Reuters - The CME Group is talking to several warehouse companies to expand its metal storage network globally, three metal industry sources told Reuters, a move that could further challenge the London Metal Exchange's (LME) dominance.

In recent years the CME, the world's largest futures market operator, has been steadily building its storage network - partly as a result of controversy surrounding the LME warehouse system.

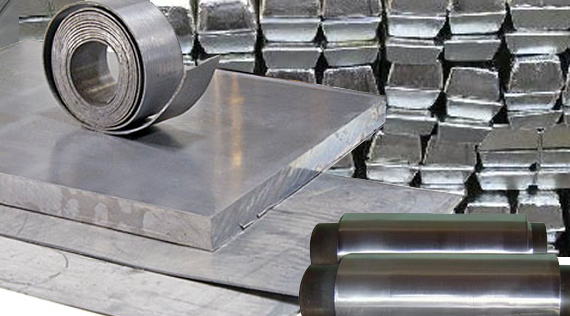

The U.S. exchange has been negotiating with firms about joining its list of approved warehouses to hold metals such as copper, aluminum, zinc and lead, which on the CME are physically deliverable.

"The CME is keen on growing its warehousing system, they want more locations," one source said. "They want to get more companies involved around the world, in Asia, the United States and Europe." CME declined to comment.

Sources did not specify how many new warehouses the CME was targeting, but while catching up with the LME is a tall order, the latest move is seen as a bold one.

All three sources declined to be named because they are not authorized to speak to the media.

The CME has a network of 24 approved warehouses according to information in its website.

Most of these are in the United States, but there are also three in Europe, added recently to store material for its new lead contract.

The LME has a network of more than 600 approved warehouses in 37 locations across the world, including Asia. It is owned by Hong Kong Exchanges and Clearing Ltd.

Sources said some new contracts are part of a move to poach business from the LME, the world's biggest and oldest metals market place, that has traditionally been a first port of call for metal consumers and producers.

"The lead and zinc contracts are part of its (CME's) push to take the LME on... it's definitely one to watch," one industry source said.

The CME zinc contract was launched in 2015 and earlier this year the exchange followed with a lead futures contract.

LME volumes greatly surpass those on the CME.

The CME's move comes after consumers complained bitterly several years ago that they had to endure long queues of up to two years to get delivery of aluminum at several LME warehouse due to backlogs.

Those delays meant fat profits for warehouse owners who collected rent as long queues built up, but the LME has imposed a series of reforms in recent years which have cut down the waiting times.

Courtesy : Reuters

| Copper Scrap View All | |

| Alternator | 0.31 (0) |

| #1 Copper Bare Bright | 3.65 (0.02) |

| Aluminum Scrap View All | |

| 356 Aluminum Wheels (Clean) | 0.71 (-0.01) |

| 6061 Extrusions | 0.62 (-0.01) |

| Steel Scrap View All | |

| #1 Bundle | 475.00 (0) |

| #1 Busheling | 495.00 (0) |

| Electronics Scrap View All | |