Commodity Trading Strategies for the day

| Commodity | Strategy | Levels | Target | Stop-Loss |

| Crude oil – Aug | Buy | 3110—3080 | 3165 | 3040 |

| Natural gas – Aug | Sell | 187—187.50 | 183.80 | 190.10 |

Gold –Daily Chart

Gold: Gold prices are trading down with a cut of 0.50% currently. The counter can slip lower towards immediate support at 24450 levels. Failure to break below 24450-24400 zones can see prices rebound towards 24600 levels. A daily close below 24400 will see prices move lower towards 24000 levels Intraday rallies will face resistance around 24730-24780 areas.

Silver –Daily Chart

Silver: Failure to pullback above 34050 will see silver prices move lower towards 33550/33300 levels. The don trend will resume only once prices break down below 33300 levels on a closing basis A reversal in the counter is likely only on a breakout above 34500 levels Intraday support is seen between 33450-33300 zones.

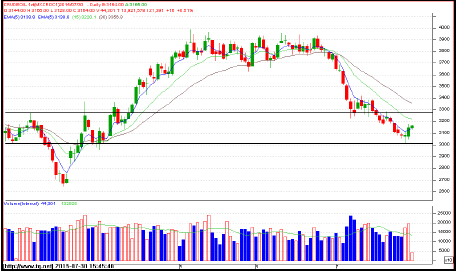

Crude –Daily Chart

Crude Oil (Rs/Bbl): Crude oil prices witnessed a sharp rally post the inventory data yesterday, The counter closed with a gain of 2%. Intraday dips towards 3110/3090 zones will find buying support and the counter can rebound towards 3170/3190 levels. We expect the counter to test its next resistance around 3200-3220 areas over the coming sessions.

Natural Gas –Intraday Chart

Natural Gas (Rs./Mmbtu): Natural gas prices have retraced lower from its intraday highs at 185.10 levels. Prices can dip towards its immediate support around 182-181.50 levels. A decisive break below 181.50 will see prices correct towards 179 levels Areas between 187 up to 189.80 are strong supply zones for natural gas.

Copper –Daily Chart

Copper: Copper prices have retraced lower from its highs at 343.95 levels. Counter can test support between 338-337.50 zones. Intraday view for the counter will remain negative until prices stay above 342.50 levels A daily close around 342-342.50 will be positive for the counter. A break below 337.50 will see prices head lower towards 335.501334.50 levels.

Zinc –Daily Chart

Zinc: Zinc prices are trading within its support between 125-124.50 zones. If prices hold on above 124.50 then the counter will rebound towards 126.35/126.60 levels by close. Sustenance below 124.50 will be negative for the counter as prices will correct towards 123.70/123.40 levels in that case.

Lead: Lead prices continue to trade with a negative bias. We reiterate that any major up move in the counter is likely only on a breakout above 110.30 levels on a daily closing basis. Prices can slide lower towards immediate support around 108.20-108 levels. Intraday rallies from lower levels will face resistance as prices approach 109.60-109.80 levels.

Nickel: Nickel prices are trading down with a cut of 1% currently. Failure to break above 715 on rallies will be a sign of weakness. The counter will slide lower towards 704/698 levels in that case. A daily close below 700 will be negative for nickel. Any major up move in the counter is likely only on a decisive breakout above 730 levels.

Aluminium: Aluminium prices retraced after hitting a high of 104.50 levels yesterday. Sustenance below 103.40 will see prices weaken towards 102.80 levels today. The intraday outlook for the counter will remain negative until prices stay below 104.50 levels today. A break out above 104.50 will see prices rebound towards 105/105.20 levels.

Courtesy : Emkay Commotrade

Emkay Commotrade Ltd.

7th Floor, The Ruby, Senapati Bapat Marg, Dadar - West, Mumbai - 400028.

India Tel: +91 22 66121212 Fax: +91 22 66121299

| Copper Scrap View All | |

| Alternator | 0.31 (0) |

| #1 Copper Bare Bright | 3.65 (0.02) |

| Aluminum Scrap View All | |

| 356 Aluminum Wheels (Clean) | 0.71 (-0.01) |

| 6061 Extrusions | 0.62 (-0.01) |

| Steel Scrap View All | |

| #1 Bundle | 475.00 (0) |

| #1 Busheling | 495.00 (0) |

| Electronics Scrap View All | |