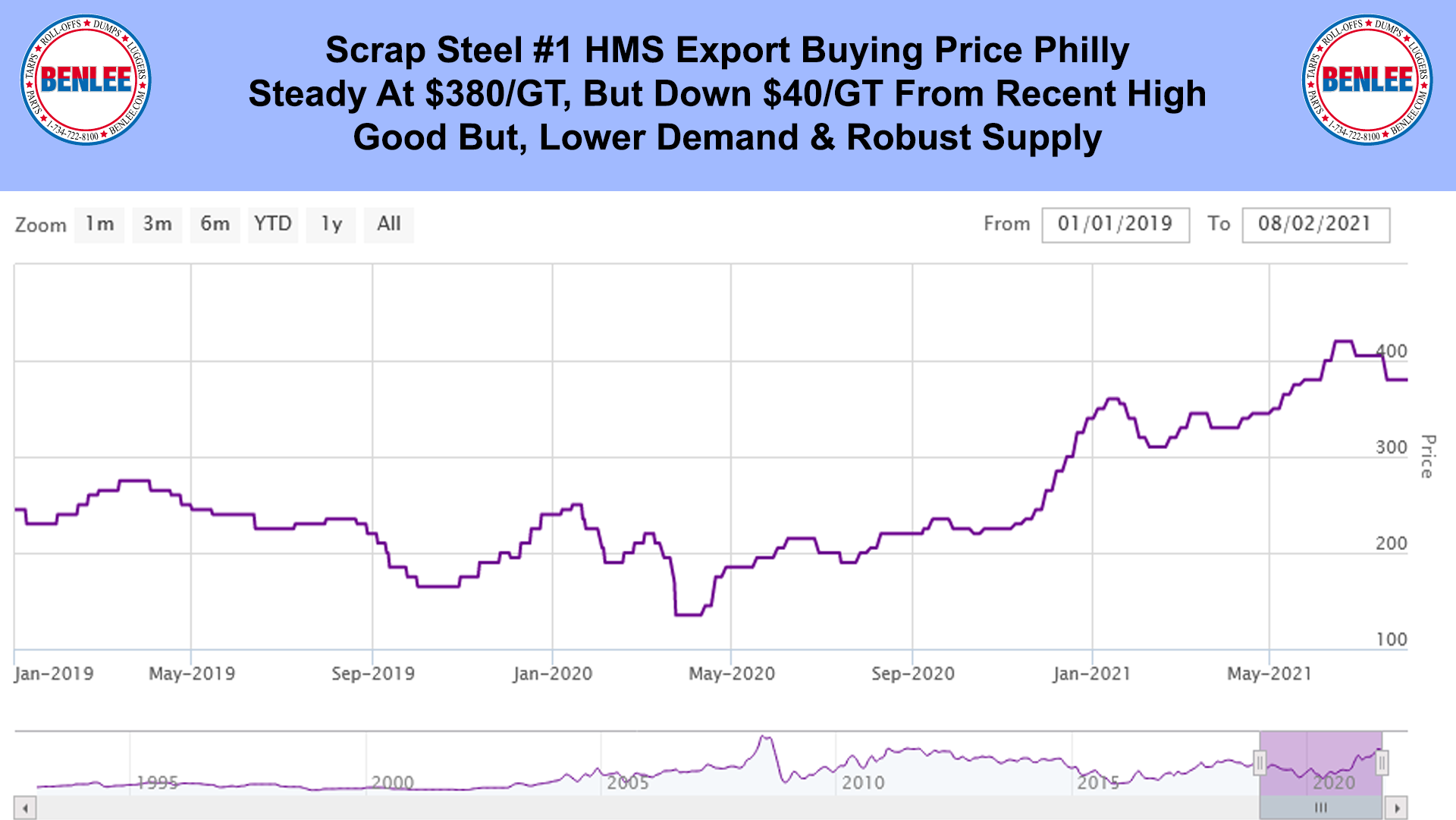

Scrap steel #1 HMS export buying price Philly, was steady at $380/GT, but down $40/GT from the recent high. This was on good, but lower demand and robust supply.

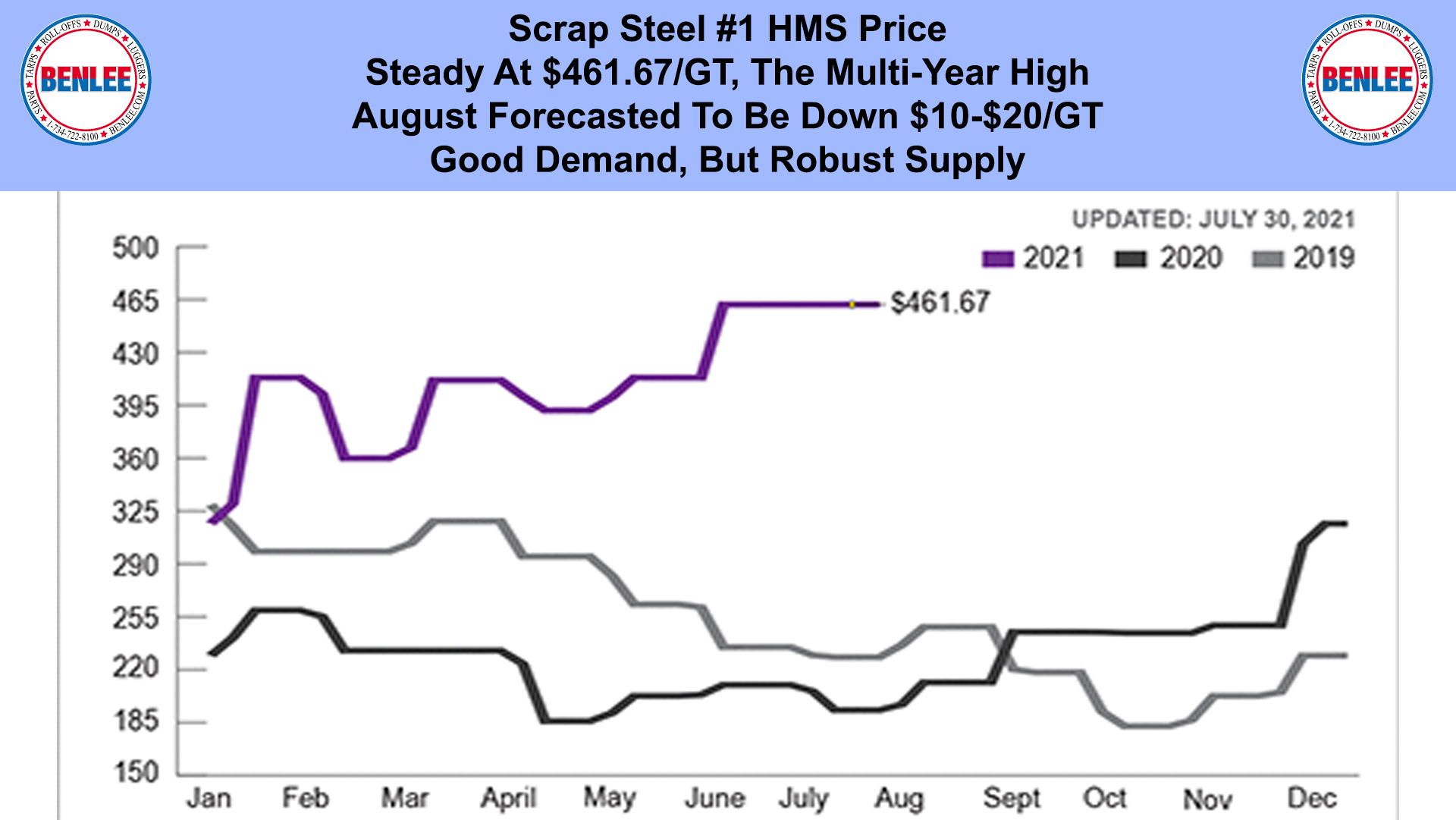

Scrap steel #1 HMS price remained steady at $461.67/GT the multi-year high. August is forecasted to be down $10-$20/GT on good demand, but robust supply.

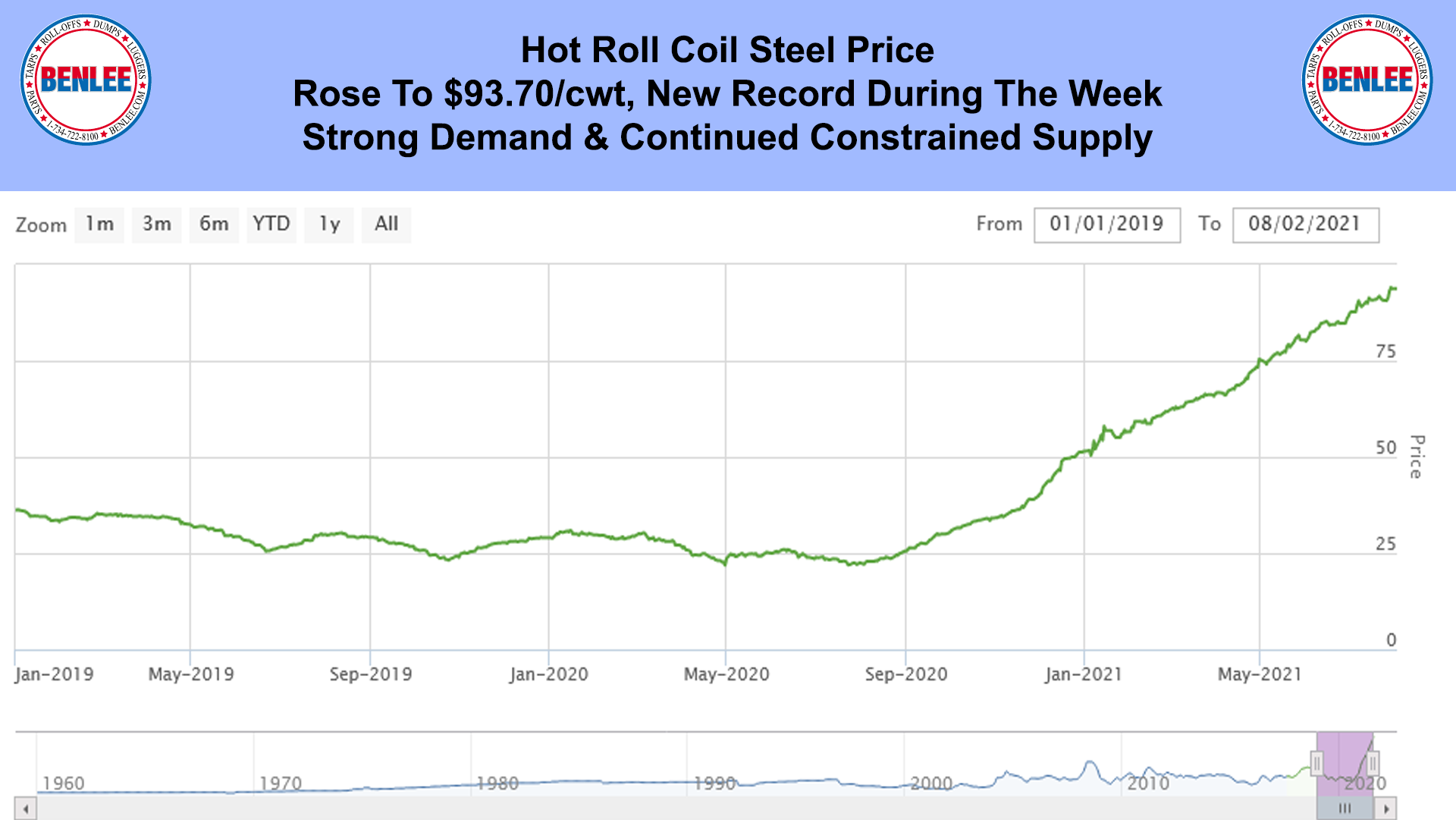

Hot Roll Coil Steel Price rose to $93.70/cwt. and hit a new record during the week. This was on strong demand and continued constrained supply.

Copper price fell to $4.48/lb., but remains high. Global demand remains robust, as China continues to sell reserves.

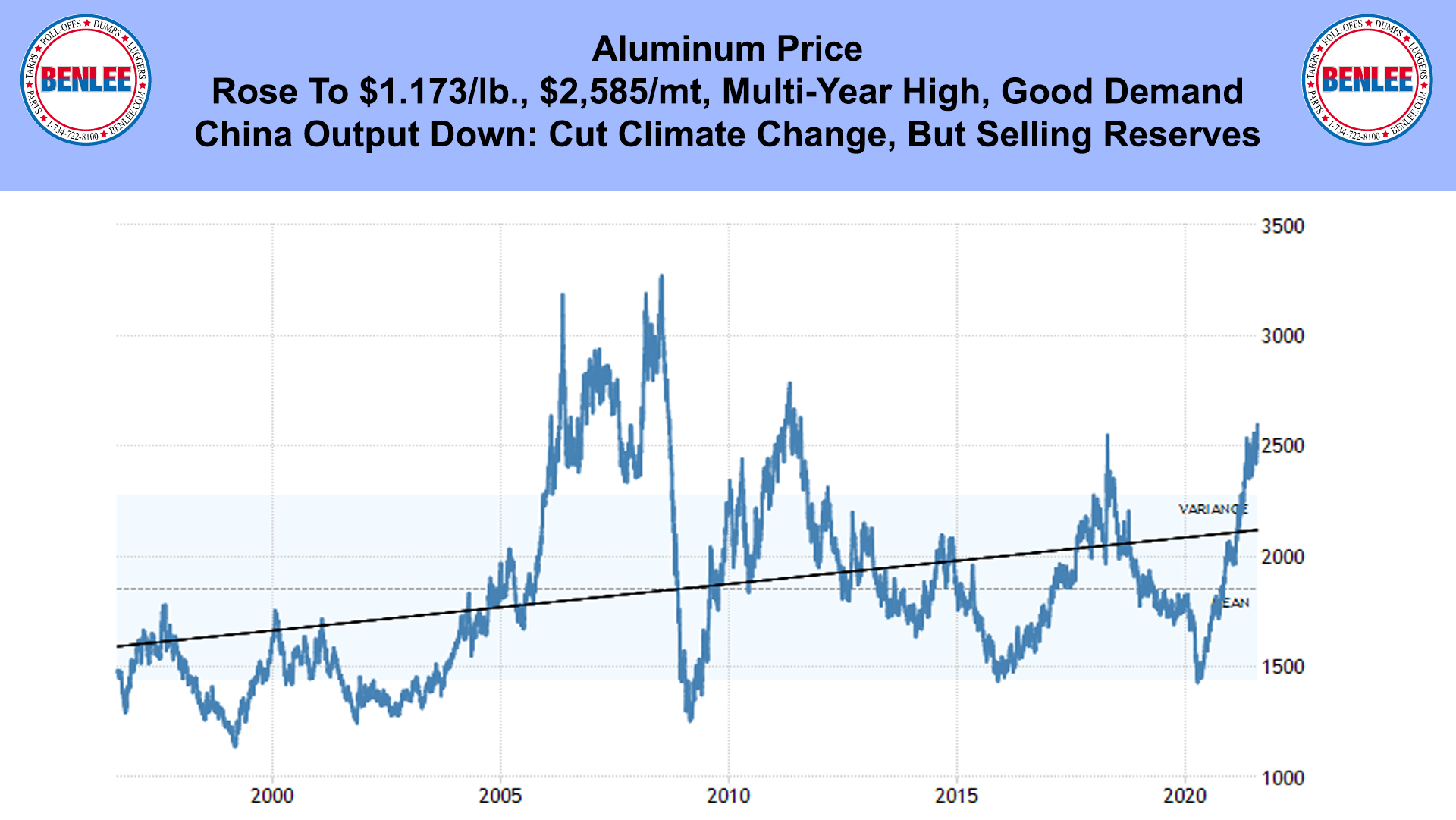

Aluminum price rose to $1.173/lb., $2,585/mt a multiyear high on good demand. China’s output is down due to climate change restrictions, but China continues selling reserves.

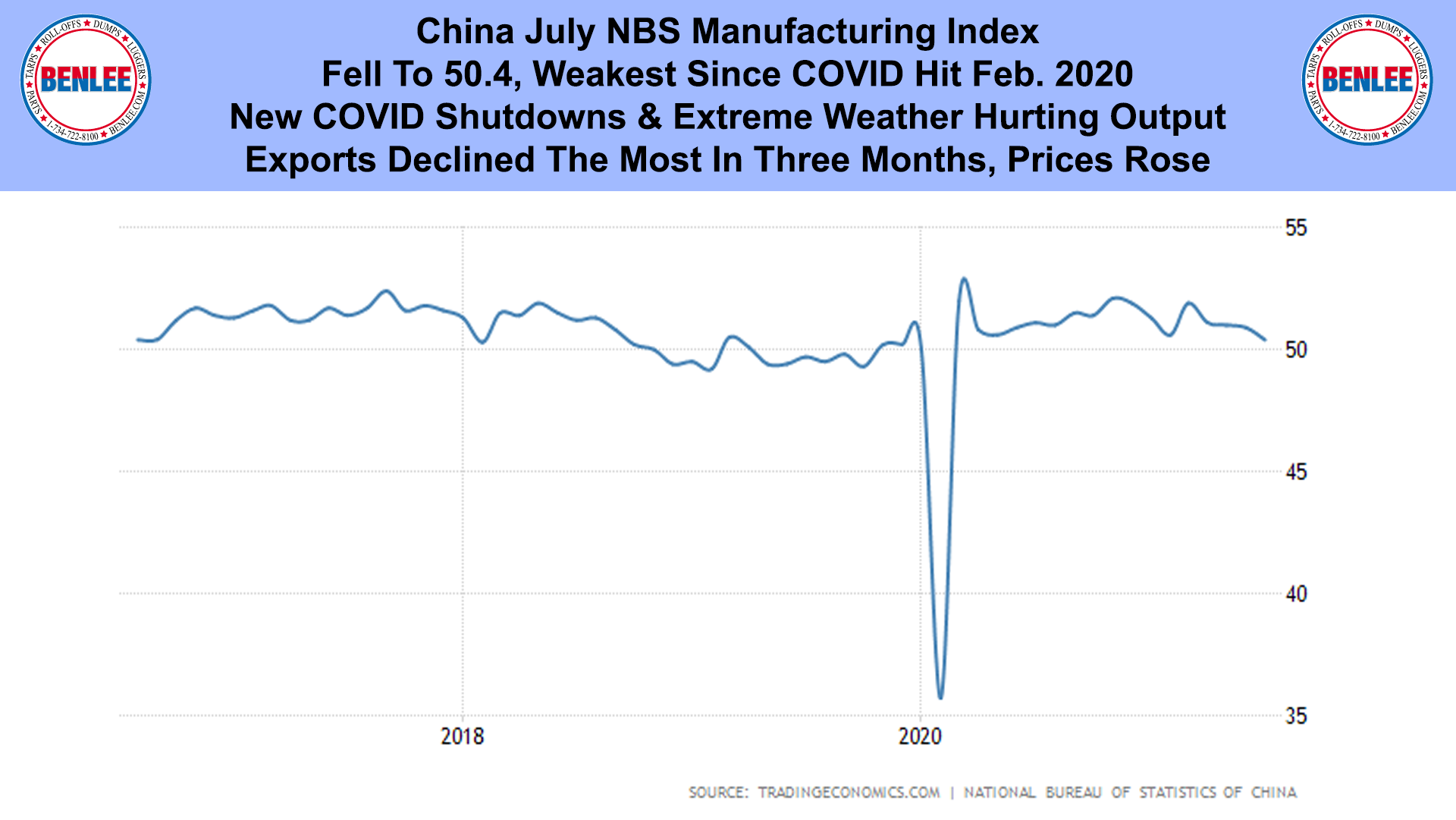

China’s July NBS manufacturing index fell to 50.4, the weakest since COVID hit in February 2020. New COVID shutdowns and extreme weather is hurting output. Exports declined the most in three months and prices rose.

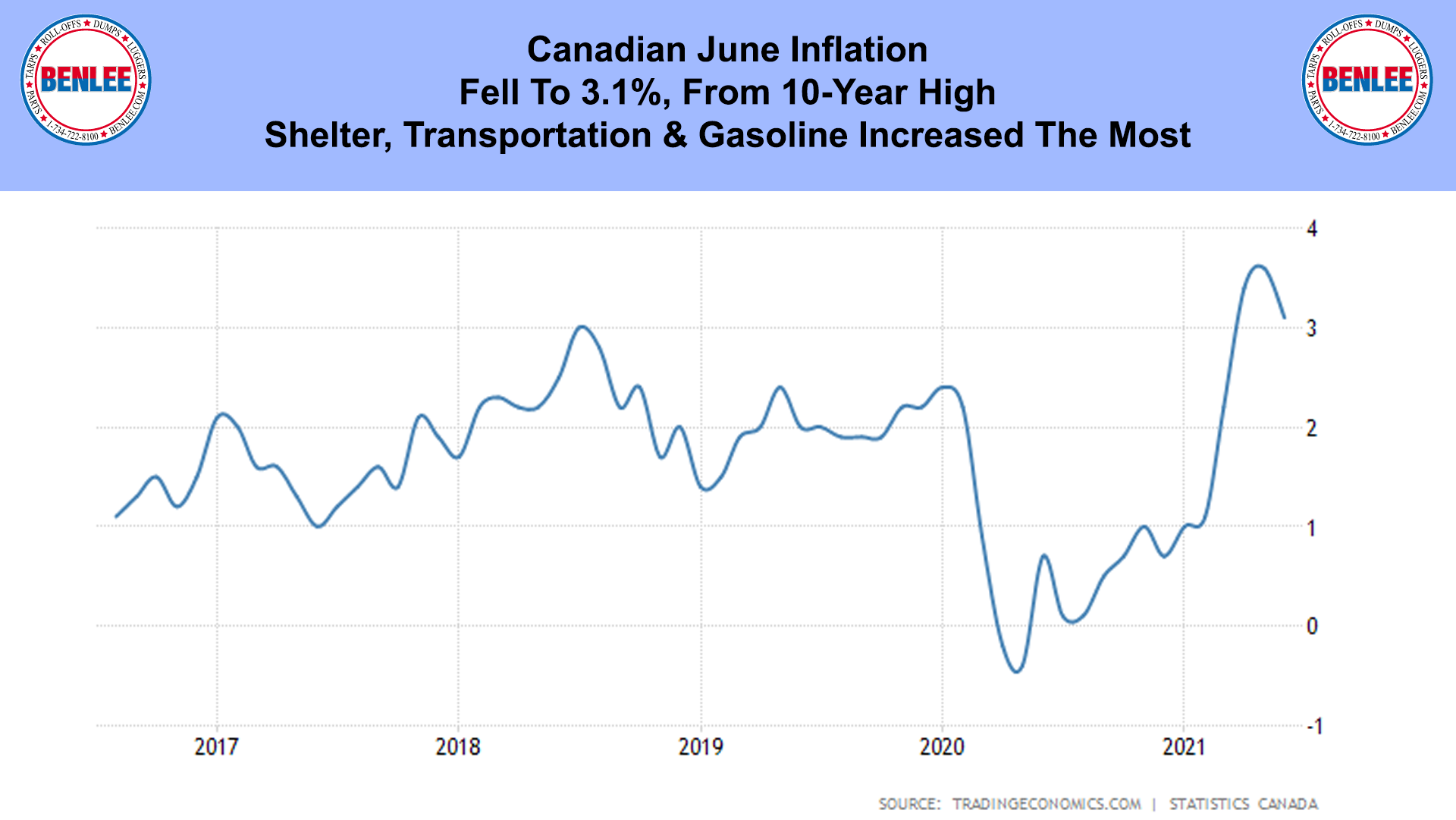

Canadian June inflation fell to 3.1%, from a 10 year high. Shelter, transportation and gasoline increased the most.

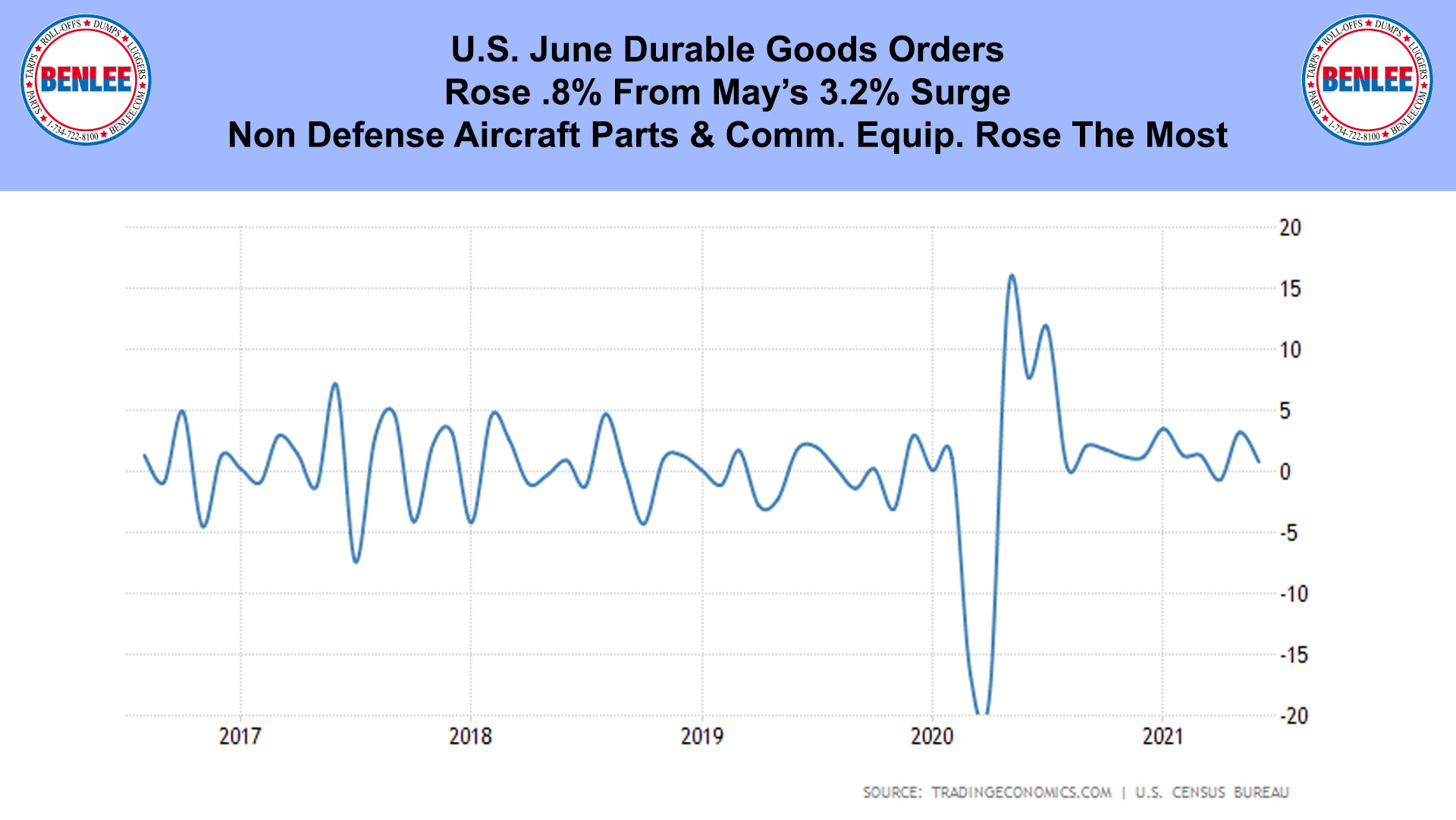

U.S. June durable good orders rose .8% from May’s 3.2% surge. Non-defense aircraft parts and communication equipment rose the most.

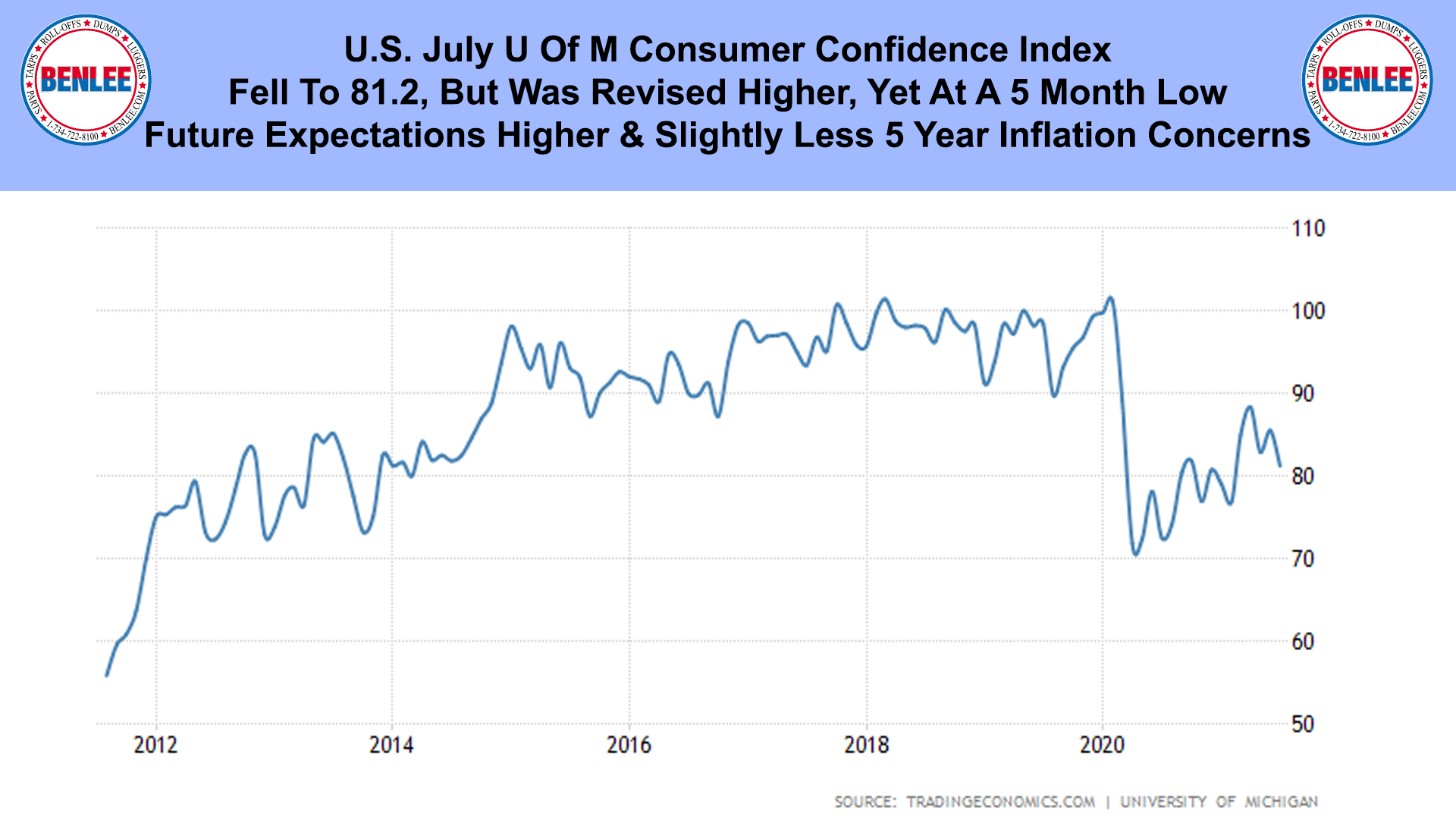

U.S. July U of M consumer confidence index, fell to 81.2, but was revised higher, yet at a 5-month low. Future expectations were higher and there were slightly less 5-year inflation concerns.

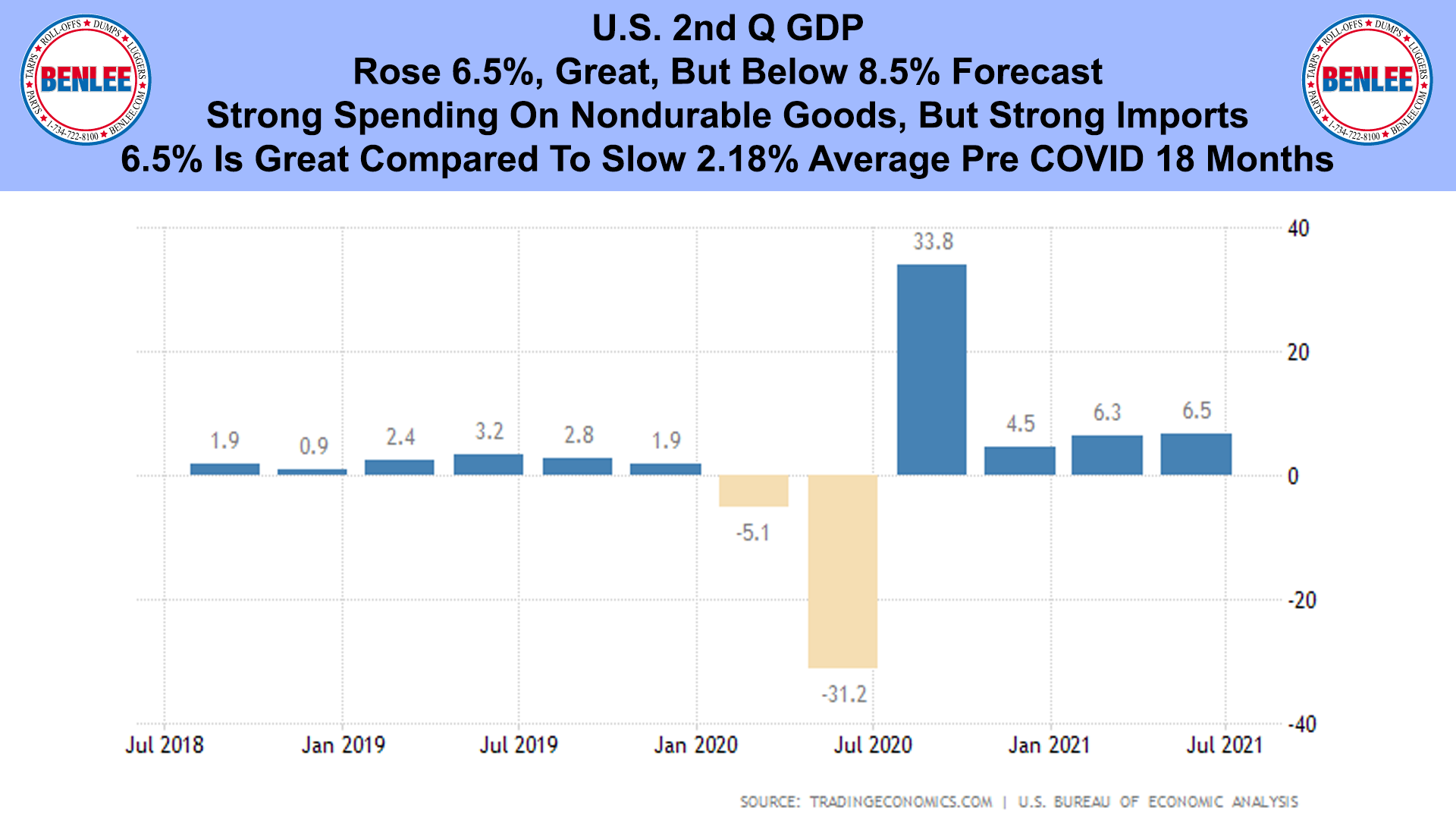

U.S. 2nd Q GDP rose 6.5%, which is great, but below the 8.5% forecast on strong spending of nondurable goods, but strong imports. 6.5% is great compared to the slow 2.18% average in the pre COVID 18 months.

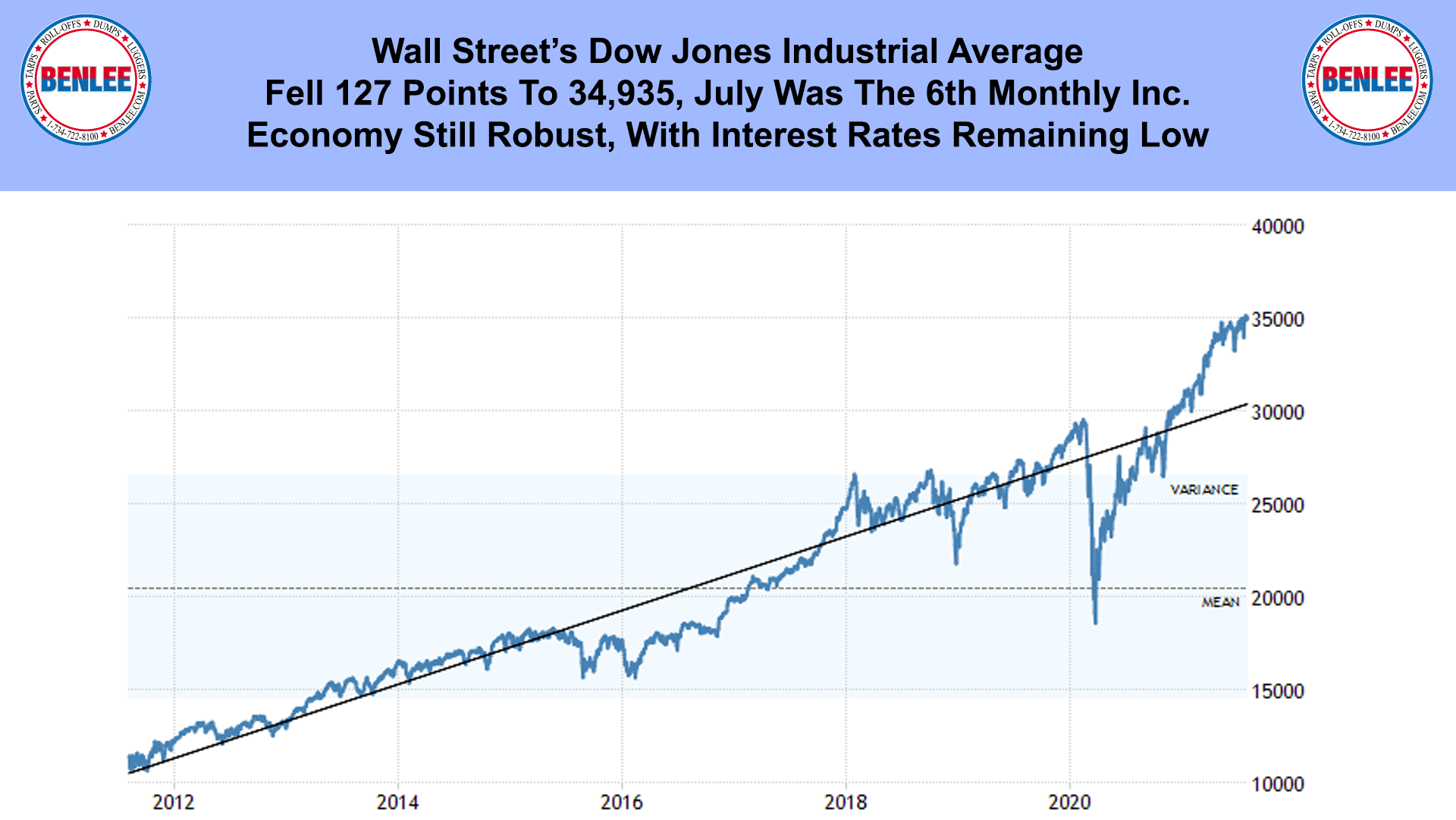

Wall Street’s Dow Jones industrial average fell 127 points to 34,935, but July was the 6th monthly increase. The economy is still robust, with interest rates remaining low.

This report is going on 6.5 years, 51 weeks a year. It is free and emailed out Monday mornings, as well as put on Facebook and LinkedIn. Importantly anyone can sign up for it at www.benlee.com. Just go to the bottom of the home page and type in your email address.